How To Fill Out Form 8812

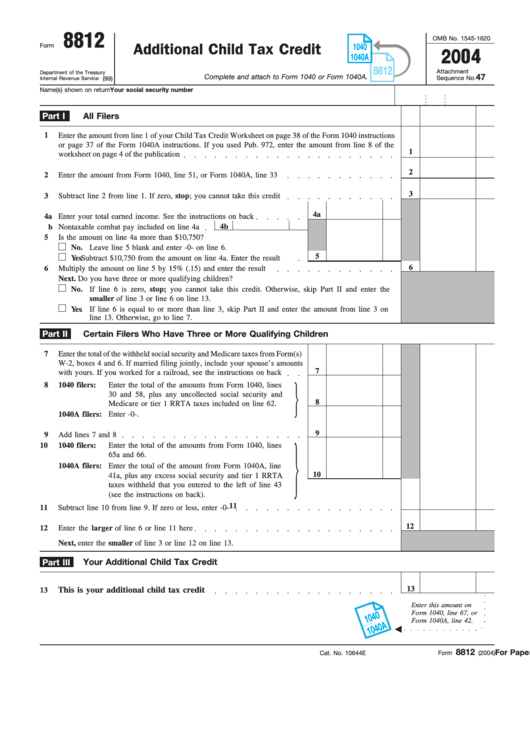

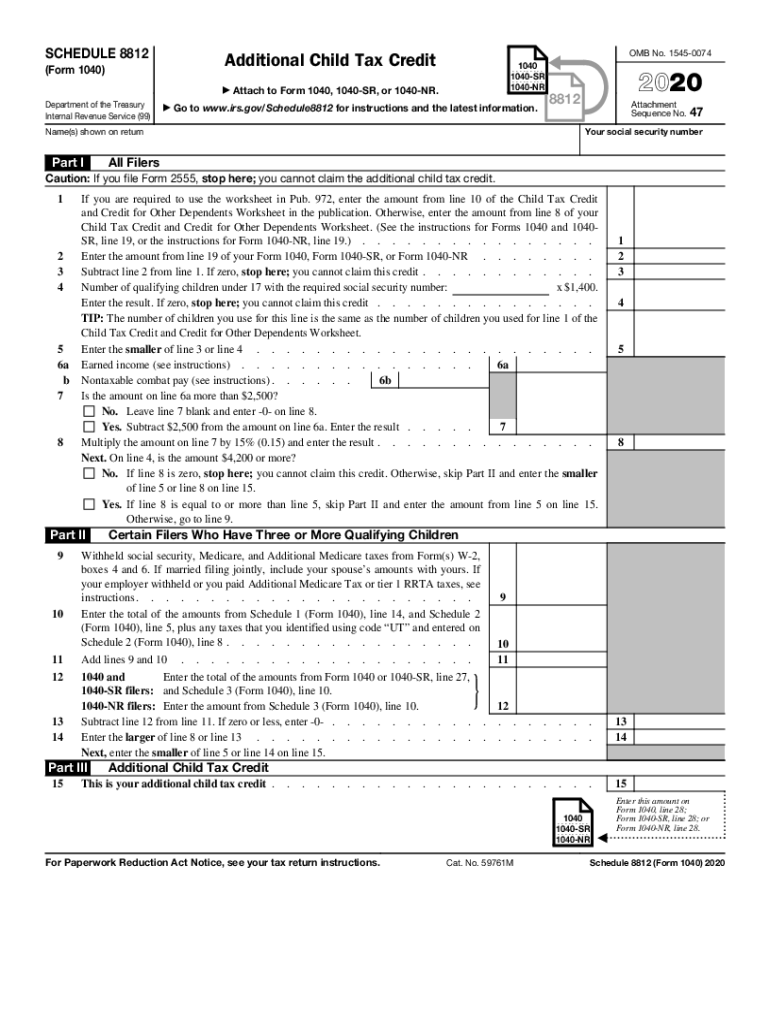

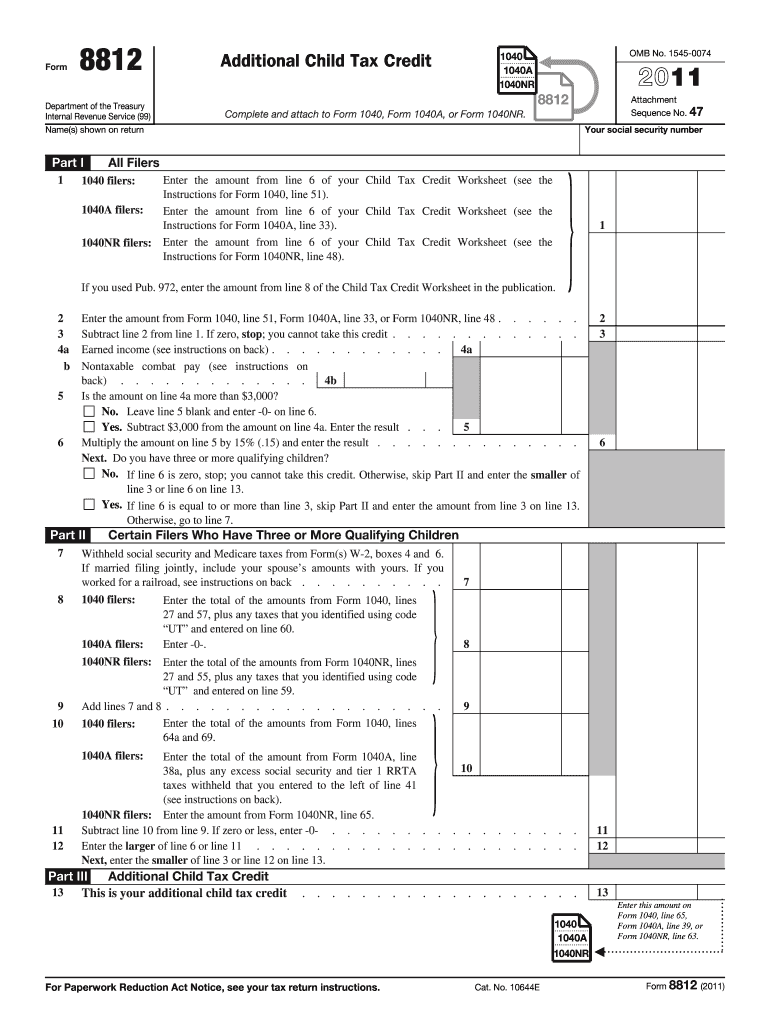

How To Fill Out Form 8812 - That means if you only owe $1,000. Enter the amount from line 11 of your form 1040, 1040. Review your form 1040 lines 24 thru 35. Web 2021 child tax credit explained as we discuss an example of how to file form 8812👉 need tax & accounting services? Web fill in the information required in irs 1040 schedule 8812 instructions, making use of fillable fields. Get ready for tax season deadlines by completing any required tax forms today. Your refund is reported on form 1040 line 35a. Caution who should use schedule 8812 first, complete the child tax credit and credit for other. Taxpayers who lived in the united states or puerto rico during 2021 must calculate the credit amount by: Insert graphics, crosses, check and text boxes, if you want.

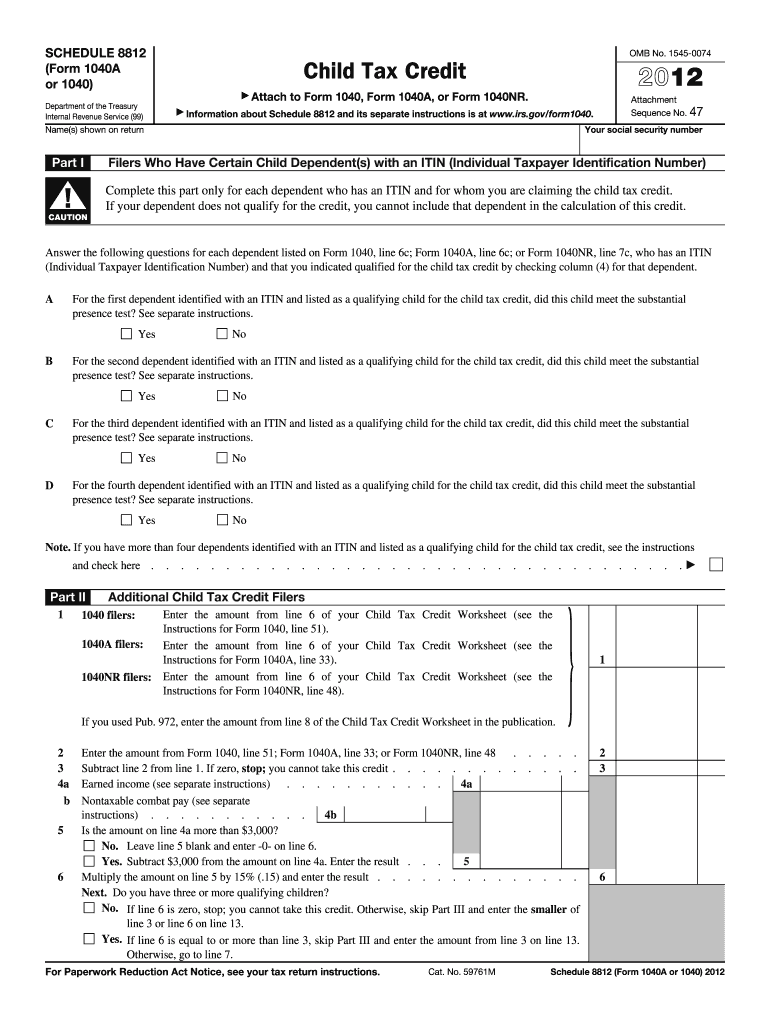

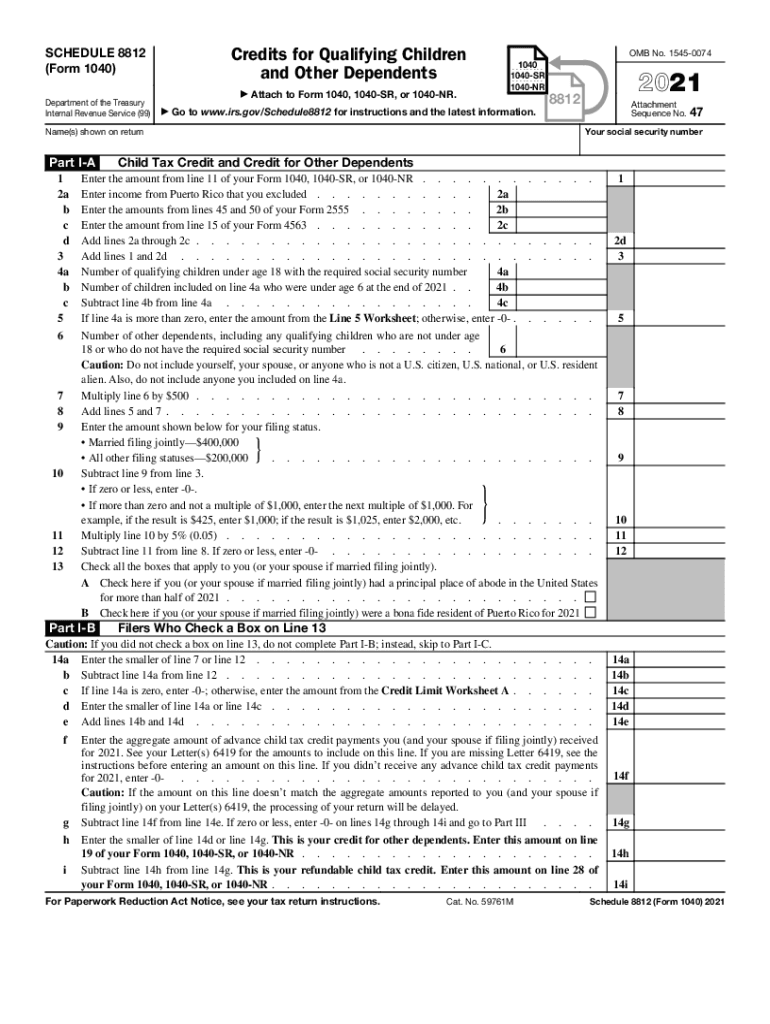

Repeating fields will be filled. Caution who should use schedule 8812 first, complete the child tax credit and credit for other. Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. Insert graphics, crosses, check and text boxes, if you want. Web filling out schedule 8812. Insert photos, crosses, check and text boxes, if needed. Taxpayers who lived in the united states or puerto rico during 2021 must calculate the credit amount by: Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Review your form 1040 lines 24 thru 35.

Sign it in a few clicks. How to claim the additional child tax credit? Web solved • by turbotax • 3264 • updated january 25, 2023. Caution who should use schedule 8812 first, complete the child tax credit and credit for other. Caution who should use schedule 8812 first, complete the child tax credit and credit for other. Type text, add images, blackout confidential details, add comments, highlights and more. Get ready for tax season deadlines by completing any required tax forms today. Edit your 8812 instructions child tax credit online. Web general instructions if you file form 2555, you cannot ! Review your form 1040 lines 24 thru 35.

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

How to claim the additional child tax credit? Edit your 8812 instructions child tax credit online. Web use part i of schedule 8812 to document that any child for whom an irs individual taxpayer identification number (itin) was entered on form 1040, line 6c; To preview your 1040 before filing: Complete, edit or print tax forms instantly.

Worksheet For Form 8812

Web general instructions if you file form 2555, you cannot ! Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web use part i of schedule 8812 to document that any child for whom an irs individual taxpayer identification number (itin) was entered on form 1040, line 6c; Enter the amount.

How to do an amendment 1040x and 201x YouTube

Web general instructions if you file form 2555, you cannot ! Insert graphics, crosses, check and text boxes, if you want. Insert photos, crosses, check and text boxes, if needed. Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. Caution who should use schedule 8812 first, complete the child tax credit.

VA Form 268812 Download Printable PDF or Fill Online VA Equal

Insert photos, crosses, check and text boxes, if needed. Ad access irs tax forms. To preview your 1040 before filing: Complete, edit or print tax forms instantly. Caution who should use schedule 8812 first, complete the child tax credit and credit for other.

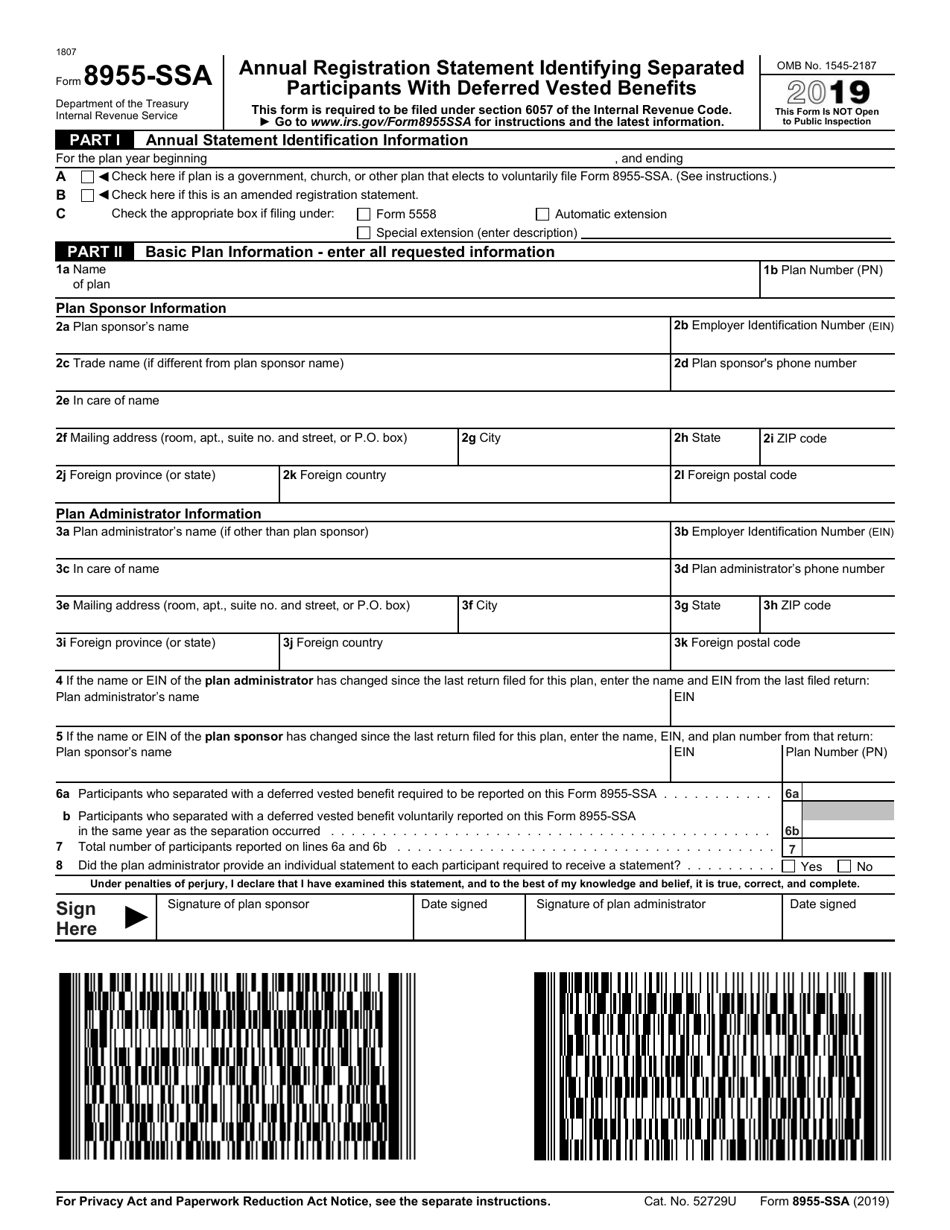

IRS Form 8955SSA Download Fillable PDF or Fill Online Annual

Sign it in a few clicks. Insert photos, crosses, check and text boxes, if needed. Repeating fields will be filled. Taxpayers who lived in the united states or puerto rico during 2021 must calculate the credit amount by: Web filling out schedule 8812.

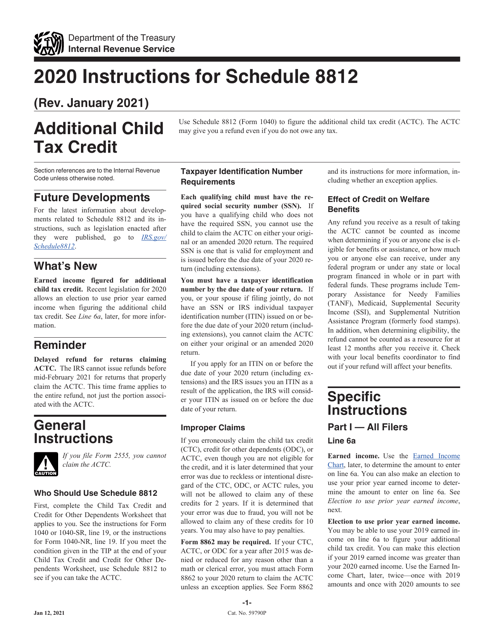

Download Instructions for IRS Form 1040 Schedule 8812 Additional Child

Enter the amount from line 11 of your form 1040, 1040. Edit your 8812 instructions child tax credit online. Web use part i of schedule 8812 to document that any child for whom an irs individual taxpayer identification number (itin) was entered on form 1040, line 6c; Taxpayers who lived in the united states or puerto rico during 2021 must.

Form 8812 Fill Out and Sign Printable PDF Template signNow

Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. Taxpayers who lived in the united states or puerto rico during 2021 must calculate the credit amount by: Web filling out schedule 8812. Review your form 1040 lines 24 thru 35. That means if you only owe $1,000.

Form 1040 U.S. Individual Tax Return Definition

Ad access irs tax forms. Your refund is reported on form 1040 line 35a. Web general instructions if you file form 2555, you cannot ! Web up to 10% cash back schedule 8812 credit calculations. Enter the amount from line 11 of your form 1040, 1040.

Form 8812 Fill Out And Sign Printable Pdf Template Signnow Gambaran

Review your form 1040 lines 24 thru 35. Web general instructions if you file form 2555, you cannot ! Insert graphics, crosses, check and text boxes, if you want. Enter the amount from line 11 of your form 1040, 1040. Type text, add images, blackout confidential details, add comments, highlights and more.

Worksheet For Form 8812

Insert photos, crosses, check and text boxes, if needed. Get ready for tax season deadlines by completing any required tax forms today. Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. Repeating fields will be filled. Web general instructions if you file form 2555, you cannot !

Insert Graphics, Crosses, Check And Text Boxes, If You Want.

Repeating fields will be filled. Ad access irs tax forms. Complete, edit or print tax forms instantly. Type text, add images, blackout confidential details, add comments, highlights and more.

Your Refund Is Reported On Form 1040 Line 35A.

How to claim the additional child tax credit? Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Get ready for tax season deadlines by completing any required tax forms today.

To Preview Your 1040 Before Filing:

Edit your 8812 instructions child tax credit online. Web filling out schedule 8812. Web 2021 child tax credit explained as we discuss an example of how to file form 8812👉 need tax & accounting services? Caution who should use schedule 8812 first, complete the child tax credit and credit for other.

Web Use Part I Of Schedule 8812 To Document That Any Child For Whom An Irs Individual Taxpayer Identification Number (Itin) Was Entered On Form 1040, Line 6C;

Web general instructions if you file form 2555, you cannot ! Web solved • by turbotax • 3264 • updated january 25, 2023. Taxpayers who lived in the united states or puerto rico during 2021 must calculate the credit amount by: Caution who should use schedule 8812 first, complete the child tax credit and credit for other.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)