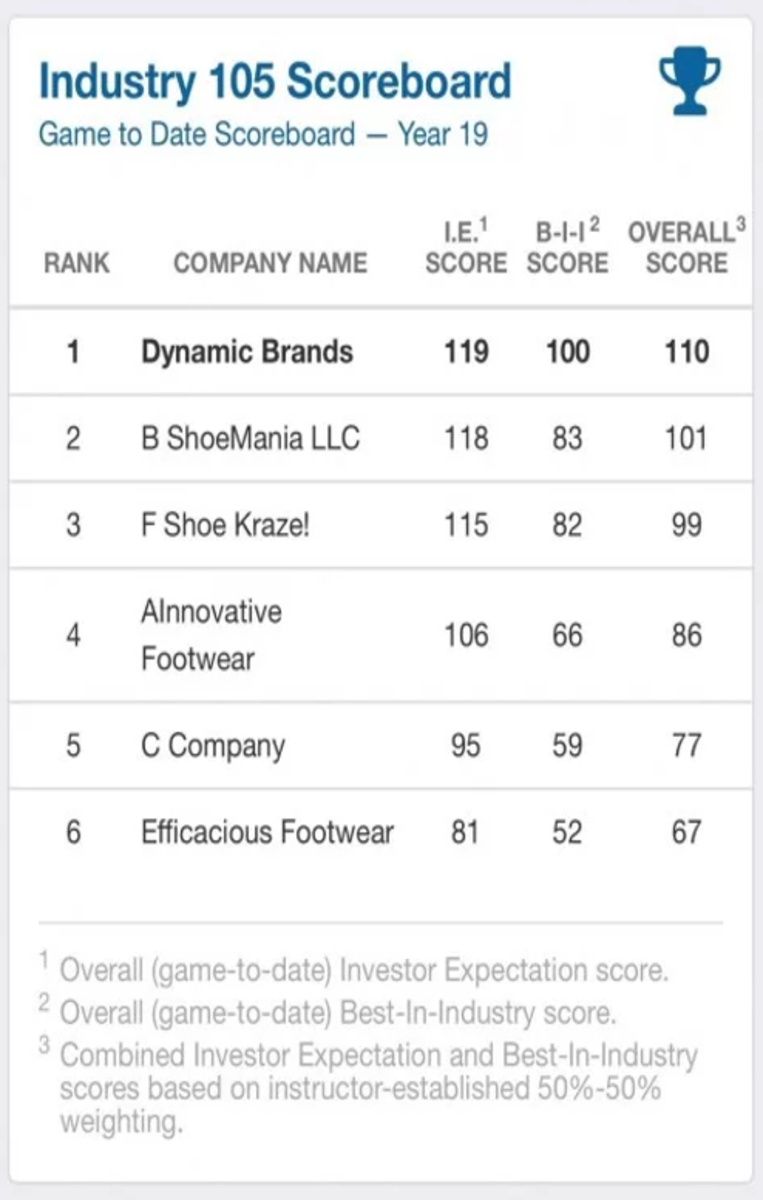

How To Increase Return On Equity In Bsg Game

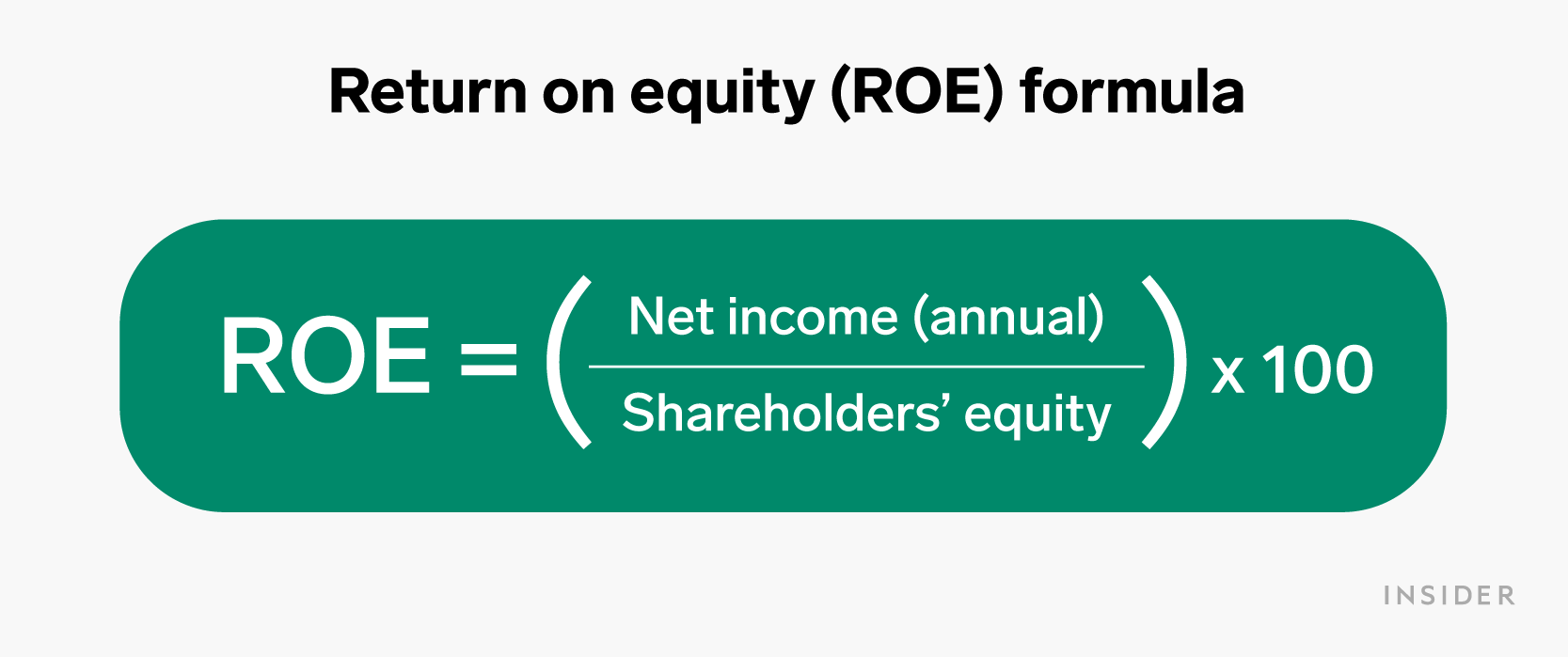

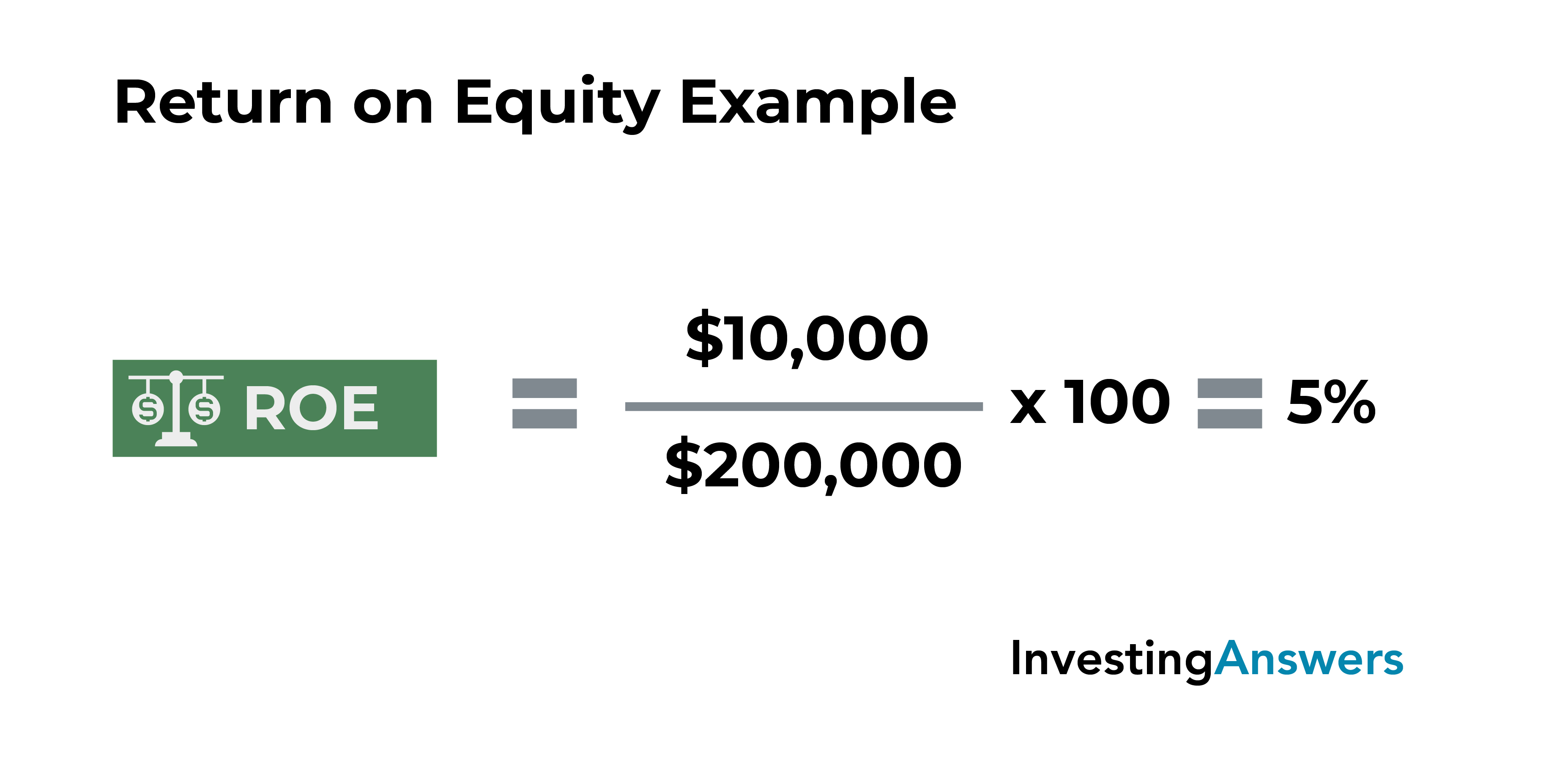

How To Increase Return On Equity In Bsg Game - Web return on equity (roe) is defined as net income (or net profit) divided by total shareholders’ equity investment in the business. Web increasing net income in your company brings forth numerous benefits, such as improved return on equity (roe), earnings per share (eps), and stock price. Is it the reason your return on equity ratio is below the bsg requirement? What’s your company’s net profit margin? Web three factors contribute to roe: We have quite large total shareholder equity of 446,571. Monitor the price elasticity after the sales forecast, check if changing the wholesale image rating and internet market share price of the shoes affects the demands of the. Increasing earnings raises roe by. Web we can help you implement strategies that enable you to boost your return on equity, improve your credit rating, boost your image rating, and increase stock price in. Web grow average return on equity investment (roe) from 14.5% at the end of year 5 to 17.5% in year 6, 20% in year 7, 25% in year 8, 30% in year 9, 35% in year 10, 40% in.

Web grow average return on equity investment (roe) from 14.5% at the end of year 5 to 17.5% in year 6, 20% in year 7, 25% in year 8, 30% in year 9, 35% in year 10, 40% in. Web accounting accounting questions and answers how do i increase the earnings per share, credit rating, and net profit when it comes to the bsg (business simulation game). Web return on equity = net income / average of total shareholder's equity at the beginning of the year and the end of the year on the company's balance sheet how. We have quite large total shareholder equity of 446,571. Earnings growth boosts roe by raising the. Web three factors contribute to roe: Maintain a b+ or higher credit rating. View the full answer step 2. What’s your company’s net profit margin? Web grow average return on equity investment (roe) from 20% at the end of year 10 to 21% in year 11 and by an additional 1% annually in years 12 through 20 (thus reaching 30%.

Web maintain a return on average equity investment (roe) of 15% or more annually. Web increasing net income in your company brings forth numerous benefits, such as improved return on equity (roe), earnings per share (eps), and stock price. Web return on equity = net income / average of total shareholder's equity at the beginning of the year and the end of the year on the company's balance sheet how. Earnings growth boosts roe by raising the. Web accounting accounting questions and answers how do i increase the earnings per share, credit rating, and net profit when it comes to the bsg (business simulation game). Web grow average return on equity investment (roe) from 20% at the end of year 10 to 21% in year 11 and by an additional 1% annually in years 12 through 20 (thus reaching 30%. Web we can help you implement strategies that enable you to boost your return on equity, improve your credit rating, boost your image rating, and increase stock price in. Monitor the price elasticity after the sales forecast, check if changing the wholesale image rating and internet market share price of the shoes affects the demands of the. What’s your company’s net profit margin? Web of shareholder' equity investment (average equity investment is equal to the sum of shareholder' equity at the beginning of the year and the end of the year divided by 2).

Return on Equity (ROE) Formula, Examples and Guide to ROE

Web return on equity (roe) is defined as net income divided by the average amount of shareholders’ equity investment—the average amount of shareholders’ equity. The amount of return (earnings), the amount of dividends (reduces retained earnings), and stock repurchases. We have quite large total shareholder equity of 446,571. Web return on equity is net profit/ shareholder’s equity. And whatever your.

What is Return on Equity, how do you calculate it, and why is it

View the full answer step 2. What’s your company’s net profit margin? Earnings growth boosts roe by raising the. Web return on equity (roe) is defined as net income (or net profit) divided by total shareholders’ equity investment in the business. And whatever your net profit is, your shareholder’s equity will increase with subsequent years, therefore by the end of.

Return on Equity (ROE)

Web return on equity is net profit/ shareholder’s equity. Earnings growth boosts roe by raising the. Web return on average equity is defined as net income divided by the average of total shareholder equity at the beginning and end of the year. Web we note to see return on equity, so keep total equity lower than increase ratio of net.

What is Return on Equity, how do you calculate it, and why is it

Web the quantity of return (earnings) the amount of dividends (which reduces retained earnings), and stock repurchases. Higher ratios indicate the company is. Web return on equity (roe) is defined as net income divided by the average amount of shareholders’ equity investment—the average amount of shareholders’ equity. Web of shareholder' equity investment (average equity investment is equal to the sum.

Tips on How to Win the Business Strategy Game (BSG) Owlcation

Web increasing net income in your company brings forth numerous benefits, such as improved return on equity (roe), earnings per share (eps), and stock price. Increasing earnings raises roe by. Maintain a b+ or higher credit rating. Is it the reason your return on equity ratio is below the bsg requirement? Web accounting accounting questions and answers how do i.

What is return on equity? How to calculate ROE to evaluate a company's

Is it the reason your return on equity ratio is below the bsg requirement? Web grow average return on equity investment (roe) from 20% at the end of year 10 to 21% in year 11 and by an additional 1% annually in years 12 through 20 (thus reaching 30%. Higher ratios indicate the company is. Web grow average return on.

20 Key Financial Ratios InvestingAnswers

Web return on equity is net profit/ shareholder’s equity. Achieve an image rating of 70 or higher. Web three factors contribute to roe: Monitor the price elasticity after the sales forecast, check if changing the wholesale image rating and internet market share price of the shoes affects the demands of the. What’s your company’s net profit margin?

Exercise 1316 Return on Equity YouTube

Web grow average return on equity investment (roe) from 14.5% at the end of year 5 to 17.5% in year 6, 20% in year 7, 25% in year 8, 30% in year 9, 35% in year 10, 40% in. Monitor the price elasticity after the sales forecast, check if changing the wholesale image rating and internet market share price of.

5 Ways to Improve Return on Equity

Web how do i increase my credit score in bsg in order to increase the credit rating of a company, you must pay off your debts or loans, increase your revenue and improve. Achieve an image rating of 70 or higher. Higher ratios indicate the company is. And whatever your net profit is, your shareholder’s equity will increase with subsequent.

Return on Equity (ROE) Formula Calculator (with Excel Template)

Web of shareholder' equity investment (average equity investment is equal to the sum of shareholder' equity at the beginning of the year and the end of the year divided by 2). Web return on average equity is defined as net income divided by the average of total shareholder equity at the beginning and end of the year. Increasing earnings raises.

Web Return On Equity (Roe) Is Defined As Net Income Divided By The Average Amount Of Shareholders’ Equity Investment—The Average Amount Of Shareholders’ Equity.

Web we can help you implement strategies that enable you to boost your return on equity, improve your credit rating, boost your image rating, and increase stock price in. Higher ratios indicate the company is. Increasing earnings raises roe by. What’s your company’s net profit margin?

Web Return On Average Equity Is Defined As Net Income Divided By The Average Of Total Shareholder Equity At The Beginning And End Of The Year.

Web how to increase roe in bsg. Web how do i increase my credit score in bsg in order to increase the credit rating of a company, you must pay off your debts or loans, increase your revenue and improve. Web accounting accounting questions and answers how do i increase the earnings per share, credit rating, and net profit when it comes to the bsg (business simulation game). Web of shareholder' equity investment (average equity investment is equal to the sum of shareholder' equity at the beginning of the year and the end of the year divided by 2).

Web The Quantity Of Return (Earnings) The Amount Of Dividends (Which Reduces Retained Earnings), And Stock Repurchases.

Web grow average return on equity investment (roe) from 14.5% at the end of year 5 to 17.5% in year 6, 20% in year 7, 25% in year 8, 30% in year 9, 35% in year 10, 40% in. Web return on equity = net income / average of total shareholder's equity at the beginning of the year and the end of the year on the company's balance sheet how. Web maintain a return on average equity investment (roe) of 15% or more annually. We have quite large total shareholder equity of 446,571.

Web Grow Average Return On Equity Investment (Roe) From 20% At The End Of Year 10 To 21% In Year 11 And By An Additional 1% Annually In Years 12 Through 20 (Thus Reaching 30%.

Adjust the financial leverage value. Monitor the price elasticity after the sales forecast, check if changing the wholesale image rating and internet market share price of the shoes affects the demands of the. Maintain a b+ or higher credit rating. Web increasing net income in your company brings forth numerous benefits, such as improved return on equity (roe), earnings per share (eps), and stock price.