How To Fill Out Form 5695

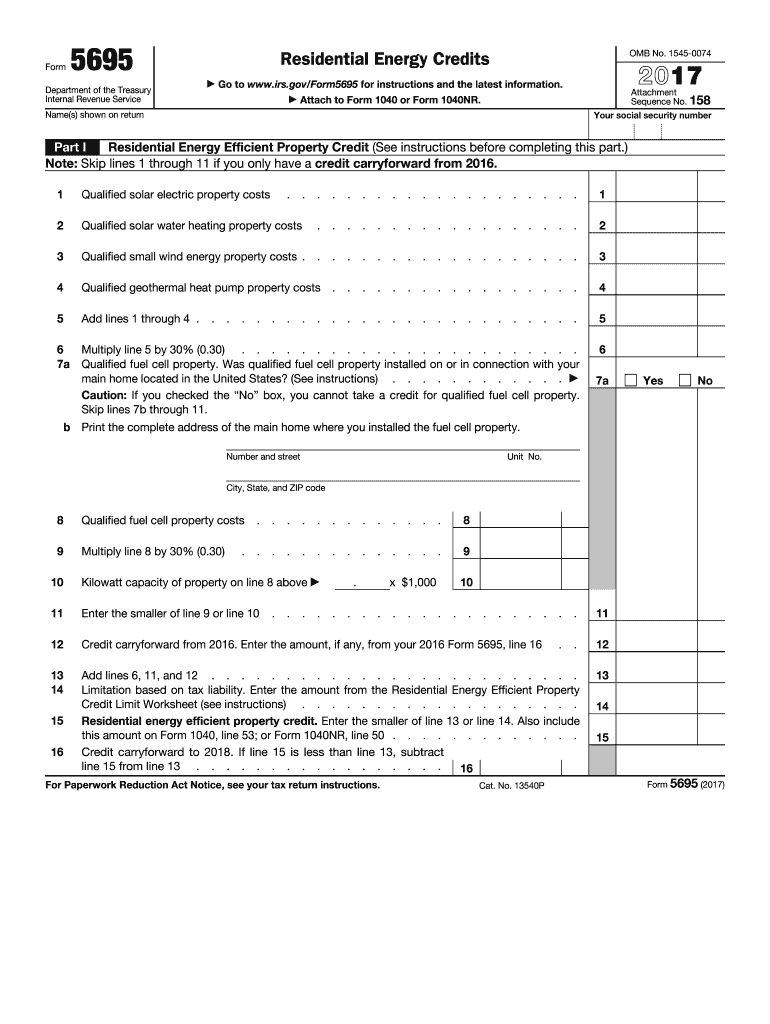

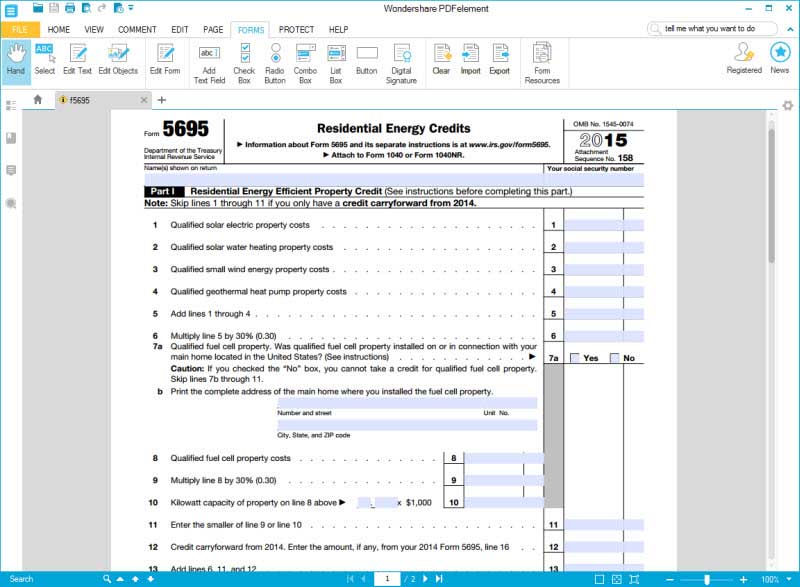

How To Fill Out Form 5695 - Web produced with cyberlink powerdirector 14 Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. Web form 5695 instructions. For updates on the 2022 versions of form 5695, see the following playlist: Web january 11, 2022 12:09 pm. The residential energy credits are: Web every gotten anything for your home to save you on your energy bill? The nonbusiness energy property credit, and the residential energy efficient property credit. Irs form 5695 has a total of two parts in two pages. Current revision form 5695 pdf.

Department of the treasury internal revenue service. Web form 5695 instructions. Web the residential energy credits are: Find out on this show of real tax talk live how that benefits you on your tax return. Yes, you can carry any unused residential solar energy credits forward to 2022. The residential clean energy credit, and the energy efficient home. Ad register and subscribe now to work on your irs form 5695 & more fillable forms. Web january 11, 2022 12:09 pm. For instructions and the latest. Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return.

Ad register and subscribe now to work on your irs form 5695 & more fillable forms. The nonbusiness energy property credit, and the residential energy efficient property credit. Yes, you can carry any unused residential solar energy credits forward to 2022. Current revision form 5695 pdf. Click my account (top right of your screen). Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web every gotten anything for your home to save you on your energy bill? You'll also need to save copies of the receipts for. Web learn about claiming residential energy credits using form 5695 here. To add or remove this.

Form 5695 Instructions Information On Form 5695 —

Web every gotten anything for your home to save you on your energy bill? You'll also need to save copies of the receipts for. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Click my account (top right of your screen).

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Web the residential energy credits are: Ad register and subscribe now to work on your irs form 5695 & more fillable forms. To claim the credit, you must file irs form 5695 as part. You just have to complete the section concerning to the types of credits you need to claim. The nonbusiness energy property credit, and the residential energy.

5695 form Fill out & sign online DocHub

The residential energy credits are: Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. You'll also need to save copies of the receipts for. For updates on the 2022 versions of form 5695, see the following playlist: Complete, edit or print tax forms instantly.

Form Instructions Is Available For How To File 5695 2018 —

Complete, edit or print tax forms instantly. The residential energy credits are: Web every gotten anything for your home to save you on your energy bill? Ad register and subscribe now to work on your irs form 5695 & more fillable forms. To claim the credit, you must file irs form 5695 as part.

Inflation Reduction Act Efficiency Tax Credits Total Guide

Web every gotten anything for your home to save you on your energy bill? Web produced with cyberlink powerdirector 14 The residential clean energy credit, and the energy efficient home. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. You just have to complete the section.

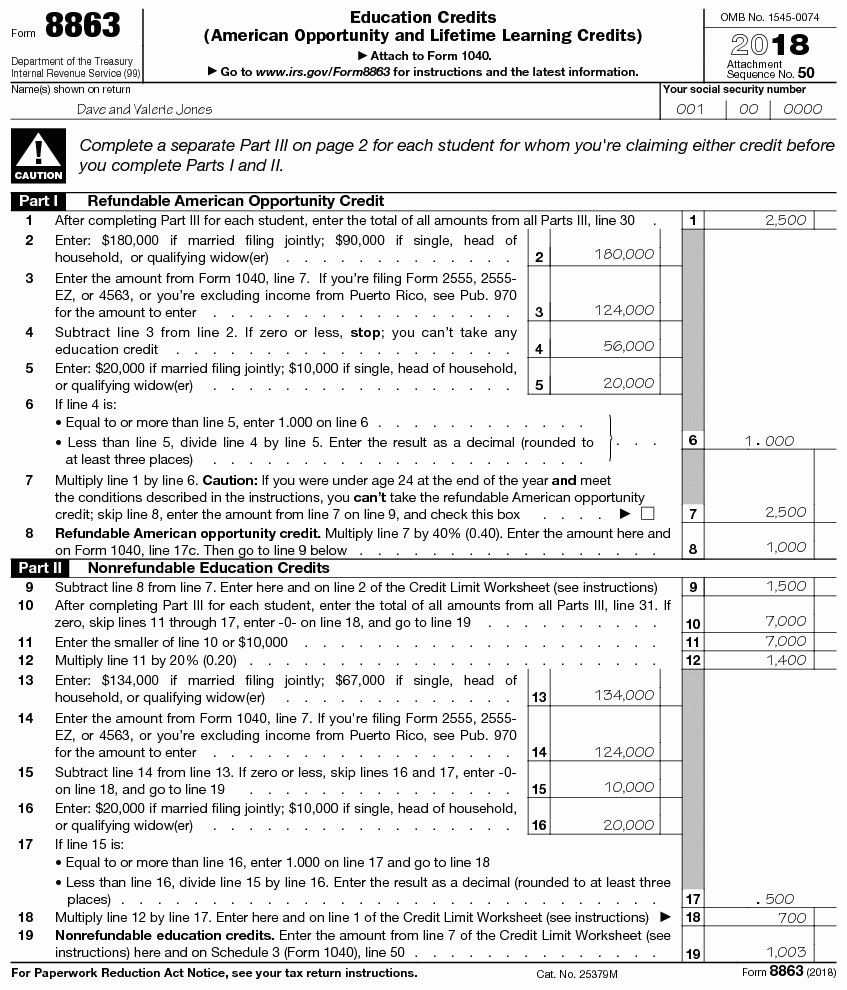

Ev Federal Tax Credit Form

Complete, edit or print tax forms instantly. Web learn about claiming residential energy credits using form 5695 here. To claim the credit, you must file irs form 5695 as part. Department of the treasury internal revenue service. You just have to complete the section concerning to the types of credits you need to claim.

IRS Zqi 2019 Official Version Win 7 Get alk kpd Telegraph

Web january 11, 2022 12:09 pm. Web every gotten anything for your home to save you on your energy bill? Complete, edit or print tax forms instantly. For updates on the 2022 versions of form 5695, see the following playlist: Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module.

What Is Form 5695 Residential Energy Credits?

To claim the credit, you must file irs form 5695 as part. Click my account (top right of your screen). Find out on this show of real tax talk live how that benefits you on your tax return. For instructions and the latest. Web the residential energy credits are:

Image tagged in scumbag,old fashioned Imgflip

For updates on the 2022 versions of form 5695, see the following playlist: Web january 11, 2022 12:09 pm. Web form 5695 instructions. To add or remove this. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment.

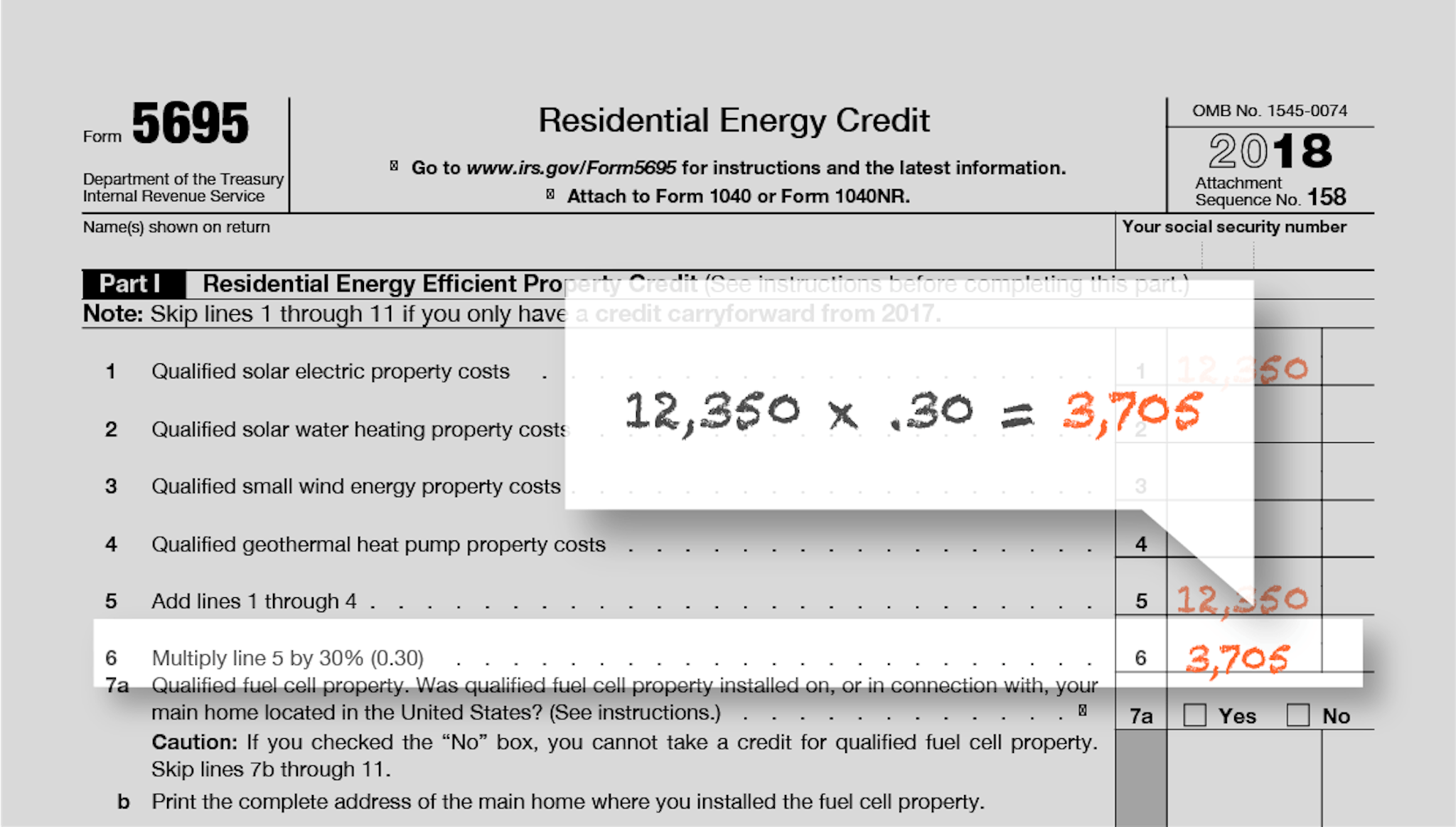

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Ad register and subscribe now to work on your irs form 5695 & more fillable forms. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. You just have to complete the section concerning to the types of credits you need to claim. For updates on the.

Click My Account (Top Right Of Your Screen).

Web learn about claiming residential energy credits using form 5695 here. Department of the treasury internal revenue service. For updates on the 2022 versions of form 5695, see the following playlist: The nonbusiness energy property credit, and the residential energy efficient property credit.

Current Revision Form 5695 Pdf.

Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your irs form 5695 & more fillable forms. Web every gotten anything for your home to save you on your energy bill? To add or remove this.

Web Federal Tax Form 5695 Is Used To Calculate Your Residential Energy Credit, And Must Be Submitted Alongside Form 1040 With Your Income Tax Return.

You'll also need to save copies of the receipts for. Irs form 5695 has a total of two parts in two pages. Web january 11, 2022 12:09 pm. Web produced with cyberlink powerdirector 14

The Residential Energy Credits Are:

Web the residential energy credits are: Web use form 5695 to figure and take your residential energy credits. The residential clean energy credit, and the energy efficient home. You just have to complete the section concerning to the types of credits you need to claim.