Irs Form 1310 Printable

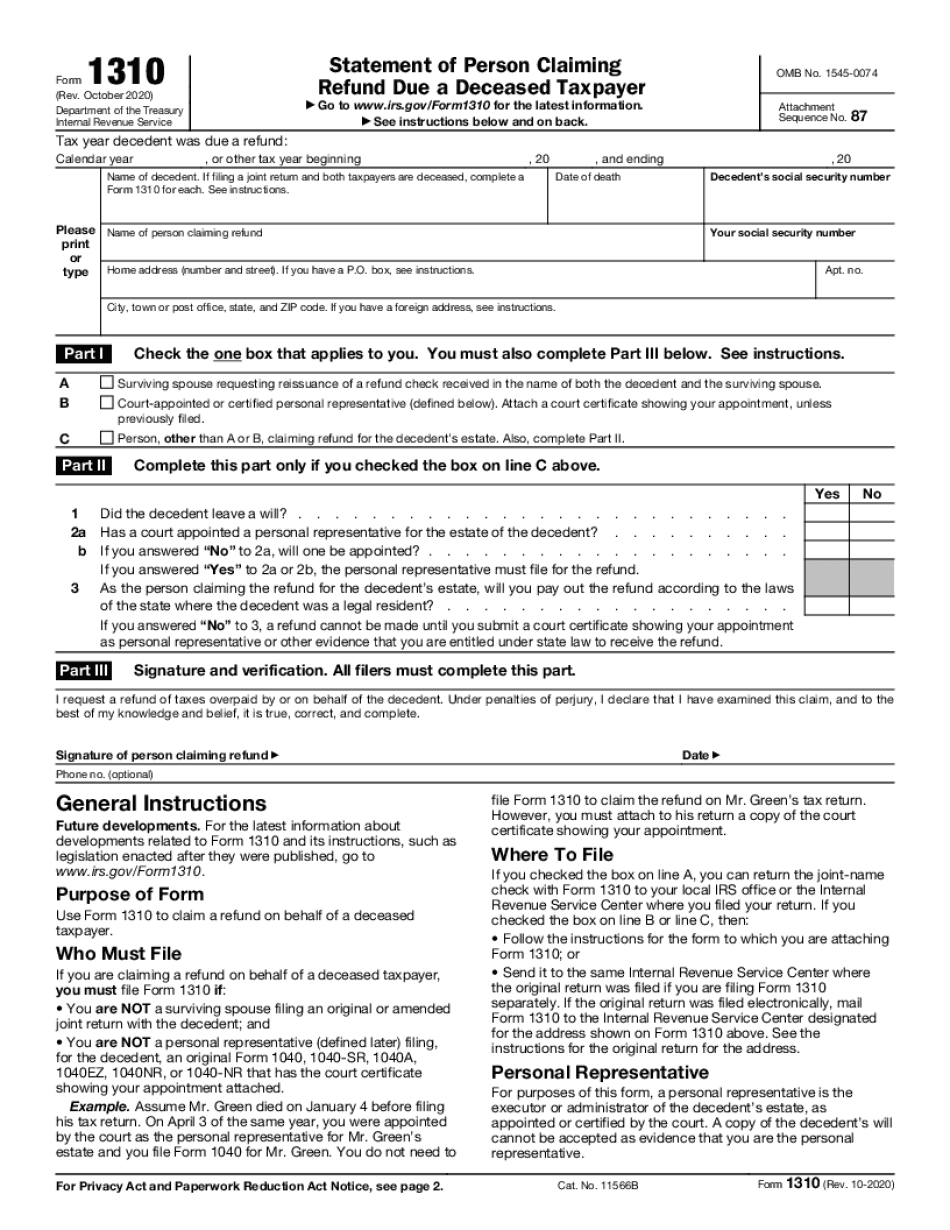

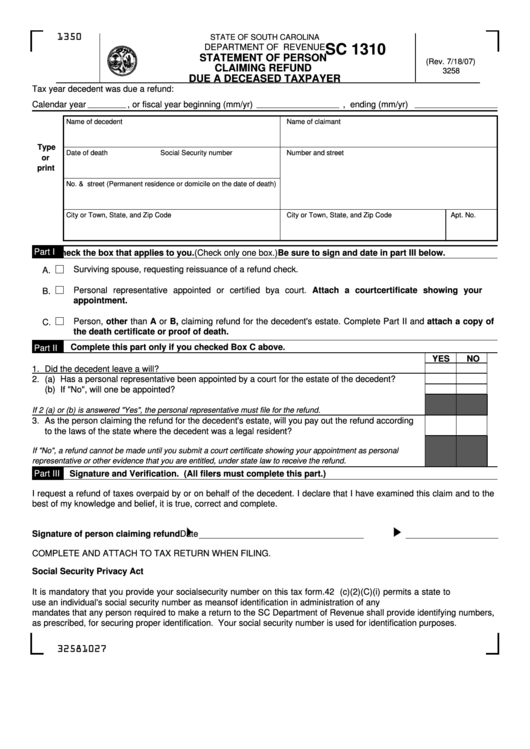

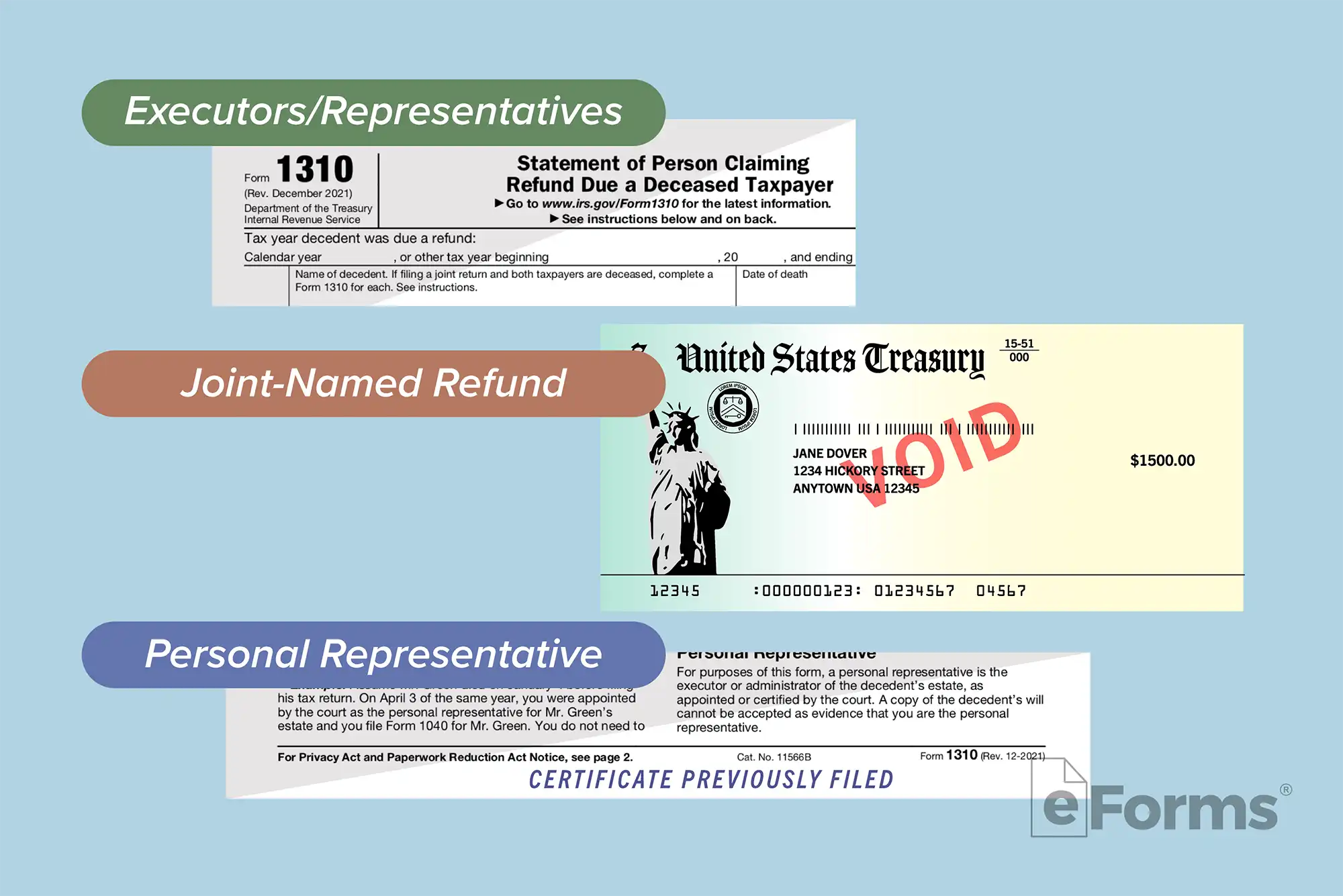

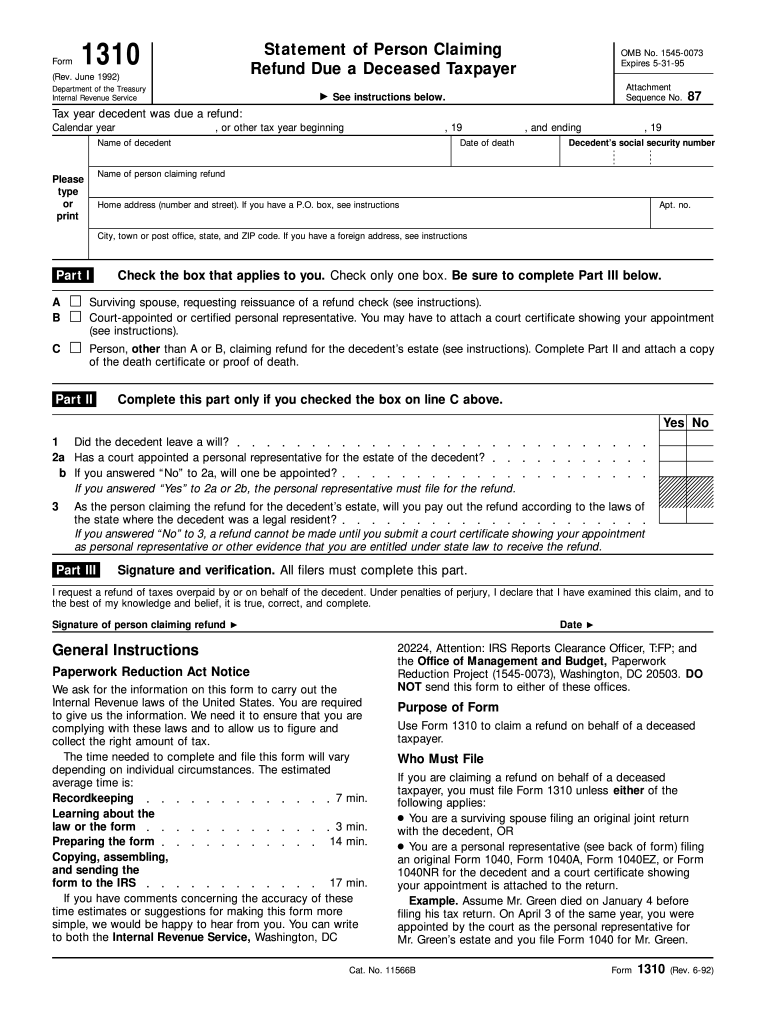

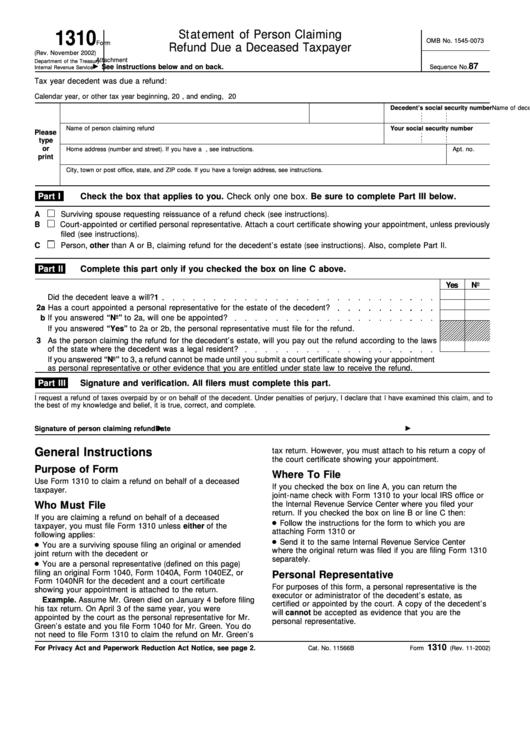

Irs Form 1310 Printable - This form is necessary to establish the legal authority of the claimant and ensure that the refund reaches the rightful person or entity. Web filing form 1310 to claim a refund on behalf of a deceased taxpayer, including eligibility, required documentation, and procedural steps. Web form 1310 is a document provided by the irs for individuals who are entitled to claim a refund owed to a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be claiming their tax refund. Web form 1310, titled statement of person claiming refund due a deceased taxpayer, is an official document used by the internal revenue service (irs) to claim a tax refund for a deceased individual. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. It serves as a notification to the irs that a taxpayer has passed away and that a refund is being claimed on their behalf. Web electronic file guidelines for form 1310. The irs has set specific electronic filing guidelines for form 1310.

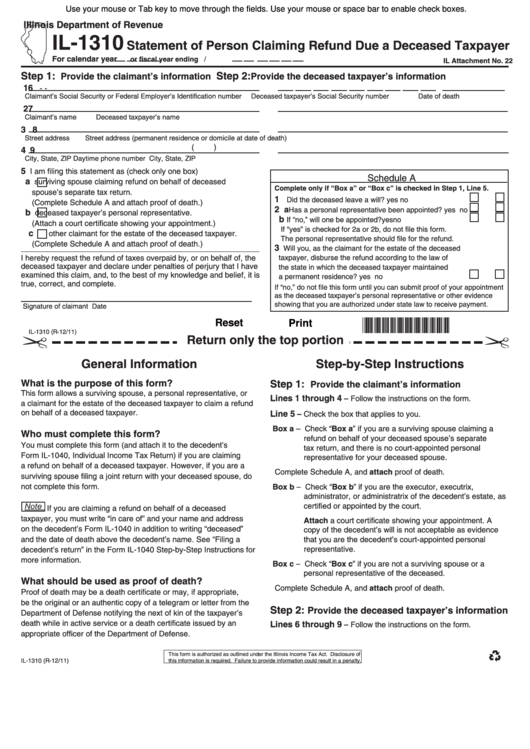

Things to know about filing the final tax return. Web form 1310 is a document provided by the irs for individuals who are entitled to claim a refund owed to a deceased taxpayer. Surviving spouses who filed a joint return with the decedent or personal. Statement of person claiming refund due a deceased taxpayer. You just need to attach a copy of the court certificate to the 1040. How to resolve form 1310 critical diagnostic ref. This form is necessary to establish the legal authority of the claimant and ensure that the refund reaches the rightful person or entity. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is the tax form that you can use to notify the internal revenue service of a taxpayer’s death. You are a surviving spouse filing an original or amended joint return with the decedent or you are a. If the decedent had a will, the named executor is the responsible party to prepare and submit irs form 1310.

Web irs form 1310 is used by an executor, administrator, or representative in order to claim a refund on behalf of a deceased taxpayer. Irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be claiming their tax refund. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. It serves as a notification to the irs that a taxpayer has passed away and that a refund is being claimed on their behalf. Web sometimes when there isn't a surviving spouse or appointed representative, a personal representative will file the final return and attach form 1310, statement of person claiming refund due a deceased taxpayer. Form 1310 is not required. This form is necessary to establish the legal authority of the claimant and ensure that the refund reaches the rightful person or entity. You just need to attach a copy of the court certificate to the 1040. Green died on january 4 before filing his tax return. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies:

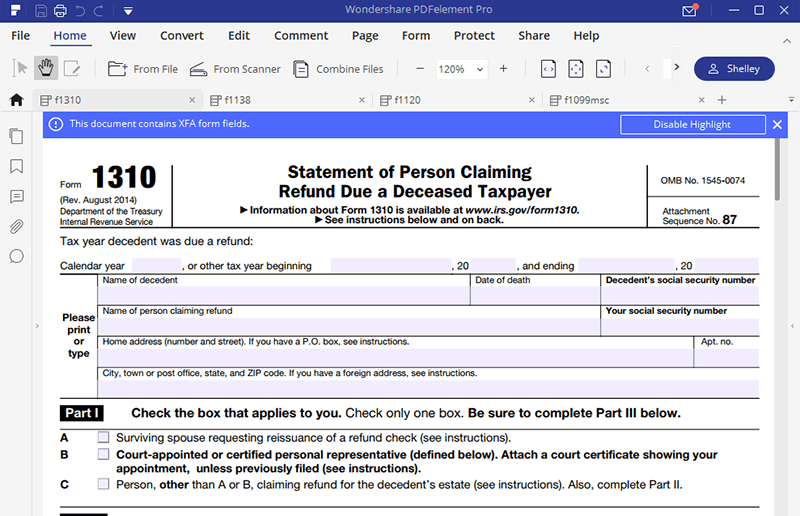

Manage Documents Using Our Editable Form For IRS Form 1310

The irs has set specific electronic filing guidelines for form 1310. See instructions below and on back. Web electronic file guidelines for form 1310. Web application for irs individual taxpayer identification number. Surviving spouses who filed a joint return with the decedent or personal.

Form Sc 1310 Statement Of Person Claiming Refund Due A Deceased

Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web irs form 1310 is filed.

IRS Form 1310 How to Fill it Right

Web the following articles are the top questions referring form 1310. Go to www.irs.gov/form1310 for the latest information. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web form 1310, titled statement of person claiming refund due a deceased taxpayer, is an official document used by.

Form 1310a Fillable Fill Online Printable Fillable Blank PdfFiller

Use form 1310 to claim a refund on behalf of a deceased taxpayer. If data entry on the. Statement of person claiming refund due a deceased taxpayer. See instructions below and on back. Web download or print the 2023 federal (statement of person claiming refund due a deceased taxpayer) (2023) and other income tax forms from the federal internal revenue.

Form 1310 Fill out & sign online DocHub

Form 1310, titled “statement of person claiming refund due a deceased taxpayer,” is a form individuals use to claim a refund on behalf of a deceased taxpayer. The irs has set specific electronic filing guidelines for form 1310. Screen doesn't meet the irs guidelines, there will be elf critical diagnostics and error messages preventing the. Web if you are claiming.

Irs Form 1310 Printable 2024

Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. Only certain people related to the decedent are eligible to make this claim. If the taxpayer was owed a tax refund, irs form 1310 will direct the irs where to send the refund. Green died on january 4 before filing his tax return..

Free IRS Form 1310 PDF eForms

This form is necessary to establish the legal authority of the claimant and ensure that the refund reaches the rightful person or entity. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Form 1310 is not required. If the taxpayer was owed a tax refund, irs form 1310 will direct the irs where to send.

Irs Form 1310 Printable vrogue.co

Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is the tax form that you can use to notify the internal revenue service of a taxpayer’s death. Web information about form 1310, statement of person claiming.

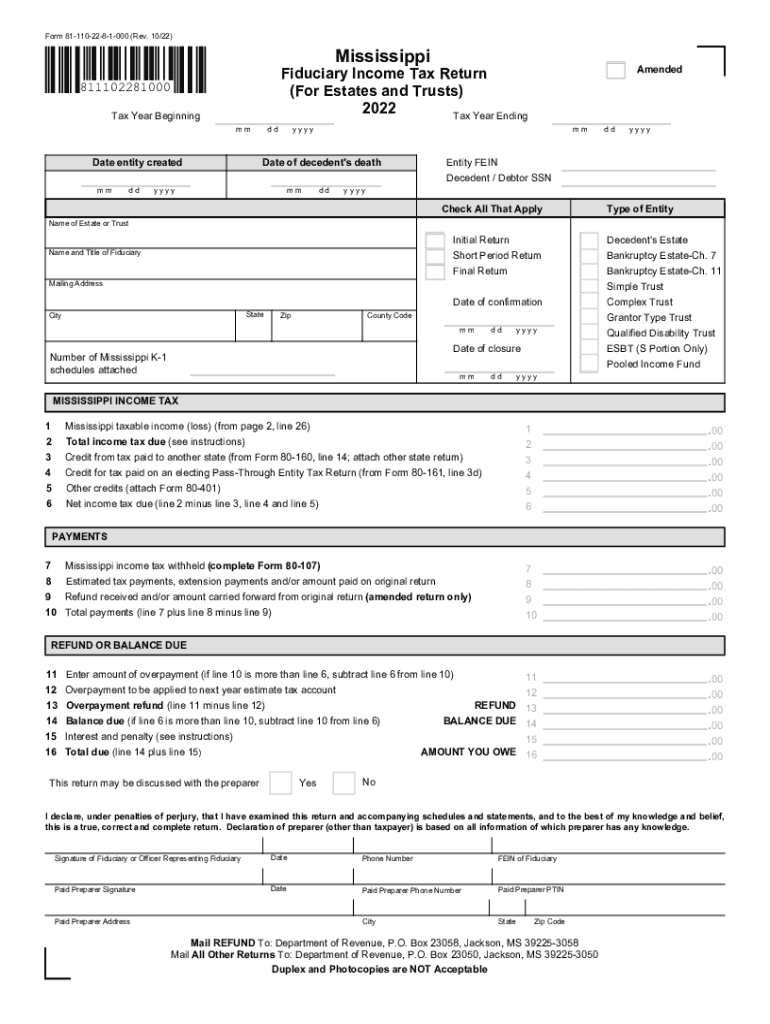

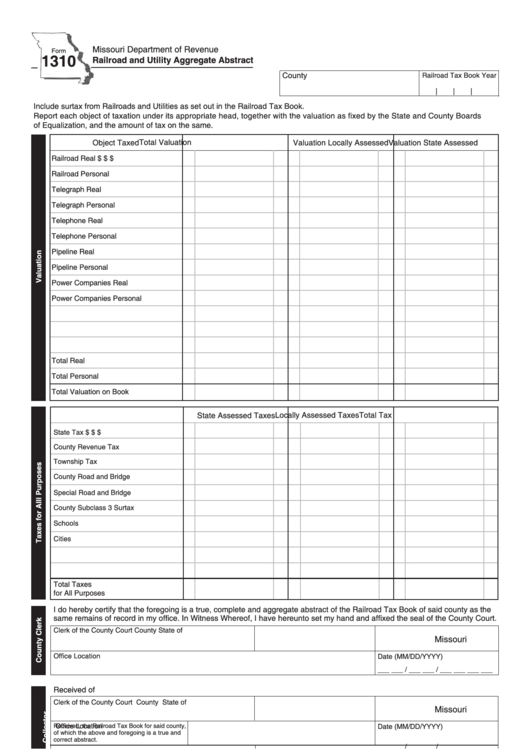

1310 Tax Exempt Form

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer. Screen doesn't meet the irs guidelines, there will be elf critical diagnostics and error messages preventing the. Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. The irs has set.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web sometimes when there isn't a surviving spouse or appointed representative, a personal representative will file the final return and attach form 1310, statement of person claiming refund due a deceased taxpayer. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer,.

Web Form 1310 Is An Irs Form Used To Claim A Federal Tax Refund For The Beneficiary Of A Recently Deceased Taxpayer.

Web the following articles are the top questions referring form 1310. It serves as a notification to the irs that a taxpayer has passed away and that a refund is being claimed on their behalf. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Screen doesn't meet the irs guidelines, there will be elf critical diagnostics and error messages preventing the.

Statement Of Person Claiming Refund Due A Deceased Taxpayer.

Irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be claiming their tax refund. The irs has set specific electronic filing guidelines for form 1310. Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. Web download or print the 2023 federal form 1310 (statement of person claiming refund due a deceased taxpayer) for free from the federal internal revenue service.

Surviving Spouses Who Filed A Joint Return With The Decedent Or Personal.

This form is necessary to establish the legal authority of the claimant and ensure that the refund reaches the rightful person or entity. You are a surviving spouse filing an original or amended joint return with the decedent, or. Web download your fillable irs form 1310 in pdf. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file.

How To Resolve Form 1310 Critical Diagnostic Ref.

Web download or print the 2023 federal (statement of person claiming refund due a deceased taxpayer) (2023) and other income tax forms from the federal internal revenue service. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Web application for irs individual taxpayer identification number.