Iowa Income Tax Form

Iowa Income Tax Form - This form is for income earned in tax year 2022, with tax returns. Web instructions iowa state income tax forms for current and previous tax years. If you need a different year from the current filing year, select the applicable year from the drop down. Web file now with turbotax we last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. Web iowa income tax forms 2022 iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53%. Detailed iowa state income tax rates and brackets are available on this page. If you still need to. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web iowa tax forms for 2022 and 2023. Web form ia 1040 is an iowa individual income tax form.

Web form ia 1040 is an iowa individual income tax form. Use fill to complete blank online state of iowa. If you need a different year from the current filing year, select the applicable year from the drop down. Complete, edit or print tax forms instantly. Be sure to verify that the form you are. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. If you still need to. Web iowa income tax forms 2022 iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53%. Register and subscribe now to work on your ia 1040 & more fillable forms. Web call the departmentfor further assistance.

Web if you filed an iowa tax return for 2021 and deducted federal income tax (refer to your 2021 iowa tax return, line 31), then received a refund of all or part of that tax from the u.s. Web detailed information about iowa state income tax brackets and rates, standard deduction information, and tax forms by tax year etc. Select “individual income tax” in the “what do you. Web the table below lists the income tax rates which will be in effect for tax years 2023 through 2026. If you need a different year from the current filing year, select the applicable year from the drop down. Register and subscribe now to work on your ia 1040 & more fillable forms. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. Web iowa income tax forms 2022 iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53%. Detailed iowa state income tax rates and brackets are available on this page. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

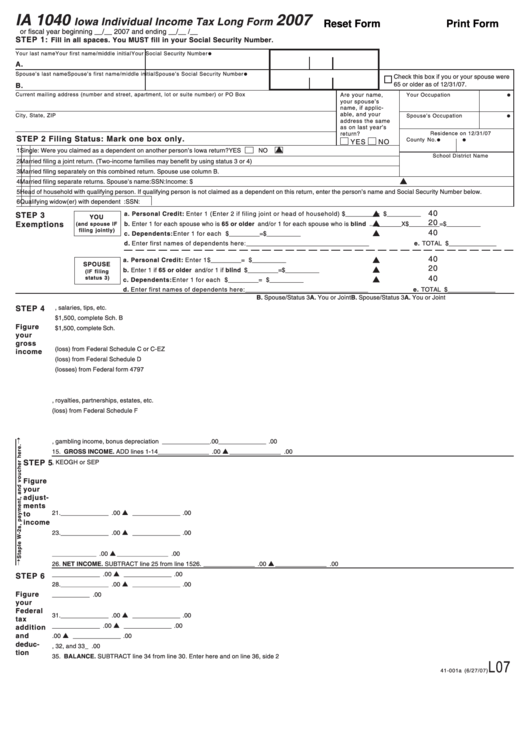

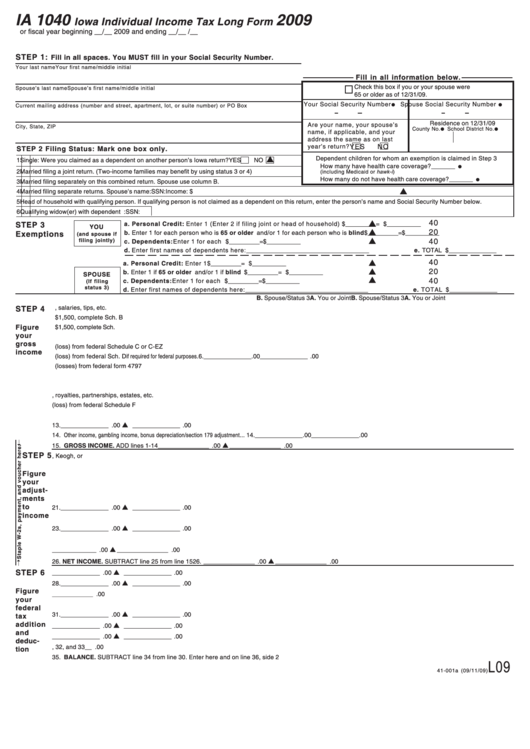

Fillable Form Ia 1040 Iowa Individual Tax Long Form 2007

Use fill to complete blank online state of iowa. If you need a different year from the current filing year, select the applicable year from the drop down. You must fill in your social security number (ssn). This form is for income earned in tax year 2022, with tax returns due in april 2023. Beginning in tax year 2026, iowa.

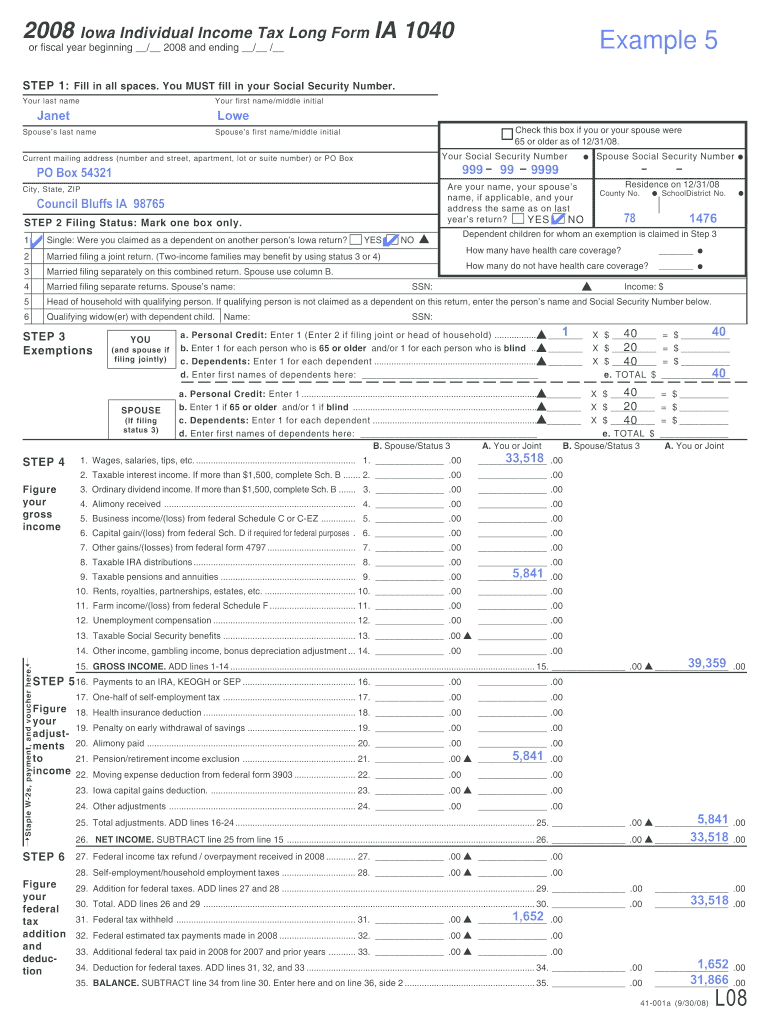

Fillable Online iowa 2008 Iowa Individual Tax Long Form IA 1040

Web instructions iowa state income tax forms for current and previous tax years. Web iowa tax forms for 2022 and 2023. Web the iowa income tax has nine tax brackets, with a maximum marginal income tax of 8.53% as of 2023. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. Web.

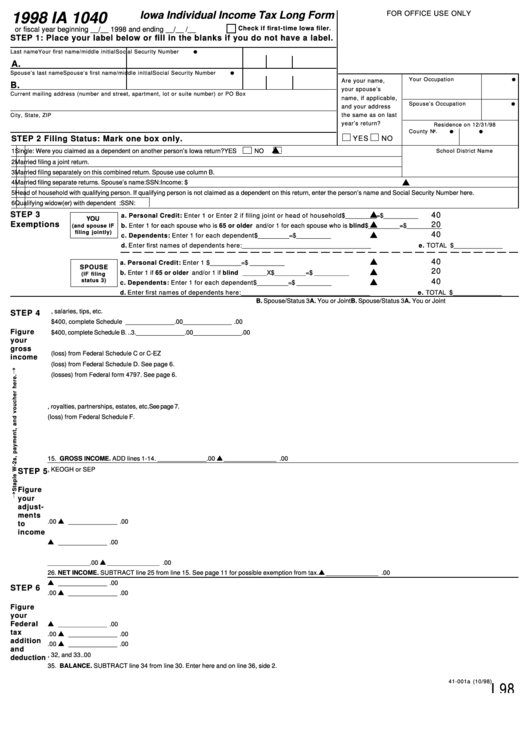

Fillable Form Ia 1040 Iowa Individual Tax Long Form 1998

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. You must fill in your social security number (ssn). Register and subscribe now to work on your ia 1040 & more fillable forms. Web file now with turbotax we last updated iowa form ia 1040 in february 2023 from the iowa department.

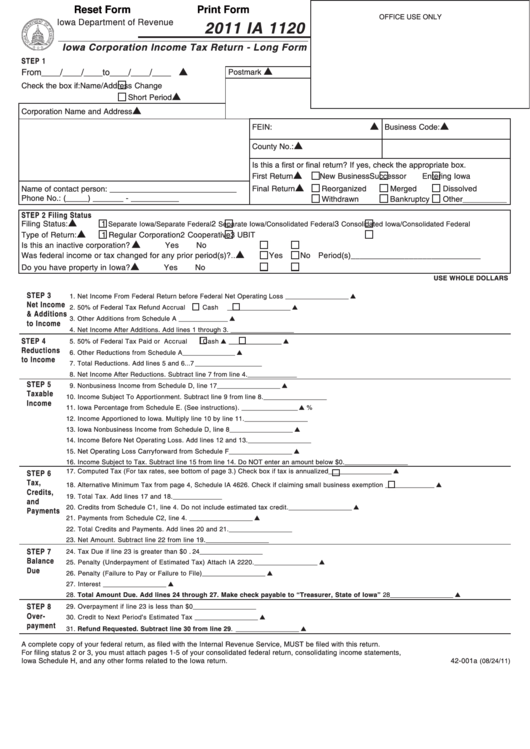

Fillable Form Ia 1120 Iowa Corporation Tax Return Long Form

This form is for income earned in tax year 2022, with tax returns. Web if you filed an iowa tax return for 2021 and deducted federal income tax (refer to your 2021 iowa tax return, line 31), then received a refund of all or part of that tax from the u.s. You must fill in your social security number (ssn)..

Form IA 1040 Iowa Individual Tax Form YouTube

Web if you filed an iowa tax return for 2021 and deducted federal income tax (refer to your 2021 iowa tax return, line 31), then received a refund of all or part of that tax from the u.s. If you need a different year from the current filing year, select the applicable year from the drop down. Web call the.

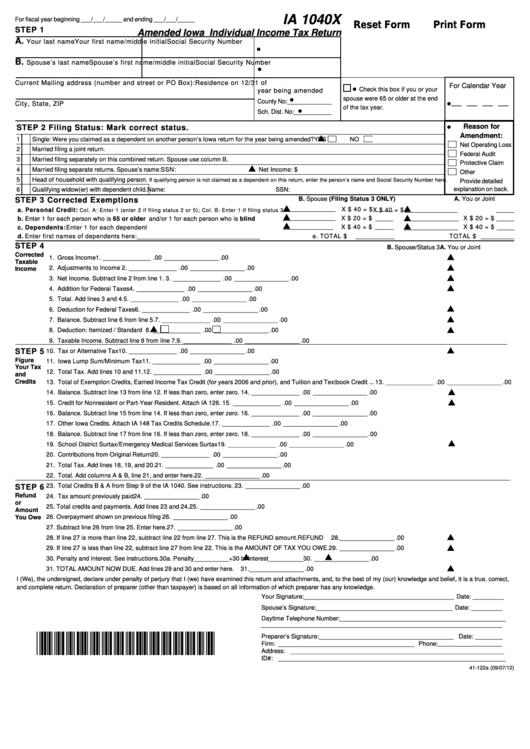

Fillable Form Ia 1040x Amended Iowa Individual Tax Return

If you need a different year from the current filing year, select the applicable year from the drop down. If you still need to. Web the iowa income tax has nine tax brackets, with a maximum marginal income tax of 8.53% as of 2023. This form is for income earned in tax year 2022, with tax returns due in april.

Top 251 Iowa Tax Forms And Templates free to download in PDF format

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web file now with turbotax we last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. Web call the departmentfor further assistance. Web if you filed an iowa tax return for 2021 and deducted federal income tax (refer.

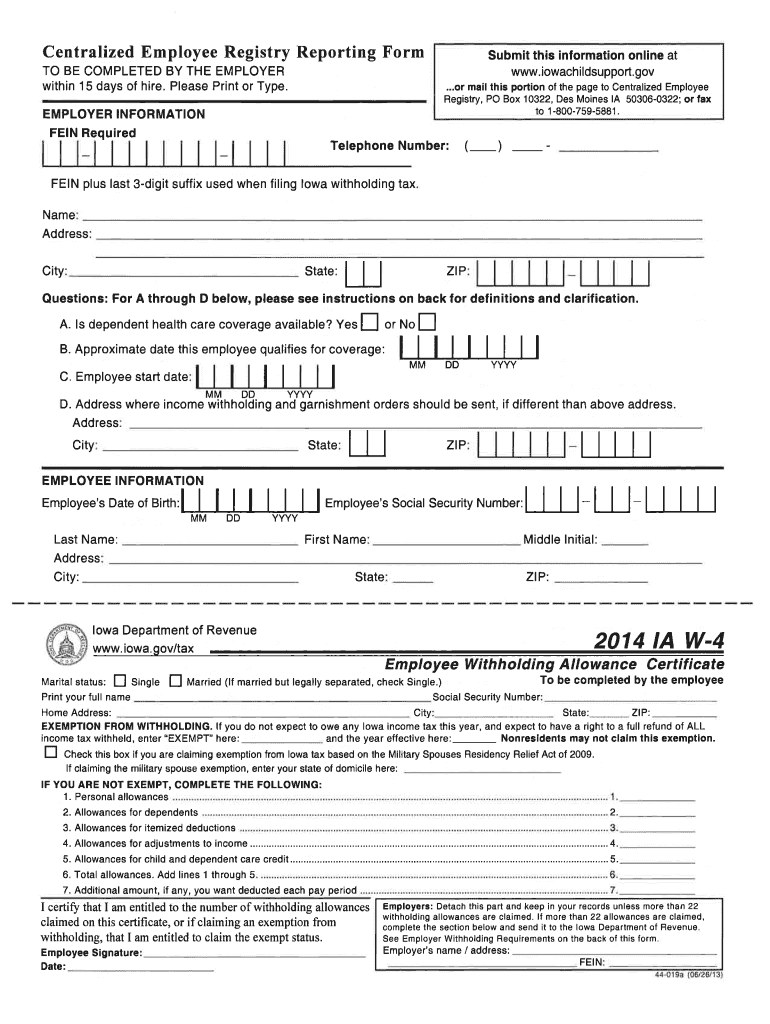

Iowa W 4 2021 Printable 2022 W4 Form

Web detailed information about iowa state income tax brackets and rates, standard deduction information, and tax forms by tax year etc. Web the iowa income tax has nine tax brackets, with a maximum marginal income tax of 8.53% as of 2023. Beginning in tax year 2026, iowa will have a flat individual income tax rate of 3.9%. If you still.

Fill Free fillable form 41146 2019 Iowa Tax Reduction

Web the table below lists the income tax rates which will be in effect for tax years 2023 through 2026. Complete, edit or print tax forms instantly. Detailed iowa state income tax rates and brackets are available on this page. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web call the.

Printable Iowa Tax Forms for Tax Year 2021

Web iowa income tax forms 2022 iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53%. Detailed iowa state income tax rates and brackets are available on this page. If you need a different year from the current filing year, select the applicable year from the drop down. Web call the.

While Most Taxpayers Have Income Taxes Automatically Withheld Every Pay Period By Their Employer, Taxpayers Who Earn Money.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Detailed iowa state income tax rates and brackets are available on this page. Web form ia 1040 is an iowa individual income tax form. Complete, edit or print tax forms instantly.

If You Still Need To.

Select “individual income tax” in the “what do you. Web iowa income tax forms 2022 iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53%. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Use fill to complete blank online state of iowa.

Web Iowa Tax Forms For 2022 And 2023.

Web the iowa income tax has nine tax brackets, with a maximum marginal income tax of 8.53% as of 2023. If you need a different year from the current filing year, select the applicable year from the drop down. Register and subscribe now to work on your ia 1040 & more fillable forms. Web detailed information about iowa state income tax brackets and rates, standard deduction information, and tax forms by tax year etc.

Web File Now With Turbotax We Last Updated Iowa Form Ia 1040 In February 2023 From The Iowa Department Of Revenue.

Be sure to verify that the form you are. Beginning in tax year 2026, iowa will have a flat individual income tax rate of 3.9%. Web the table below lists the income tax rates which will be in effect for tax years 2023 through 2026. Can be found on this page.