Instructions For Form 8379

Instructions For Form 8379 - If you file form 8379 by. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web 1 best answer johnw15 intuit alumni you'll need to look at the line instructions in the instructions for form 8379 , but here are some tips. Edit, sign and save irs 8379 instructions form. Sign online button or tick the preview image of the blank. Generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). Irs 8379 inst & more fillable forms, register and subscribe now! Web federal — injured spouse allocation download this form print this form it appears you don't have a pdf plugin for this browser. Web irs form 8379 is a tax form that can be filed to reclaim part of a tax refund that has been used to pay for an overdue debt.

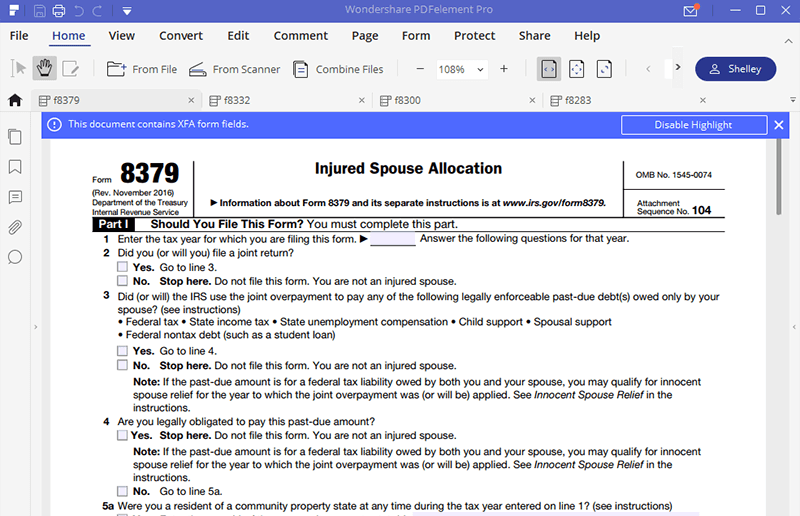

9 minutes watch video get the form! The injured spouse on a jointly filed tax return files form 8379 to get. Please use the link below to download 2022. Sign online button or tick the preview image of the blank. 104 part i should you file this form?. Web 1 best answer johnw15 intuit alumni you'll need to look at the line instructions in the instructions for form 8379 , but here are some tips. Edit, sign and save irs 8379 instructions form. Web a information about form 8379 and its separate instructions is at www.irs.gov/form8379. Web irs form 8379 is a tax form that can be filed to reclaim part of a tax refund that has been used to pay for an overdue debt. Irs 8379 inst & more fillable forms, register and subscribe now!

Complete, edit or print tax forms instantly. You may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your. Edit, sign and save irs 8379 instructions form. Web taxslayer support how do i complete the injured spouse form (8379)? To get started on the blank, use the fill camp; Form 8379 is filed with one spouse (the injured spouse) on a jointly registered tax return when the joint overpayback was (or is expected in be) applied. 104 part i should you file this form?. Web a information about form 8379 and its separate instructions is at www.irs.gov/form8379. Get ready for tax season deadlines by completing any required tax forms today. Web 1 best answer johnw15 intuit alumni you'll need to look at the line instructions in the instructions for form 8379 , but here are some tips.

Form 8379 Instructions Fillable and Editable PDF Template

Web if you file form 8379 by itself, you must write or enter both spouses' social security numbers in the same order as they showed on your joint return. The injured spouse on a jointly filed tax return files form 8379 to get. Edit, sign and save irs 8379 instructions form. Web by submitting form 8379, the injured spouse requests.

8900.1 Vol. 5 Ch. 5 Sec. 2, Certificate Airframe and/or Powerplant

Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Web taxslayer support how do i complete the injured spouse form (8379)? Edit, sign and save irs 8379 instructions form. 9 minutes watch video get the form! Web irs form 8379 is a tax form that can be filed to reclaim part of.

Irs Forms 8379 Instructions Universal Network

Web by submitting form 8379, the injured spouse requests that the internal revenue service (irs) release their share of a joint tax refund. The injured spouse on a jointly filed tax return files form 8379 to get. Web irs form 8379 is a tax form that can be filed to reclaim part of a tax refund that has been used.

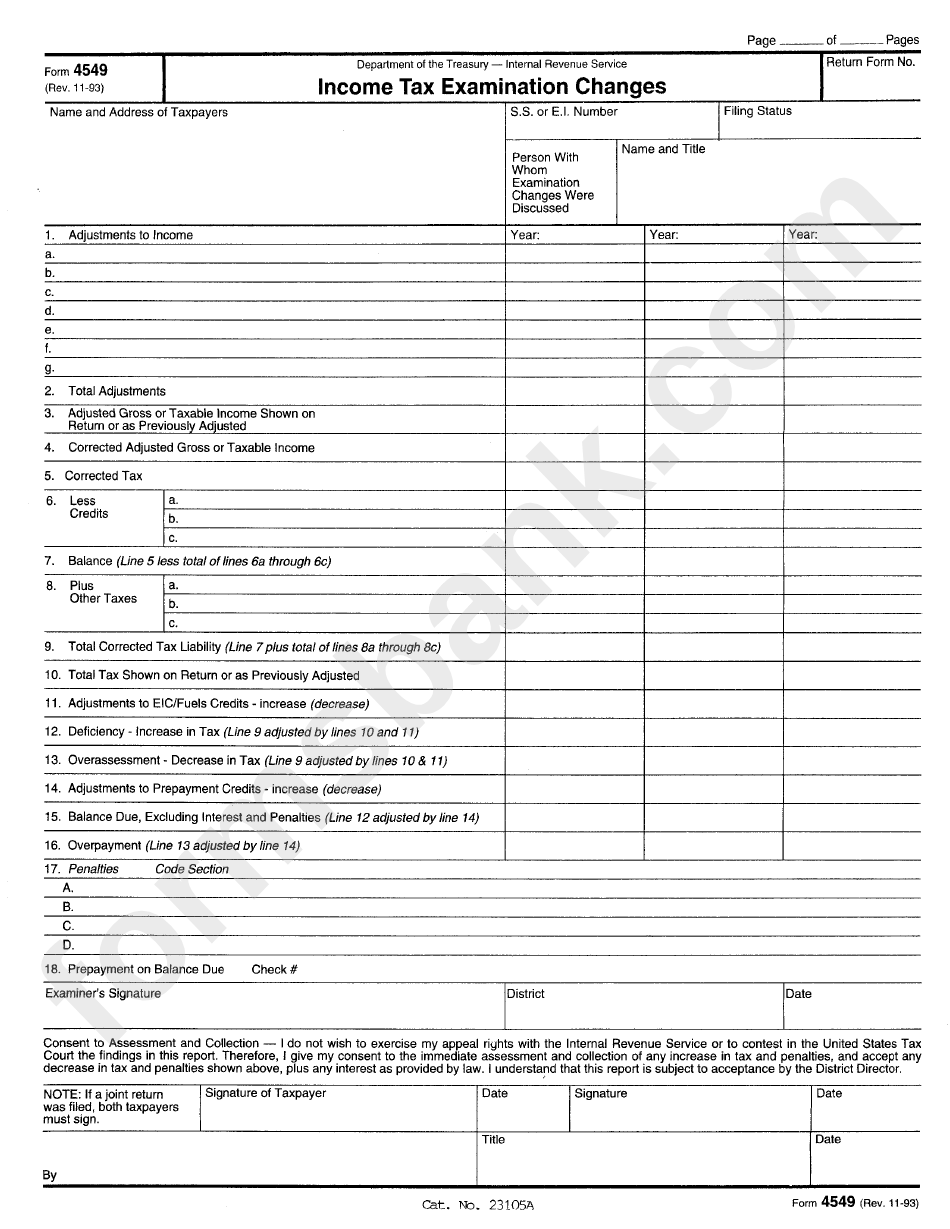

Form 4549 Tax Examination Changes Internal Revenue Service

Irs 8379 inst & more fillable forms, register and subscribe now! Form 8379 is filed with one spouse (the injured spouse) on a jointly registered tax return when the joint overpayback was (or is expected in be) applied. Web federal — injured spouse allocation download this form print this form it appears you don't have a pdf plugin for this.

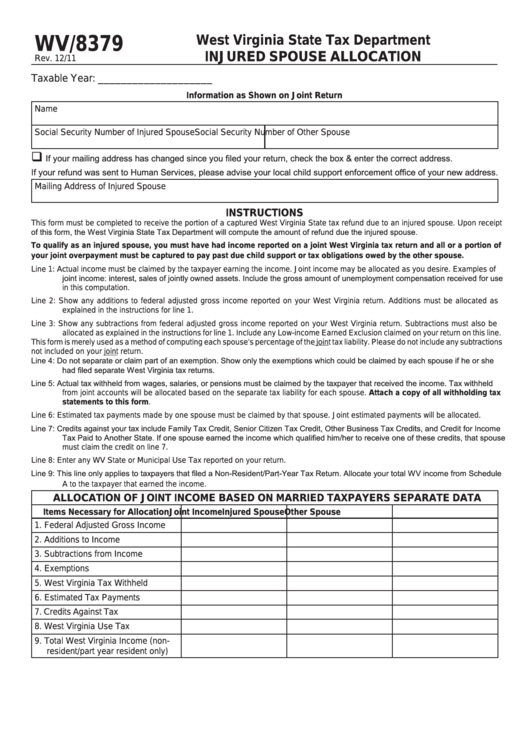

Form Wv/8379 Injured Spouse Allocation printable pdf download

If you file form 8379 by. Please use the link below to download 2022. Web in the print dialog box that appears you are able to choose if you wish to send the output to a printer or a pdf document. Step by step instructions comments. Publication 504, divorced or separated individuals

example of form 8379 filled out Fill Online, Printable, Fillable

Publication 555, community property irs: Complete, edit or print tax forms instantly. Web taxslayer support how do i complete the injured spouse form (8379)? Web irs form 8379 is a tax form that can be filed to reclaim part of a tax refund that has been used to pay for an overdue debt. Web if you file form 8379 by.

F8379 injure spouse form

Web if you file form 8379 by itself, you must write or enter both spouses' social security numbers in the same order as they showed on your joint return. 104 part i should you file this form?. Get ready for tax season deadlines by completing any required tax forms today. Publication 555, community property irs: Web federal — injured spouse.

Irs Form 8379 Line 20 Universal Network

How to file form 8379. Sign online button or tick the preview image of the blank. If a married couple files a joint tax return. Only the injured spouse needs to. Web a information about form 8379 and its separate instructions is at www.irs.gov/form8379.

Форма IRS 8379 заполните правильно

Web by submitting form 8379, the injured spouse requests that the internal revenue service (irs) release their share of a joint tax refund. Web a information about form 8379 and its separate instructions is at www.irs.gov/form8379. If you file form 8379 by. Irs 8379 inst & more fillable forms, register and subscribe now! Publication 555, community property irs:

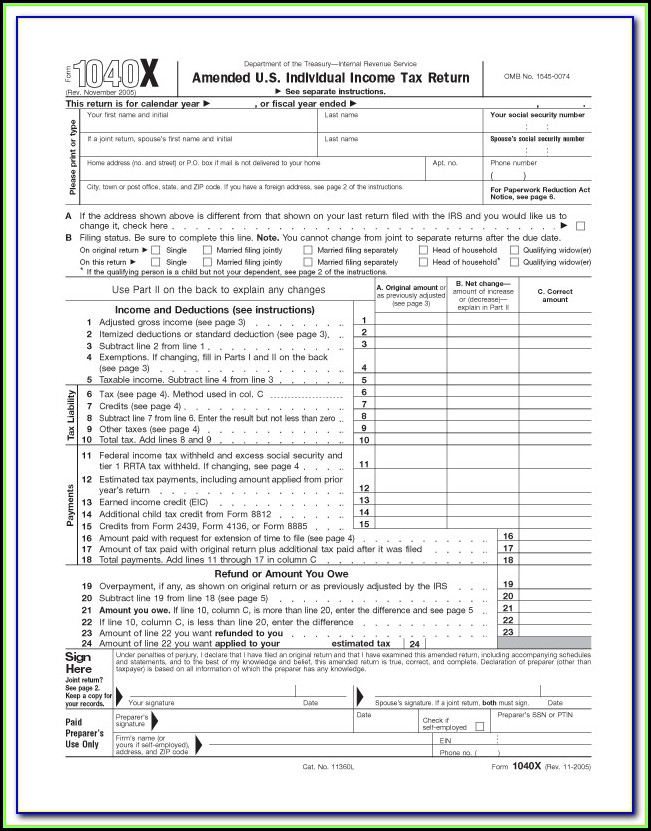

Irs Forms 1040x Instructions Form Resume Examples mx2WBDJV6E

Only the injured spouse needs to. Step by step instructions comments. Ad access irs tax forms. Form 8379 is filed with one spouse (the injured spouse) on a jointly registered tax return when the joint overpayback was (or is expected in be) applied. Edit, sign and save irs 8379 instructions form.

Ad Access Irs Tax Forms.

Complete, edit or print tax forms instantly. 104 part i should you file this form?. Web in the print dialog box that appears you are able to choose if you wish to send the output to a printer or a pdf document. See the irs instructions for form 8379 for additional.

Irs 8379 Inst & More Fillable Forms, Register And Subscribe Now!

Publication 555, community property irs: Web 1 best answer johnw15 intuit alumni you'll need to look at the line instructions in the instructions for form 8379 , but here are some tips. Please use the link below to download 2022. Web federal — injured spouse allocation download this form print this form it appears you don't have a pdf plugin for this browser.

If You File Form 8379 By.

Sign online button or tick the preview image of the blank. The injured spouse on a jointly filed tax return files form 8379 to get. To get started on the blank, use the fill camp; Web irs form 8379 instructions by forrest baumhover march 30, 2023 reading time:

Generally, If You File Form 8379 With A Joint Return On Paper, The Time Needed To Process It Is About 14 Weeks (11 Weeks If Filed Electronically).

Web a information about form 8379 and its separate instructions is at www.irs.gov/form8379. Edit, sign and save irs 8379 instructions form. Get ready for tax season deadlines by completing any required tax forms today. Form 8379 is filed with one spouse (the injured spouse) on a jointly registered tax return when the joint overpayback was (or is expected in be) applied.