Grand Rapids Tax Form

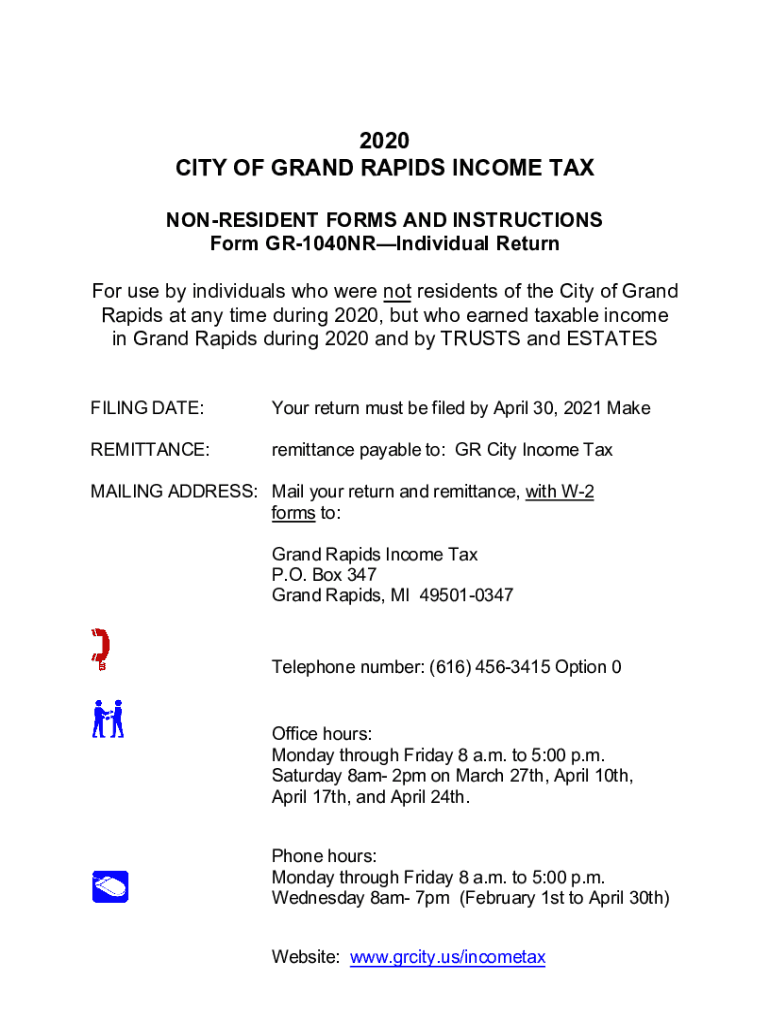

Grand Rapids Tax Form - Web irs forms and publications. Web 0.75% residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Web individual tax forms current year tax forms. For use by individuals who were not residents of. Also includes forms from previous years. State of michigan tax form; Click the city name to access the appropriate. Choose the correct version of the editable. Web the income tax department's library of income tax forms.

Grand rapids income tax p.o. Web 0.75% residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax. Web tax day this year is next monday, april 18. Web city of grand rapids income tax. Complete, edit or print tax forms instantly. Originally, the deadline to file taxes in grand rapids was april 30, but that's been pushed back to may 2. For use by individuals who were not residents of. Web individual tax forms current year tax forms. State of michigan tax form; Current and past tax foreclosure auction results;

Quarterly report of lodging excise tax form; Choose the correct version of the editable. Your return must be filed by april 30, 2021 make remittance payable to:. Web city of grand rapids income tax. Web irs forms and publications. Complete, edit or print tax forms instantly. City of walker tax form; Grand rapids income tax p.o. Web in grand rapids during 2020 and by trusts and estates. Web 0.75% residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax.

Rapids Tax Form Fill Out and Sign Printable PDF Template signNow

Your return must be filed by april 30, 2021 make remittance payable to:. Web employee’s withholding certificate for grand rapids income tax nonresident 1. Web city of grand rapids income tax. Grand rapids income tax p.o. Current and past tax foreclosure auction results;

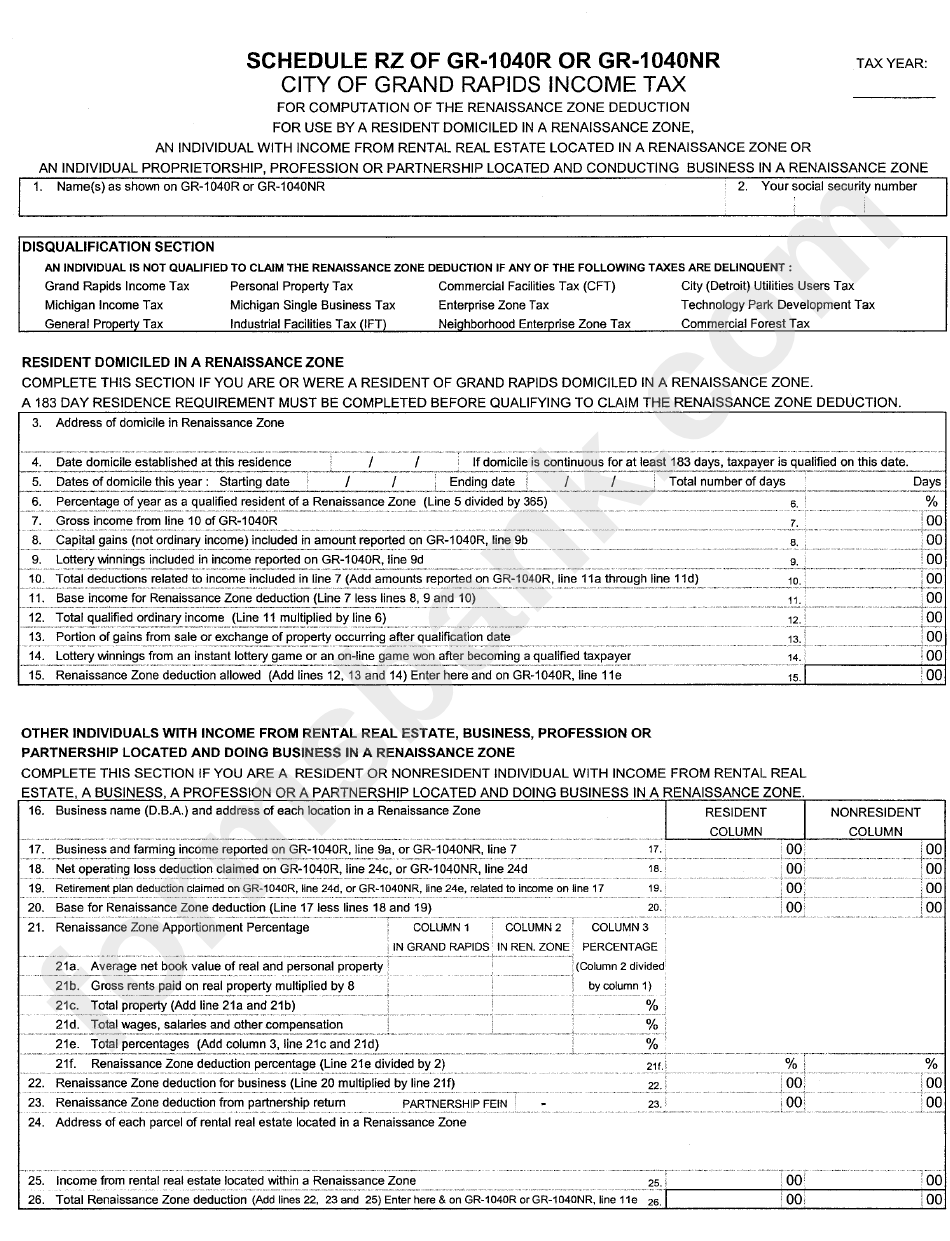

Schedule Rz Of Gr1040r Or Gr1040nr City Of Grand Rapids Tax

Also includes forms from previous years. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Web if you have not received your summer property tax bill in the mail by monday, july 10, 2023, please contact the city treasurer's office to request a duplicate.

Hundreds of taxpayers will get letter from city for making this mistake

City of grand rapids tax form; Web employee’s withholding certificate for grand rapids income tax nonresident 1. Complete, edit or print tax forms instantly. Web if you have not received your summer property tax bill in the mail by monday, july 10, 2023, please contact the city treasurer's office to request a duplicate bill be sent to you or. Quarterly.

Line 44 on form 1040 instructions

Print full name social security no. For use by individuals who were not residents of. Click the city name to access the appropriate. Grand rapids income tax p.o. Choose the correct version of the editable.

Grand Rapids Coins Charges No Sales Tax on Coins Bought In Michigan

Cocodoc is the best website for you to go, offering you a great and easy to edit version of grand rapids. Current and past tax foreclosure auction results; We have everything individuals, businesses, and withholders need to file taxes with the city. City of walker tax form; Web city of benton harbor.

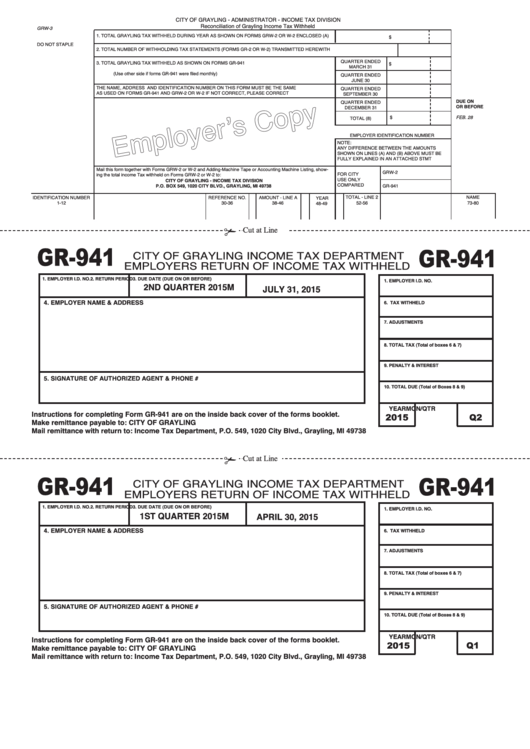

Form Gr941 Employers Return Of Tax Withheld City Of

Web find and fill out the correct grand rapids michigan tax forms 2018. Complete, edit or print tax forms instantly. Current and past tax foreclosure auction results; Cocodoc is the best website for you to go, offering you a great and easy to edit version of grand rapids. Your return must be filed by april 30, 2021 make remittance payable.

Top 40 City Of Grand Rapids Tax Forms And Templates free to download in

Web employee’s withholding certificate for grand rapids income tax nonresident 1. For use by individuals who were not residents of. Web tax day this year is next monday, april 18. Web city of grand rapids income tax. City of walker tax form;

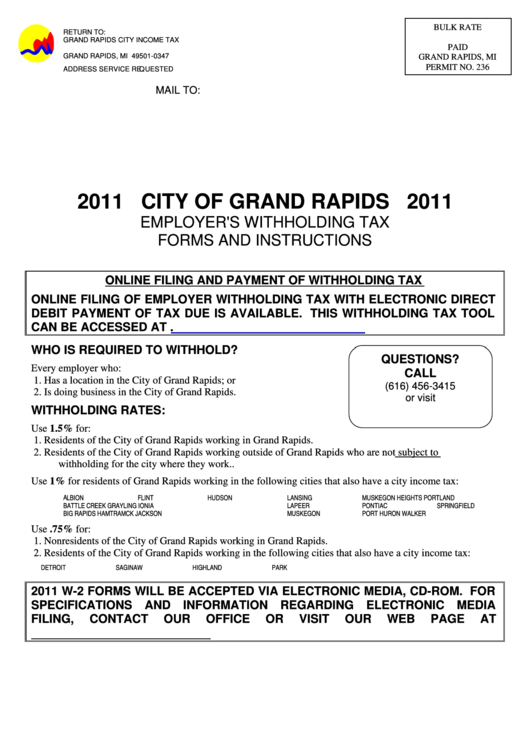

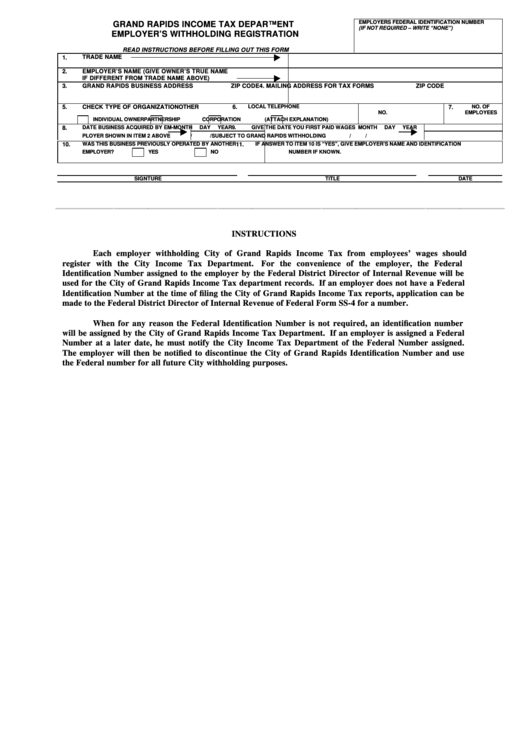

Employer'S Withholding Registration Form City Of Grand Rapids

Web in grand rapids during 2020 and by trusts and estates. Web find and fill out the correct grand rapids michigan tax forms 2018. Web tax day this year is next monday, april 18. Web the income tax department's library of income tax forms. City of walker tax form;

No distribution of paper forms for 2013 Grand Rapids tax returns

Web individual tax forms current year tax forms. We have everything individuals, businesses, and withholders need to file taxes with the city. City of walker tax form; Click the city name to access the appropriate. Edit, sign and print tax forms on any device with uslegalforms.

Grand Rapids tax administrator urges itemizers to wait until

Web city of grand rapids income tax. Web irs forms and publications. Complete, edit or print tax forms instantly. Web if you have not received your summer property tax bill in the mail by monday, july 10, 2023, please contact the city treasurer's office to request a duplicate bill be sent to you or. Quarterly report of lodging excise tax.

Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

Web city of grand rapids income tax. Web city of benton harbor. State of michigan tax form; Also includes forms from previous years.

Your Return Must Be Filed By April 30, 2021 Make Remittance Payable To:.

Web 0.75% residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax. Forms may also be available at the local irs office: Web if you have not received your summer property tax bill in the mail by monday, july 10, 2023, please contact the city treasurer's office to request a duplicate bill be sent to you or. Web city of grand rapids income tax.

Choose The Correct Version Of The Editable.

Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Originally, the deadline to file taxes in grand rapids was april 30, but that's been pushed back to may 2. Web tax day this year is next monday, april 18. Web in grand rapids during 2020 and by trusts and estates.

Current And Past Tax Foreclosure Auction Results;

City of grand rapids tax form; Web individual tax forms current year tax forms. For use by individuals who were not residents of. Cocodoc is the best website for you to go, offering you a great and easy to edit version of grand rapids.