Installment Request Form 9465

Installment Request Form 9465 - Treasury and its designated financial agent to initiate a monthly ach debit (electronic withdrawal) entry to the financial institution account indicated for. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. The irs will contact you to approve or deny your installment plan request. Web in order to request the installment agreement, you must be unable to pay the tax in full within 120 days of the tax return filing deadline or the date you receive an irs. The irs encourages you to pay a portion of the. If you owe $50,000 or less, you may be able to avoid filing form 9465 and. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Web filing form 9465 does not guarantee your request for a payment plan. Get ready for tax season deadlines by completing any required tax forms today.

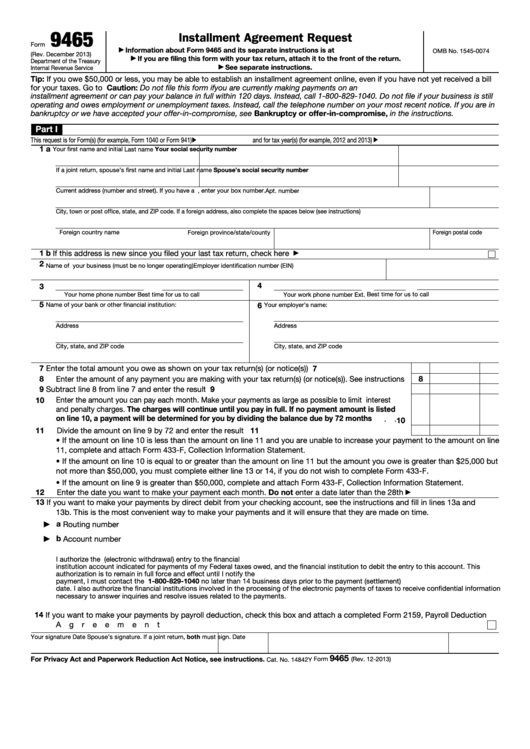

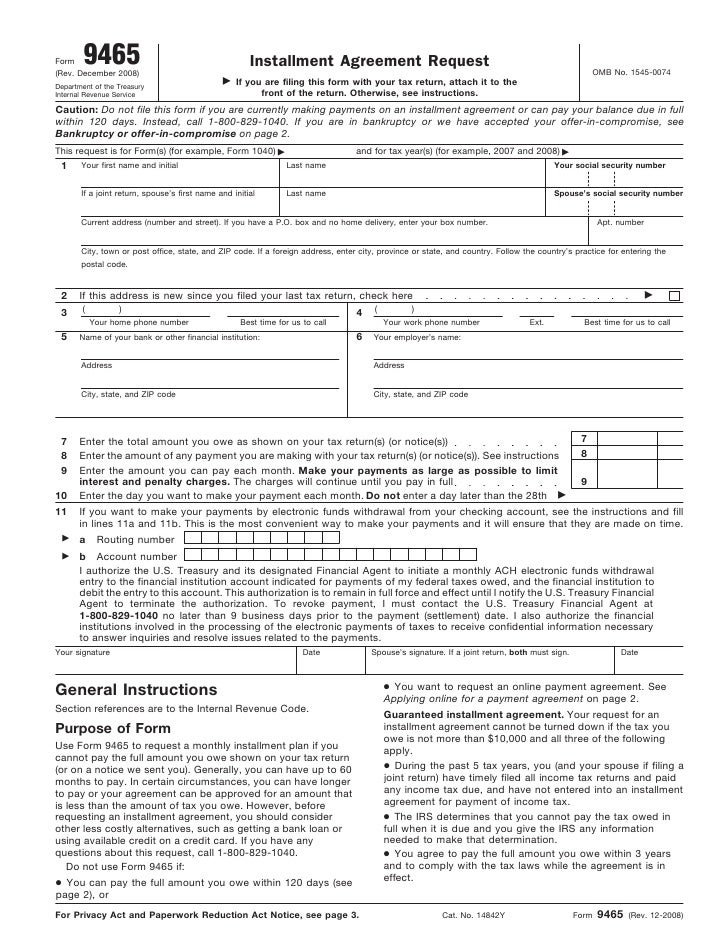

Web filing form 9465 does not guarantee your request for a payment plan. The irs will contact you to approve or deny your installment plan request. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Web if the taxpayer can't pay the total tax currently due but would like to pay the tax due through form 9465, installment agreement request, use the steps below to request an. 9465 installment agreement request form omb no. December 2008) if you are filing this form with. The irs encourages you to pay a portion of the. To enter or review information for. Ad fill your 9465 installment agreement request online, download & print. If you are filing this.

9465 installment agreement request form omb no. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. If you owe $50,000 or less, you may be able to avoid filing form 9465 and. Ad fill your 9465 installment agreement request online, download & print. Web filing form 9465 does not guarantee your request for a payment plan. Employers engaged in a trade or business. Treasury and its designated financial agent to initiate a monthly ach debit (electronic withdrawal) entry to the financial institution account indicated for. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Employee's withholding certificate form 941;

Form 9465FS Installment Agreement Request (2011) Free Download

Employee's withholding certificate form 941; Web irs form 9465 installment agreement request instructions if you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax.

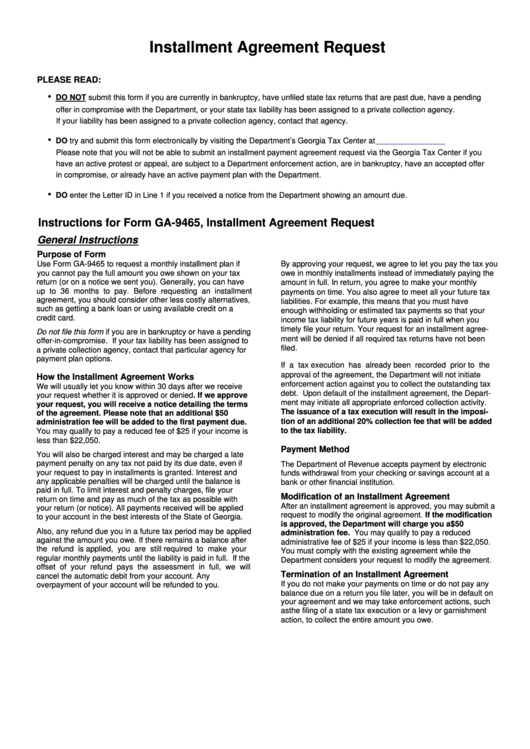

Fillable Form Ga9465 Installment Agreement Request printable pdf

Employee's withholding certificate form 941; 9465 installment agreement request form omb no. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web complete this form to request an installment payment agreement with the irs for unpaid.

Fillable Form 9465 Installment Agreement Request printable pdf download

December 2008) if you are filing this form with. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay.

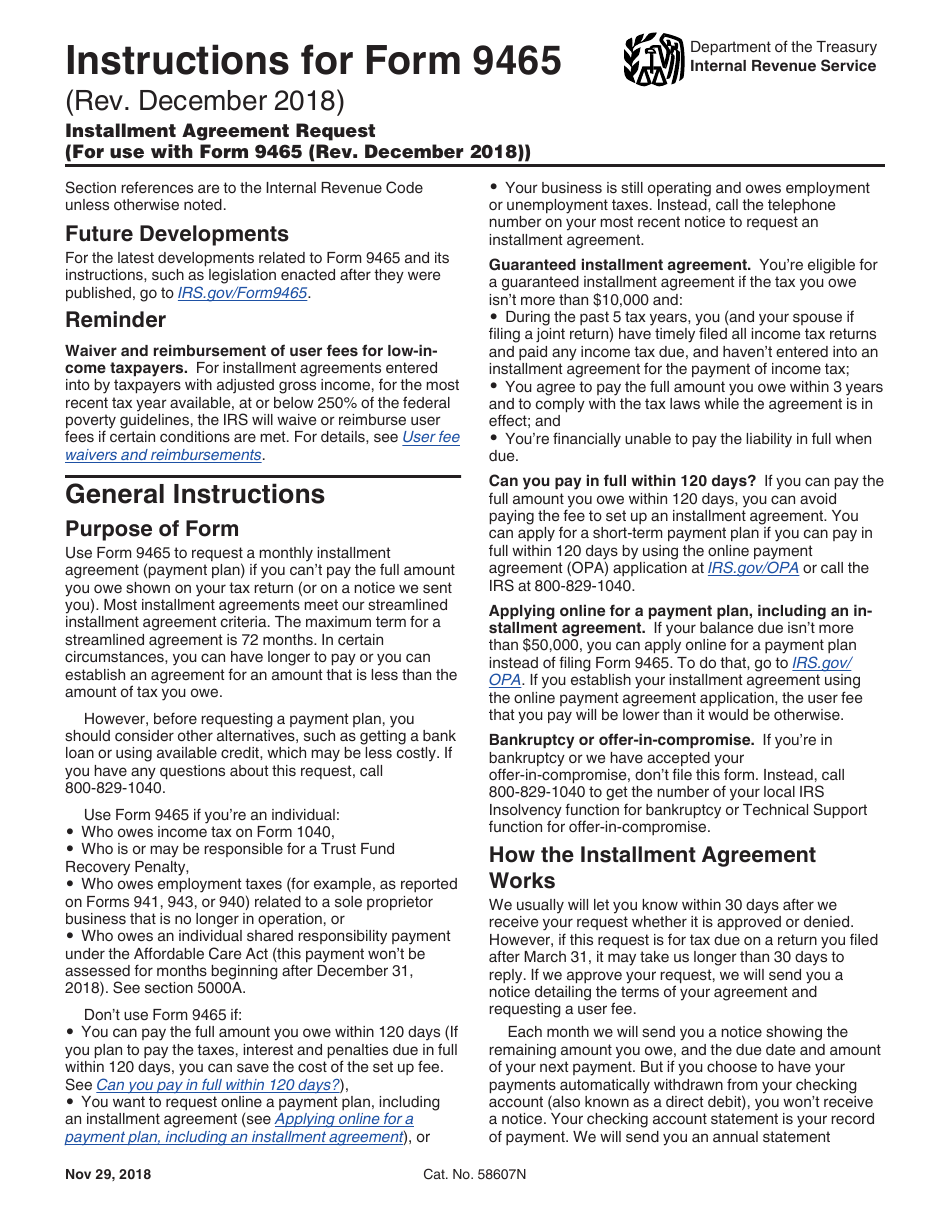

Download Instructions for IRS Form 9465 Installment Agreement Request

If you owe $50,000 or less, you may be able to avoid filing form 9465 and. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. If you are filing this. Web filing form 9465 does not guarantee your request for a payment plan. December 2008) if.

Form 9465Installment Agreement Request

Employers engaged in a trade or business. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. If you owe $50,000 or less, you may be able to avoid filing form 9465 and. If you are filing this. Get ready for tax season deadlines by completing any.

Irs Form 9465 Installment Agreement Request Software Free Download

Treasury and its designated financial agent to initiate a monthly ach debit (electronic withdrawal) entry to the financial institution account indicated for. 9465 installment agreement request form omb no. Employee's withholding certificate form 941; Web if the taxpayer can't pay the total tax currently due but would like to pay the tax due through form 9465, installment agreement request, use.

Stay on Top of your Tax Installments by Filing Form 9465

Web complete this form to request an installment payment agreement with the irs for unpaid taxes. Get ready for tax season deadlines by completing any required tax forms today. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Ad.

Form 9465, Installment Agreement Request 2013 MbcVirtual

If you owe $50,000 or less, you may be able to avoid filing form 9465 and. Get ready for tax season deadlines by completing any required tax forms today. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. The.

IRS Form 9465 Guide to Installment Agreement Request

Get ready for tax season deadlines by completing any required tax forms today. December 2008) if you are filing this form with. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. If you owe $50,000 or less, you may.

Tax Hacks 2017 Can’t Pay Your Taxes? Here’s What to Do ‒ Money Talks News

Web complete this form to request an installment payment agreement with the irs for unpaid taxes. 9465 installment agreement request form omb no. Employers engaged in a trade or business. To enter or review information for. The irs encourages you to pay a portion of the.

Web Filing Form 9465 Does Not Guarantee Your Request For A Payment Plan.

Web to request an installment agreement, the taxpayer must complete form 9465. Employee's withholding certificate form 941; The irs will contact you to approve or deny your installment plan request. Web in order to request the installment agreement, you must be unable to pay the tax in full within 120 days of the tax return filing deadline or the date you receive an irs.

Employee's Withholding Certificate Form 941;

Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. To enter or review information for. Web if the taxpayer can't pay the total tax currently due but would like to pay the tax due through form 9465, installment agreement request, use the steps below to request an. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date.

Web Use Form 9465 To Request A Monthly Installment Agreement (Payment Plan) If You Can’t Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice We Sent You).

Get ready for tax season deadlines by completing any required tax forms today. 9465 installment agreement request form omb no. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. If you owe $50,000 or less, you may be able to avoid filing form 9465 and.

Web Use Irs Form 9465 Installment Agreement Request To Request A Monthly Installment Plan If You Can't Pay Your Full Tax Due Amount.

Ad fill your 9465 installment agreement request online, download & print. Employers engaged in a trade or business who. Web complete this form to request an installment payment agreement with the irs for unpaid taxes. Treasury and its designated financial agent to initiate a monthly ach debit (electronic withdrawal) entry to the financial institution account indicated for.