Irs Form 13873

Irs Form 13873 - Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Forms with missing signatures will be rejected. Web older tax years are provided on a form 13873 series. Tax filers who have received an. Signatures are required for any taxpayer listed. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Web there are different versions of irs form 13873, including the: Only list a spouse if their own transcripts will be requested and they will be signing the request. What can i do to fix this?

Web older tax years are provided on a form 13873 series. Web there are different versions of irs form 13873, including the: What can i do to fix this? Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Signatures are required for any taxpayer listed. Forms with missing signatures will be rejected. Tax filers who have received an. Only list a spouse if their own transcripts will be requested and they will be signing the request. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling.

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Only list a spouse if their own transcripts will be requested and they will be signing the request. What can i do to fix this? Web older tax years are provided on a form 13873 series. Tax filers who have received an. Forms with missing signatures will be rejected. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Signatures are required for any taxpayer listed. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web there are different versions of irs form 13873, including the:

How to Obtain the NonFiling Letter from the IRS, Students Fill Online

Web there are different versions of irs form 13873, including the: Web older tax years are provided on a form 13873 series. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation.

Irs Form 4506t Printable Printable Forms Free Online

Only list a spouse if their own transcripts will be requested and they will be signing the request. Web there are different versions of irs form 13873, including the: Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record.

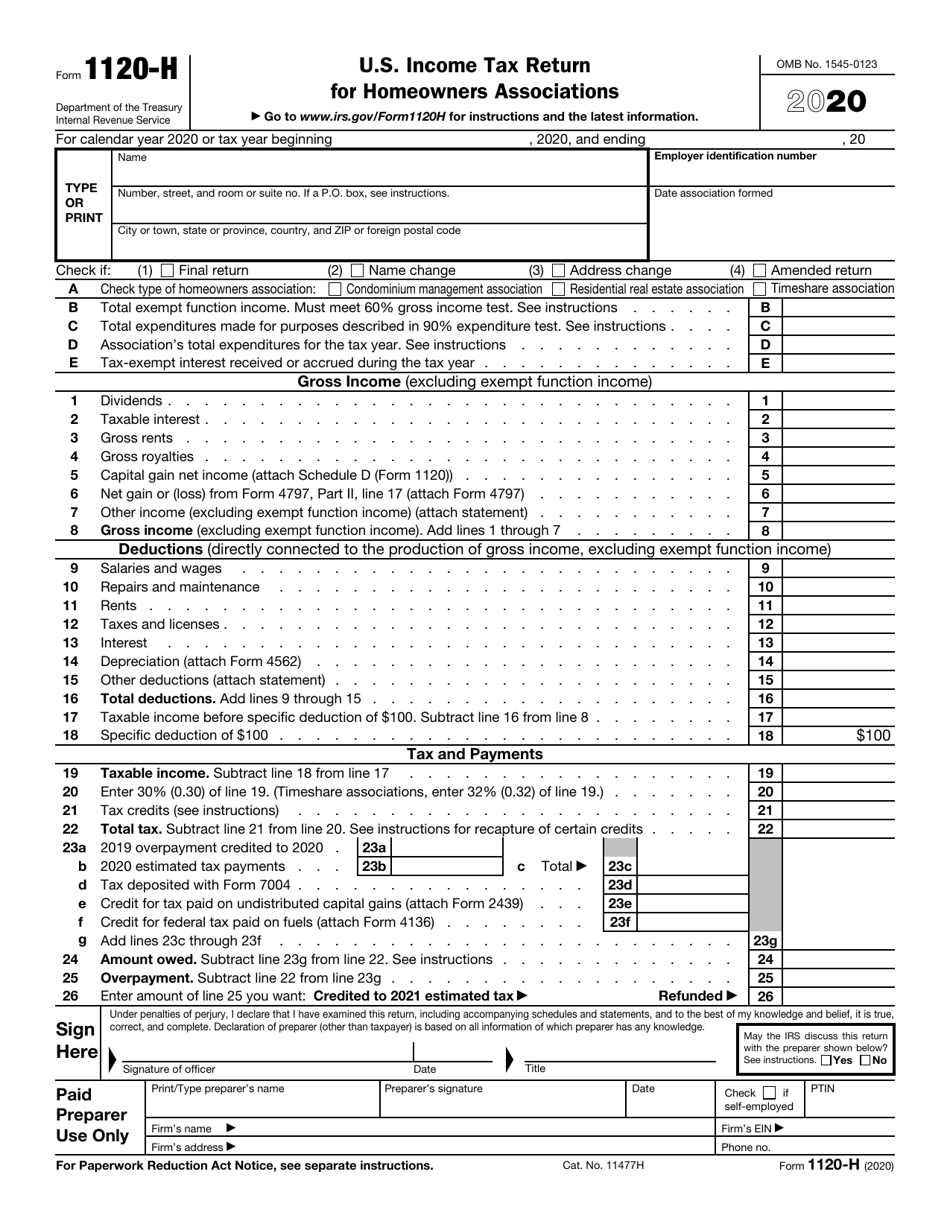

IRS Form 1120H Download Fillable PDF or Fill Online U.S. Tax

Tax filers who have received an. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Forms with missing signatures will be rejected. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record.

Irss forms tewspartners

Only list a spouse if their own transcripts will be requested and they will be signing the request. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that.

14 Form Irs Seven Signs You’re In Love With 14 Form Irs AH STUDIO Blog

Web older tax years are provided on a form 13873 series. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Web the income verification express service (ives) program is.

Acceptable Documentation From Irs For Verification Of Nonfiling Status

Web there are different versions of irs form 13873, including the: Signatures are required for any taxpayer listed. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Only a.

Formulario 433F del IRS Consejos, asignación e información de

Signatures are required for any taxpayer listed. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Forms with missing signatures.

IRS FORM 147C PDF

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Forms with missing signatures will be rejected. Tax filers who have received an. Only list a spouse if their own transcripts will be requested and they will.

EDGAR Filing Documents for 000075068620000052

Only list a spouse if their own transcripts will be requested and they will be signing the request. What can i do to fix this? Tax filers who have received an. Signatures are required for any taxpayer listed. Only a form 13873 that has a nonfiling or a no record found message is acceptable.

Compilation Error undeclared identifier trying to pass values from

Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. What can i do to fix this? Web older tax years are provided on a form 13873 series. Web there.

Only A Form 13873 That Has A Nonfiling Or A No Record Found Message Is Acceptable.

Tax filers who have received an. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Web older tax years are provided on a form 13873 series. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application.

Forms With Missing Signatures Will Be Rejected.

Web there are different versions of irs form 13873, including the: What can i do to fix this? Signatures are required for any taxpayer listed. Only list a spouse if their own transcripts will be requested and they will be signing the request.