How To Fill Out Form 4852 Without Pay Stub

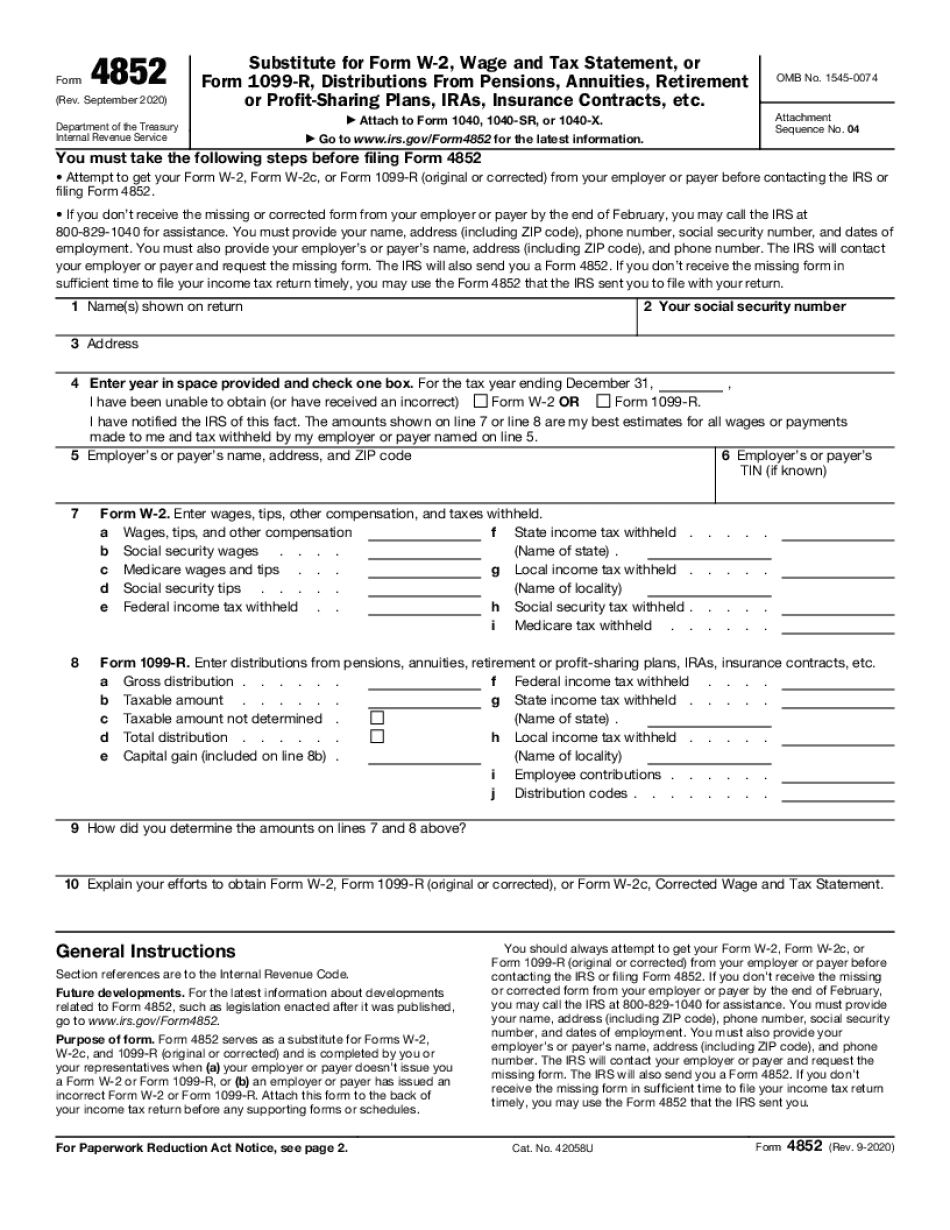

How To Fill Out Form 4852 Without Pay Stub - Complete, edit or print tax forms instantly. Download or email irs 4852 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web how do i fill out form 4852 correctly? Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or. Ad access irs tax forms. Web when can i use irs form 4852? Web the first thing you need to do is go to the irs website and fill out form 4852. To begin, access form 4852 on the internal revenue. Solved • by turbotax • 1436 • updated january 13, 2023 you can file a conventional paper return that.

Download or email irs 4852 & more fillable forms, register and subscribe now! Ad register and subscribe now to work on your irs 4852 & more fillable forms. To obtain form 4852, contact the irs using the number listed under “how to use form. Ad access irs tax forms. Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or. Solved • by turbotax • 1436 • updated january 13, 2023 you can file a conventional paper return that. Download form 4852 from the irs website and complete it using a copy of your. The irs requests this form only be used. Web the best way to file taxes with the last pay stub is by filing internal revenue service form 4852 online. Web how do i fill out form 4852 correctly?

Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or. Web when can i use irs form 4852? Ad access irs tax forms. When you call, have the following information: Complete, edit or print tax forms instantly. Web the best way to file taxes with the last pay stub is by filing internal revenue service form 4852 online. Complete, edit or print tax forms instantly. Solved • by turbotax • 1436 • updated january 13, 2023 you can file a conventional paper return that. To begin, access form 4852 on the internal revenue. Web the first thing you need to do is go to the irs website and fill out form 4852.

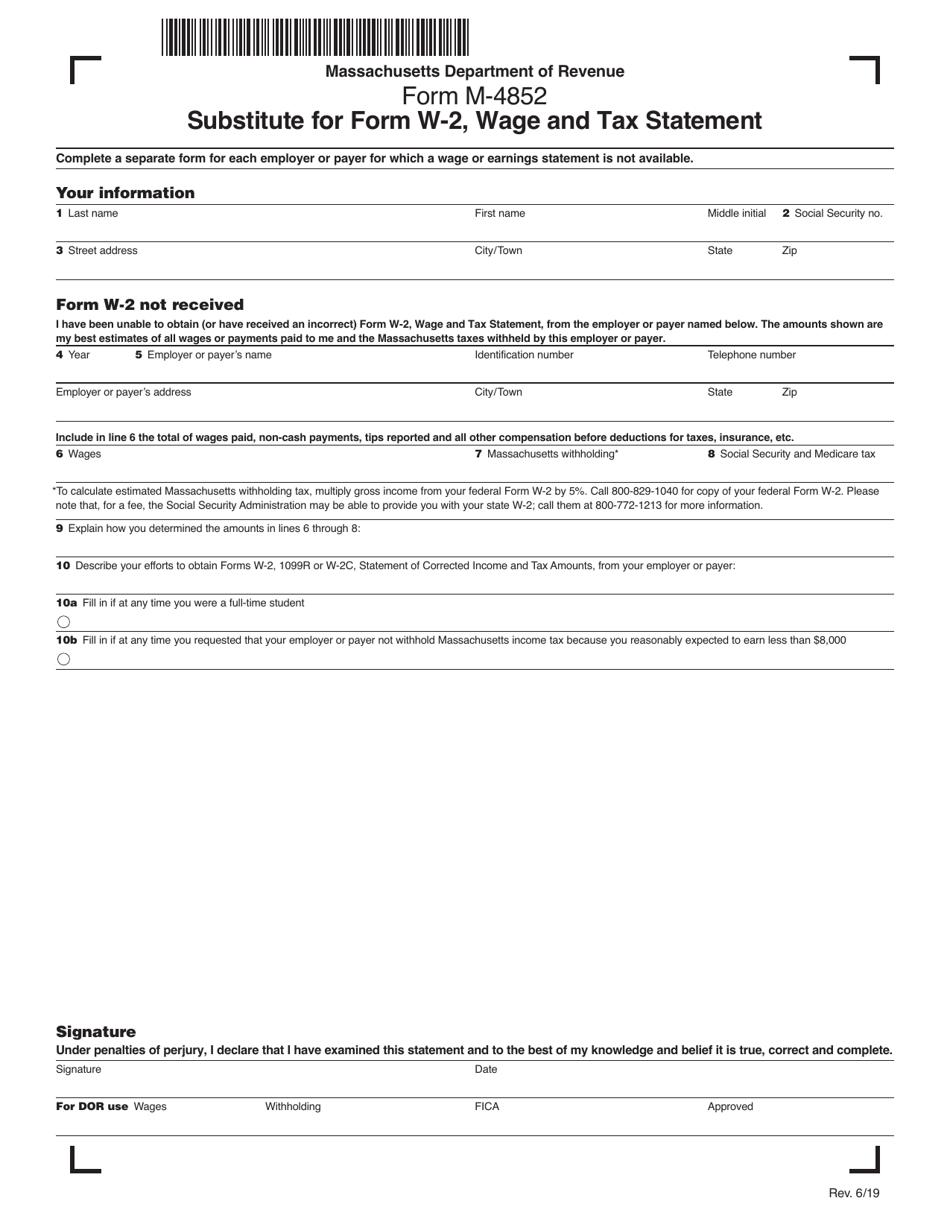

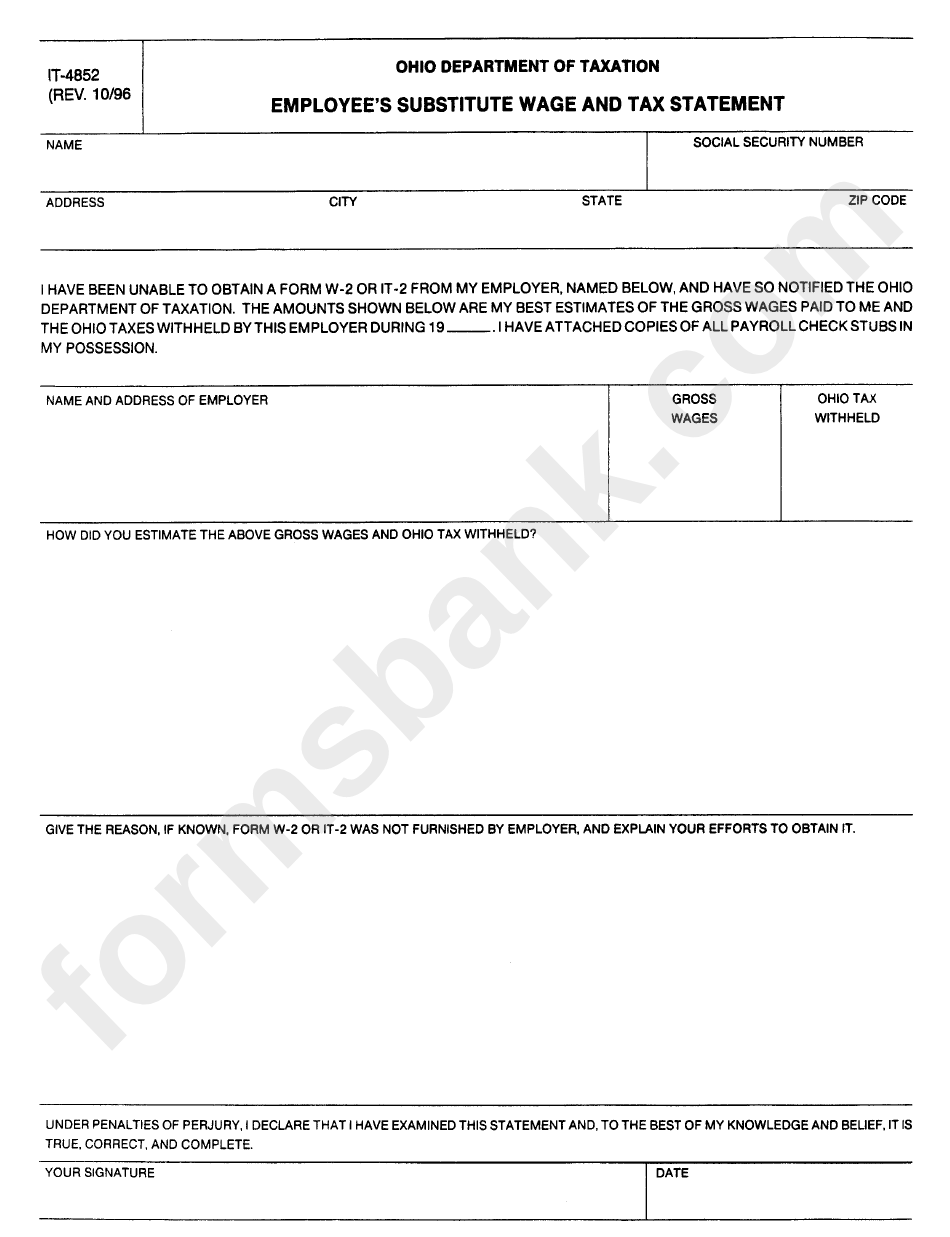

Form M4852 Download Printable PDF or Fill Online Substitute for Form W

Download or email irs 4852 & more fillable forms, register and subscribe now! Web how do i fill out form 4852 correctly? Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or. When you call, have the following information: Web.

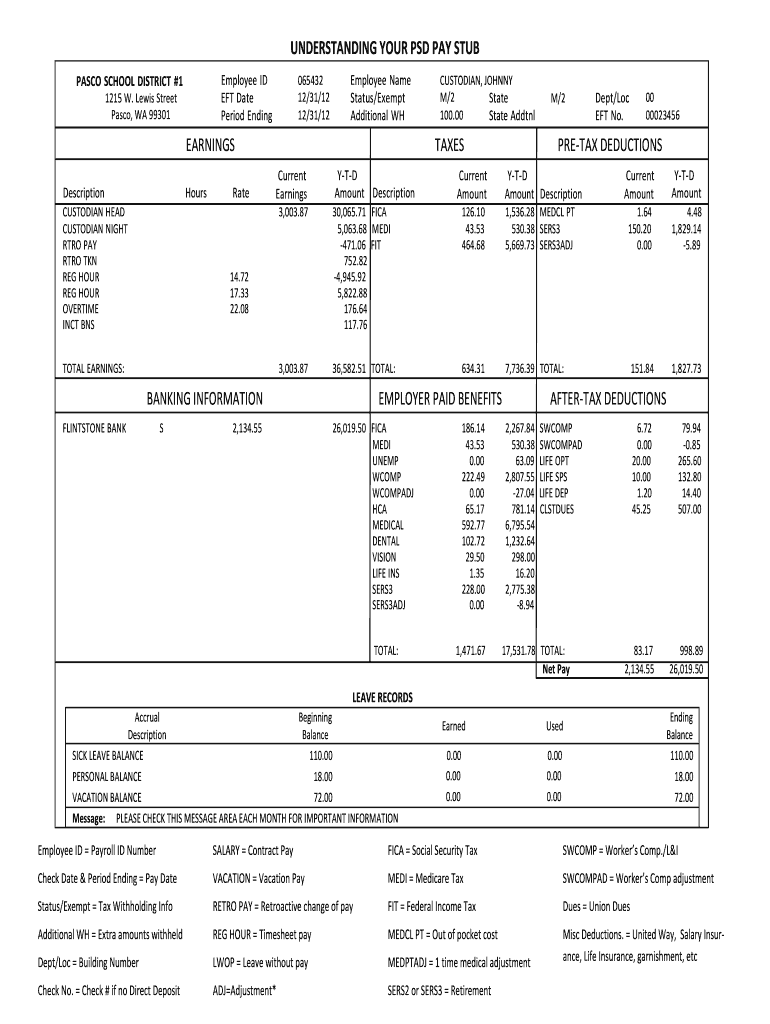

Adp Check Stub Maker Form Fill Out and Sign Printable PDF Template

The irs requests this form only be used. Download or email irs 4852 & more fillable forms, register and subscribe now! Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or. When you call, have the following information: Download form.

Missing a W2? Follow these 3 easy steps to file a tax return

Complete, edit or print tax forms instantly. Web the first thing you need to do is go to the irs website and fill out form 4852. Complete, edit or print tax forms instantly. When you call, have the following information: Ad access irs tax forms.

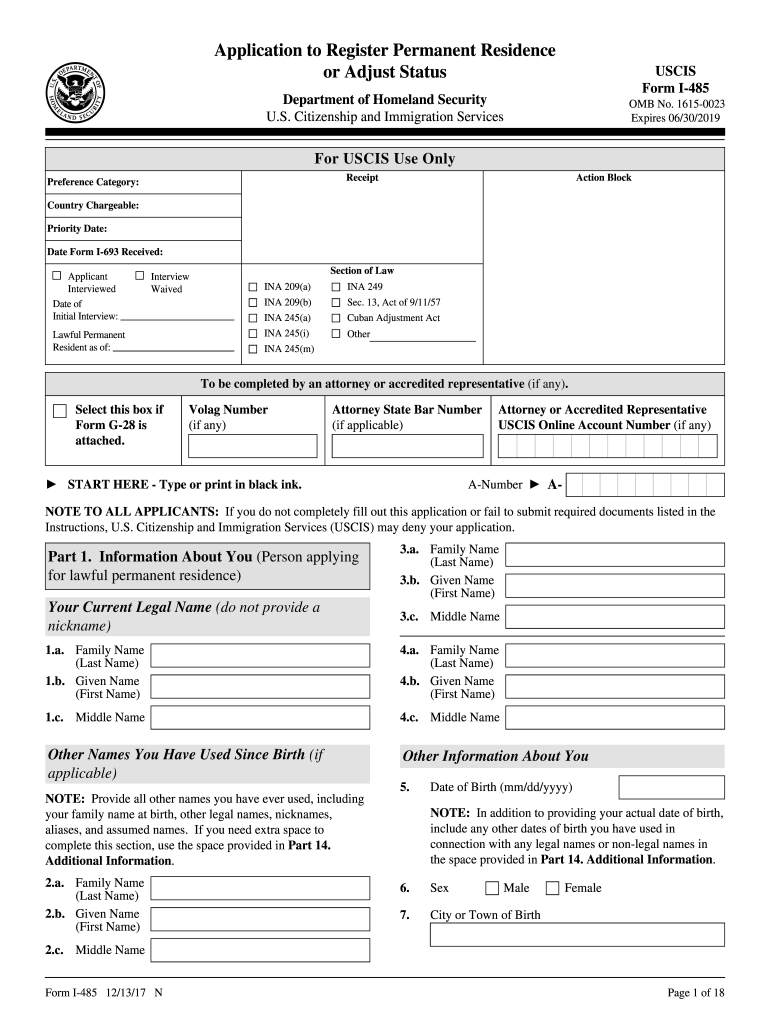

2017 Form USCIS I485 Fill Online, Printable, Fillable, Blank pdfFiller

Download or email irs 4852 & more fillable forms, register and subscribe now! Ad access irs tax forms. Complete, edit or print tax forms instantly. To begin, access form 4852 on the internal revenue. The irs requests this form only be used.

How to Fill Out Form 4852 Without Pay Stub

Ad access irs tax forms. Web the first thing you need to do is go to the irs website and fill out form 4852. To obtain form 4852, contact the irs using the number listed under “how to use form. Solved • by turbotax • 1436 • updated january 13, 2023 you can file a conventional paper return that. Ad.

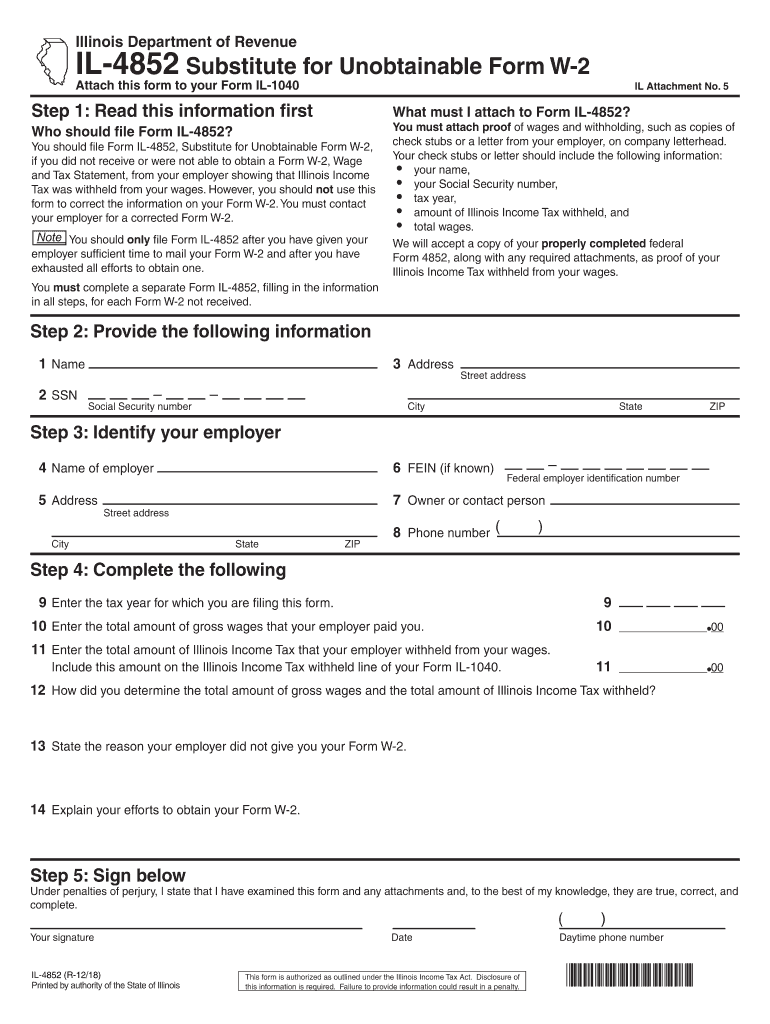

Il 4852 Fill Out and Sign Printable PDF Template signNow

Ad register and subscribe now to work on your irs 4852 & more fillable forms. Web how do i fill out form 4852 correctly? Web when can i use irs form 4852? Download or email irs 4852 & more fillable forms, register and subscribe now! Ad access irs tax forms.

Form It4852 Employee'S Substitute Wage And Tax Statement printable

Download or email irs 4852 & more fillable forms, register and subscribe now! Download or email irs 4852 & more fillable forms, register and subscribe now! Ad register and subscribe now to work on your irs 4852 & more fillable forms. Web the best way to file taxes with the last pay stub is by filing internal revenue service form.

Last paystub or W2 Filing taxes, Irs forms, Tax services

When you call, have the following information: The irs requests this form only be used. Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or. Download form 4852 from the irs website and complete it using a copy of your..

Form 4852 Fill Out and Sign Printable PDF Template signNow

Ad register and subscribe now to work on your irs 4852 & more fillable forms. Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or. Web the first thing you need to do is go to the irs website and.

How to fill out Form I485 (expires july 31 2021) Aplication to

Download form 4852 from the irs website and complete it using a copy of your. Ad register and subscribe now to work on your irs 4852 & more fillable forms. To begin, access form 4852 on the internal revenue. Web the first thing you need to do is go to the irs website and fill out form 4852. Web how.

Complete, Edit Or Print Tax Forms Instantly.

Download or email irs 4852 & more fillable forms, register and subscribe now! The irs requests this form only be used. Complete, edit or print tax forms instantly. Web how do i fill out form 4852 correctly?

Web When Can I Use Irs Form 4852?

Download form 4852 from the irs website and complete it using a copy of your. Download or email irs 4852 & more fillable forms, register and subscribe now! Ad access irs tax forms. Web the best way to file taxes with the last pay stub is by filing internal revenue service form 4852 online.

Solved • By Turbotax • 1436 • Updated January 13, 2023 You Can File A Conventional Paper Return That.

Ad register and subscribe now to work on your irs 4852 & more fillable forms. When you call, have the following information: To begin, access form 4852 on the internal revenue. Ad access irs tax forms.

To Obtain Form 4852, Contact The Irs Using The Number Listed Under “How To Use Form.

Web the first thing you need to do is go to the irs website and fill out form 4852. Web if you file your return and attach form 4852, you’ll need to estimate the wages you earned, taxes withheld, and the period for which you did not receive or.