How To File Form 1116

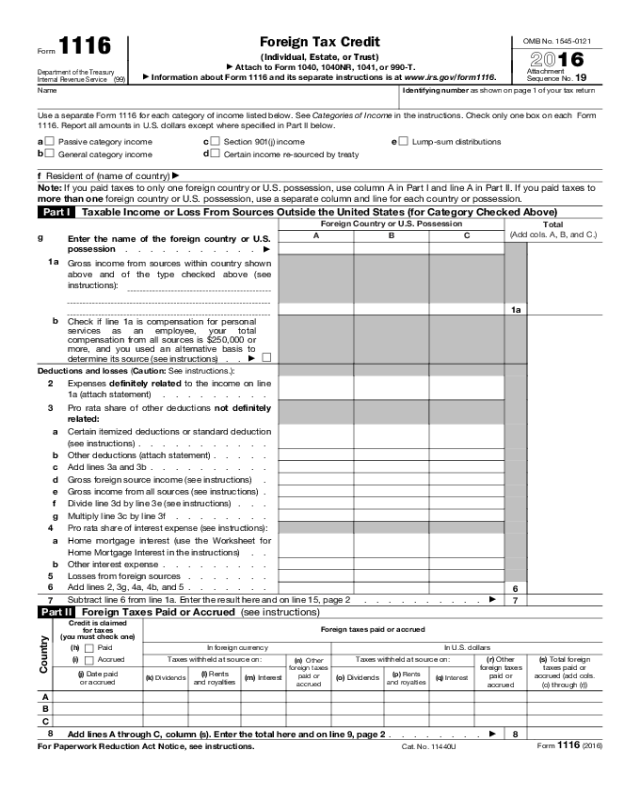

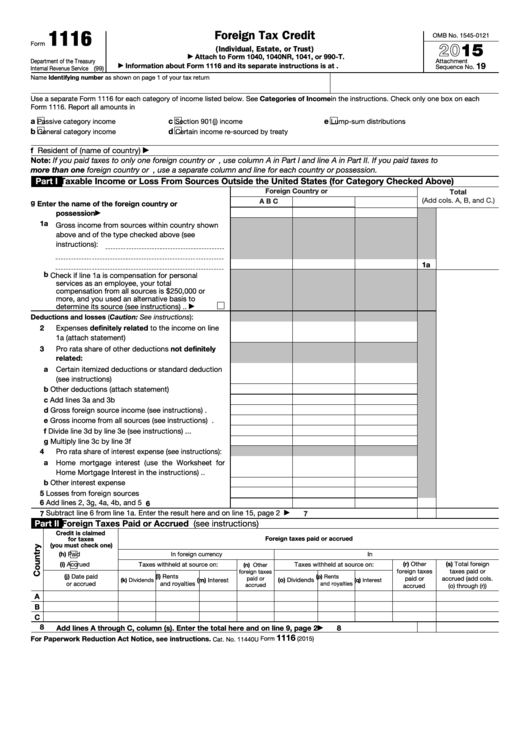

How To File Form 1116 - Within your federal tax return: At the end of this lesson, using your resource materials, you will be able to: The foreign tax credit can be claimed for tax paid. Web form 16 is a document which contains all details required to file the it returns. Web this could be the case, for example, when the partnership knows that the direct and indirect partners do not claim a foreign tax credit or when the partnership. Tax liability due to taxes levied by a foreign. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a. Enter a 1 or 2 in, elect not to file form 1116: Web starting in tax year 2021, the irs released a new schedule b for form 1116 to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web is form 1116 required?

At the end of this lesson, using your resource materials, you will be able to: Web what do i need? Web this could be the case, for example, when the partnership knows that the direct and indirect partners do not claim a foreign tax credit or when the partnership. Form 1116, foreign tax credit for. Generating form 1116 foreign tax credit for an individual return in lacerte. Enter a 1 or 2 in, elect not to file form 1116: Web starting in tax year 2021, the irs released a new schedule b for form 1116 to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web by intuit•updated 1 month ago. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a. Go to tax tools > tools to open the tools center.

The employers will need to provide form 16 to employees at the end of every. Web is form 1116 required? At the end of this lesson, using your resource materials, you will be able to: Click on general info/elections from the top left navigation panel. Web form 16 is a document which contains all details required to file the it returns. Enter a 1 or 2 in, elect not to file form 1116: Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing form 1116. You must have incurred or paid a foreign tax liability. Web form 1116 instructions step one: Generating form 1116 foreign tax credit for an individual return in lacerte.

The Expat's Guide to Form 1116 Foreign Tax Credit

Within your federal tax return: The employers will need to provide form 16 to employees at the end of every. Go to tax tools > tools to open the tools center. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

The employers will need to provide form 16 to employees at the end of every. Within your federal tax return: Tax liability due to taxes levied by a foreign. Web dec 29, 2022 who must file with respect to each separate category of income, if you’re filing form 1116 that has a foreign tax carryover in the prior tax year,.

Form 1116 Edit, Fill, Sign Online Handypdf

Your foreign tax credit cannot be more than. Web you figure your foreign tax credit and the foreign tax credit limit on form 1116, foreign tax credit. Web dec 29, 2022 who must file with respect to each separate category of income, if you’re filing form 1116 that has a foreign tax carryover in the prior tax year, the current.

The Expat's Guide to Form 1116 Foreign Tax Credit

Web is form 1116 required? Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a. Web form 1116 instructions step one: Web by intuit•updated 1 month ago. At the end of this lesson, using your resource materials, you will.

Demystifying IRS Form 1116 Calculating Foreign Tax Credits SF Tax

Tax liability due to taxes levied by a foreign. Web form 16 is a document which contains all details required to file the it returns. You must have incurred or paid a foreign tax liability. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Web what do i need? Within your federal tax return: Tax liability due to taxes levied by a foreign. A form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other. Web there is a new schedule c (form 1116) which is used.

Do I Need to File Form 1116 to Use the Foreign Tax Credit? YouTube

Web dec 29, 2022 who must file with respect to each separate category of income, if you’re filing form 1116 that has a foreign tax carryover in the prior tax year, the current tax. Go to tax tools > tools to open the tools center. Web single filers who paid $300 or less in foreign taxes, and married joint filers.

Fillable Form 1116 Foreign Tax Credit printable pdf download

You must have incurred or paid a foreign tax liability. Web this could be the case, for example, when the partnership knows that the direct and indirect partners do not claim a foreign tax credit or when the partnership. Generating form 1116 foreign tax credit for an individual return in lacerte. But using the form enables you. Web what do.

Form 1116 Foreign Tax Credit YouTube

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web there is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. But using.

Web Starting In Tax Year 2021, The Irs Released A New Schedule B For Form 1116 To Reconcile Your Prior Year Foreign Tax Carryover With Your Current Year Foreign Tax Carryover.

Form 1116, foreign tax credit for. Web dec 29, 2022 who must file with respect to each separate category of income, if you’re filing form 1116 that has a foreign tax carryover in the prior tax year, the current tax. Tax liability due to taxes levied by a foreign. Enter a 1 or 2 in, elect not to file form 1116:

Web Go To Screen 35, Foreign Tax Credit (1116).

Go to tax tools > tools to open the tools center. The foreign tax credit can be claimed for tax paid. Click on general info/elections from the top left navigation panel. Web what do i need?

Web 1 Best Answer Fangxial Expert Alumni Try The Following Steps To Resolve Your Issue:

Web this could be the case, for example, when the partnership knows that the direct and indirect partners do not claim a foreign tax credit or when the partnership. Web form 16 is a document which contains all details required to file the it returns. A form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other. The employers will need to provide form 16 to employees at the end of every.

But Using The Form Enables You.

Web by intuit•updated 1 month ago. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing form 1116. Web you figure your foreign tax credit and the foreign tax credit limit on form 1116, foreign tax credit. Web is form 1116 required?