Iowa Representative Certification Form

Iowa Representative Certification Form - Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6). Report fraud & identity larceny; Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. Get access to the largest online library of legal forms for any state. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. This includes power of attorney, designated disclosure, and representative certification forms. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Stay informed, subscribe to receive updates.

Get access to the largest online library of legal forms for any state. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6). This includes power of attorney, designated disclosure, and representative certification forms. Stay informed, subscribe to receive updates. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf:

Stay informed, subscribe to receive updates. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Get access to the largest online library of legal forms for any state. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6). See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department.

Download Iowa Acceptance of Service, Waiver and Answer Form for Free

Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any.

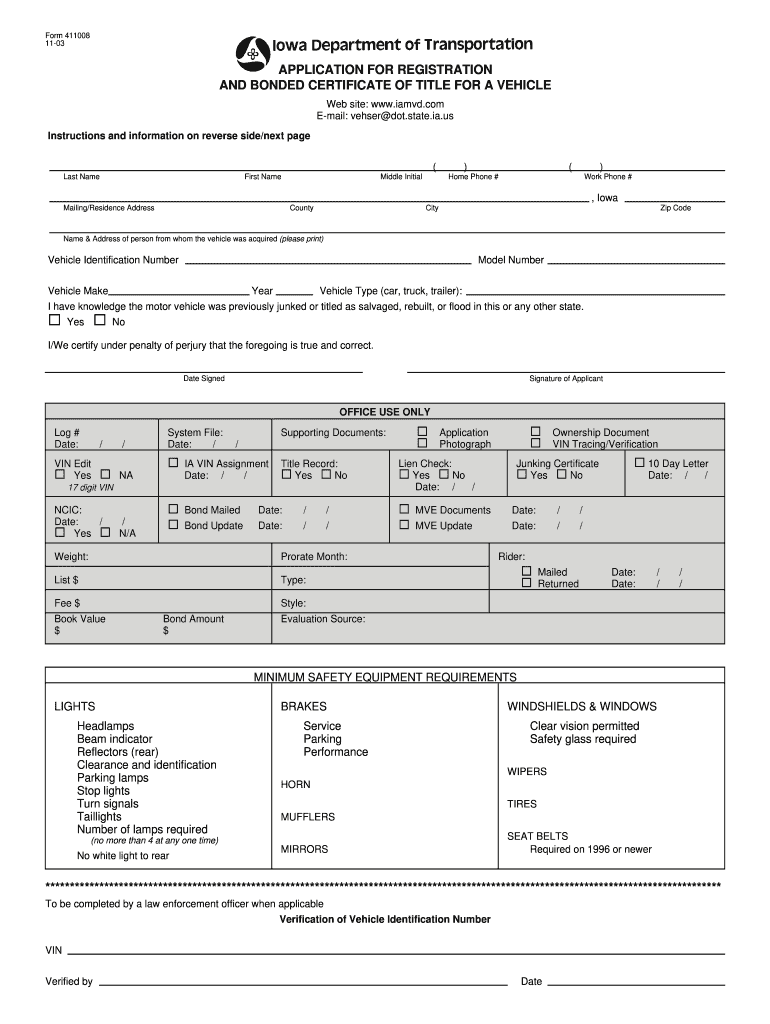

Iowa Form 411008 Fill Out and Sign Printable PDF Template signNow

Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer.

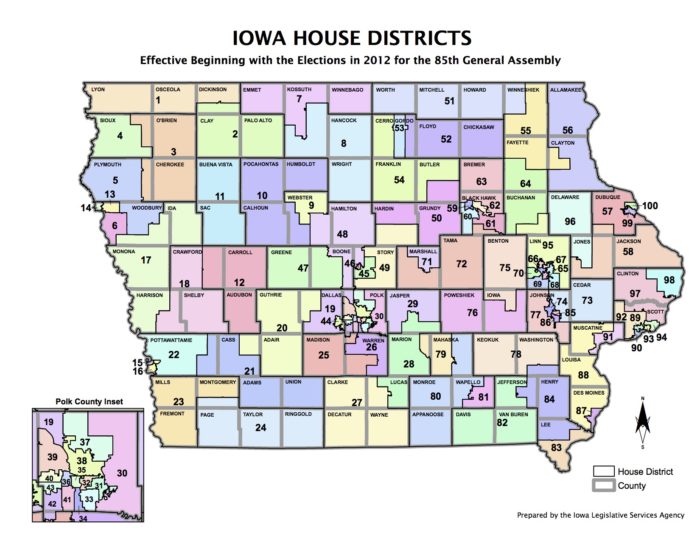

Bleeding Heartland

Get access to the largest online library of legal forms for any state. This includes power of attorney, designated disclosure, and representative certification forms. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer.

Changes to the 2015 Iowa Probate Code Authority of Representative to

Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. This includes power of attorney, designated disclosure, and representative certification forms. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Signature i,.

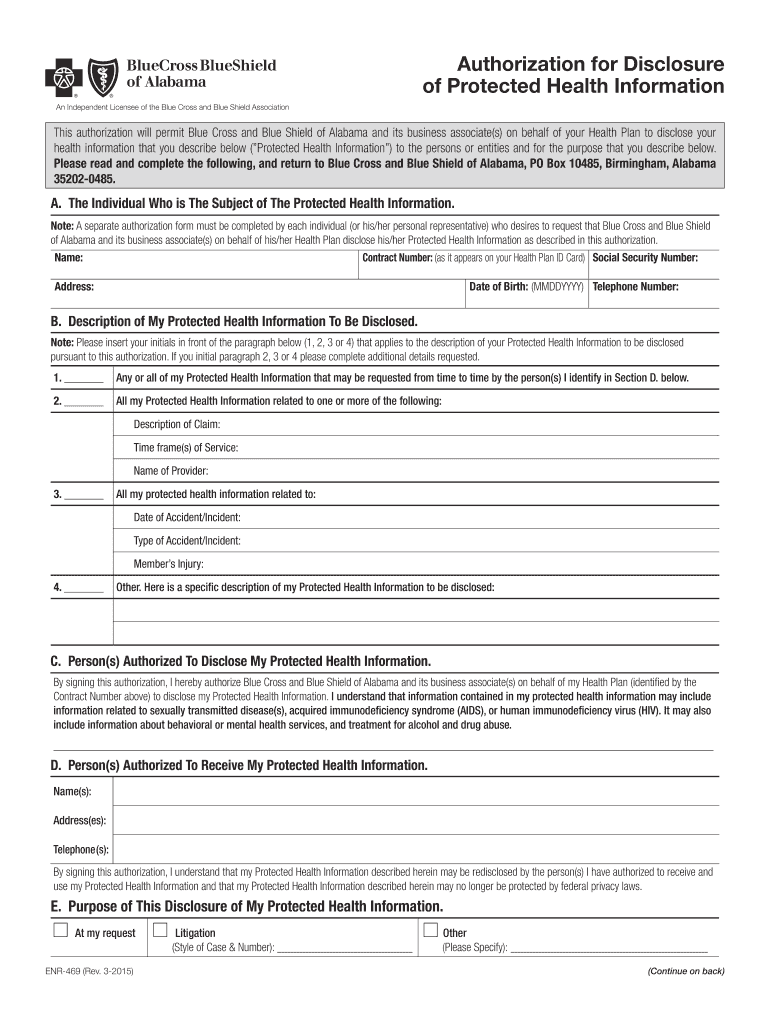

20152022 AL BCBS Form ENR469 Fill Online, Printable, Fillable, Blank

See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized.

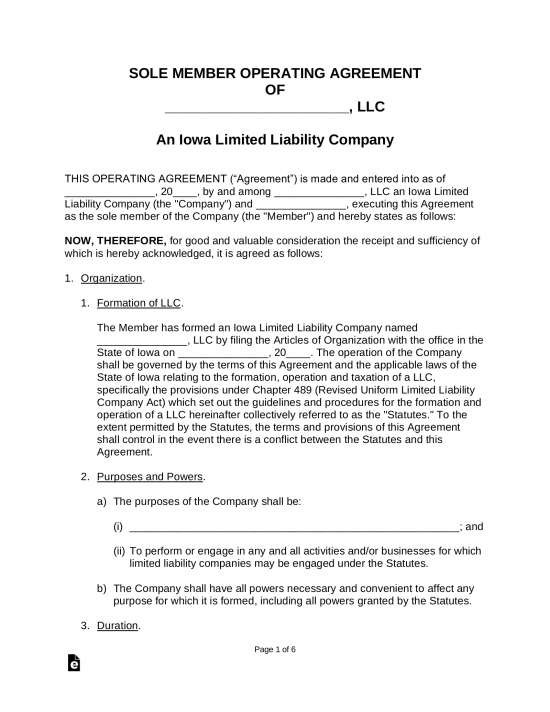

Iowa SingleMember LLC Operating Agreement Form eForms

This includes power of attorney, designated disclosure, and representative certification forms. Get access to the largest online library of legal forms for any state. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Web managing and revoking access to accounts in govconnectiowa.

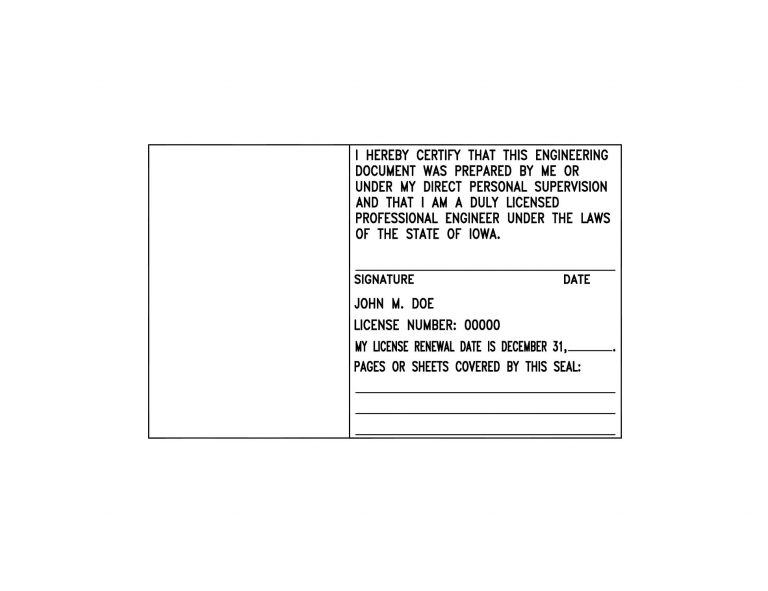

Iowa Professional Engineer Certification block PE Stamps

Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. Web the ia 2848 that you do not authorize the representative listed above to perform.

Download Iowa Affidavit of Correction Form for Free FormTemplate

Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Stay informed, subscribe to receive updates. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to.

Iowa Certificate of Authority Harbor Compliance

Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web the ia 2848 that you do not authorize the representative listed above to.

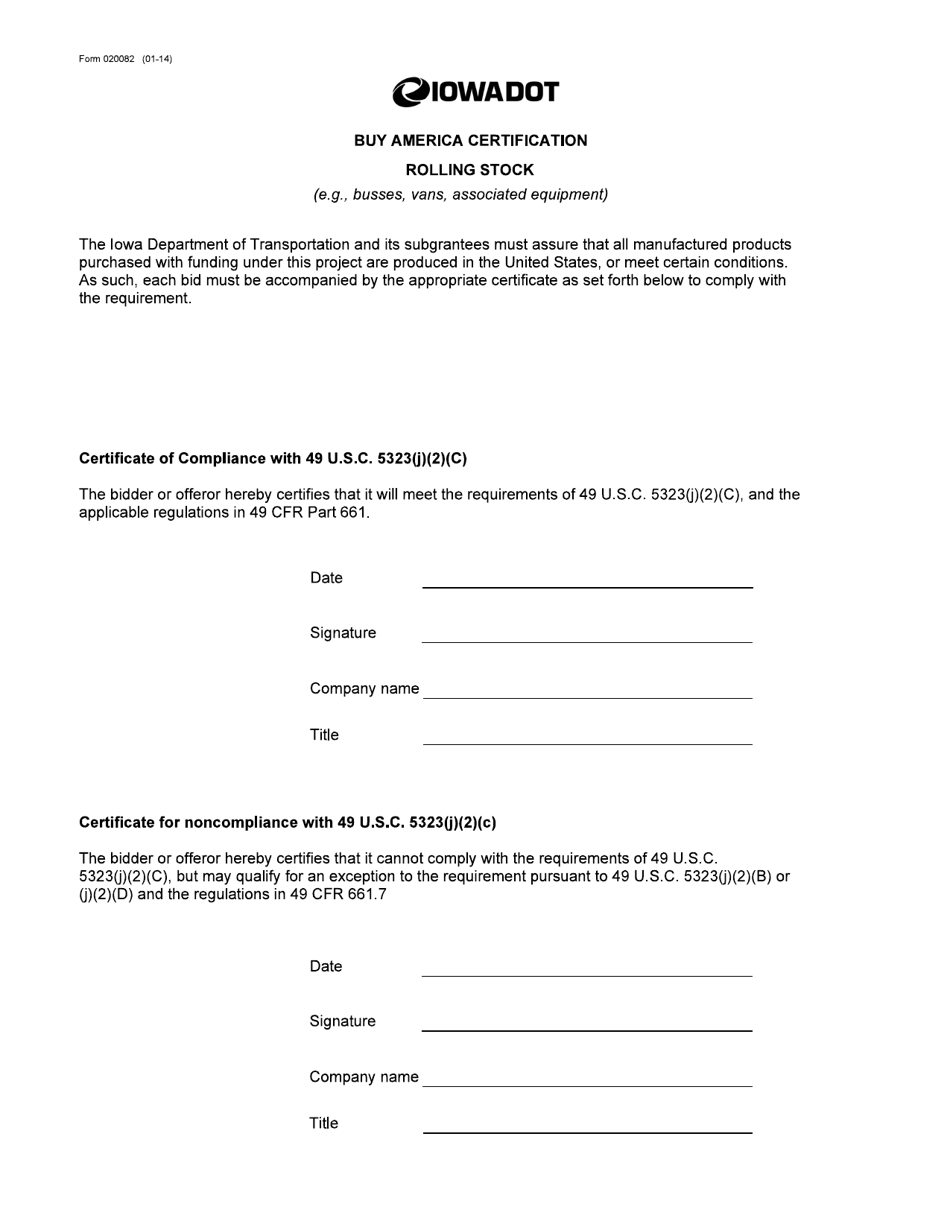

Form 020082 Download Fillable PDF or Fill Online Buy America

Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6). Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer..

See Subrule 7.6(6) Since More Information About Humans Who May Qualify As Authorized Representatives And The Information Necessary.

Get access to the largest online library of legal forms for any state. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department.

Web The Ia 2848 That You Do Not Authorize The Representative Listed Above To Perform On Your Behalf:

Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Stay informed, subscribe to receive updates. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6). Report fraud & identity larceny;

Signature I, The Undersigned, Declare Under Penalties Of Perjury Or False Certificate, That I Am The Person Listed As “Taxpayer” Above Or.

This includes power of attorney, designated disclosure, and representative certification forms.