How To File Form 5472

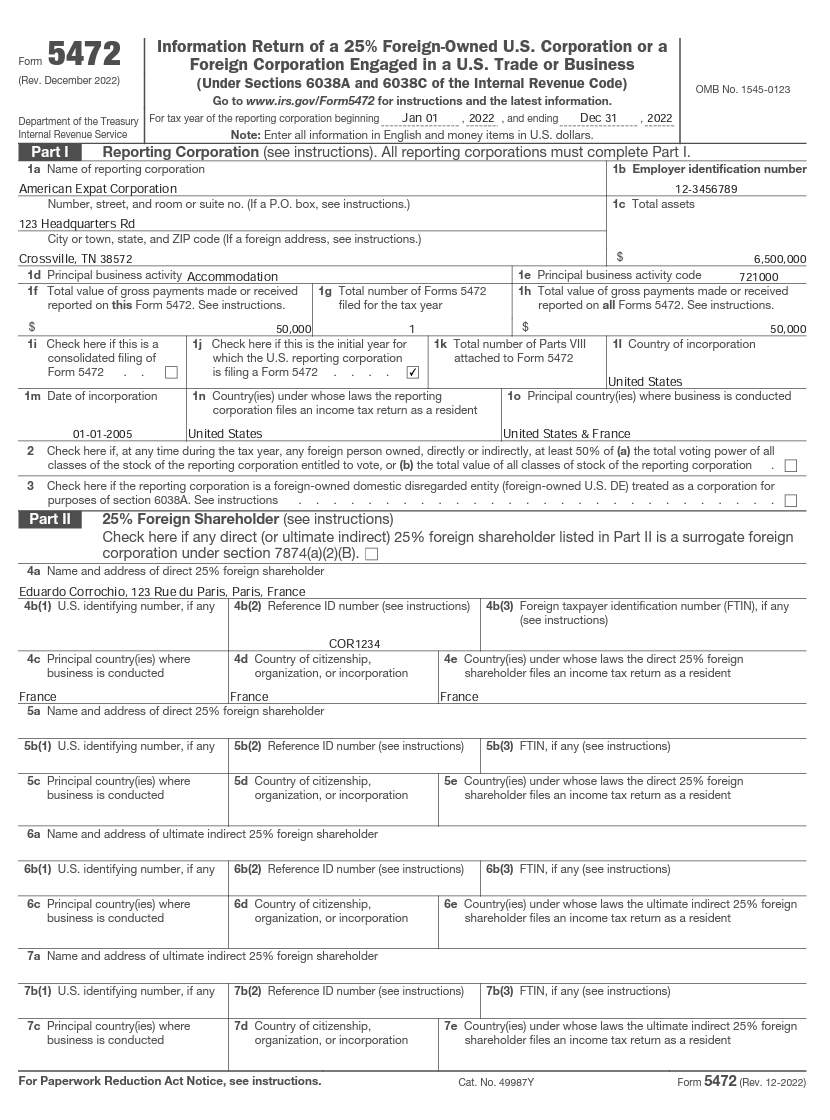

How To File Form 5472 - Just like any other company, the owner of a llc must apply for an ein by preparing. Llc must file a form 5472 with a proforma form 1120 every tax year. De required to file form 5472 can request an extension of time to file by filing form 7004. Web in order to file form 5472, your client will need to get an ein number to properly file with the irs. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Web irs form 5472 is known as information return of a 25% foreign owned us corporation or a foreign corporation engaged in a us trade or business. Complete, edit or print tax forms instantly. However, it is not always so simple. Corporations file form 5472 to provide information. The common parent must attach to form 5472 a schedule stating which members of the u.s.

Just like any other company, the owner of a llc must apply for an ein by preparing. As the name of the form. However, it is not always so simple. De required to file form 5472 can request an extension of time to file by filing form 7004. Penalties for not complying with form 5472 filing. Affiliated group are reporting corporations. Complete, edit or print tax forms instantly. Web form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting. The common parent must attach to form 5472 a schedule stating which members of the u.s. Extension of time to file.

Web in order to file form 5472, your client will need to get an ein number to properly file with the irs. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. De required to file form 5472 can request an extension of time to file by filing form 7004. Penalties for not complying with form 5472 filing. Des must use a special mailing address and filing instructions for submitting forms 1120 and 5472. Corporations file form 5472 to provide information. For tax year of the reporting corporation beginning , , and ending , note: Extension of time to file. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,.

Should I File Form 5472 if my LLC Owns Real Estate? YouTube

Web the instructions for form 1120. Llc must file a form 5472 with a proforma form 1120 every tax year. Enter all information in english and. Download or email irs 5472 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

Download or email irs 5472 & more fillable forms, register and subscribe now! The form is filed on behalf of the us corporation as an entity. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Enter all information in english and. Web go to www.irs.gov/form5472 for instructions and the latest information.

Form 5472 and Disregarded Entities Who Must File It?

Web go to www.irs.gov/form5472 for instructions and the latest information. Web irs form 5472 is known as information return of a 25% foreign owned us corporation or a foreign corporation engaged in a us trade or business. Web form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year.

How to File Form 5472 Extension Due July 15th 2020! YouTube

Enter all information in english and. The form is filed on behalf of the us corporation as an entity. Web irs form 5472 is known as information return of a 25% foreign owned us corporation or a foreign corporation engaged in a us trade or business. Ad complete irs tax forms online or print government tax documents. As the name.

What is the IRS Form 5472 in Florida? EPGD Business Law

Penalties for not complying with form 5472 filing. The form is filed on behalf of the us corporation as an entity. Llc must file a form 5472 with a proforma form 1120 every tax year. The common parent must attach to form 5472 a schedule stating which members of the u.s. Affiliated group are reporting corporations.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Enter all information in english and. Web in order to file form 5472, you have to apply for a u.s employer identification number, or ein. Des must use a special mailing address.

IRS Form 5472

Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web go to www.irs.gov/form5472 for instructions and the latest information. Enter all information in english and. Corporations file form 5472 to provide information. The form is filed on behalf of the us corporation as an entity.

Form 5472 Instructions, Examples, and More

Download or email irs 5472 & more fillable forms, register and subscribe now! Penalties for not complying with form 5472 filing. As the name of the form. Web the instructions for form 1120. The form is filed on behalf of the us corporation as an entity.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

However, it is not always so simple. Web go to www.irs.gov/form5472 for instructions and the latest information. Ad complete irs tax forms online or print government tax documents. Penalties for not complying with form 5472 filing. Extension of time to file.

International Tax Advisors Tax Issues for Companies With Foreign

Web in order to file form 5472, you have to apply for a u.s employer identification number, or ein. The form is filed on behalf of the us corporation as an entity. Web irs form 5472 is known as information return of a 25% foreign owned us corporation or a foreign corporation engaged in a us trade or business. Just.

Web In Order To File Form 5472, Your Client Will Need To Get An Ein Number To Properly File With The Irs.

Web the instructions for form 1120. Download or email irs 5472 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Enter all information in english and.

Penalties For Not Complying With Form 5472 Filing.

Web form 5472 should be used to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting. De required to file form 5472 can request an extension of time to file by filing form 7004. Web in order to file form 5472, you have to apply for a u.s employer identification number, or ein. Get ready for tax season deadlines by completing any required tax forms today.

Web Go To Www.irs.gov/Form5472 For Instructions And The Latest Information.

The form is filed on behalf of the us corporation as an entity. However, it is not always so simple. Des must use a special mailing address and filing instructions for submitting forms 1120 and 5472. Extension of time to file.

Web Irs Form 5472 Is Known As Information Return Of A 25% Foreign Owned Us Corporation Or A Foreign Corporation Engaged In A Us Trade Or Business.

Just like any other company, the owner of a llc must apply for an ein by preparing. The common parent must attach to form 5472 a schedule stating which members of the u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file. For tax year of the reporting corporation beginning , , and ending , note:

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-768x768.jpg)