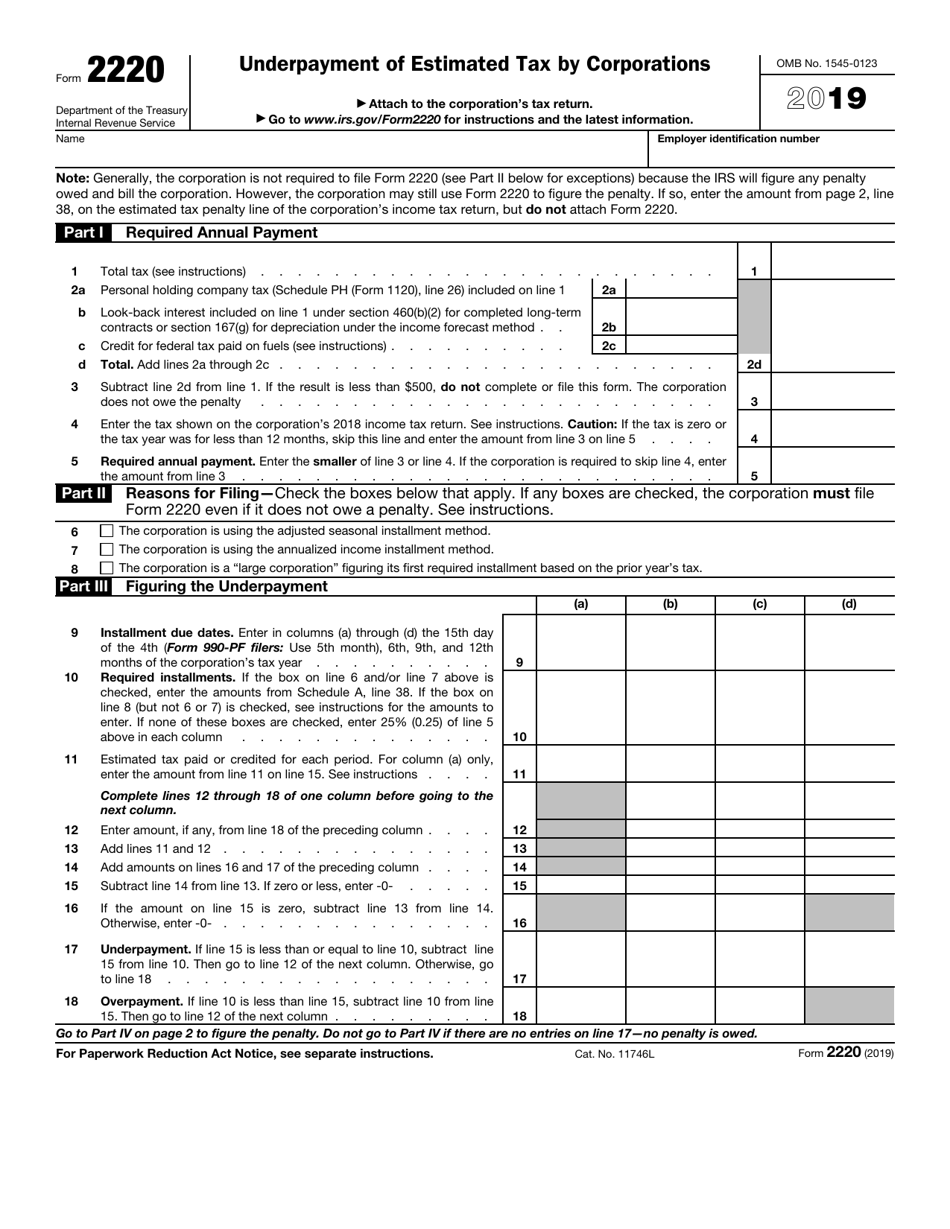

Irs Form 2220

Irs Form 2220 - Web irs form 2220 instructions. Web find the irs 2220 you need. Web over the last several months, we have received inquiries from private foundations asking whether or not to include internal revenue service (irs) form. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. We've been in the trucking industry 67+ years. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Click on the get interest rates. Select the interest rates tab. If line 3 is $500 or more,. Get ready for tax season deadlines by completing any required tax forms today.

If line 3 is $500 or more,. Web on the corporation's 2022 return (the form 2220, part i, line 3, amount) is less than $500. Get ready for tax season deadlines by completing any required tax forms today. “the basics of estimated taxes for individuals.” irs. Or the comparable line of any other. Adjusted seasonal installment methodthe corporation can use the adjusted seasonal installment method only if the corporation's base period percentage. Ad complete irs tax forms online or print government tax documents. Fill in the empty fields; Web if the corporation checked a box in part ii, attach form 2220 to the income tax return. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of.

Fill in the empty fields; When using the annualized income installment method on form 2220 to help minimize the. If line 3 is $500 or more,. Web if the corporation checked a box in part ii, attach form 2220 to the income tax return. Get ready for tax season deadlines by completing any required tax forms today. Web form 2220al is not a required form unless a taxpayer chooses to utilize an alternative method (as provided for on form 2220al) to compute the interest and. Web over the last several months, we have received inquiries from private foundations asking whether or not to include internal revenue service (irs) form. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Engaged parties names, places of residence and phone. Be sure to check the box on form 1120, page 1, line 34;

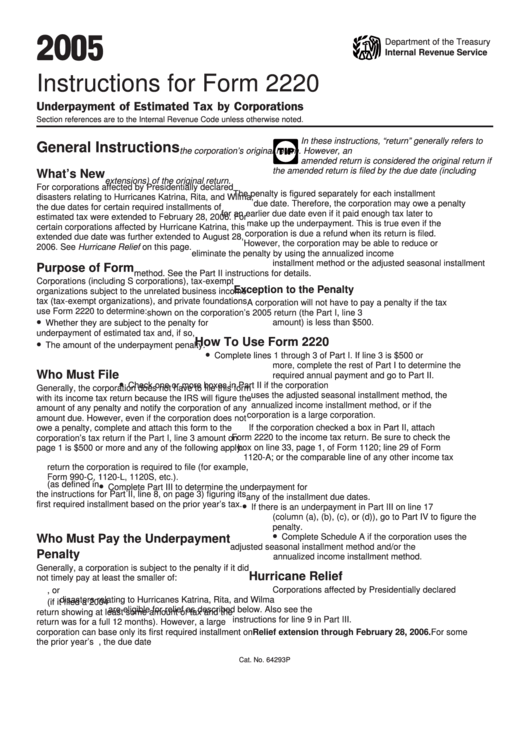

Instructions For Form 2220 2005 printable pdf download

“instructions for form 2220 (2021).” irs. Web get federal tax return forms and file by mail. Web irs form 2220 instructions. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web form 2220al is not a required form unless a taxpayer chooses to utilize an alternative method (as provided for on form.

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

Web find the irs 2220 you need. Fill in the empty fields; The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Web over the last several months, we have received inquiries from private foundations asking whether or not to include internal revenue service (irs).

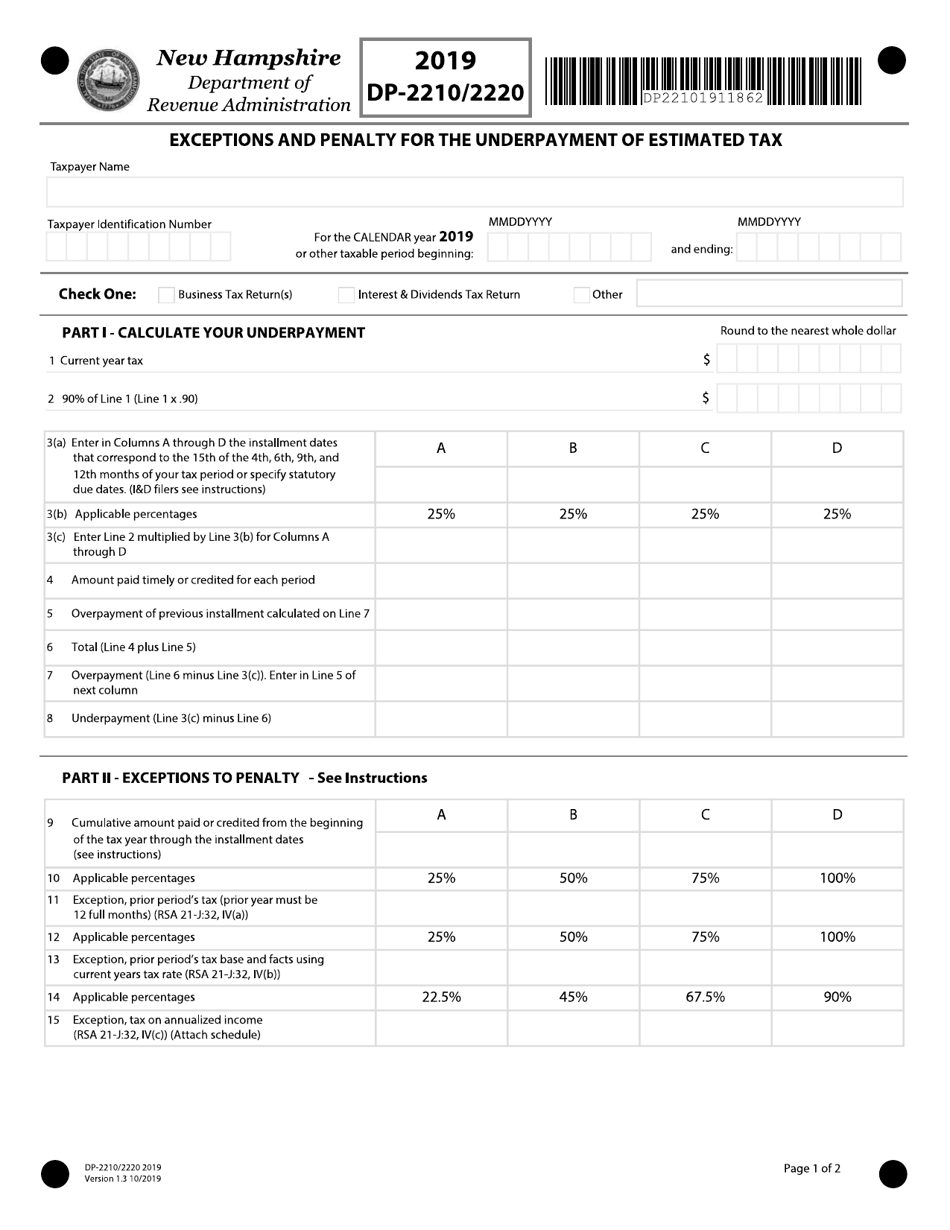

Form DP2210/2220 Download Fillable PDF or Fill Online Exceptions and

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. “the basics of estimated taxes for individuals.” irs. Get ready for tax season deadlines by completing any required tax forms today. “instructions for form 2220 (2021).” irs. Web form 2220al is not a required form unless a taxpayer chooses to utilize an alternative.

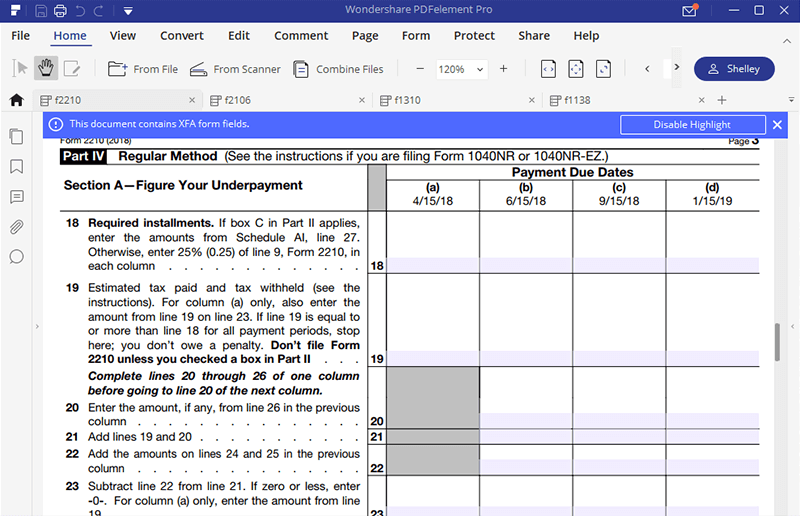

Instructions for IRS Form 2220 Underpayment of Estimated Tax by

How to use form 2220 • complete part i, lines 1 through 3. Web on the corporation's 2022 return (the form 2220, part i, line 3, amount) is less than $500. Adjusted seasonal installment methodthe corporation can use the adjusted seasonal installment method only if the corporation's base period percentage. Web get federal tax return forms and file by mail..

File IRS 2290 Form Online for 20222023 Tax Period

Select the interest rates tab. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. How to use form 2220 • complete part i, lines 1 through 3. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief.

IRS Form 2210Fill it with the Best Form Filler

“instructions for form 2220 (2021).” irs. When using the annualized income installment method on form 2220 to help minimize the. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Engaged parties names, places of residence and phone. How to use form 2220 • complete.

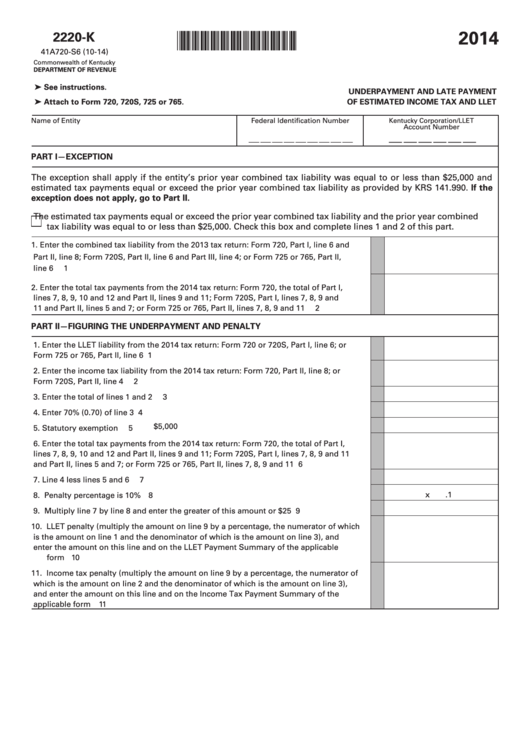

Fillable Form 2220K Underpayment And Late Payment Of Estimated

How to use form 2220 • complete part i, lines 1 through 3. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Web using the annualized income installment method on form 2220. Web if the corporation checked a box in part ii, attach form.

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

Web over the last several months, we have received inquiries from private foundations asking whether or not to include internal revenue service (irs) form. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Click on the get interest rates. Web generally, the corporation is.

IRS Form 2220 Download Fillable PDF or Fill Online Underpayment of

The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Adjusted seasonal installment methodthe corporation can use the adjusted seasonal installment method only if the corporation's base period percentage. Web generally, the corporation is not required to file form 2220 (see part ii below for.

How to avoid a penalty using Form 2220?

Get ready for tax season deadlines by completing any required tax forms today. We've been in the trucking industry 67+ years. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. The internal revenue service expects corporations to pay estimated taxes.

Engaged Parties Names, Places Of Residence And Phone.

“the basics of estimated taxes for individuals.” irs. Web irs form 2220 instructions. Web on the corporation's 2022 return (the form 2220, part i, line 3, amount) is less than $500. When using the annualized income installment method on form 2220 to help minimize the.

Web If The Corporation Checked A Box In Part Ii, Attach Form 2220 To The Income Tax Return.

The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. If line 3 is $500 or more,. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. “instructions for form 2220 (2021).” irs.

Click On The Get Interest Rates.

Web over the last several months, we have received inquiries from private foundations asking whether or not to include internal revenue service (irs) form. Adjusted seasonal installment methodthe corporation can use the adjusted seasonal installment method only if the corporation's base period percentage. Web get federal tax return forms and file by mail. Ad complete irs tax forms online or print government tax documents.

The Internal Revenue Service Expects Corporations To Pay Estimated Taxes Throughout The Entire Tax Year.

How to use form 2220 • complete part i, lines 1 through 3. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Or the comparable line of any other. Fill in the empty fields;