Injured Spouse Form 2023

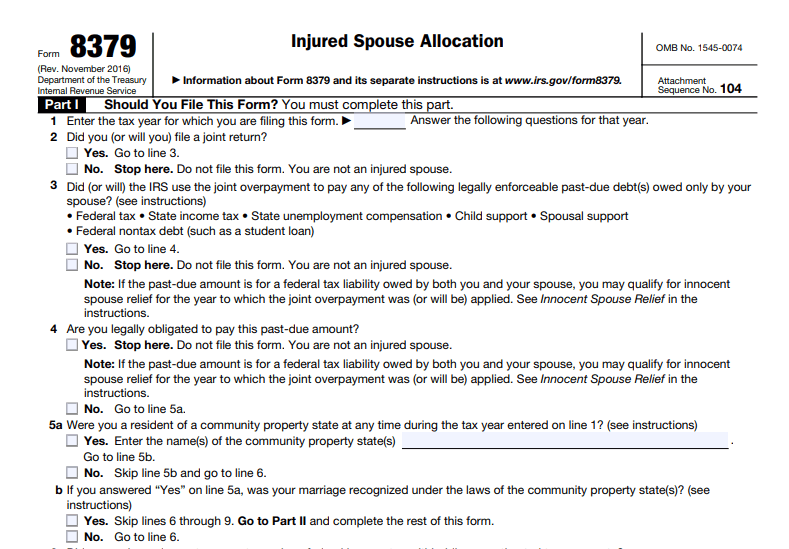

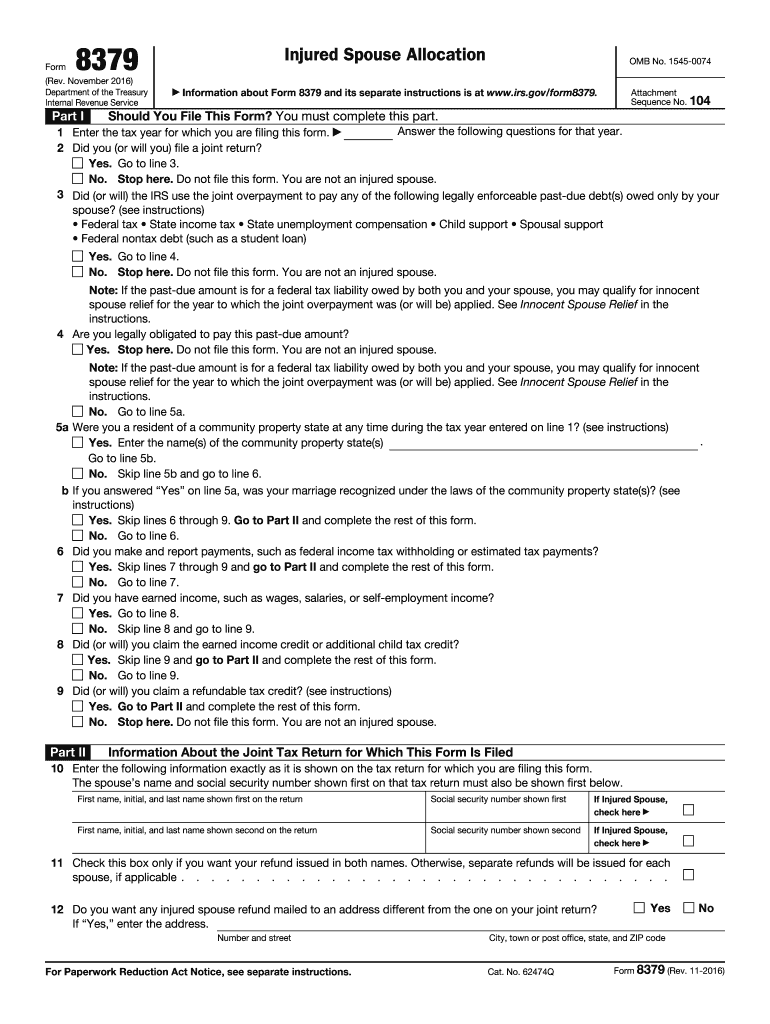

Injured Spouse Form 2023 - If you file form 8379 with a joint return electronically, the time needed to. The form can be included. Web injured spouse allocation form (no. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Get ready for tax season deadlines by completing any required tax forms today. Web then, you will need to write some information about you and your spouse. This form is for income earned in tax year. You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment was, or is expected to be, applied (offset) to your. Ad download or email irs 8379 & more fillable forms, register and subscribe now! Can i file injured spouse for previous.

It includes your name, social security number, address, and phone number. Web then, you will need to write some information about you and your spouse. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Form 8857 is used to. However, if at any time after this refund has been released, if i, my spouse/joint filer or anyone on our behalf files an amended. Web if married spouses file a joint tax return and any overpayment is applied to one party's past tax obligations, the injured spouse can file irs form 8379: The request for mail order forms may be used to order one copy or. Ad download or email irs 8379 & more fillable forms, register and subscribe now! You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment was, or is expected to be, applied (offset) to your. Web more about the federal form 8379.

You will need to check a box. Can i file injured spouse for previous. You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment was, or is expected to be, applied (offset) to your. Web answer yes, you can file form 8379 electronically with your tax return. Ad download or email irs 8379 & more fillable forms, register and subscribe now! However, if at any time after this refund has been released, if i, my spouse/joint filer or anyone on our behalf files an amended. Form 8379 is used by injured. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Form 8857 is used to. This form is for income earned in tax year.

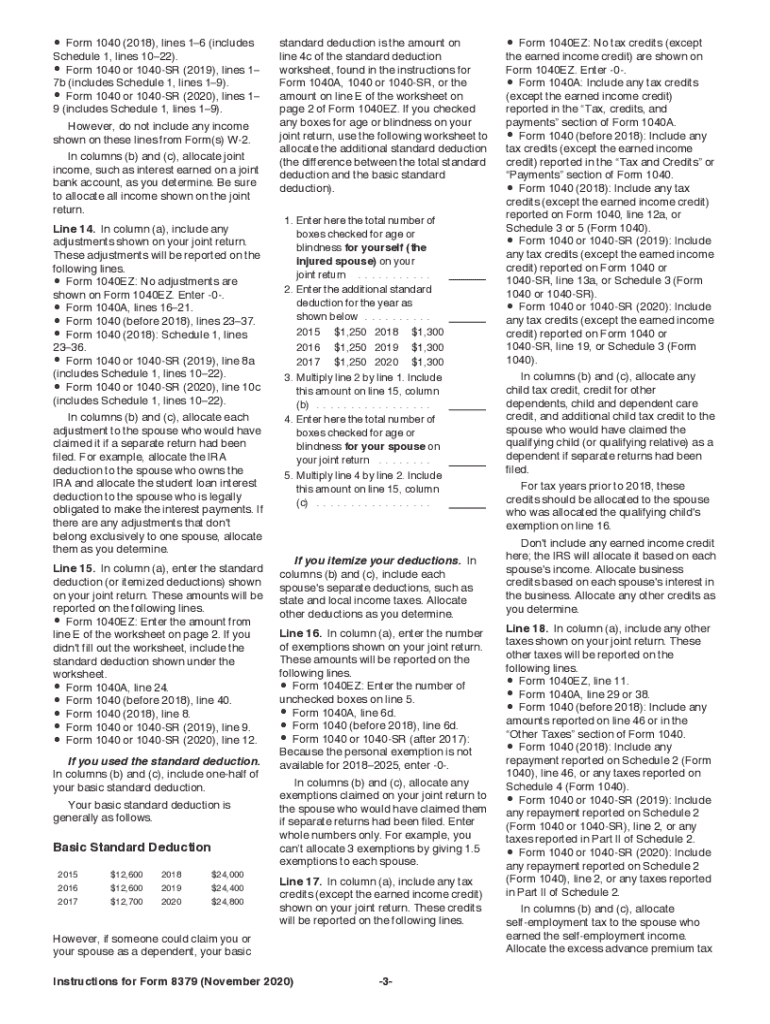

2020 Form IRS 8379 Instructions Fill Online, Printable, Fillable, Blank

Web answer yes, you can file form 8379 electronically with your tax return. It includes your name, social security number, address, and phone number. You will need to check a box. Form 8379 is used by injured. If you file form 8379 with a joint return electronically, the time needed to.

Spouse Tax Adjustment Worksheet

If you file form 8379 with a joint return electronically, the time needed to. We last updated federal form 8379 in february 2023 from the federal internal revenue service. Web if you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know. Web answer yes, you can file form 8379 electronically with your.

FREE 7+ Sample Injured Spouse Forms in PDF

If you file form 8379 with a joint return electronically, the time needed to. Web if you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know. We last updated federal form 8379 in february 2023 from the federal internal revenue service. Web then, you will need to write some information about you.

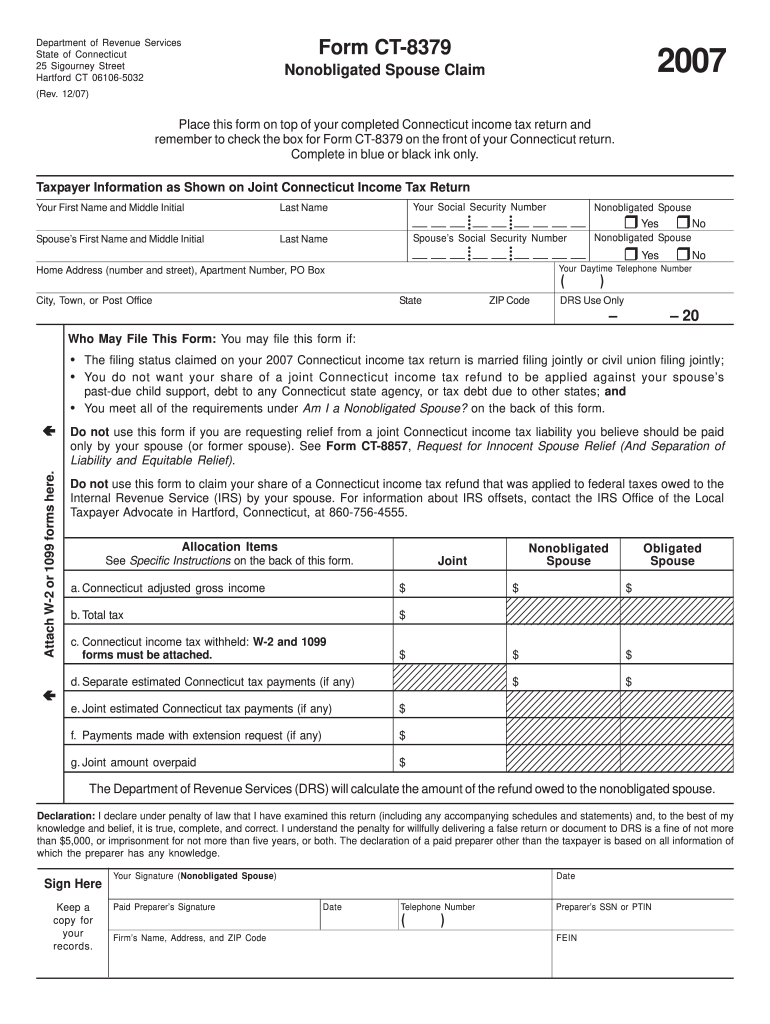

Connecticut injured spouse form Fill out & sign online DocHub

Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Web on form 8379, the term “injured.

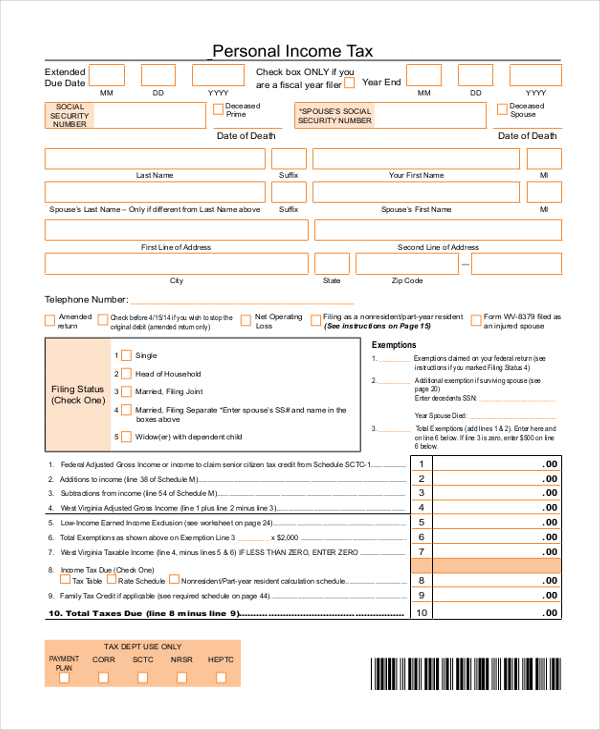

FREE 9+ Sample Injured Spouse Forms in PDF

The request for mail order forms may be used to order one copy or. Web more about the federal form 8379. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when.

FREE 9+ Sample Injured Spouse Forms in PDF

This form is for income earned in tax year. You need to file form 8379 for each year you’re an. Form 8857 is used to. If you file form 8379 with a joint return electronically, the time needed to. You may be an injured spouse if you file a joint return and all or part of your portion of the.

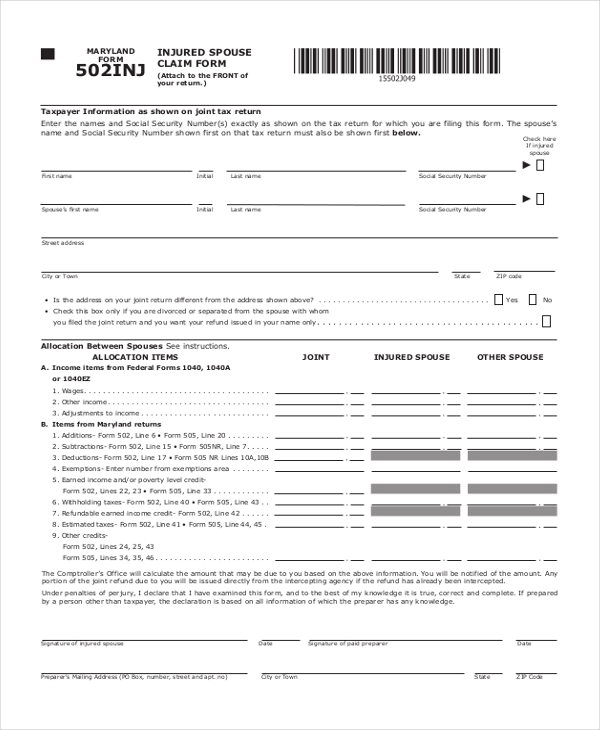

FREE 7+ Sample Injured Spouse Forms in PDF

However, if at any time after this refund has been released, if i, my spouse/joint filer or anyone on our behalf files an amended. Web on form 8379, the term “injured spouse” designates a spouse who has been negatively impacted by having their joint tax refund used to pay down the other. Get ready for tax season deadlines by completing.

What Is an Injured Spouse? Injured Spouse Tax Eligibility HowStuffWorks

Web injured spouse allocation form (no. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. You will need to check a box. Web if you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know. Can i file injured spouse for.

Everything You Need to Know about Injured Spouse Tax Relief (IRS Form

Web on form 8379, the term “injured spouse” designates a spouse who has been negatively impacted by having their joint tax refund used to pay down the other. If you file form 8379 with a joint return electronically, the time needed to. Web more about the federal form 8379. Web if you’re an injured spouse, you must file a form.

Irs form 8379 Fill out & sign online DocHub

Form 8857 is used to. You will need to check a box. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Web then, you will need to write some information about you and your spouse. This form is.

Web Then, You Will Need To Write Some Information About You And Your Spouse.

The form can be included. Web on form 8379, the term “injured spouse” designates a spouse who has been negatively impacted by having their joint tax refund used to pay down the other. However, if at any time after this refund has been released, if i, my spouse/joint filer or anyone on our behalf files an amended. Web if you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know.

Web You May Qualify As An Injured Spouse, If You Plan On Filing A Joint Return With Your Spouse And Your Spouse Owes A Debt That You Are Not Responsible For.

Web answer yes, you can file form 8379 electronically with your tax return. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past.

Form 8379 Is Used By Injured.

This form is for income earned in tax year. You will need to check a box. Web if married spouses file a joint tax return and any overpayment is applied to one party's past tax obligations, the injured spouse can file irs form 8379: You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment was, or is expected to be, applied (offset) to your.

Web Information About Form 8857, Request For Innocent Spouse Relief, Including Recent Updates, Related Forms, And Instructions On How To File.

Web injured spouse allocation form (no. Ad download or email irs 8379 & more fillable forms, register and subscribe now! We last updated federal form 8379 in february 2023 from the federal internal revenue service. It includes your name, social security number, address, and phone number.