Instructions Form 5500

Instructions Form 5500 - Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6047(e), 6057(b), and 6058(a) of the internal revenue code (the code). Form 5500 version selection tool. Complete all entries in accordance with the instructions to the form 5500. Web sending the form to the irs form 5500 (initial filers) 87 hr., 3 min. Complete and download the form to your computer to print and sign before mailing. Web forms and filing instructions. Other form 5500 data sets. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Form 5500 raw data sets.

Be sure to enter your information in the specific line fields provided. Web form 5500 is a report detailing a company’s employee benefits. Schedule a (form 5500) 17 hr., 28 min. Complete and download the form to your computer to print and sign before mailing. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Form 5500 raw data sets. Complete the form by hand using only black or blue ink. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web sending the form to the irs form 5500 (initial filers) 87 hr., 3 min. Web form 5500 annual return/report of employee benefit plan | instructions;

Form 5500 version selection tool. Web sending the form to the irs form 5500 (initial filers) 87 hr., 3 min. Form 5500 raw data sets. Complete all entries in accordance with the instructions to the form 5500. Web form 5500 is a report detailing a company’s employee benefits. Web forms and filing instructions. Complete the form by hand using only black or blue ink. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Be sure to enter your information in the specific line fields provided. The form, and any required schedules and attachments, must be filed by the last day of the 7th calendar month after the end of the plan year (not to exceed 12 months in length) that began in 2009.

Understanding the Form 5500 for Defined Contribution Plans Fidelity

Complete and download the form to your computer to print and sign before mailing. Complete all entries in accordance with the instructions to the form 5500. Schedule b (form 5500) part 1 30 hr., 37 min. Complete the form by hand using only black or blue ink. Form 5500 (all other filers) 81 hr., 33 min.

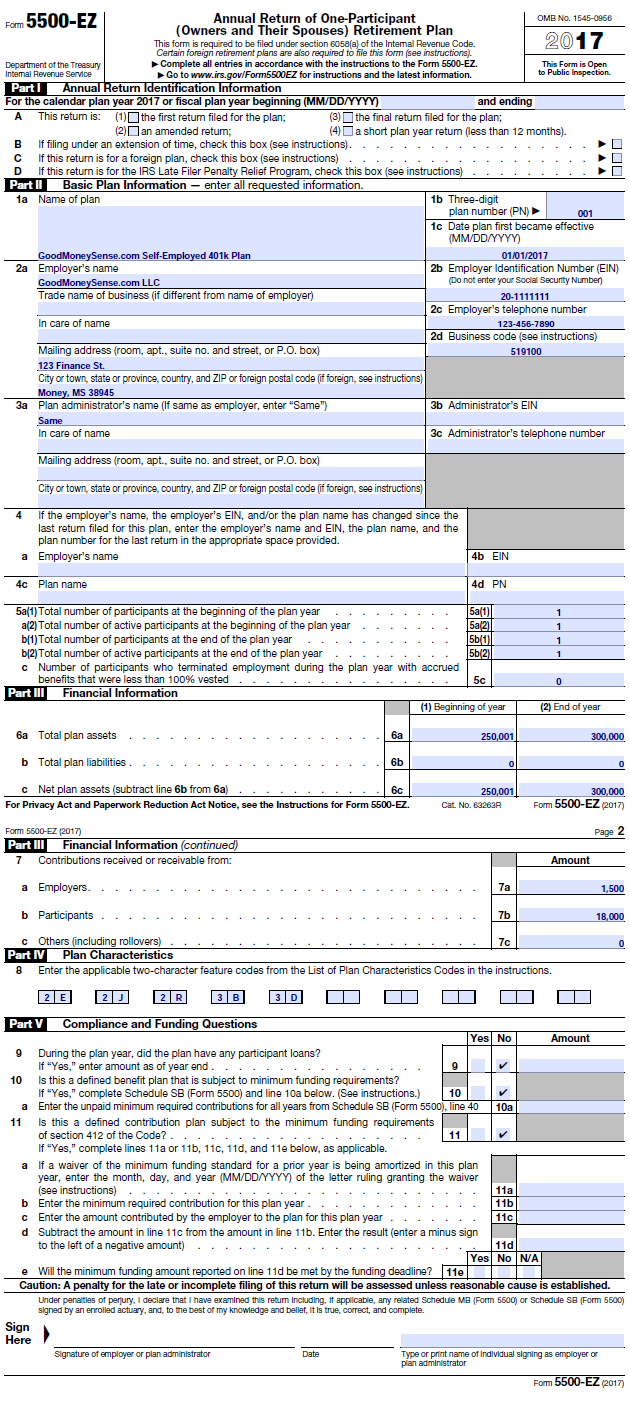

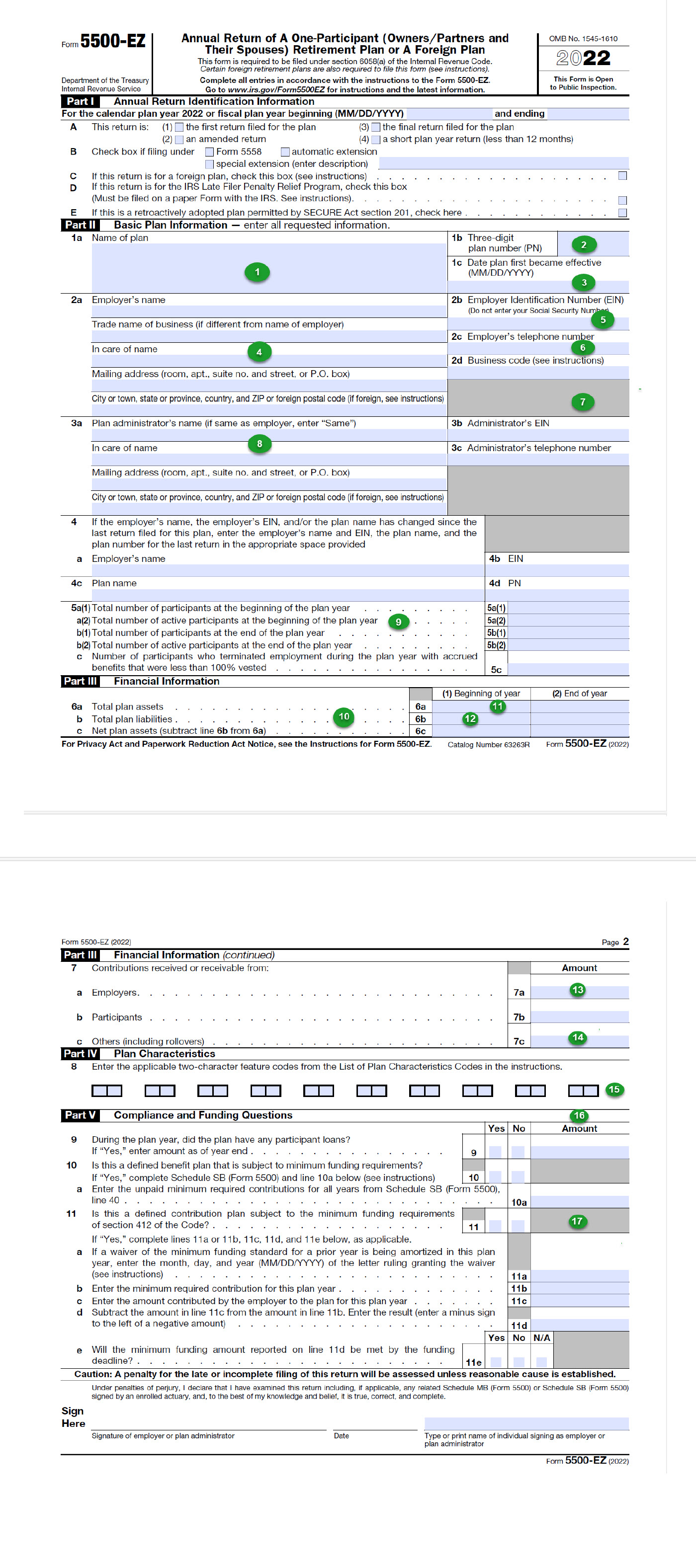

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Web form 5500 is a report detailing a company’s employee benefits. Schedule b (form 5500) part 1 30 hr., 37 min. Form 5500 (all other filers) 81 hr., 33 min. Web sending the form to the irs form 5500 (initial filers) 87 hr., 3 min. Complete all entries in accordance with the instructions to the form 5500.

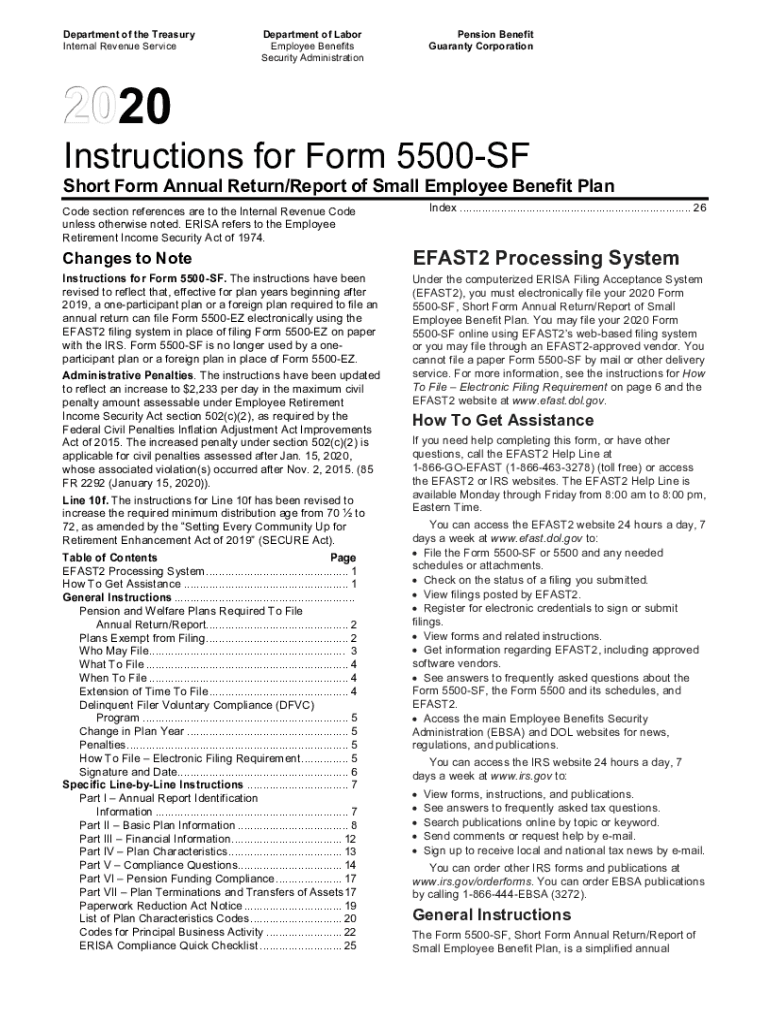

Form Instructions 5500EZ Fill Online, Printable, Fillable Blank

Schedule b (form 5500) part 1 30 hr., 37 min. Web form 5500 is a report detailing a company’s employee benefits. The form, and any required schedules and attachments, must be filed by the last day of the 7th calendar month after the end of the plan year (not to exceed 12 months in length) that began in 2009. We.

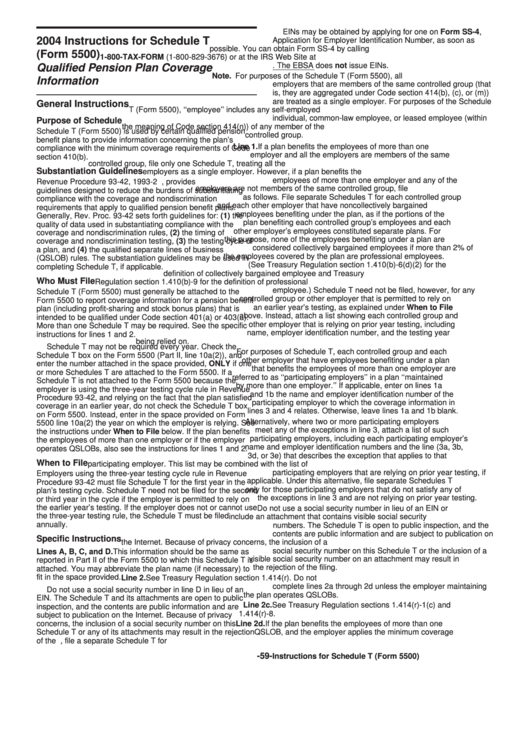

Instructions For Schedule T (Form 5500) 2004 printable pdf download

Web form 5500 annual return/report of employee benefit plan | instructions; The form, and any required schedules and attachments, must be filed by the last day of the 7th calendar month after the end of the plan year (not to exceed 12 months in length) that began in 2009. Complete and download the form to your computer to print and.

IRS Releases Draft Version of 2023 Form 5500EZ Instructions Fill

Form 5500 raw data sets. The form, and any required schedules and attachments, must be filed by the last day of the 7th calendar month after the end of the plan year (not to exceed 12 months in length) that began in 2009. Be sure to enter your information in the specific line fields provided. Complete and download the form.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Complete the form by hand using only black or blue ink. Form 5500 raw data sets. Complete all entries in accordance with the instructions to the form 5500. Other form 5500 data.

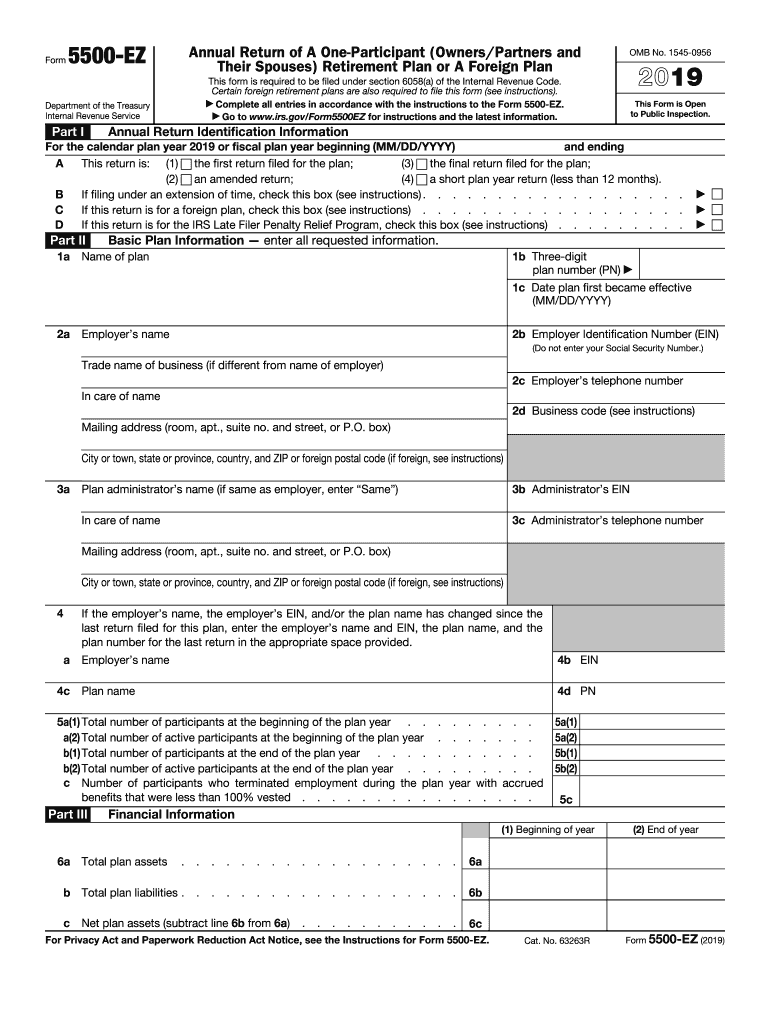

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Be sure to enter your information in the specific line fields provided. Form 5500 raw data sets. Complete the form by hand using only black or blue ink. Web form 5500 is a report detailing a company’s employee benefits. Web forms and filing instructions.

Form 5500 Instructions 5 Steps to Filing Correctly

Schedule b (form 5500) part 1 30 hr., 37 min. Schedule a (form 5500) 17 hr., 28 min. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web form 5500 is a report detailing a company’s employee benefits. Form 5500 version selection tool.

irs form 5500 instructions 2014 Fill out & sign online DocHub

We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web sending the form to the irs form 5500 (initial filers) 87 hr., 3 min. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as.

How To File The Form 5500EZ For Your Solo 401k for 2017 Good Money Sense

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web sending the form to the irs form 5500 (initial filers) 87 hr., 3 min. Other form 5500 data sets. Be sure to enter your information in the specific line fields provided. Form 5500 (all other filers) 81 hr., 33 min.

Web Form 5500 Is A Report Detailing A Company’s Employee Benefits.

Web sending the form to the irs form 5500 (initial filers) 87 hr., 3 min. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. The form, and any required schedules and attachments, must be filed by the last day of the 7th calendar month after the end of the plan year (not to exceed 12 months in length) that began in 2009. Web form 5500 annual return/report of employee benefit plan | instructions;

Pension Benefit Plan All Pension Benefit Plans Covered By Erisa Must File An Annual Return/Report Except As Provided In This Section.

Other form 5500 data sets. Form 5500 (all other filers) 81 hr., 33 min. Complete all entries in accordance with the instructions to the form 5500. Web forms and filing instructions.

Schedule A (Form 5500) 17 Hr., 28 Min.

We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Complete and download the form to your computer to print and sign before mailing. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6047(e), 6057(b), and 6058(a) of the internal revenue code (the code). Complete the form by hand using only black or blue ink.

Form 5500 Raw Data Sets.

Be sure to enter your information in the specific line fields provided. Form 5500 version selection tool. Schedule b (form 5500) part 1 30 hr., 37 min.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](https://emparion.com/wp-content/uploads/2018/05/5500ez-part-8.jpg)