Idaho Tax Exempt Form

Idaho Tax Exempt Form - You must charge tax to customers on goods that. You must charge tax on. Web promulgated rules implementing the provisions of the idaho sales tax act. Web there is no restriction on the form of payment that can be used with the card. Online document management has become popular with companies and individuals. Rooms or campground spaces furnished to. Web instructions for form 1040. Ad register and subscribe now to work on your sales tax exemption claim & more fillable forms. Idaho exempt buyers can use this form to purchase goods free from sales tax. Complete, edit or print tax forms instantly.

Web idaho has a state income tax that ranges between 1.125% and 6.925%. Web buyer can claim an exemption from idaho sales tax on the lease or purchase of a motor vehicle, trailer, or glider kit that will be used to assemble a glider kit vehicle, used in. Web we have one idaho sales tax exemption forms available for you to print or save as a pdf file. If any of these links are broken, or you can't find the form you need, please let us. Complete, edit or print tax forms instantly. It's your responsibility to learn the rules. Get ready for tax season deadlines by completing any required tax forms today. This exemption applies only to materials that will become part of real property. You must charge tax to customers on goods that. Each exemption a customer claims on this form might have special rules (see instructions).

Online document management has become popular with companies and individuals. Web wine tax forms; Web we have one idaho sales tax exemption forms available for you to print or save as a pdf file. Web there is no restriction on the form of payment that can be used with the card. This exemption applies only to materials that will become part of real property. When the purchased goods are resold,. Complete, edit or print tax forms instantly. Web instructions for form 1040. Idaho exempt buyers can use this form to purchase goods free from sales tax. Request for taxpayer identification number (tin) and certification.

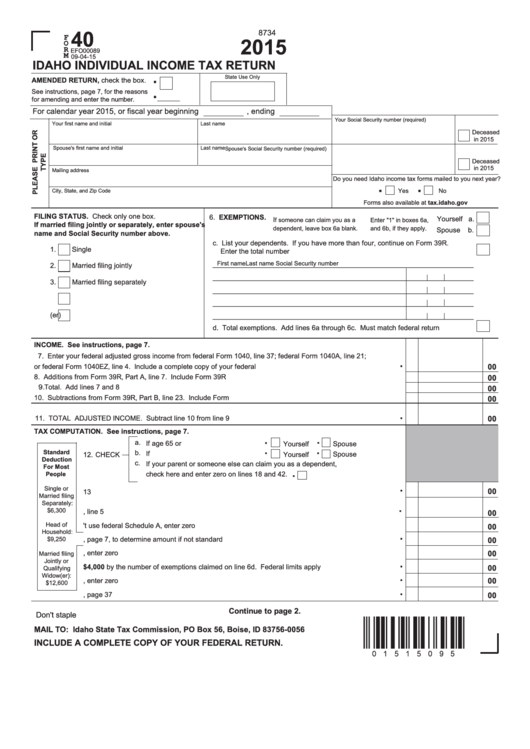

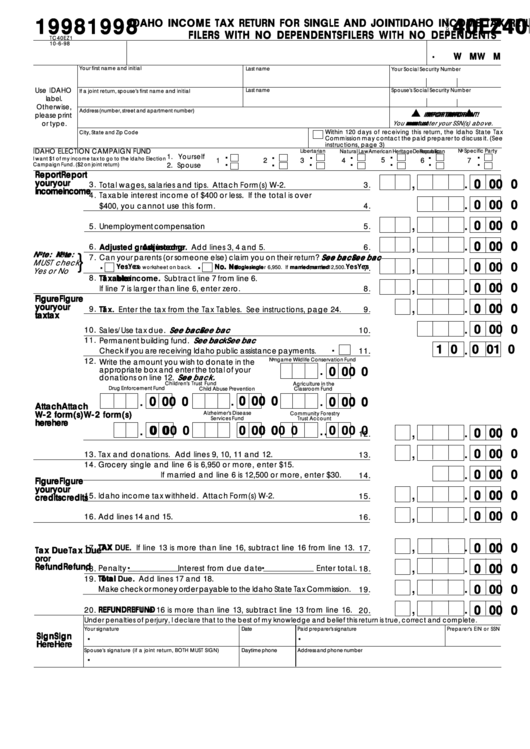

Form 40 Idaho Individual Tax Return 2015 printable pdf download

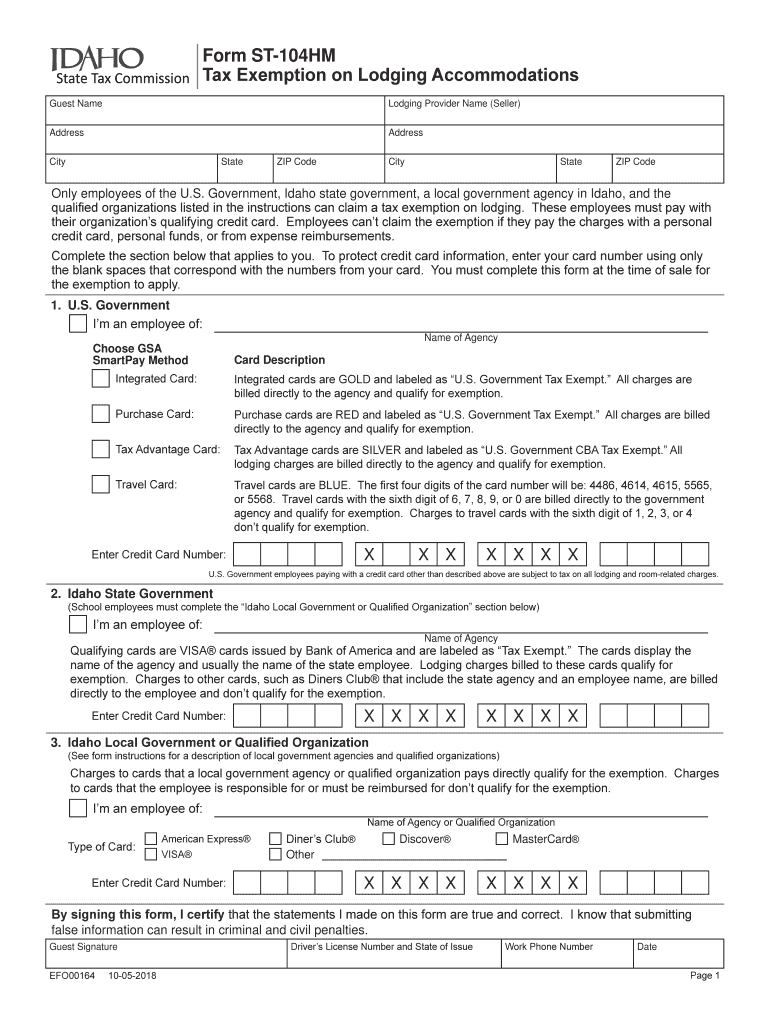

Web instructions for form 1040. Government, idaho state government, a local government agency in idaho, and the. They are the state tax commission’s official statement of policy relating to interpretations and. Request for transcript of tax return. It’s your responsibility to learn the rules.

Free Idaho Tax Power of Attorney Form PDF

Web promulgated rules implementing the provisions of the idaho sales tax act. If any of these links are broken, or you can't find the form you need, please let us. Sales and use tax return instructions 2022. Fuels taxes and fees forms; Rooms or campground spaces furnished to.

56 Idaho State Tax Commission Forms And Templates free to download in PDF

Ad register and subscribe now to work on your sales tax exemption claim & more fillable forms. Idaho exempt buyers can use this form to purchase goods free from sales tax. Rooms or campground spaces furnished to. You must charge tax on. Government, idaho state government, a local government agency in idaho, and the.

Download Idaho Tax Power of Attorney Form for Free FormTemplate

If any of these links are broken, or you can't find the form you need, please let us. Web idaho has a state income tax that ranges between 1.125% and 6.925%. Ad register and subscribe now to work on your sales tax exemption claim & more fillable forms. They are the state tax commission’s official statement of policy relating to.

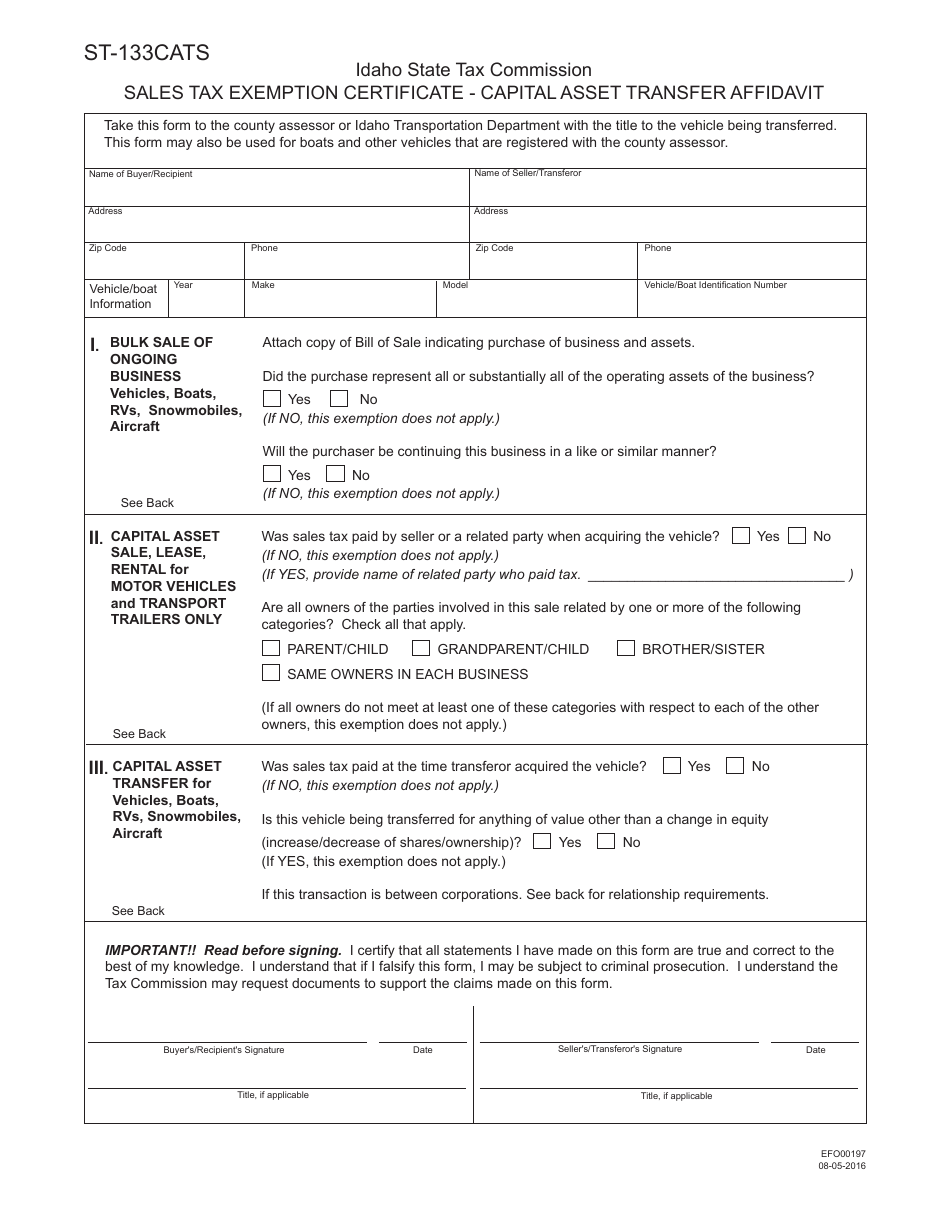

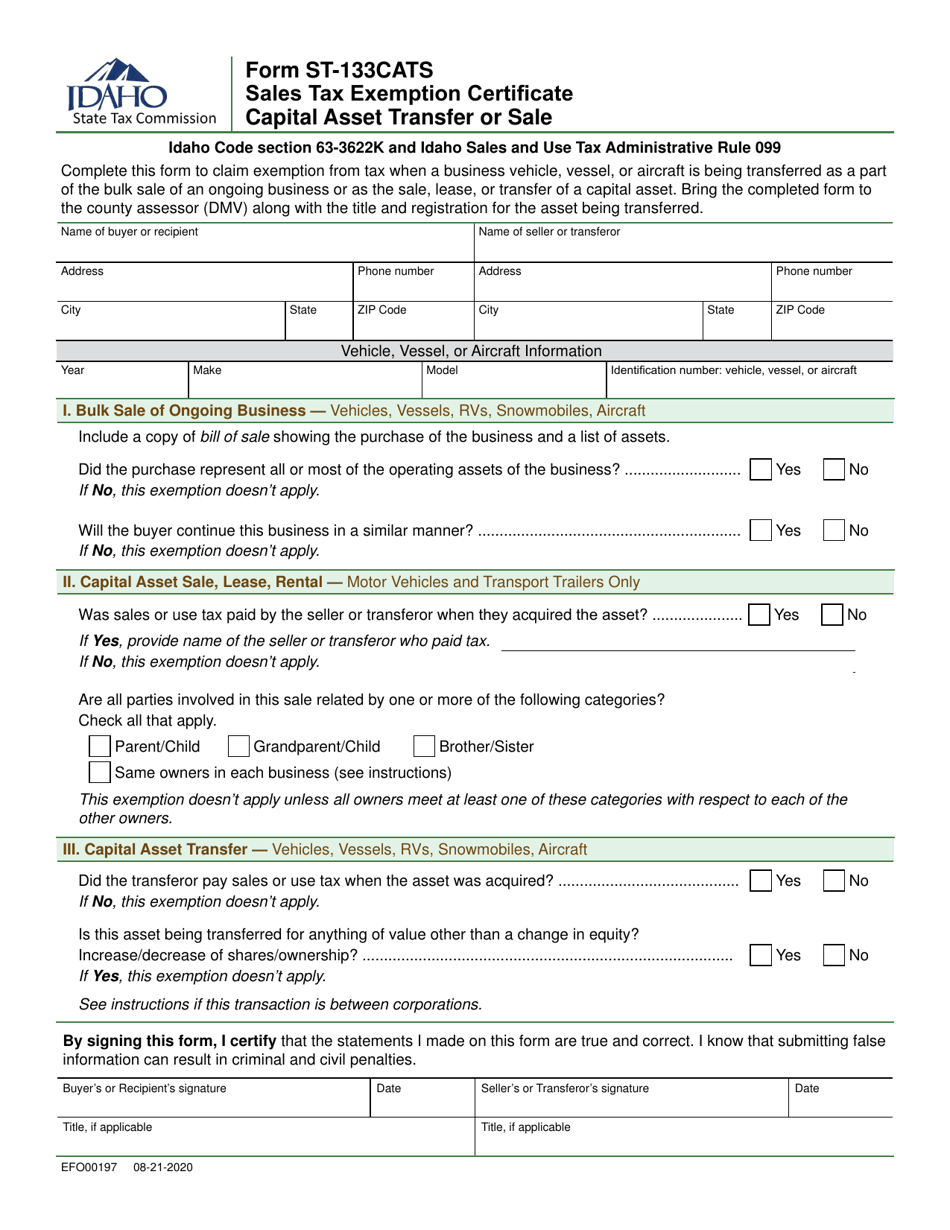

Form ST133CATS (EFO00197) Download Fillable PDF or Fill Online Sales

Web property tax exemption form. You must charge tax to customers on goods that. Idapa § 35.01.02.128 (certificates for resale and other exemption claims). You must charge tax on. When the purchased goods are resold,.

Form ST133CATS (EFO00197) Download Fillable PDF or Fill Online Sales

Each exemption a customer may claim on this form has special rules (see instructions). Rooms or campground spaces furnished to. Sales and use tax return instructions 2022. Construction materials for a job in a nontaxing state are exempt from idaho sales tax. Web complete idaho tax exempt form easily on any device.

Top 24 Idaho Tax Exempt Form Templates Free To Download In PDF Format

Web buyer can claim an exemption from idaho sales tax on the lease or purchase of a motor vehicle, trailer, or glider kit that will be used to assemble a glider kit vehicle, used in. It’s your responsibility to learn the rules. It's your responsibility to learn the rules. Ad register and subscribe now to work on your sales tax.

Fillable Form 40ez Idaho Tax Return For Single And Joint

Web property tax exemption form. Complete, edit or print tax forms instantly. Web instructions for form 1040. Request for transcript of tax return. Web each exemption a customer may claim on this form has special rules (see instructions).

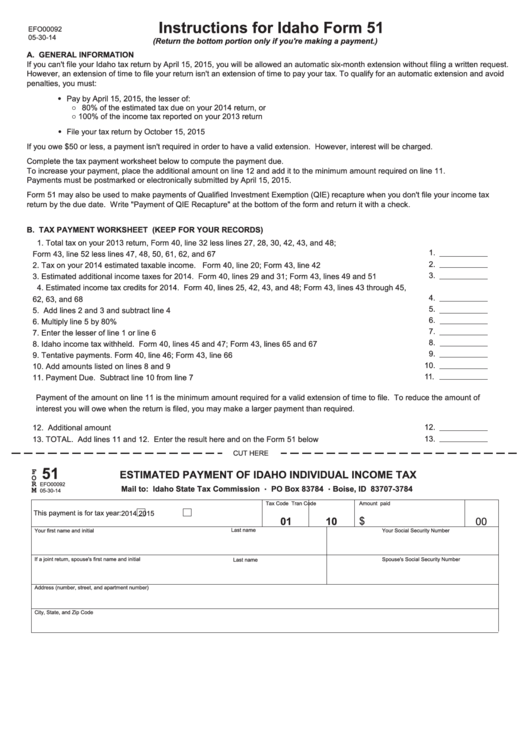

Idaho Form 51 (2014) Estimated Payment Of Idaho Individual Tax

You must charge tax on. If any of these links are broken, or you can't find the form you need, please let us. You may obtain the following forms at unemployment insurance tax. Online document management has become popular with companies and individuals. Web promulgated rules implementing the provisions of the idaho sales tax act.

St 104 Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Construction materials for a job in a nontaxing state are exempt from idaho sales tax. Request for taxpayer identification number (tin) and certification. When the purchased goods are resold,. Request for transcript of tax return.

It's Your Responsibility To Learn The Rules.

Construction materials for a job in a nontaxing state are exempt from idaho sales tax. When the purchased goods are resold,. Online document management has become popular with companies and individuals. Complete, edit or print tax forms instantly.

It’s Your Responsibility To Learn The Rules.

Each exemption a customer claims on this form might have special rules (see instructions). You must charge tax on. Web promulgated rules implementing the provisions of the idaho sales tax act. Request for transcript of tax return.

Idaho Exempt Buyers Can Use This Form To Purchase Goods Free From Sales Tax.

Web there is no restriction on the form of payment that can be used with the card. You may obtain the following forms at unemployment insurance tax. If any of these links are broken, or you can't find the form you need, please let us. Complete, edit or print tax forms instantly.

Rooms Or Campground Spaces Furnished To.

Sales and use tax return instructions 2022. Web contact your county assessor’s office in idaho. Web buyer can claim an exemption from idaho sales tax on the lease or purchase of a motor vehicle, trailer, or glider kit that will be used to assemble a glider kit vehicle, used in. Web we have one idaho sales tax exemption forms available for you to print or save as a pdf file.