How To Form A Nonprofit In Colorado

How To Form A Nonprofit In Colorado - Helping others shouldn't have to be complicated. Learn how to start your nonprofit today. Choose your registered agent step 3: Get a free year of reliable registered agent services when you form your nonprofit with northwest ($29 plus state fees). This guide will walk you through the nine steps required to. Colorado board of directors requirements the colorado corporations and. Register your nonprofit & get access to grants reserved just for nonprofits. Business entity data filed by nonprofit. Northwest can help form your nonprofit for you for $29 + state fees. You're just 3 simple steps away from filing your nonprofit for free.

Web how to start a nonprofit in colorado name your organization name incorporators and directors appoint a registered agent file a colorado articles of. Apply for exemption from state taxes a. Web to start a colorado 501 (c) (3) nonprofit organization, you'll need to first register a nonprofit corporation with the state of colorado, and then apply for tax exempt. Find forms for your industry in minutes. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. Name your colorado nonprofit step 2: What is a colorado registered. Articles of incorporation for a nonprofit. Register your nonprofit & get access to grants reserved just for nonprofits. Northwest can help form your nonprofit for you for $29 + state fees.

Streamlined document workflows for any industry. The centennial state has colorful vistas that. Colorado board of directors requirements the colorado corporations and. Web guidelines for starting a nonprofit developing bylaws and setting up the board of directors. Business entity data filed by nonprofit. Adopt bylaws & conflict of. The composition and recruitment of the board of directors is. Start a business how to start a nonprofit corporation in colorado 1. Helping others shouldn't have to be complicated. We have the tools and information you'll need to make it easy.

State Of Colorado Workers Comp Waiver Form Form Resume Examples

Colorado board of directors requirements the colorado corporations and. Web welcome to the registration and compliance page for colorado nonprofit organizations. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an colorado nonprofit. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever.

The Colorado Nonprofit for Pets Evergreen Animal Protective League

Find forms for your industry in minutes. Streamlined document workflows for any industry. Helping others shouldn't have to be complicated. Web how to start a nonprofit in colorado name your organization name incorporators and directors appoint a registered agent file a colorado articles of. However, the irs tends to look more favorably on.

How to start a nonprofit in Colorado 501c3 Organization YouTube

The composition and recruitment of the board of directors is. Learn how to start your nonprofit today. Web how to start a nonprofit in colorado name your organization name incorporators and directors appoint a registered agent file a colorado articles of. State income tax exemption once your organization receives your 501 (c) determination letter from the irs, your. As the.

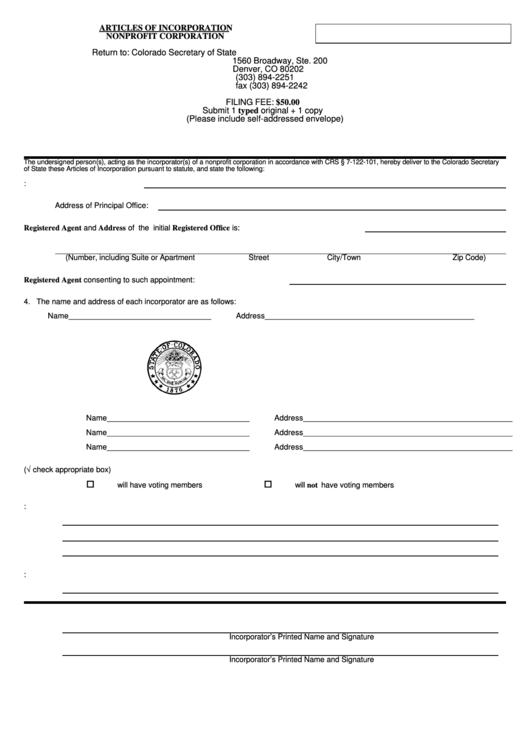

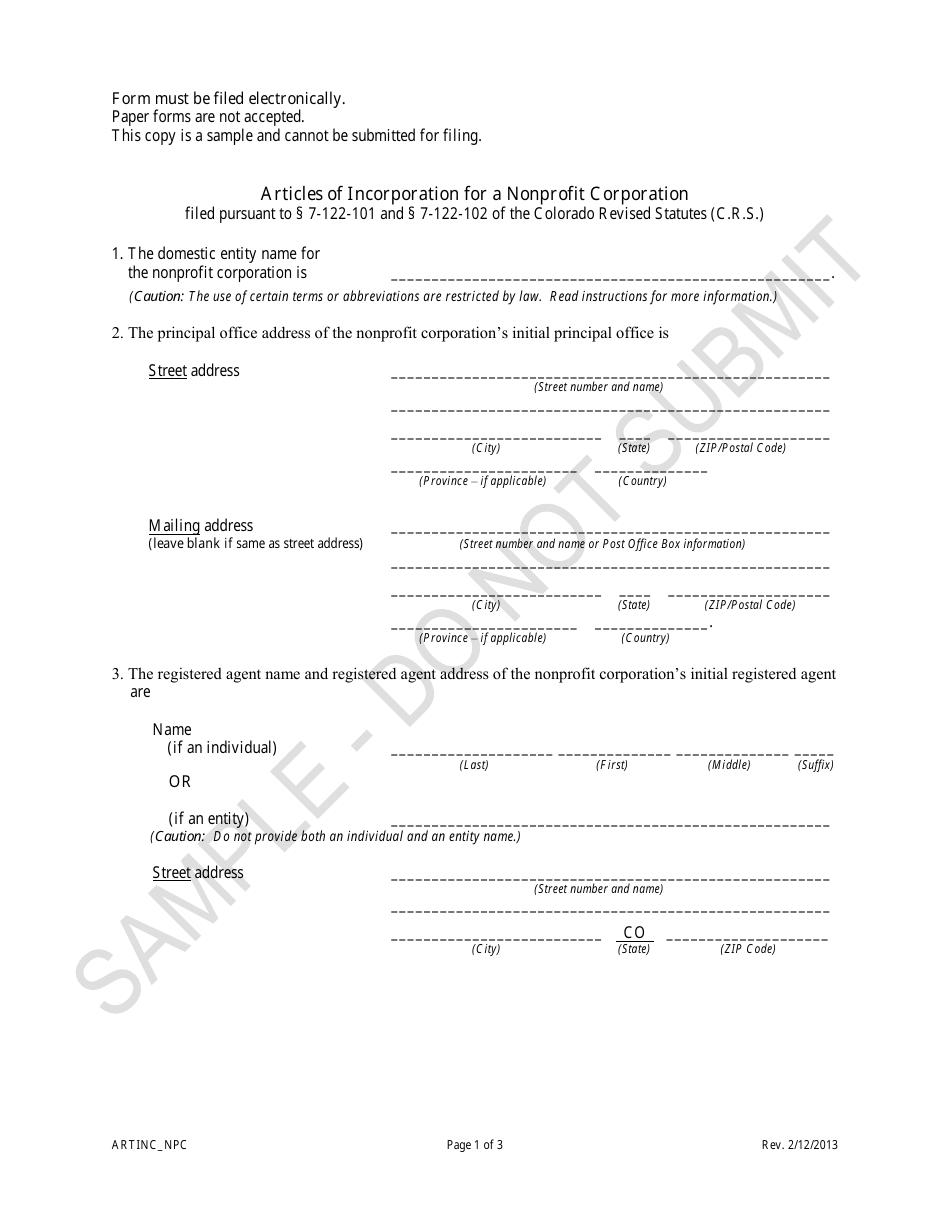

Articles Of Incorporation For A Nonprofit Corporation Form Colorado

Register your nonprofit & get access to grants reserved just for nonprofits. The centennial state has colorful vistas that. Web guidelines for starting a nonprofit developing bylaws and setting up the board of directors. Business entity data filed by nonprofit. State income tax exemption once your organization receives your 501 (c) determination letter from the irs, your.

What Can We Learn About Colorado's Nonprofit Successes And Concerns

Colorado board of directors requirements the colorado corporations and. This guide will walk you through the nine steps required to. Learn how to start your nonprofit today. We have the tools and information you'll need to make it easy. In colorado, your nonprofit organization only needs one director.

How to Form a Colorado Nonprofit Corporation in 2022

Choose your registered agent step 3: Web welcome to the registration and compliance page for colorado nonprofit organizations. What is a colorado registered. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an colorado nonprofit. Web how to start a nonprofit in colorado name your organization name incorporators and directors appoint.

Colorado Articles of Incorporation for a Nonprofit Corporation Sample

Find forms for your industry in minutes. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. Select your board members & officers step 4: Northwest can help form your nonprofit for you for $29 + state fees. Web welcome to the registration and compliance page for colorado nonprofit organizations.

Could legal homeless campgrounds work in Salt Lake City? The Salt

Start a business how to start a nonprofit corporation in colorado 1. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. The composition and recruitment of the board of directors is. Choose your registered agent step 3: You're just 3 simple steps away from filing your nonprofit for free.

How to Start a Nonprofit in Colorado A Founder's Guide

Web how to start a nonprofit in colorado name your organization name incorporators and directors appoint a registered agent file a colorado articles of. Select a name for your organization the first step in starting a nonprofit organization after deciding on the cause is naming the colorado nonprofit association. Streamlined document workflows for any industry. Get a free year of.

How to Start a Nonprofit in Colorado A Founder's Guide

Northwest can help form your nonprofit for you for $29 + state fees. Choose your registered agent step 3: Name your colorado nonprofit step 2: Learn how to start your nonprofit today. The price of nolo's online nonprofit formation service varies depending on your needs.

The Centennial State Has Colorful Vistas That.

Web $99+ state fees see our packages use our step by step guide ready to get started? Learn how to start your nonprofit today. Web to start a colorado 501 (c) (3) nonprofit organization, you'll need to first register a nonprofit corporation with the state of colorado, and then apply for tax exempt. What is a colorado registered.

This Guide Will Walk You Through The Nine Steps Required To.

Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an colorado nonprofit. However, the irs tends to look more favorably on. Learn how to start your nonprofit today. Select your board members & officers step 4:

Web How To Start A Nonprofit In Colorado Name Your Organization Name Incorporators And Directors Appoint A Registered Agent File A Colorado Articles Of.

Web submit irs form 1023, application for recognition of exemption to: You're just 3 simple steps away from filing your nonprofit for free. Register your nonprofit & get access to grants reserved just for nonprofits. Business entity data filed by nonprofit.

Helping Others Shouldn't Have To Be Complicated.

The composition and recruitment of the board of directors is. Colorado board of directors requirements the colorado corporations and. Helping others shouldn't have to be complicated. State income tax exemption once your organization receives your 501 (c) determination letter from the irs, your.