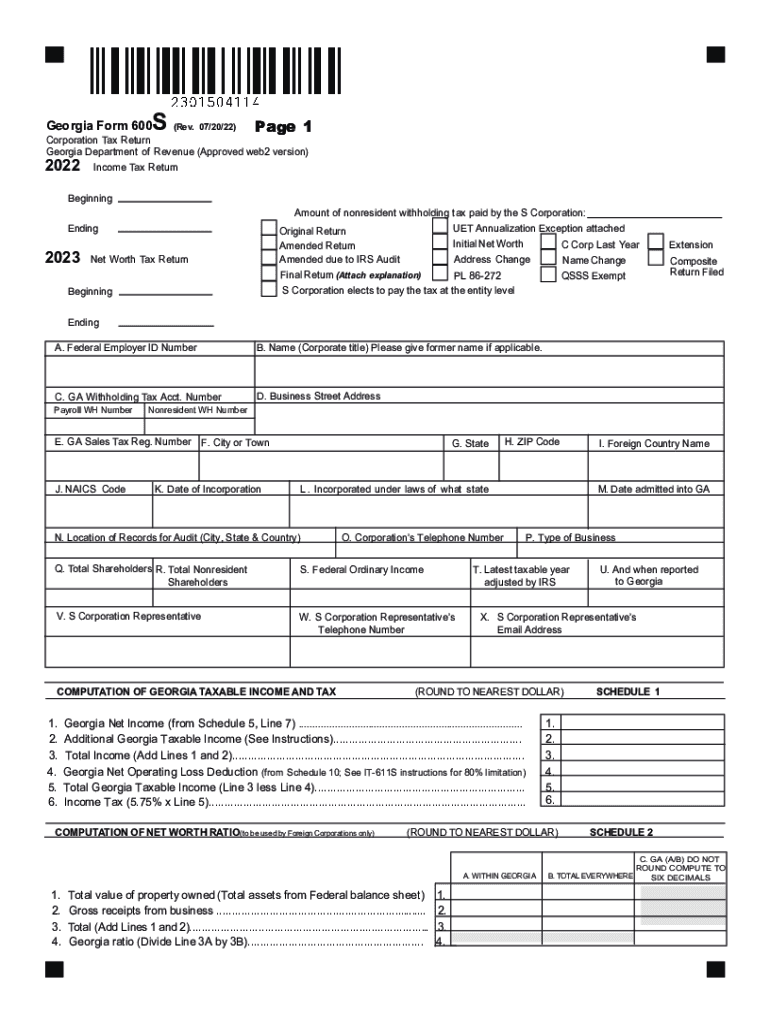

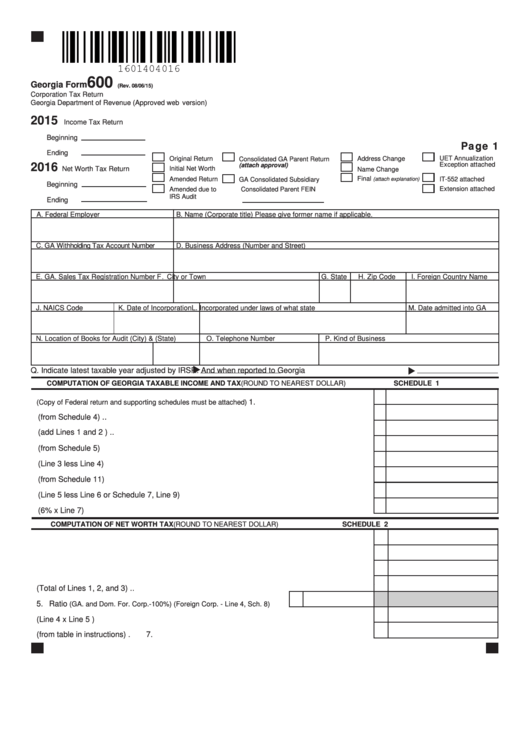

Georgia Form 600S Instructions

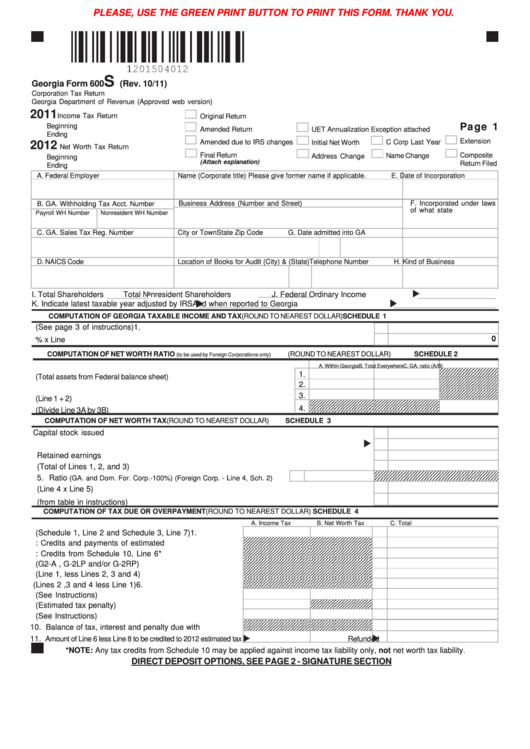

Georgia Form 600S Instructions - Tax to claim credits you must file electronically Refundable tax credits (round to nearest dollar) schedule 10b. Due dates for partnership returns partnership returns. Georgia ratio (divide line 3a by 3b). You can download or print current or past. Web we last updated georgia form 600s in january 2023 from the georgia department of revenue. Complete, edit or print tax forms instantly. Web form code, enter either a code of '2' or '3' filing status federal deductions if blank standard deductions is used number of dependents. We last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. Web local, state, and federal government websites often end in.gov.

Tax to claim credits you must file electronically Due dates for partnership returns partnership returns. Assigned tax credits (round to nearest dollar). Web get your online template and fill it in using progressive features. Computation of tax due or overpayment (round to nearest dollar) schedule 4. Complete, edit or print tax forms instantly. Direct deposit options (for u.s. All corporations must complete this georgia income tax form at the end of each tax year. Schedule 10b (corporation) name fein. Refundable tax credits (round to nearest dollar) schedule 10b.

Web we last updated georgia form 600s in january 2023 from the georgia department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Web get your online template and fill it in using progressive features. Complete, edit or print tax forms instantly. Web georgia form 600 is known as the corporation tax return form. Schedule 10b (corporation) name fein. Web print blank form > georgia department of revenue print Georgia ratio (divide line 3a by 3b). Loss year loss amount income year nol utilized. Refundable tax credits (round to nearest dollar) schedule 10b.

¿Quién es el sujeto pasivo en el modelo 600? Tucuerpohabla.es

Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600s, fully updated for tax year 2022. Assigned tax credits (round to nearest dollar). Direct deposit options (for u.s. Georgia ratio (divide line 3a by 3b). State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end.

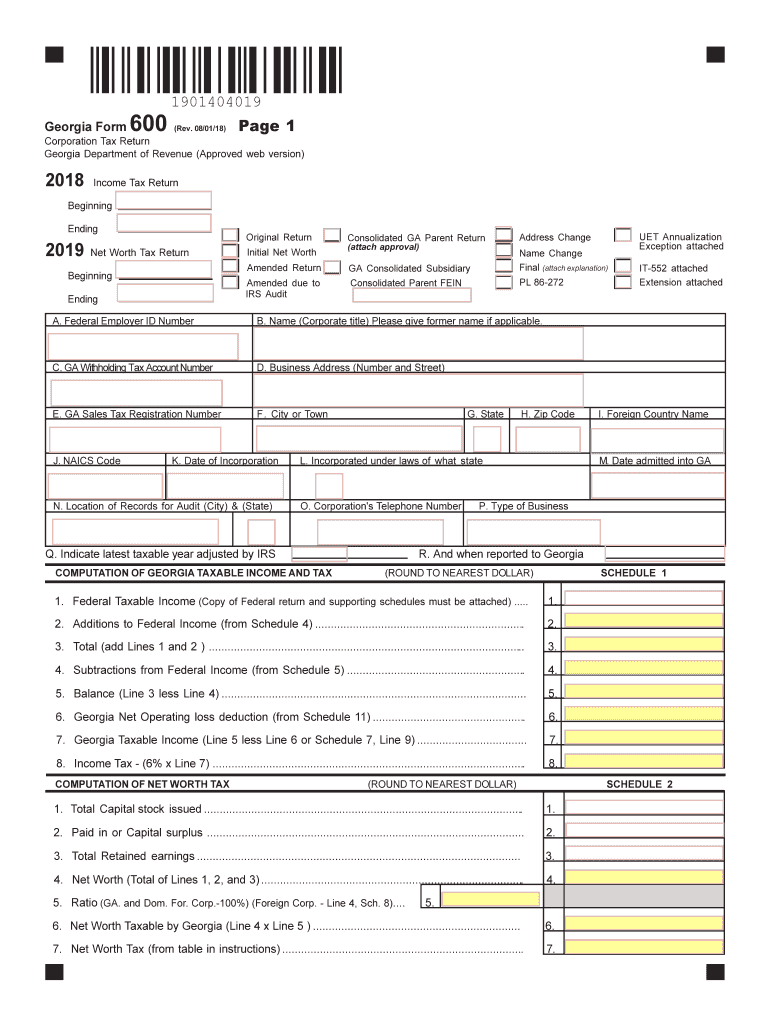

2018 Form GA DoR 600 Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600s, fully updated for tax year 2022. Due dates for partnership returns partnership returns. As defined in the income tax laws of georgia, qualified only in cases of nonresident. Refundable tax credits (round to nearest dollar) schedule 10b. File form 600.

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

You can download or print current or past. This form is for income earned in tax year 2022, with tax returns due in april. Web local, state, and federal government websites often end in.gov. Direct deposit options (for u.s. Accounts only) see booklet for further instructions.

Fillable Form 600s Corporation Tax Return printable pdf download

A consent agreement of nonresident shareholders of s corporations. Get ready for tax season deadlines by completing any required tax forms today. Web georgia form 600 is known as the corporation tax return form. Accounts only) see booklet for further instructions. Web print blank form > georgia department of revenue print

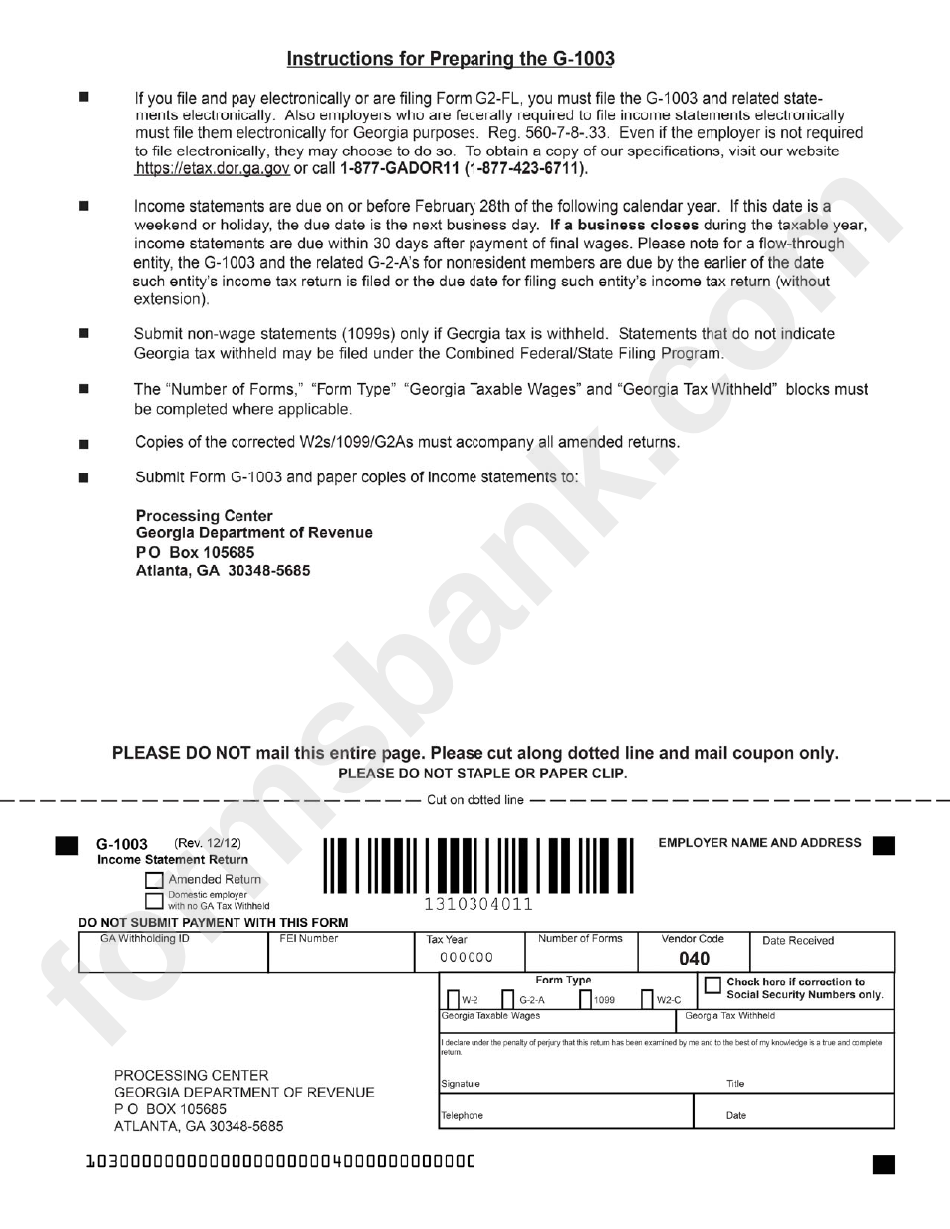

Form G1003 Statement Return Department Of Revenue

Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Georgia ratio (divide line 3a by 3b). Web georgia taxable income (see instructions). Add and customize text, images, and fillable fields,. Web we last updated the corporate tax return in january 2023, so this is the latest.

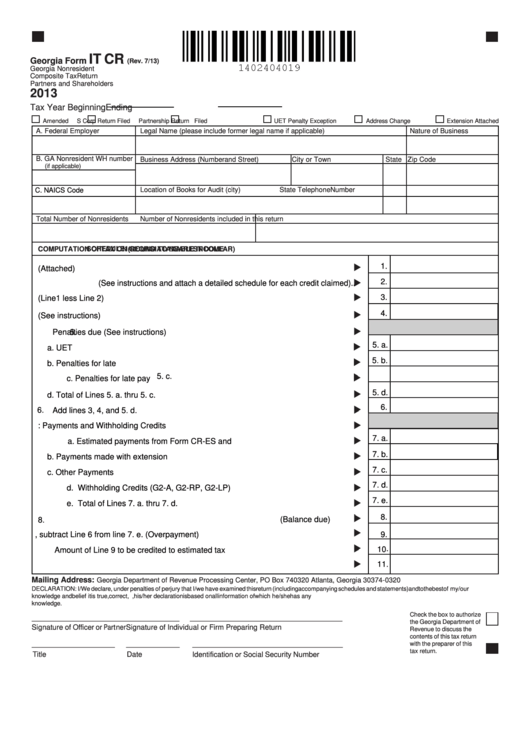

Fillable Form It Cr Nonresident Composite Tax Return

Any tax credits from schedule 11 may be applied against income tax liability only, not. Web form to file corporate tax returns. Direct deposit options (for u.s. This form is for income earned in tax year 2022, with tax returns due in april. All corporations must complete this georgia income tax form at the end of each tax year.

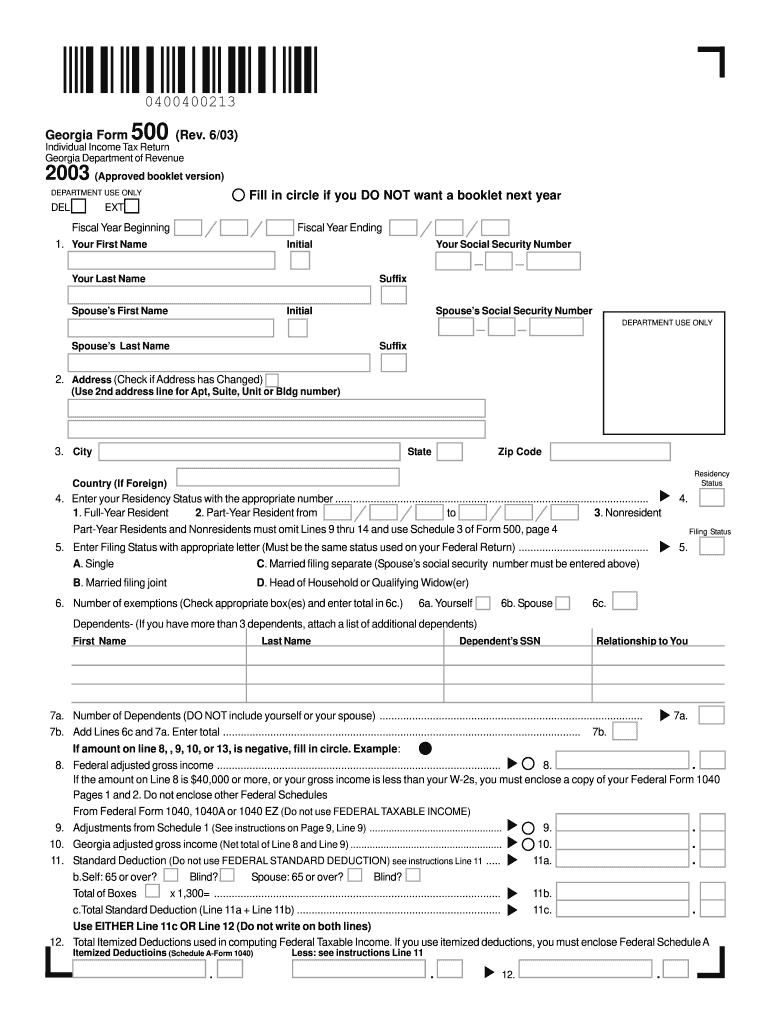

500 Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Web we last updated georgia form 600s in january 2023 from the georgia department of revenue. Any tax credits from schedule 11 may be applied against income tax liability only, not. Due dates for partnership returns partnership returns. Web form to file corporate tax returns.

2003 Form GA DoR 500 Fill Online, Printable, Fillable, Blank pdfFiller

State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. You can download or print current or past. Direct deposit options (for u.s. Complete, edit or print tax forms instantly. Any tax credits from schedule 11 may be applied against income tax liability only, not.

Form 600 Instructions 2022 Fill Out and Sign Printable PDF

Web we last updated georgia form 600s in january 2023 from the georgia department of revenue. Web local, state, and federal government websites often end in.gov. Tax to claim credits you must file electronically For calendar year or fiscal year beginning and ending. Due dates for partnership returns partnership returns.

Web Form Code, Enter Either A Code Of '2' Or '3' Filing Status Federal Deductions If Blank Standard Deductions Is Used Number Of Dependents.

Schedule 10b (corporation) name fein. Any tax credits from schedule 11 may be applied against income tax liability only, not. Direct deposit options (for u.s. You can download or print current or past.

As Defined In The Income Tax Laws Of Georgia, Qualified Only In Cases Of Nonresident.

State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Web get your online template and fill it in using progressive features. Web georgia taxable income (see instructions). Add and customize text, images, and fillable fields,.

Web Georgia Law Recognizes An Election To File As An S Corporation Under The Provisions Of The I.r.c.

All corporations must complete this georgia income tax form at the end of each tax year. We last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. Upload, modify or create forms. Enjoy smart fillable fields and interactivity.

Georgia Ratio (Divide Line 3A By 3B).

Get ready for tax season deadlines by completing any required tax forms today. Tax to claim credits you must file electronically A consent agreement of nonresident shareholders of s corporations. Assigned tax credits (round to nearest dollar).