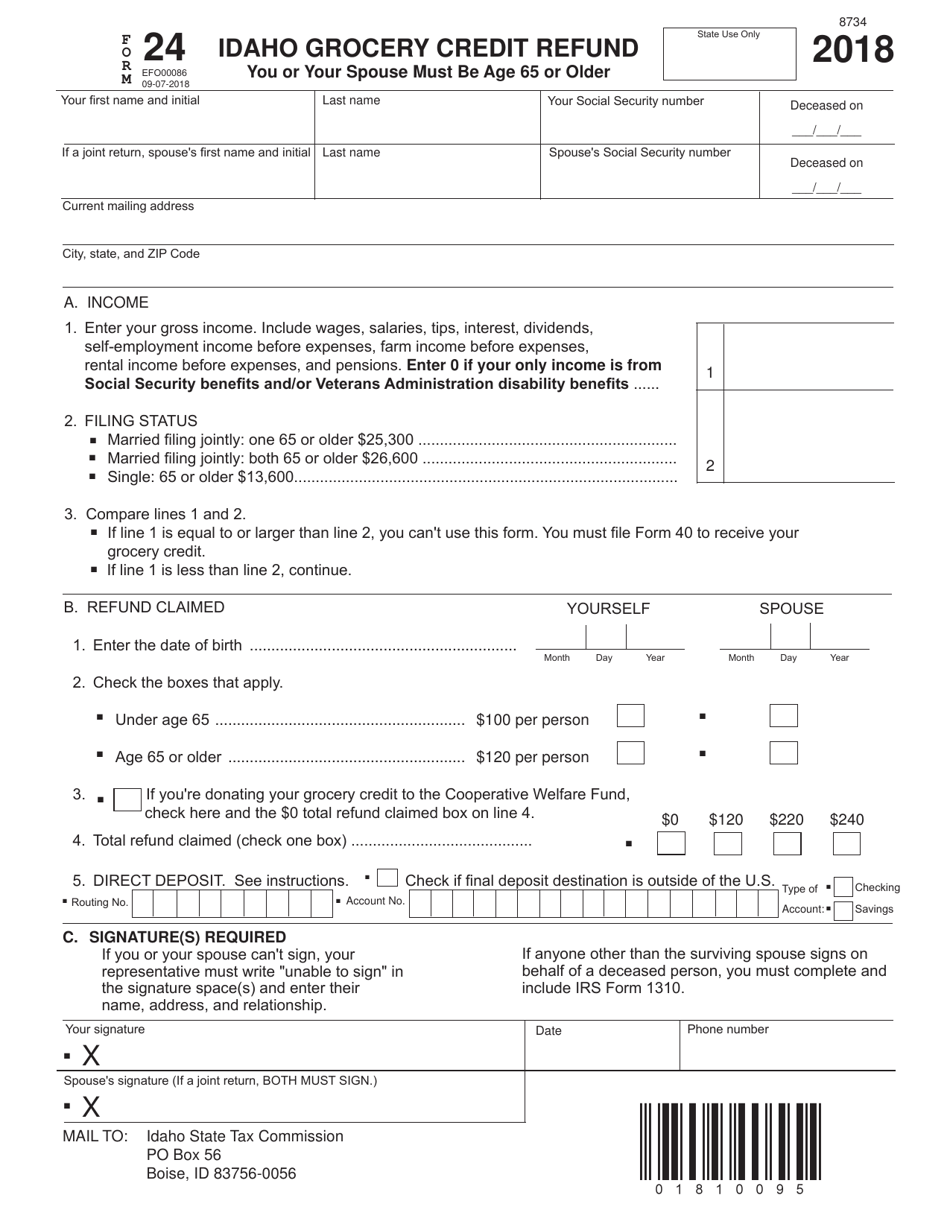

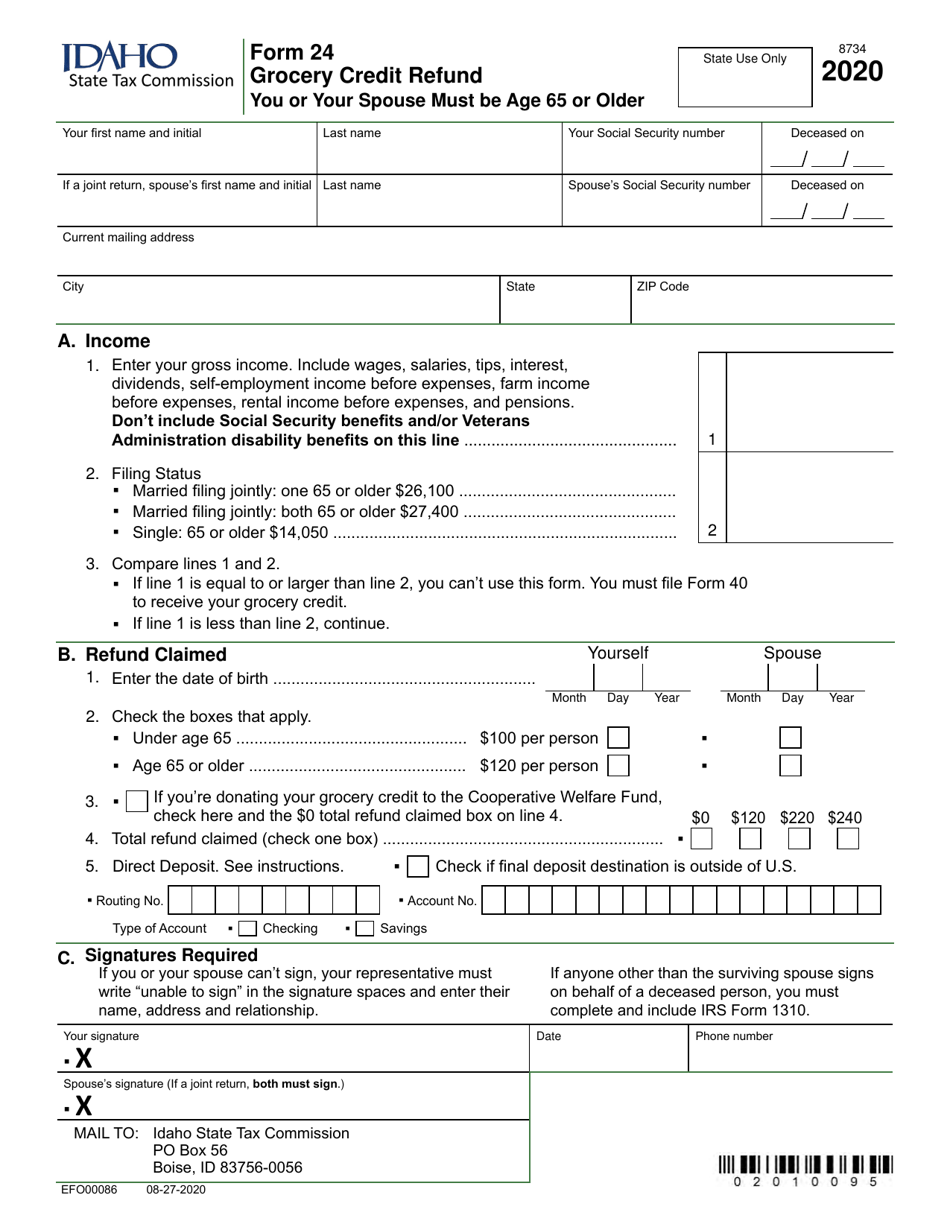

Idaho Grocery Tax Credit Form

Idaho Grocery Tax Credit Form - An additional eight states levy. Web we last updated the idaho grocery credit refund in february 2023, so this is the latest version of form 24, fully updated for tax year 2022. State section edit credits grocery credit note: Web we last updated idaho form 24 in february 2023 from the idaho state tax commission. Web istc educated taxpayers about their obligations then people can pay your fair exchange of taxes, & enforces idaho’s laws to ensure of fairness of the tax system. If line 1 is less than line 2, continue. Most residents can claim up to $100 for themselves, their spouse, and each qualifying dependent. Web idaho seniors file form 24 to get a grocery credit refund when they’re not required to file an income tax return. For most idaho residents it averages $100 per person. Web does turbotax support the idaho grocery credit?

Web istc educated taxpayers about their obligations then people can pay your fair exchange of taxes, & enforces idaho’s laws to ensure of fairness of the tax system. Web istc informs taxpayers about their debts so all can get their fair share of taxes, & enhanced idaho’s laws to ensure the truth of of tax system. Turbotax help intuit does turbotax support the idaho grocery credit? The grocery tax credit offsets the sales tax you pay on groceries throughout the year. State use only see page 7 of the instructions for the reasons to amend, and enter. According to the idaho state tax commission,. Its purpose is to offset some or all of the amount of sales tax that residents. Most residents can claim up to $100 for themselves, their spouse, and each qualifying dependent. Web idaho seniors file form 24 to get a grocery credit refund when they’re not required to file an income tax return. Web to claim the grocery credit within your account, follow the steps below:

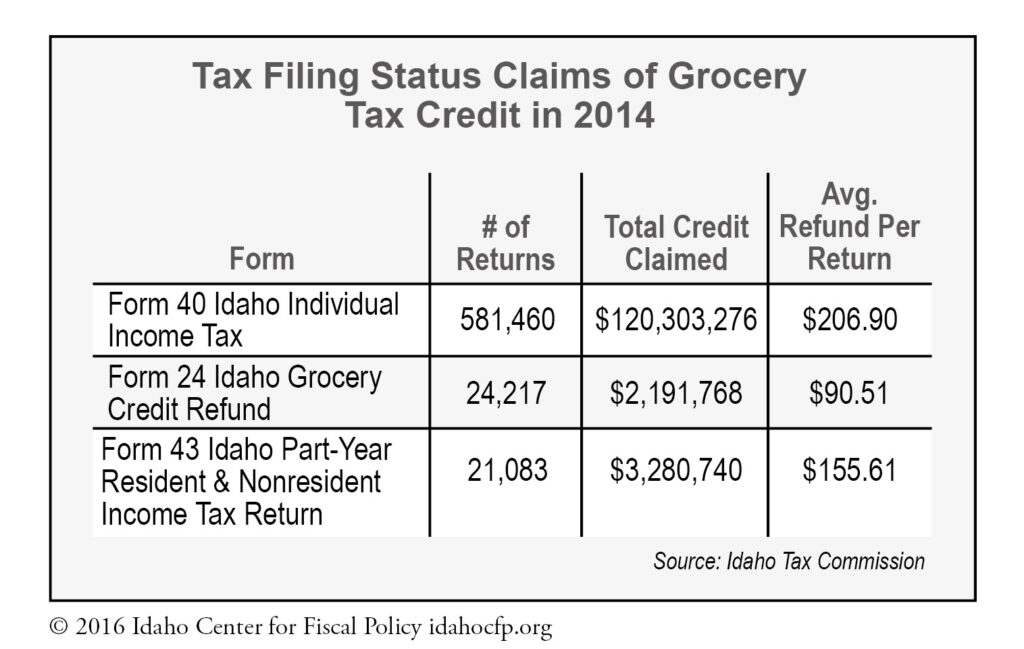

Most residents can claim up to $100 for themselves, their spouse, and each qualifying dependent. Web does turbotax support the idaho grocery credit? Please do not include a decimal point when reporting. State use only see page 7 of the instructions for the reasons to amend, and enter. Filers claim credit in three ways source: Web idaho grocery credit. Web idaho’s grocery tax credit is meant to offset residents’ sales tax paid on food items. If you’re under 65, use form 40, idaho individual income tax. Web the state of idaho allows idaho residents to claim an average of a $100 income tax credit per person on grocery purchases made in the state. Web istc educated taxpayers about their obligations then people can pay your fair exchange of taxes, & enforces idaho’s laws to ensure of fairness of the tax system.

Idaho governor signs 20 grocery tax credit increase

Web hb 509 would increase the credit from $100 to $120 for people under 65 and from $120 to $140 for those 65 and older. Web istc informs taxpayers about their debts so all can get their fair share of taxes, & enhanced idaho’s laws to ensure the truth of of tax system. If you’re 65 or older, use the.

Grocery Tax Credit FAQ's Idaho Center for Fiscal Policy

According to the idaho state tax commission,. State section edit credits grocery credit note: Web istc educated taxpayers about their obligations then people can pay your fair exchange of taxes, & enforces idaho’s laws to ensure of fairness of the tax system. If you’re 65 or older, use the idaho state tax commission’s. Refund claimed yourself spouse enter the date.

Bill to boost Idaho grocery tax credit by 20 passes House Cache

If line 1 is less than line 2, continue. Web idaho grocery credit. For most idaho residents it averages $100 per person. You can download or print current. Web (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be.

Idaho's Grocery Tax Remains for Now

Web istc informs taxpayers about their debts so all can get their fair share of taxes, & enhanced idaho’s laws to ensure the truth of of tax system. You can download or print current. If line 1 is less than line 2, continue. State use only see page 7 of the instructions for the reasons to amend, and enter. The.

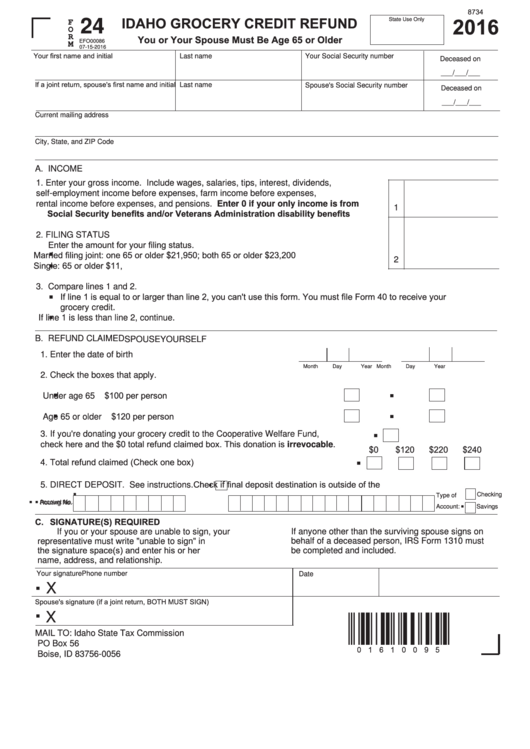

Fillable Form 24 Idaho Grocery Credit Refund 2016 printable pdf

Web to claim the grocery credit within your account, follow the steps below: State section edit credits grocery credit note: Web the state of idaho allows idaho residents to claim an average of a $100 income tax credit per person on grocery purchases made in the state. Refund claimed yourself spouse enter the date of birth. State use only see.

Fill Free fillable Idaho Real Estate Commission PDF forms

Turbotax help intuit does turbotax support the idaho grocery credit? Web we last updated the idaho grocery credit refund in february 2023, so this is the latest version of form 24, fully updated for tax year 2022. An additional eight states levy. Required to file a tax return? Web hb 509 would increase the credit from $100 to $120 for.

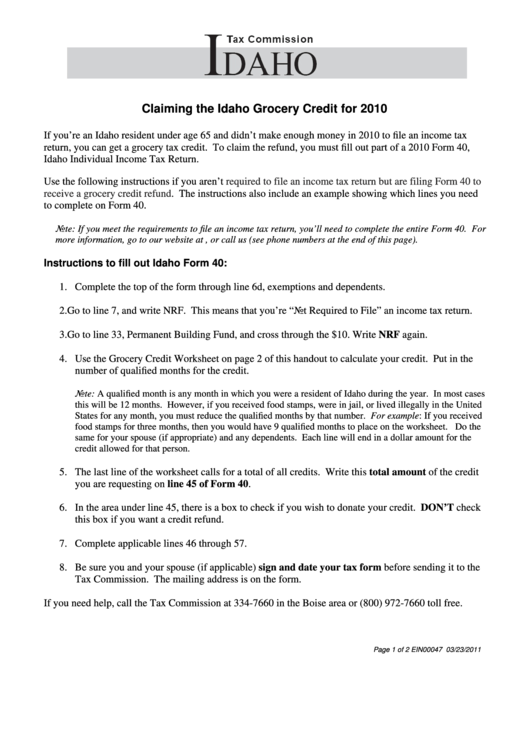

Grocery Credit Worksheet, Form 40 Idaho Individual Tax Return

Web we last updated the idaho grocery credit refund in february 2023, so this is the latest version of form 24, fully updated for tax year 2022. If you’re 65 or older, use the idaho state tax commission’s. Its purpose is to offset some or all of the amount of sales tax that residents. Web to claim the grocery credit.

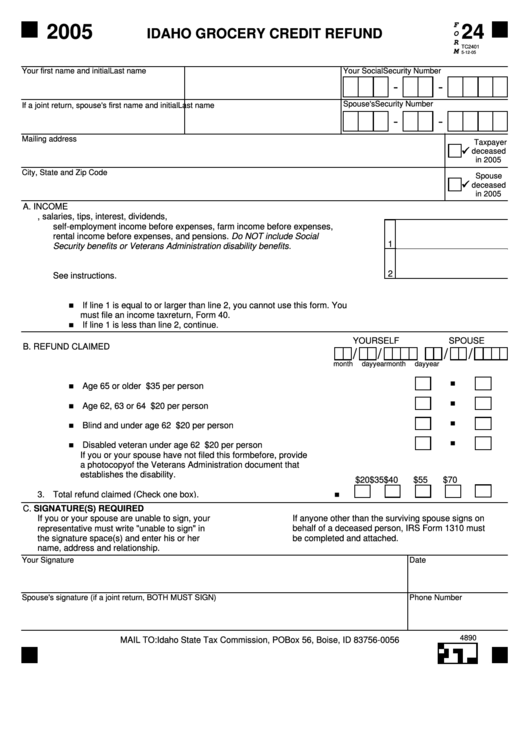

Fillable Form 24 Idaho Grocery Credit Refund 2005 printable pdf

Web the state of idaho allows idaho residents to claim an average of a $100 income tax credit per person on grocery purchases made in the state. Web hb 509 would increase the credit from $100 to $120 for people under 65 and from $120 to $140 for those 65 and older. Turbotax help intuit does turbotax support the idaho.

Form EFO00086 (24) Download Fillable PDF or Fill Online Idaho Grocery

Web istc informs taxpayers about their debts so all can get their fair share of taxes, & enhanced idaho’s laws to ensure the truth of of tax system. Its purpose is to offset some or all of the amount of sales tax that residents. If you’re 65 or older, use the idaho state tax commission’s. Web idaho grocery credit. Web.

Form 24 (EFO00086) Download Fillable PDF or Fill Online Grocery Credit

Filers claim credit in three ways source: Web istc informs taxpayers about their debts so all can get their fair share of taxes, & enhanced idaho’s laws to ensure the truth of of tax system. According to the idaho state tax commission,. If line 1 is less than line 2, continue. Web you must file form 40to receive your grocery.

Web (Idaho Sales And Use Tax Administrative Rules 091 And 107) The Seller Must See Proof That The Buyer Is An Enrolled Member Of An Indian Tribe For The Sale To Be.

Web form 402022 individual income tax return amended return? Web idaho seniors file form 24 to get a grocery credit refund when they’re not required to file an income tax return. State use only see page 7 of the instructions for the reasons to amend, and enter. Web you must file form 40to receive your grocery credit.

Turbotax Help Intuit Does Turbotax Support The Idaho Grocery Credit?

Refund claimed yourself spouse enter the date of birth. The grocery tax credit is a refund for idahoans. Solved • by turbotax • 2072 •. The tax commission normally begins processing.

Web Idaho Grocery Credit.

Web the state of idaho allows idaho residents to claim an average of a $100 income tax credit per person on grocery purchases made in the state. Web if idaho doesn’t require you to file a tax return, do one of the following to claim the grocery credit refund: If you’re 65 or older, use the idaho state tax commission’s. Its purpose is to offset some or all of the amount of sales tax that residents.

If You’re Under 65, Use Form 40, Idaho Individual Income Tax.

Please do not include a decimal point when reporting. If you're required to file an idaho income tax return, claim your idaho. Web we last updated the idaho grocery credit refund in february 2023, so this is the latest version of form 24, fully updated for tax year 2022. Web this page explains idaho grocery credit requirements and restrictions.