Interest Expense Balance Sheet

Interest Expense Balance Sheet - An interest expense is the cost incurred by an entity for borrowed funds. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Web the formula is: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web the accounting treatment of interest expense is as follows: Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Web suzanne kvilhaug what is an interest expense? Here is the formula to calculate interest on the income statement: Lenders list accrued interest as revenue. Interest expense = average balance of debt obligation x interest rate.

Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web suzanne kvilhaug what is an interest expense? Web the formula is: Here is the formula to calculate interest on the income statement: Web the accounting treatment of interest expense is as follows: Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Interest expense = average balance of debt obligation x interest rate. Lenders list accrued interest as revenue. Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. An interest expense is the cost incurred by an entity for borrowed funds.

Web the accounting treatment of interest expense is as follows: Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web suzanne kvilhaug what is an interest expense? Here is the formula to calculate interest on the income statement: Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company. Web the formula is: Lenders list accrued interest as revenue. Interest expense = average balance of debt obligation x interest rate. An interest expense is the cost incurred by an entity for borrowed funds.

Interest Expense Formula and Calculator

Web the formula is: Here is the formula to calculate interest on the income statement: Web suzanne kvilhaug what is an interest expense? Interest expense = average balance of debt obligation x interest rate. Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet.

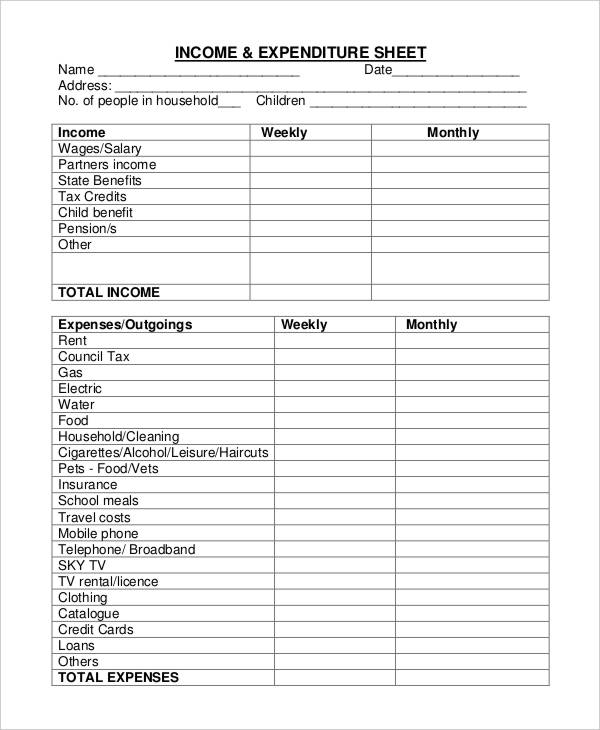

33+ Expense Sheet Templates

Web the formula is: Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Here is the formula to calculate interest on the income statement: Web the accounting treatment of interest expense is as follows: Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company.

Interest Expenses How They Work, Coverage Ratio Explained / FASB Topic

Interest expense = average balance of debt obligation x interest rate. Web the accounting treatment of interest expense is as follows: Web suzanne kvilhaug what is an interest expense? Lenders list accrued interest as revenue. Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet.

Interest Expense in a Monthly Financial Model (Cash Interest vs

Here is the formula to calculate interest on the income statement: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Interest expense = average balance of debt obligation x interest rate. Principal x interest rate x time period = interest expense example of how to calculate interest expense for.

How To Calculate Employee Benefit Expense

Web the accounting treatment of interest expense is as follows: Web the formula is: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Principal x interest rate x time period = interest expense example of.

Interest Expense Formula and Calculator

Web the accounting treatment of interest expense is as follows: Web the formula is: Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Lenders list accrued interest as revenue. Here is the formula to calculate interest on the income statement:

Interest Expense in a Monthly Financial Model (Cash Interest vs

An interest expense is the cost incurred by an entity for borrowed funds. Web the accounting treatment of interest expense is as follows: Lenders list accrued interest as revenue. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Interest expense = average balance of debt obligation x interest rate.

Balance Sheet Highlights 19

Web the accounting treatment of interest expense is as follows: Web suzanne kvilhaug what is an interest expense? Interest expense = average balance of debt obligation x interest rate. Lenders list accrued interest as revenue. Web the formula is:

Interest Expense in a Monthly Financial Model (Cash Interest vs

Web the formula is: An interest expense is the cost incurred by an entity for borrowed funds. Here is the formula to calculate interest on the income statement: Web the accounting treatment of interest expense is as follows: Interest expense = average balance of debt obligation x interest rate.

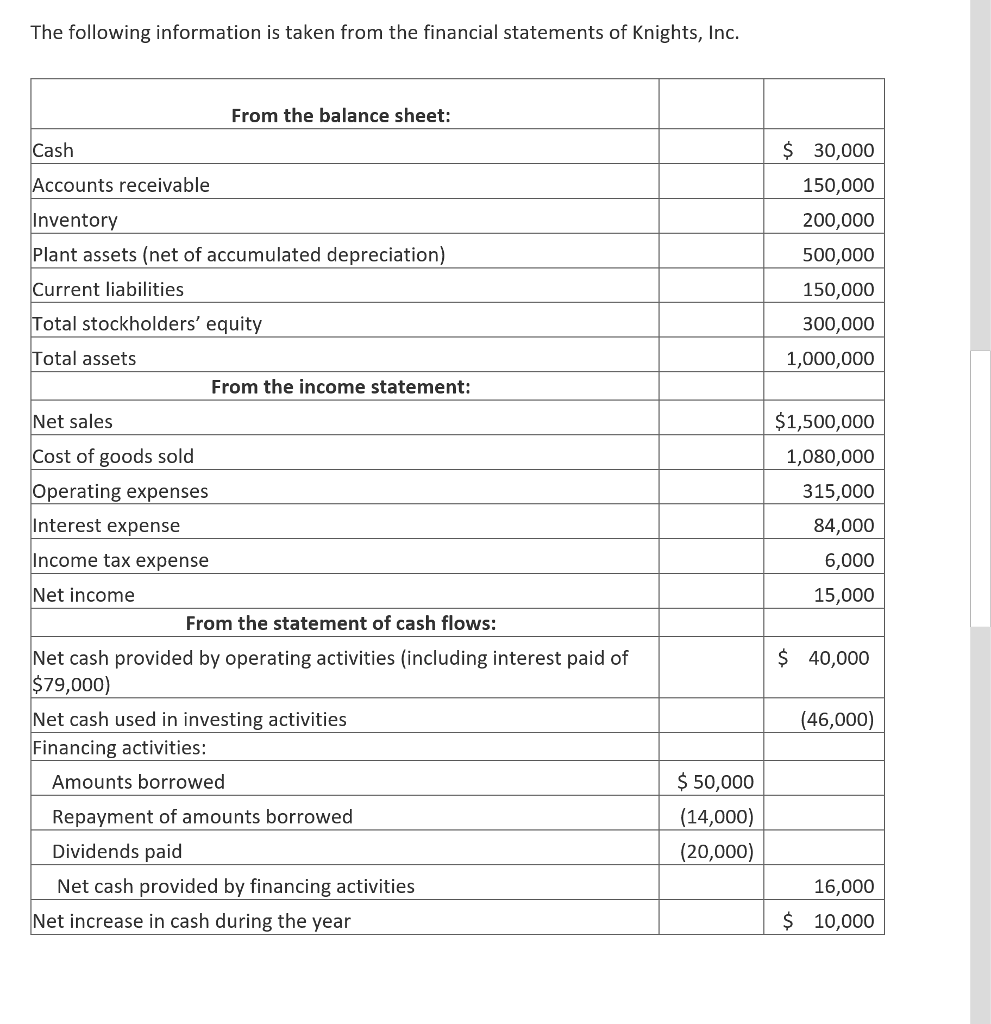

Solved Explain how the interest expense shown in the

Web the formula is: An interest expense is the cost incurred by an entity for borrowed funds. Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Lenders list accrued interest as revenue. Web the accounting treatment of interest expense is as follows:

Web The Formula Is:

An interest expense is the cost incurred by an entity for borrowed funds. Web borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Income statement (i/s) → on the income statement, interest expense impacts the earnings before. Principal x interest rate x time period = interest expense example of how to calculate interest expense for example, a company.

Web Suzanne Kvilhaug What Is An Interest Expense?

Web the accounting treatment of interest expense is as follows: Lenders list accrued interest as revenue. Here is the formula to calculate interest on the income statement: Interest expense = average balance of debt obligation x interest rate.

:max_bytes(150000):strip_icc()/interestexpense.asp_final-97773a4d154444b4a5fb30fbbae4102d.png)