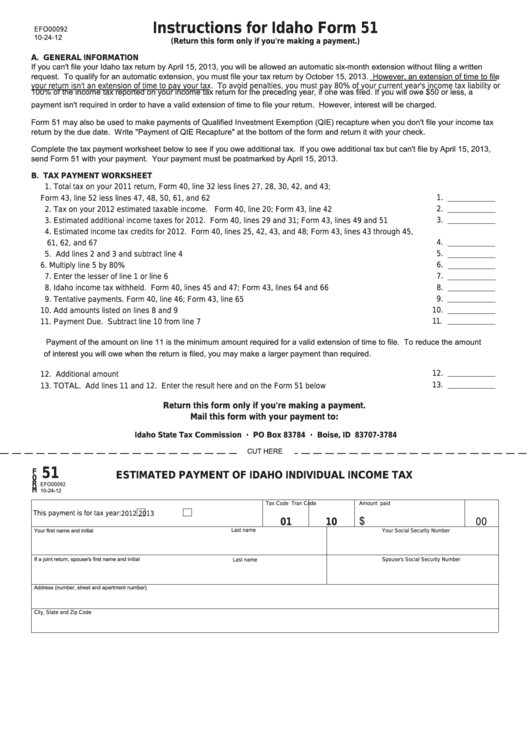

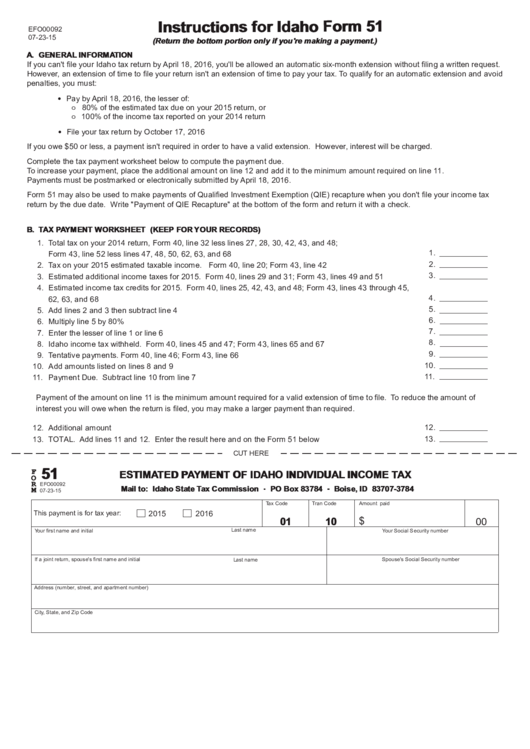

Idaho Tax Extension Form 51

Idaho Tax Extension Form 51 - If you’re unsure whether you owe idaho tax or you want to. Estimated payment of idaho individual income tax 2014. General information if you can't file your idaho tax return. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Details on the form 51 payment voucher and. Web you can find form 51 at tax.idaho.gov. Web to ensure you owe tax, use worksheet form 51. Estimated payment of idaho individual income tax 2013. Web tax extension idaho requires: To make a payment and avoid a penalty, do one of the following:

Web tax extension idaho requires: Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have. Mail form 51 with your check or money order. Mail form 51 with your check or money order. Web you can find form 51 at tax.idaho.gov. Web mail form 51 with your check or money order. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. Web to see if you qualify for an extension, complete the worksheet on idaho form 51, estimated payment of individual income tax. If you need to make a payment, you can mail the. Web it appears you don't have a pdf plugin for this browser.

Make an online payment through the idaho state tax commission website. Web tax extension idaho requires: Estimated payment of idaho individual income tax 2014. Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. To make a payment and avoid a filing penalty, do one of the following: Web you can find form 51 at tax.idaho.gov. Mail form 51 with your check or money order. Web form 49r—recapture of idaho investment tax credit form cg—idaho capital gains deduction form 51—estimated payment of idaho individual income tax (extension.

Idaho Tax Relief Payments Head Out First Week of August

Web you can find form 51 at tax.idaho.gov. Details on the form 51 payment voucher and. Explore more file form 4868 and. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment.

Idaho Sales Tax Guide

Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have. Estimated payment of idaho individual income tax 2014..

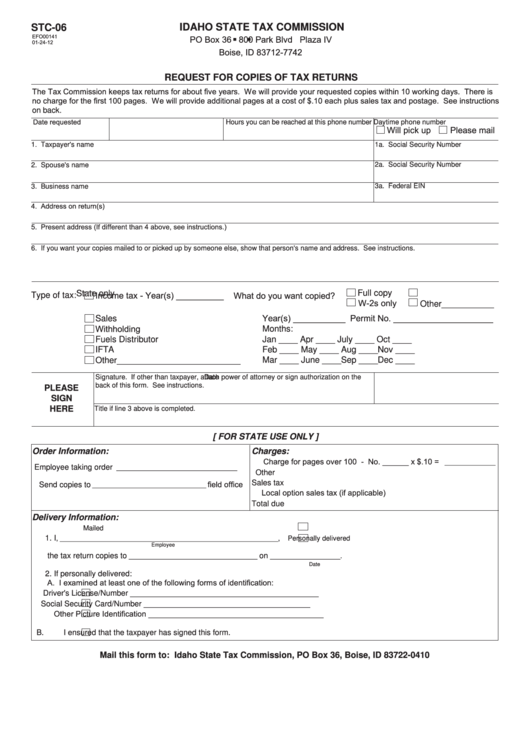

Fillable Form Stc06 Idaho State Tax Commission printable pdf download

File this statement with the idaho state tax. Web you can find form 51 at tax.idaho.gov. Details on the form 51 payment voucher and. After you finish the worksheet, do one of the following: Mail form 51 with your check or money order.

Idaho Sales Tax Exemption Form St 133 20202021 Fill and Sign

Explore more file form 4868 and. Web mail form 51 with your check or money order. Web instead, idaho state tax commission provides form 51 solely to be used as a voucher to accompany an extension payment. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Web you can find form.

Idaho Corporate Tax Rate Decrease Enacted

Web use form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year. To make a payment and avoid a penalty, do one of the following: If you need to make a payment, you can mail the. Web use idaho form 51 (estimated payment of.

Fillable Form 51 Estimated Payment Of Idaho Individual Tax

Web tax extension idaho requires: Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year. Web you can find form 51 at tax.idaho.gov. Details on the form 51 payment voucher and. Web you can find form 51 at tax.idaho.gov.

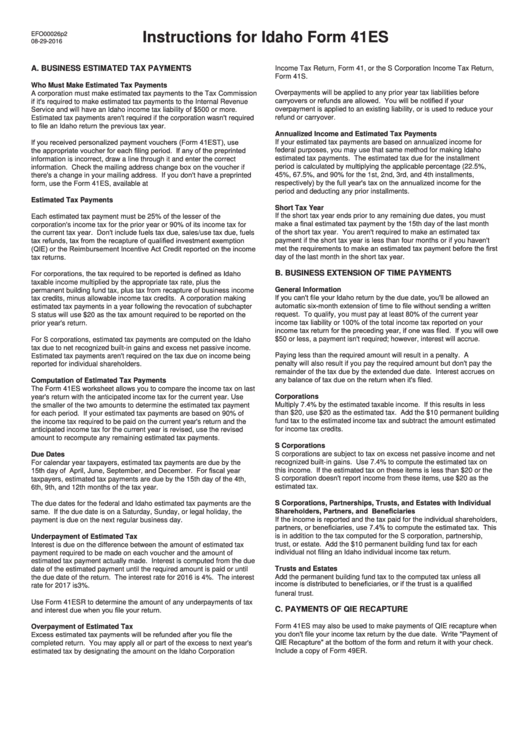

Instructions For Idaho Form 41es printable pdf download

The state of idaho doesn’t require any extension form as it automatically grants extensions up to 6 months. Estimated payment of idaho individual income tax 2013. Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have..

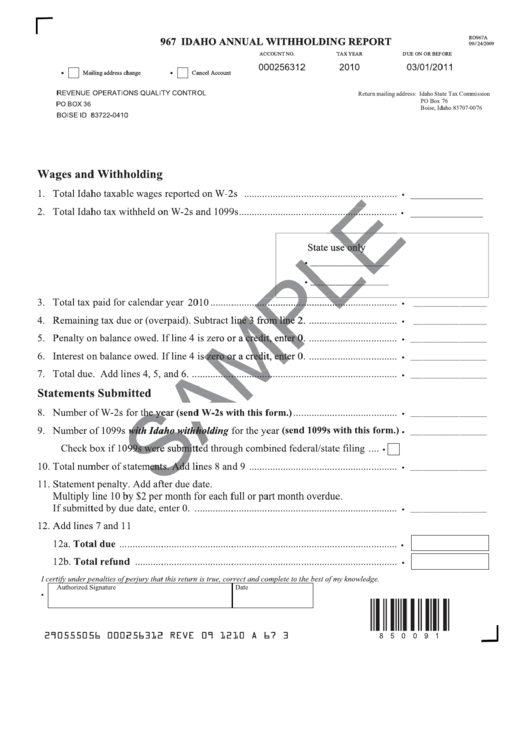

Form Ro967a Idaho Annual Withholding Report printable pdf download

Web you can find form 51 at tax.idaho.gov. Estimated payment of idaho individual income tax 2013. Explore more file form 4868 and. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Mail form 51 with your check or money order.

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

If you need to make a payment, you can mail the. Web use form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year. Web to ensure you owe tax, use worksheet form 51. Details on the form 51 payment voucher and. General information if.

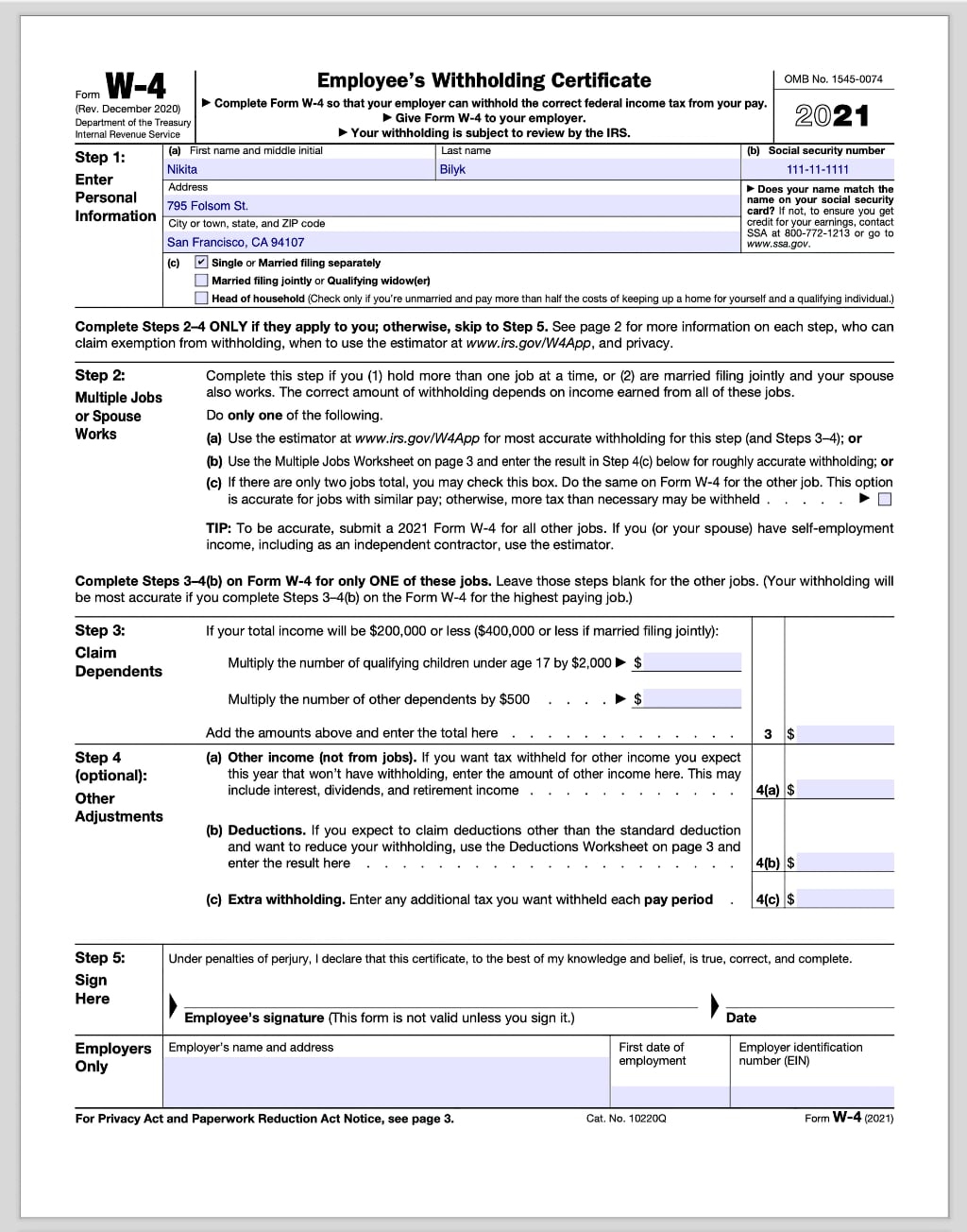

Idaho W 4 2021 2022 W4 Form

The worksheet will help you figure. Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have. General information if you can't file your idaho tax return. Web it appears you don't have a pdf plugin for.

Web You Can Find Form 51 At Tax.idaho.gov.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Mail form 51 with your check or money order. Web you can find form 51 at tax.idaho.gov.

Web To See If You Qualify For An Extension, Complete The Worksheet On Idaho Form 51, Estimated Payment Of Individual Income Tax.

If you need to make a payment, you can mail the. Explore more file form 4868 and. The state of idaho doesn’t require any extension form as it automatically grants extensions up to 6 months. Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have.

Web Use Idaho Form 51 (Estimated Payment Of Idaho Individual Income Tax) To Make A State Extension Payment.

Web mail form 51 with your check or money order. Estimated payment of idaho individual income tax 2014. Mail form 51 with your check or money order. Estimated payment of idaho individual income tax 2013.

Web Use Form 51 To Calculate Any Payment Due For A Valid Tax Year 2021 Extension Or Make Estimated Payments For Tax Year 2022 (Check The Appropriate Year.

After you finish the worksheet, do one of the following: If you’re unsure whether you owe idaho tax or you want to. File this statement with the idaho state tax. Web to ensure you owe tax, use worksheet form 51.