Goodwill Printable Donation Receipt

Goodwill Printable Donation Receipt - Web a donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Your support is essential to fully realizing our mission: This donation valuation guide can be used to estimate the value of your donations. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Sign in or sign up. With this system, you will no longer have to hold on to your paper receipt. This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. Use this receipt when filing your taxes. Just remember to ask the donation attendant for a receipt. Once you register, the donation tracker will generate an electronic receipt for you and even send it to your email address.

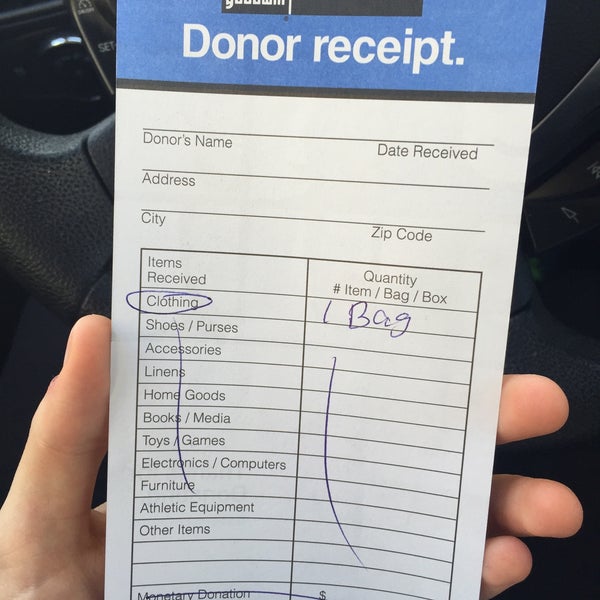

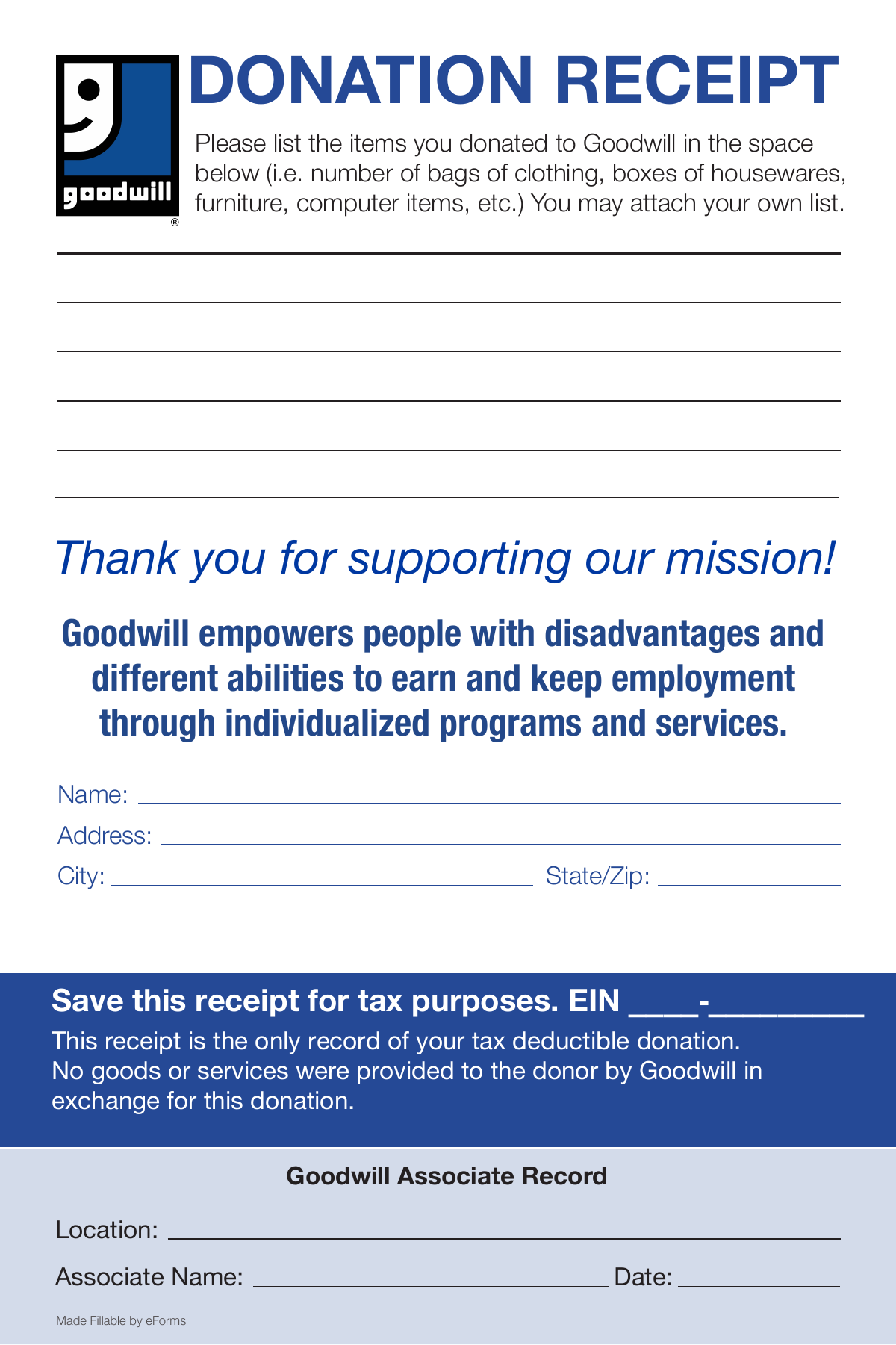

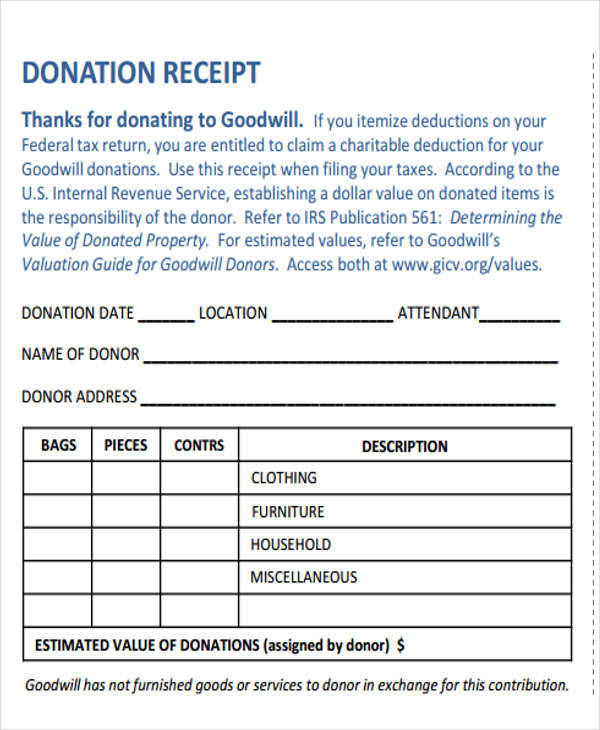

Use this receipt when filing your taxes. Number of bags of clothing, boxes of housewares, furniture, computer items, etc.) you may attach your own list. This receipt is the only record of your tax deductible donation. Your support is essential to fully realizing our mission: Thanks for donating to goodwill. Once you register, the donation tracker will generate an electronic receipt for you and even send it to your email address. For information on rights and services to persons with developmental disabilities contact: Once you register your donations online through this system, you can print a receipt when needed, print a yearly donation report, or send a copy to your email. Just remember to ask the donation attendant for a receipt. Your donation will help to fund programs and services for people with disabilities and other challenges.

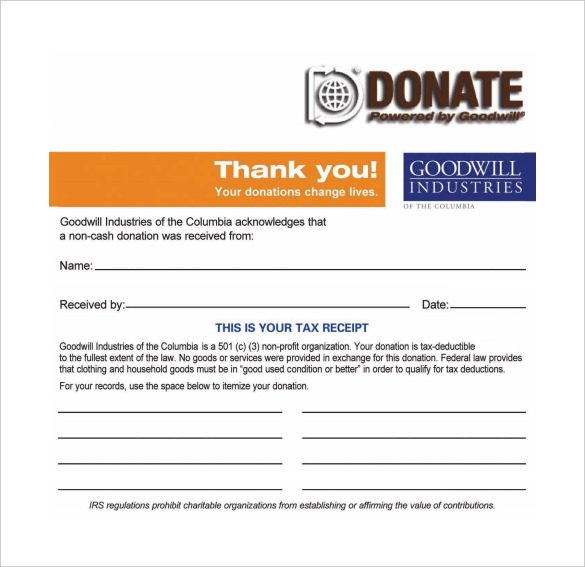

Web a donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. If you decide to donate during working hours, you can ask the goodwill representative for. Just remember to ask the donation attendant for a receipt. As the donor, you are responsible for appraising the donated items. Web we’re making it easier than ever for you to track your goodwill donation receipts. Web your receipt is the only record of your tax deductible donation. Support is unavailable on weekends and may delay the resolution of critical issues. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use the contact information below. Thanks for donating to goodwill. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code.

Free Goodwill Donation Receipt Template PDF eForms

Use this receipt when filing your taxes. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. The app simplifies receipt management by sending customized donation receipts automatically. This receipt is the only record of your tax deductible donation. Support is unavailable on weekends and may delay.

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. With this system, you will no longer have to hold on.

Editable Donation Receipt Goodwill Fillable Printable vrogue.co

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. For information on rights and services to persons with developmental disabilities contact: A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Thank.

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

The app provides flexible options for customizing donation widgets and amounts. Web the digital donation receipt will generate one for you. For information on donating to charities visit www.irs.gov. Web we’re making it easier than ever for you to track your goodwill donation receipts. Some goodwill® agencies also make their donation receipts available online.

Free Printable Donation Receipt Templates [PDF, Word, Excel]

For information on donating to charities visit www.irs.gov. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Just remember to ask the donation attendant for a receipt. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction.

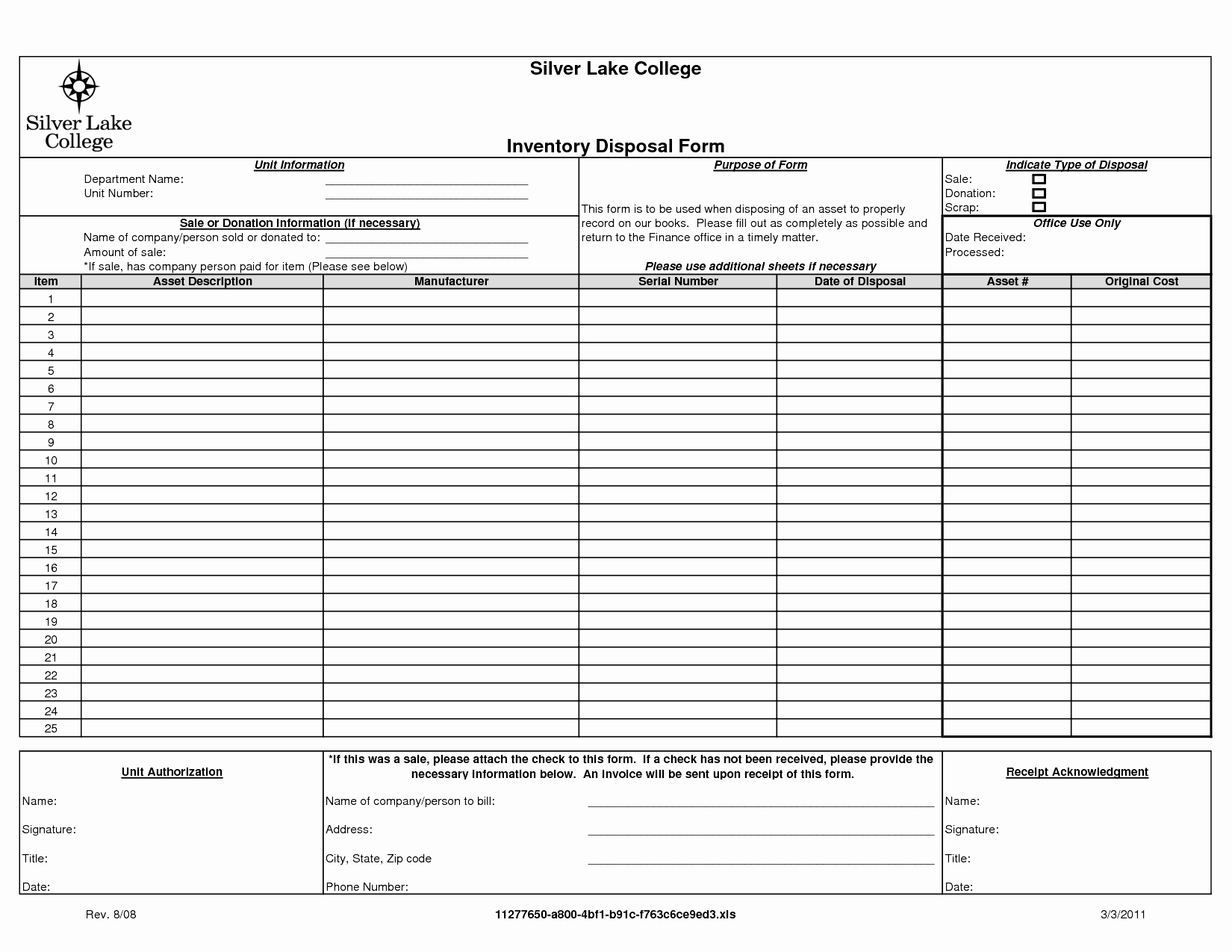

Printable Goodwill Donation Form

The app provides flexible options for customizing donation widgets and amounts. For more information about our programs, please click here. Just remember to ask the donation attendant for a receipt. Go to the donation tracker. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code.

23+ Donation Receipt Templates Sample Templates

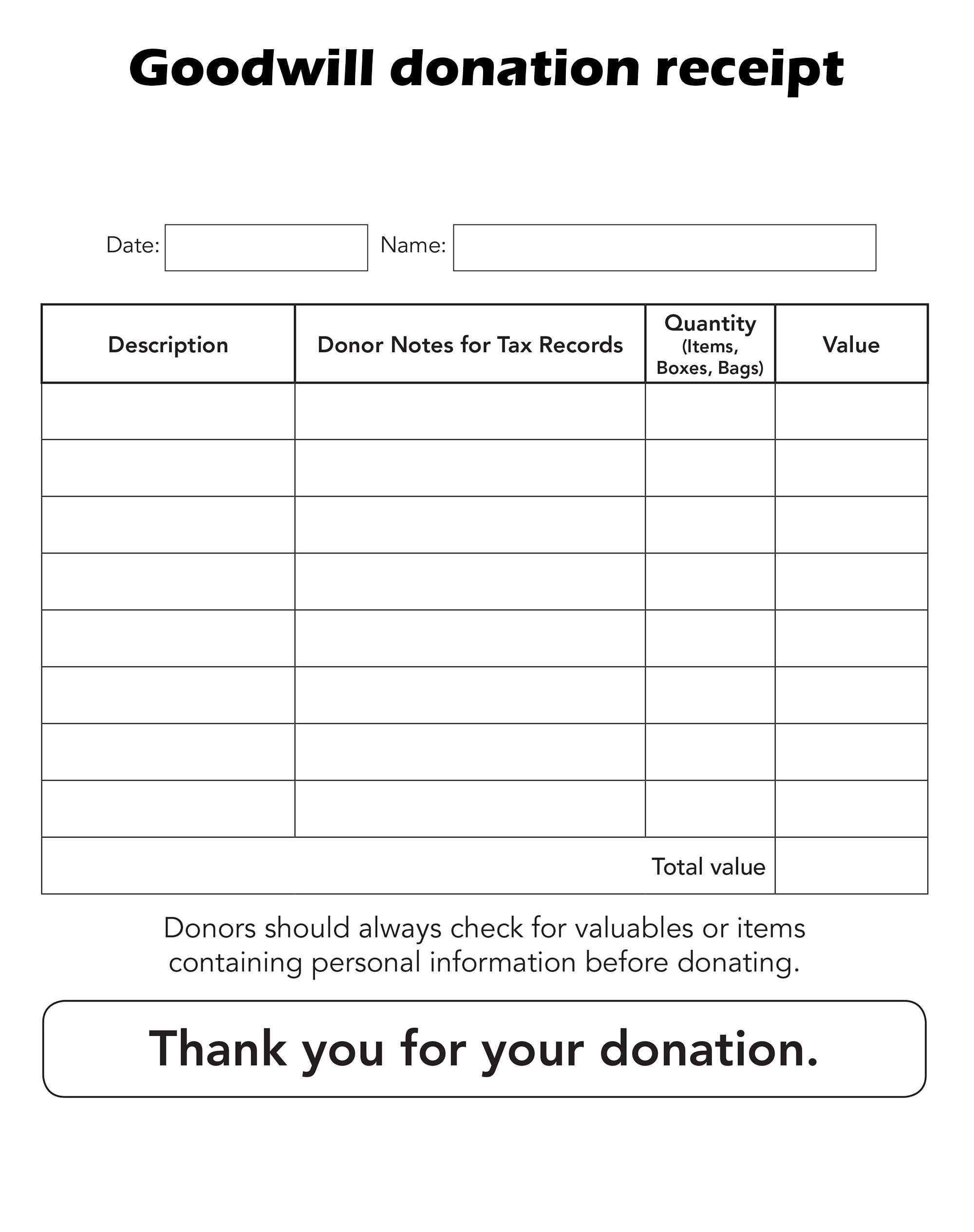

Your donation will help to fund programs and services for people with disabilities and other challenges. Use this receipt when filing your taxes. After filling out the form below, you can download your donation receipt. Download the goodwill donation receipt. Web a goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as.

Printable Goodwill Donation Receipt

Web get a donation receipt thank you for donating! If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Your donation will help to fund programs and services for people with disabilities and other challenges. After filling out the form below, you can download your donation receipt. Go to.

Free Sample Printable Donation Receipt Template Form

Browse 4 goodwill donation form templates collected for any of your needs. With this system, you will no longer have to hold on to your paper receipt. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Web with this new optional online tracker, you no longer have.

Free Donation Receipt Templates Samples PDF Word eForms

Web a donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Information to be completed by donor: Often a goodwill donation receipt is presented as a letter or an email, which is given or sent to the benefactor after the donation has been received. Thanks for donating to goodwill. This.

For Information On Rights And Services To Persons With Developmental Disabilities Contact:

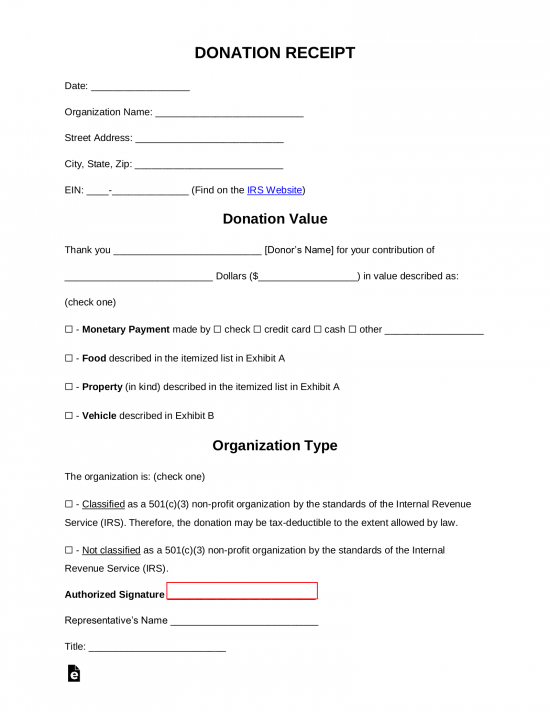

Web get a donation receipt thank you for donating! Number of bags of clothing, boxes of housewares, furniture, computer items, etc.) you may attach your own list. Web the illustrated guide below will help you draft and fill out the donation receipt form effortlessly and quickly. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more.

If You Donated To A Goodwill In The Following Areas And Need To Obtain Your Donation Receipt, Please Use The Contact Information Below.

A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. The app provides flexible options for customizing donation widgets and amounts. Use this receipt when filing your taxes. This receipt is the only record of your tax deductible donation.

Thanks For Donating To Goodwill.

Your support is essential to fully realizing our mission: Web a donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. For more information about our programs, please click here. Download the goodwill donation receipt.

If You Itemize Deductions On Your Federal Tax Return, You Are Entitled To Claim A Charitable Deduction For Your Goodwill Donations.

Information to be completed by donor: Support is unavailable on weekends and may delay the resolution of critical issues. Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. As the donor, you are responsible for appraising the donated items.

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-24.jpg)

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-05.jpg)

![Free Printable Donation Receipt Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/06/Donation-Receipt-1024x576.jpg)