Form W8Ben-E Instructions

Form W8Ben-E Instructions - Lines 6, 7, and 8. It’s best to review the form with your tax advisor in order to. Instead, give it to the person who is. October 2021) department of the treasury internal revenue service certificate of foreign status of. What's new guidance under section 1446(f). Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: Hybrid entity making a claim of treaty benefits. For paperwork reduction act notice, see separate instructions. Review the situations listed at the top of the form under the header “do not use this form if.” if any.

October 2021) department of the treasury internal revenue service certificate of foreign status of. Review the situations listed at the top of the form under the header “do not use this form if.” if any. Instead, give it to the person who is. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: For paperwork reduction act notice, see separate instructions. Lines 6, 7, and 8. What's new guidance under section 1446(f). It’s best to review the form with your tax advisor in order to. Hybrid entity making a claim of treaty benefits.

Lines 6, 7, and 8. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: October 2021) department of the treasury internal revenue service certificate of foreign status of. Hybrid entity making a claim of treaty benefits. For paperwork reduction act notice, see separate instructions. It’s best to review the form with your tax advisor in order to. What's new guidance under section 1446(f). Review the situations listed at the top of the form under the header “do not use this form if.” if any. Instead, give it to the person who is.

W 8ben E Instructions Chapter 4 Status

What's new guidance under section 1446(f). It’s best to review the form with your tax advisor in order to. For paperwork reduction act notice, see separate instructions. Instead, give it to the person who is. October 2021) department of the treasury internal revenue service certificate of foreign status of.

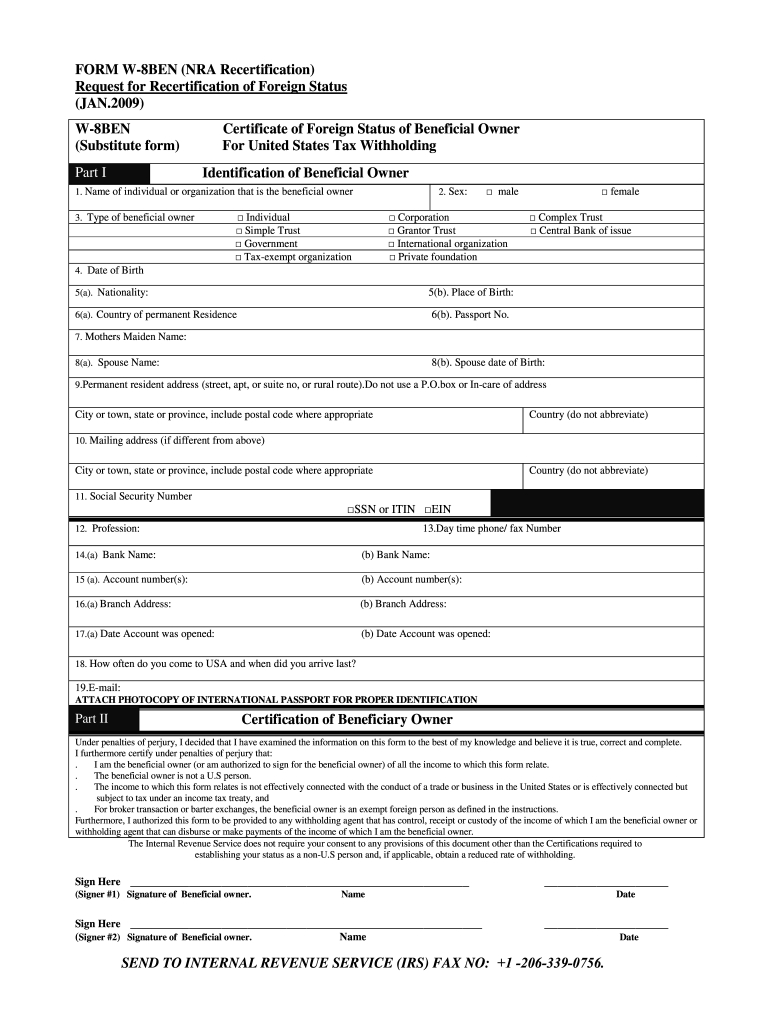

Irs Form W8 Printable Example Calendar Printable

Lines 6, 7, and 8. For paperwork reduction act notice, see separate instructions. It’s best to review the form with your tax advisor in order to. Instead, give it to the person who is. What's new guidance under section 1446(f).

W 8ben instructions for canadian corporations

October 2021) department of the treasury internal revenue service certificate of foreign status of. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: For paperwork reduction act notice, see separate instructions. What's new guidance under section 1446(f). It’s best to review the form with your tax.

How to fill W8BEN E Form as a Company 2018 YouTube

Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: Hybrid entity making a claim of treaty benefits. For paperwork reduction act notice, see separate instructions. October 2021) department of the treasury internal revenue service certificate of foreign status of. Review the situations listed at the top.

W8BEN Form Instructions for Canadians Cansumer

Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: For paperwork reduction act notice, see separate instructions. Review the situations listed at the top of the form under the header “do not use this form if.” if any. It’s best to review the form with your.

W8BENE Form Instructions for Canadian Corporations Cansumer

For paperwork reduction act notice, see separate instructions. October 2021) department of the treasury internal revenue service certificate of foreign status of. Lines 6, 7, and 8. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: Hybrid entity making a claim of treaty benefits.

Thoughts on Form W8BENE for companies selling software licenses

For paperwork reduction act notice, see separate instructions. Instead, give it to the person who is. What's new guidance under section 1446(f). It’s best to review the form with your tax advisor in order to. Review the situations listed at the top of the form under the header “do not use this form if.” if any.

W8BENE Form Instructions for Canadian Corporations Cansumer

What's new guidance under section 1446(f). Hybrid entity making a claim of treaty benefits. It’s best to review the form with your tax advisor in order to. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: Review the situations listed at the top of the form.

Form W8BENE Instructions UK

October 2021) department of the treasury internal revenue service certificate of foreign status of. What's new guidance under section 1446(f). Hybrid entity making a claim of treaty benefits. It’s best to review the form with your tax advisor in order to. Web below are some brief instructions on how to fill in the top required parts of the form in.

W8BEN Form Instructions for Canadians Cansumer

Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: It’s best to review the form with your tax advisor in order to. Review the situations listed at the top of the form under the header “do not use this form if.” if any. What's new guidance.

What's New Guidance Under Section 1446(F).

Review the situations listed at the top of the form under the header “do not use this form if.” if any. Web below are some brief instructions on how to fill in the top required parts of the form in less than 10 minutes: October 2021) department of the treasury internal revenue service certificate of foreign status of. Instead, give it to the person who is.

Hybrid Entity Making A Claim Of Treaty Benefits.

It’s best to review the form with your tax advisor in order to. Lines 6, 7, and 8. For paperwork reduction act notice, see separate instructions.