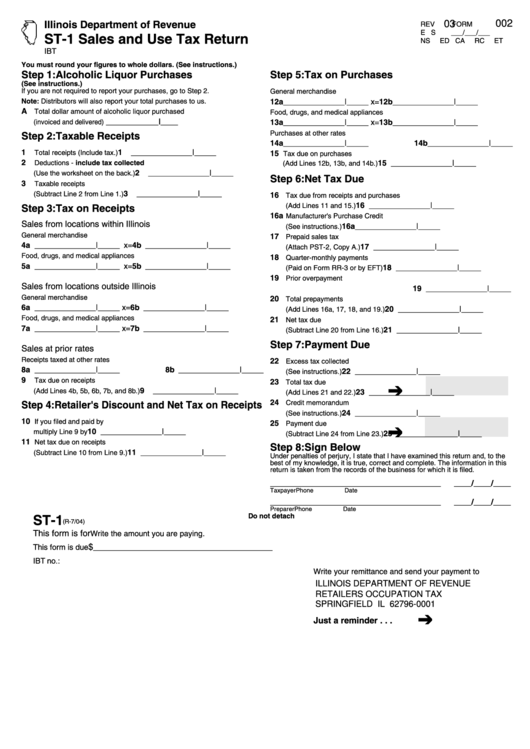

Illinois Form St 1

Illinois Form St 1 - Easily sign the illinois sales tax form st 1 with your. Secretary of state publications are available in pdf (portable document format) unless stated otherwise. The department has the ability to electronically receive and process the. Web electronic filing program for sales & use tax returns. Forms with fillable fields should be saved, opened and. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Ad download or email & more fillable forms, register and subscribe now! If you are reporting sales for more than. Web illinois department of revenue. Documents are in adobe acrobat portable document format (pdf).

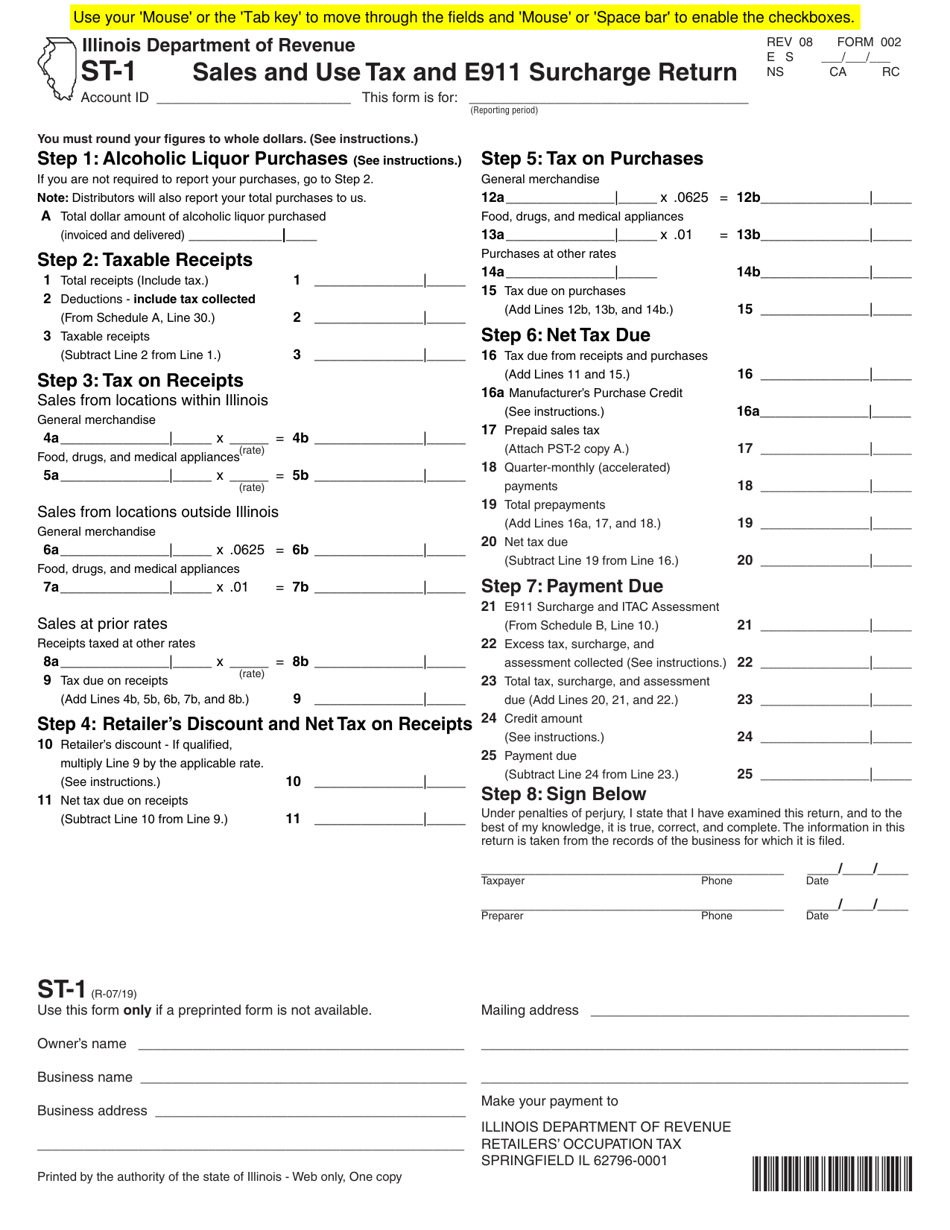

This is the most commonly used form to file and pay. Forms with fillable fields should be saved, opened and. If you are reporting sales for more than. Secretary of state publications are available in pdf (portable document format) unless stated otherwise. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. The department has the ability to electronically receive and process the. Easily sign the illinois sales tax form st 1 with your. Web the form 15: Ad download or email & more fillable forms, register and subscribe now! 4a _____ x 5% = 4b _____ 5.

Ad download or email & more fillable forms, register and subscribe now! Secretary of state publications are available in pdf (portable document format) unless stated otherwise. Add lines 2b, 3b, and 4b. General information do not write above this line. Forms with fillable fields should be saved, opened and. Taxable receipts.” the illinois filing system will automatically round this. Web illinois department of revenue. Documents are in adobe acrobat portable document format (pdf). Web the form 15: Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions.

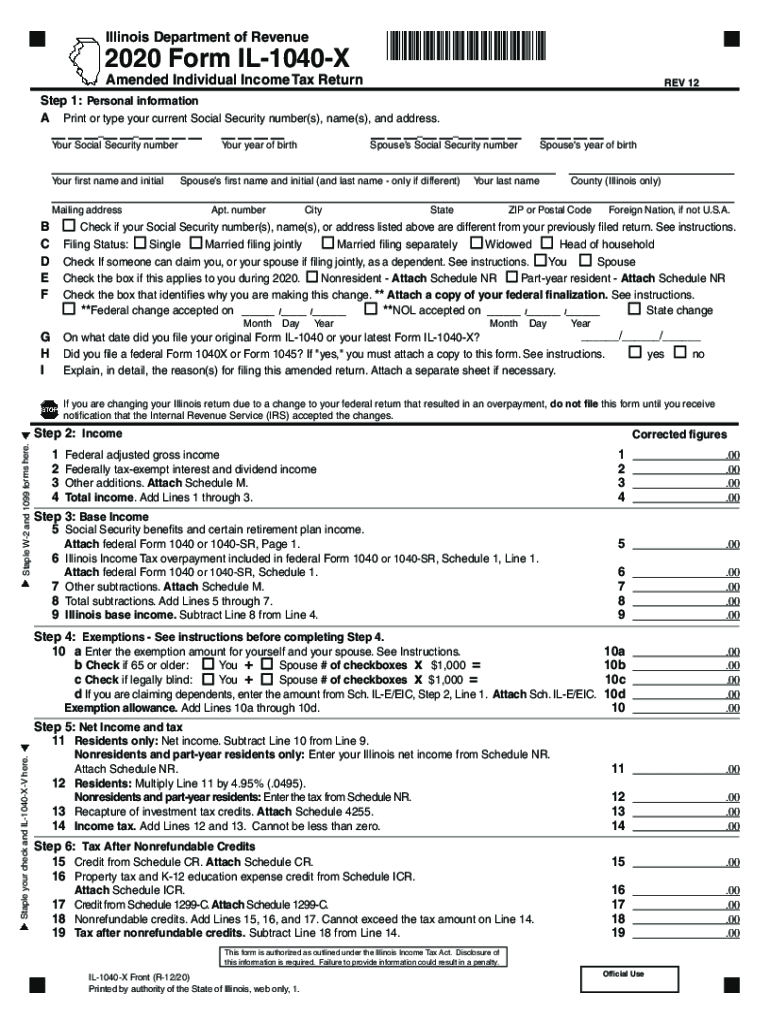

Il 1040 Fill Out and Sign Printable PDF Template signNow

Ad download or email & more fillable forms, register and subscribe now! Before viewing these documents you may need to download adobe acrobat reader. If you are reporting sales for more than. This is the amount of your credit for tax holiday items. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions.

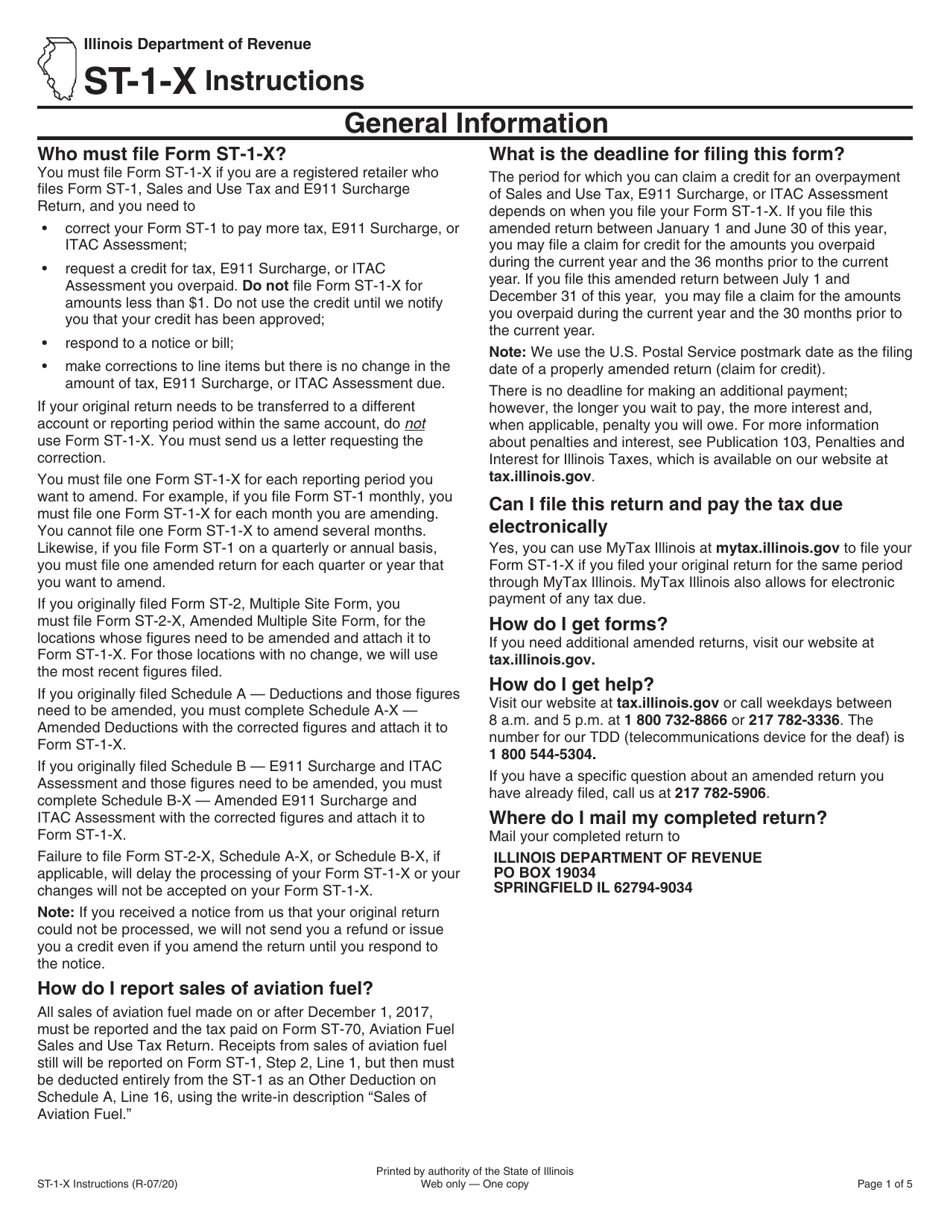

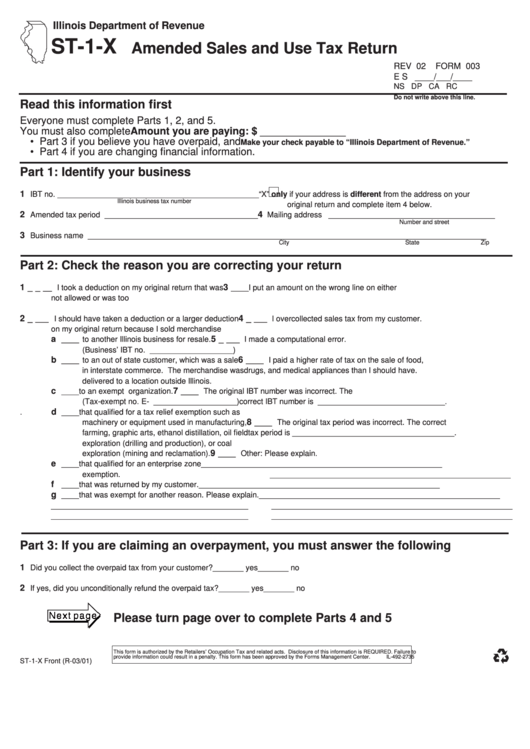

Download Instructions for Form ST1X, 003 Amended Sales and Use Tax

Taxable receipts.” the illinois filing system will automatically round this. Web the form 15: 4a _____ x 5% = 4b _____ 5. When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Secretary of state publications are available in pdf (portable document format).

Form ST1 Download Fillable PDF or Fill Online Sales and Use Tax and

Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. Ad download or email & more fillable forms, register and subscribe now! The department has the ability to electronically receive and process the. Easily sign the illinois sales tax form st 1 with.

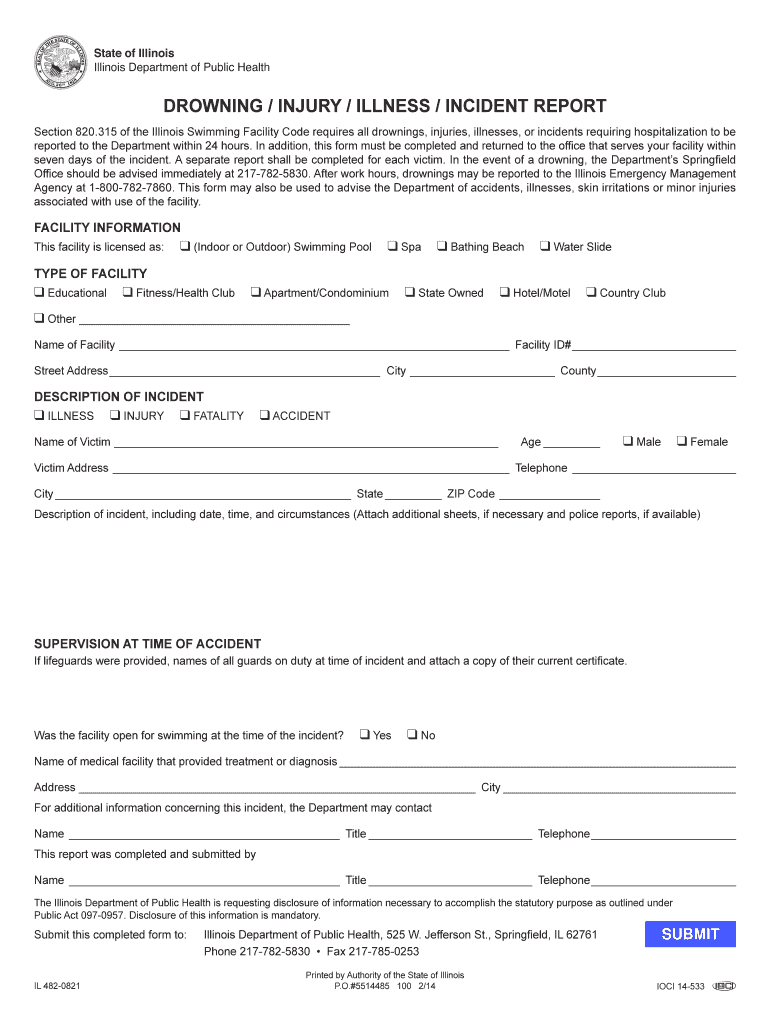

Illinois Polst Form 2022 Fill Out and Sign Printable PDF Template

Documents are in adobe acrobat portable document format (pdf). Web illinois department of revenue. Ad download or email & more fillable forms, register and subscribe now! Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. Open the tax illinois gov individuals a.

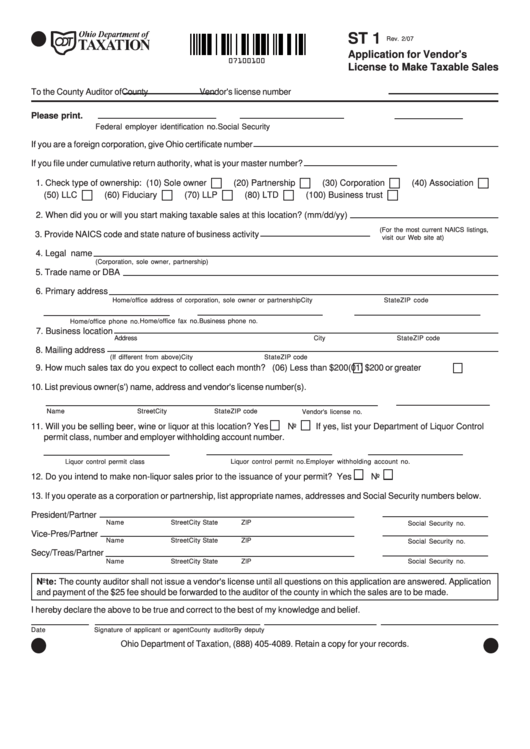

Fillable Form St 1 Application For Vendor'S License To Make Taxable

General information do not write above this line. Easily sign the illinois sales tax form st 1 with your. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. This is the amount of your credit for tax holiday items. Secretary of state publications are.

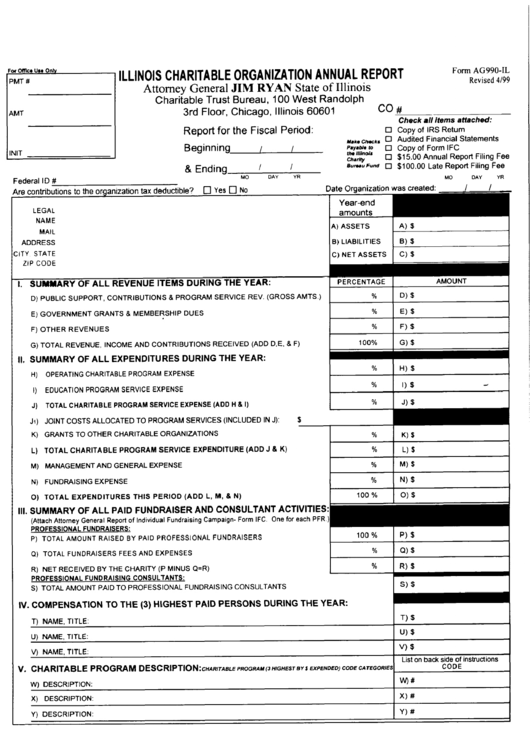

Form Ag990Il Illinois Charitable Organization Annual Report 1999

Forms with fillable fields should be saved, opened and. Web illinois department of revenue. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and.

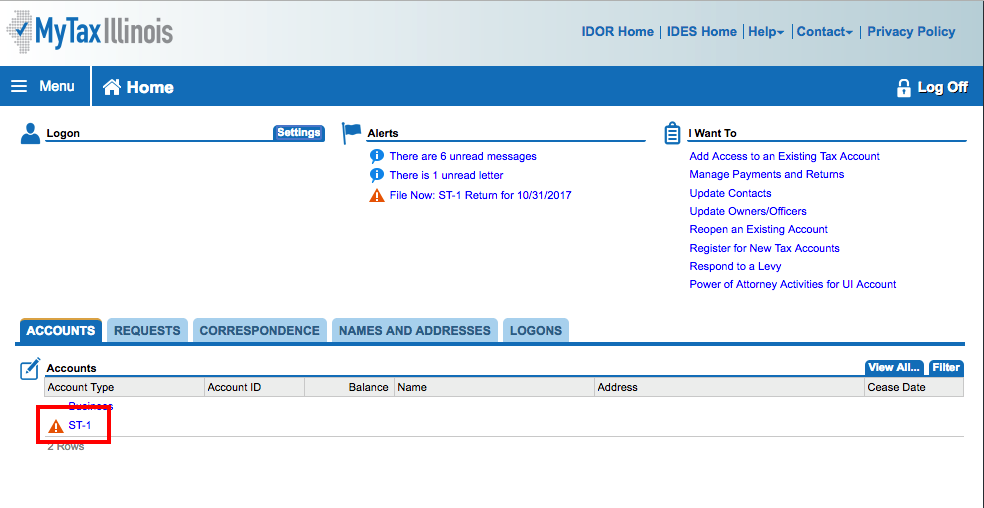

St 1 Fill Online, Printable, Fillable, Blank pdfFiller

This is the most commonly used form to file and pay. When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Documents are in adobe acrobat portable document format (pdf). Web illinois department of revenue. 4a _____ x 5% = 4b _____ 5.

How to File an Illinois Sales Tax ReturnTaxJar Blog

Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. General information do not write above this line. Documents are in adobe acrobat portable document format (pdf). Web electronic filing program for sales & use tax returns. Taxable receipts.” the illinois filing system will automatically.

Form St1X Amended Sales And Use Tax Return Form State Of Illinois

Documents are in adobe acrobat portable document format (pdf). If you are reporting sales for more than. Add lines 2b, 3b, and 4b. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Secretary of state publications are available in pdf (portable document format) unless stated otherwise.

Form St1/2 Sales And Use Tax Multiple Site Return printable pdf

Forms with fillable fields should be saved, opened and. Web illinois department of revenue. Before viewing these documents you may need to download adobe acrobat reader. General information do not write above this line. This is the most commonly used form to file and pay.

When Completing This Form, Round To The Nearest Dollar By Dropping Amounts Less Than 50 Cents And Increasing Amounts Of 50 Cents Or More To The Next.

Add lines 2b, 3b, and 4b. 4a _____ x 5% = 4b _____ 5. Web the form 15: Taxable receipts.” the illinois filing system will automatically round this.

General Information Do Not Write Above This Line.

This is the most commonly used form to file and pay. Before viewing these documents you may need to download adobe acrobat reader. If you are reporting sales for more than. Secretary of state publications are available in pdf (portable document format) unless stated otherwise.

Web Illinois Department Of Revenue.

The department has the ability to electronically receive and process the. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. Documents are in adobe acrobat portable document format (pdf). Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions.

Amended Sales And Use Tax And E911 Surcharge Return.

Easily sign the illinois sales tax form st 1 with your. Ad download or email & more fillable forms, register and subscribe now! Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. Web electronic filing program for sales & use tax returns.