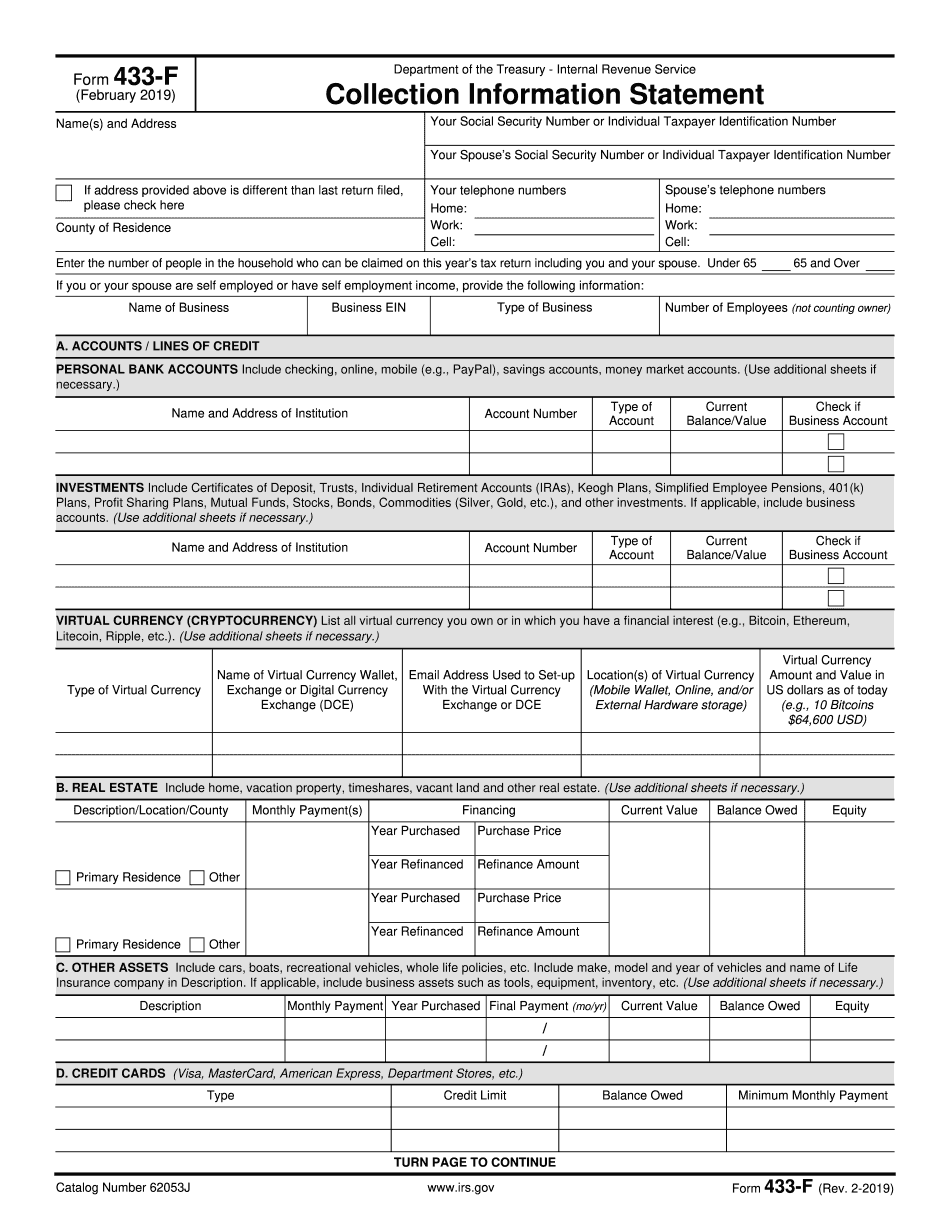

Irs Form 433F

Irs Form 433F - It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. Monthly necessary living expenses (list monthly amounts. If the net rental income is a loss, enter “0.” do not enter a negative number. Requests for copy of tax return (form 4506) Do not include deductions for depreciation or depletion. These standards are effective on april 25, 2022 for purposes of federal tax administration only. Use this form if you are an individual who owes income tax on a form 1040, u.s. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. For expenses paid other than monthly, see instructions.)

If the net rental income is a loss, enter “0.” do not enter a negative number. Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. Requests for copy of tax return (form 4506) These standards are effective on april 25, 2022 for purposes of federal tax administration only. Do not include deductions for depreciation or depletion. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del Web this is the amount earned after ordinary and necessary monthly rental expenses are paid. Refer to form 8821, tax information authorization. It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. You may be able to establish an online payment agreement on the.

Requests for copy of tax return (form 4506) Monthly necessary living expenses (list monthly amounts. Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. Refer to form 8821, tax information authorization. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del Web this is the amount earned after ordinary and necessary monthly rental expenses are paid. Use this form if you are an individual who owes income tax on a form 1040, u.s. If the net rental income is a loss, enter “0.” do not enter a negative number. Do not include deductions for depreciation or depletion. These standards are effective on april 25, 2022 for purposes of federal tax administration only.

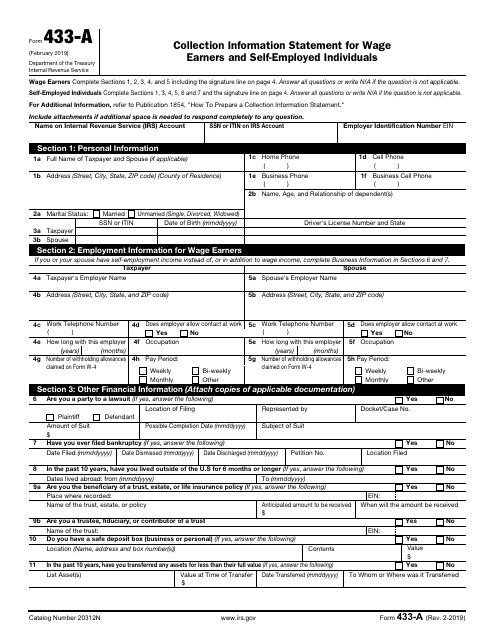

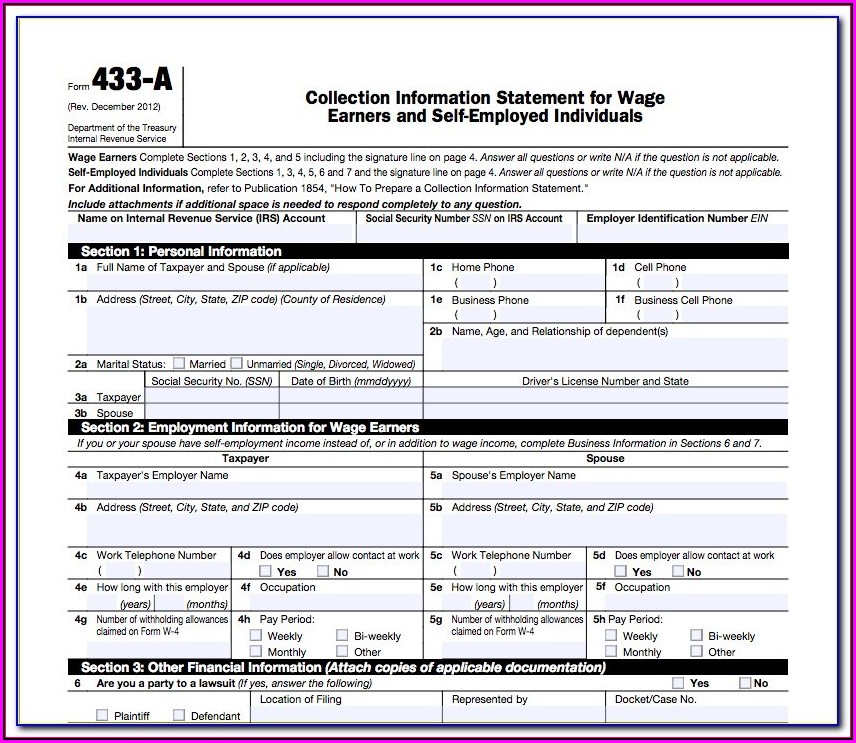

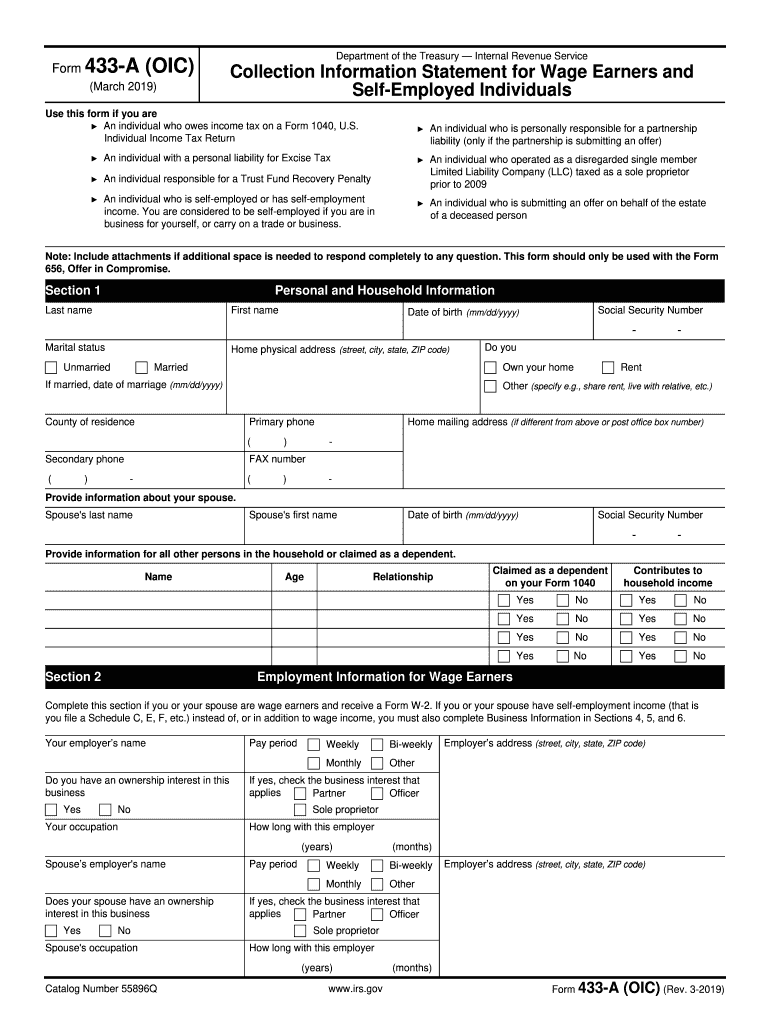

IRS Form 433A Download Fillable PDF or Fill Online Collection

For expenses paid other than monthly, see instructions.) You may be able to establish an online payment agreement on the. It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. Web this is the amount earned after ordinary and necessary monthly rental expenses are paid. Requests for copy of tax return (form.

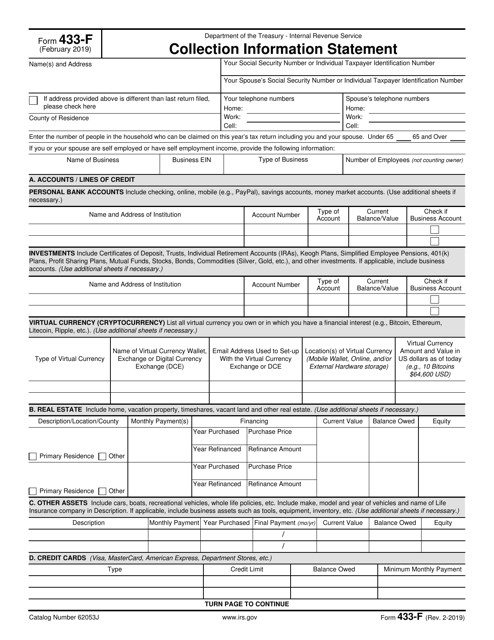

IRS Form 433F Download Fillable PDF or Fill Online Collection

Do not include deductions for depreciation or depletion. Refer to form 8821, tax information authorization. If the net rental income is a loss, enter “0.” do not enter a negative number. It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. These standards are effective on april 25, 2022 for purposes of.

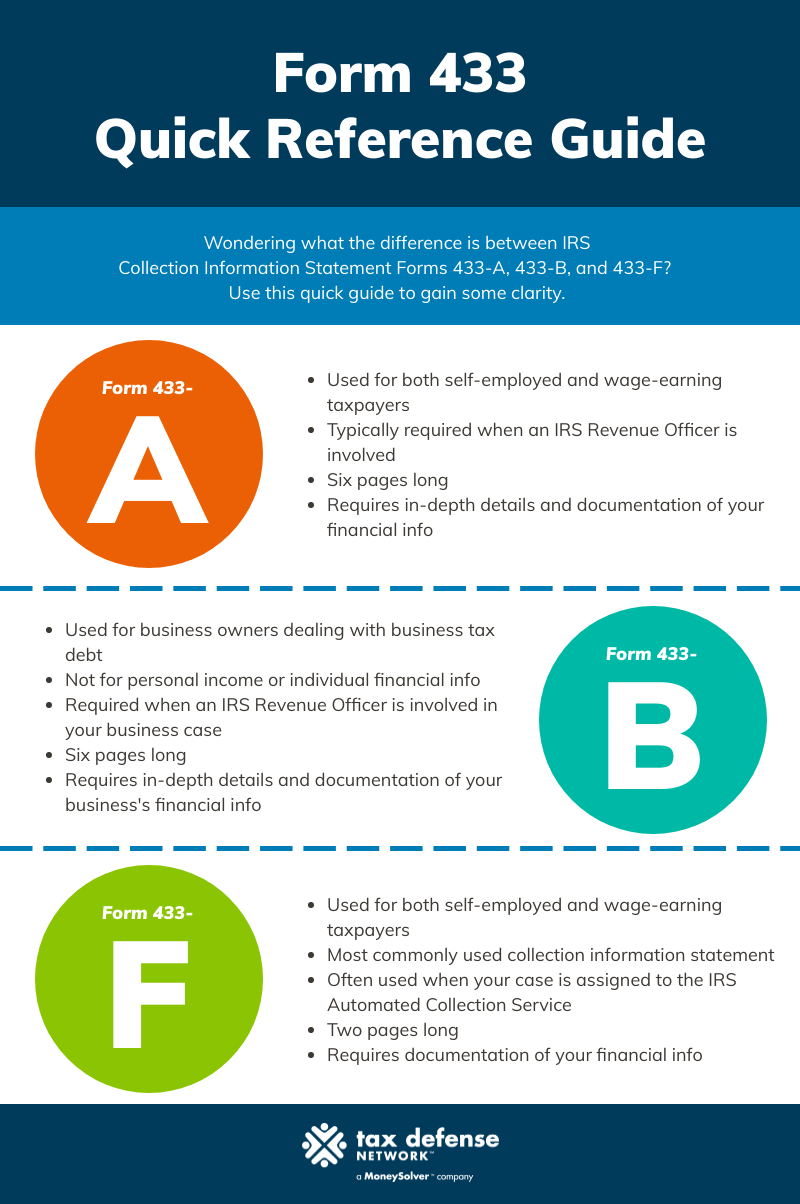

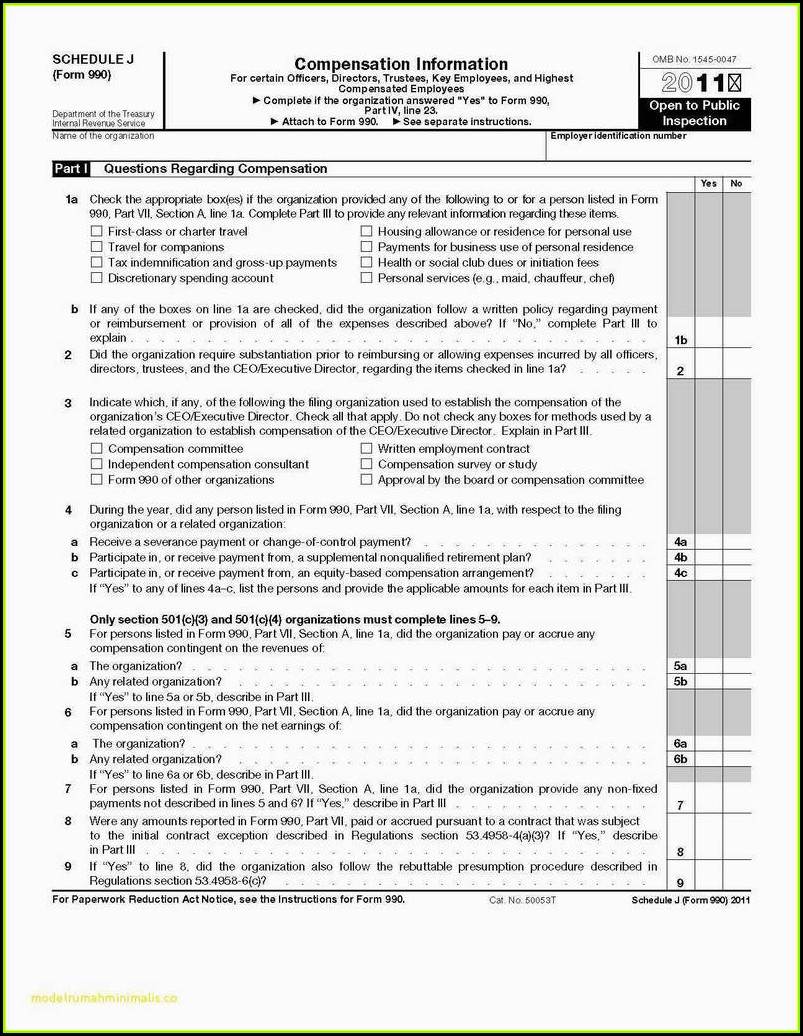

Form 433A & 433F How the IRS Decides Your Ability to Pay

Do not include deductions for depreciation or depletion. Refer to form 8821, tax information authorization. For expenses paid other than monthly, see instructions.) These standards are effective on april 25, 2022 for purposes of federal tax administration only. Web this is the amount earned after ordinary and necessary monthly rental expenses are paid.

Irs Form 433 F Fillable Form Resume Examples 4x2vwwp95l

You may be able to establish an online payment agreement on the. Web this is the amount earned after ordinary and necessary monthly rental expenses are paid. Do not include deductions for depreciation or depletion. Monthly necessary living expenses (list monthly amounts. These standards are effective on april 25, 2022 for purposes of federal tax administration only.

2003 Form IRS 433F Fill Online, Printable, Fillable, Blank pdfFiller

You may be able to establish an online payment agreement on the. It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. If the net rental income is a loss, enter “0.” do not enter a negative number. Use this form if you are an individual who owes income tax on a.

Irs Form 433 F Fillable & Printable PDF Templates

Do not include deductions for depreciation or depletion. You may be able to establish an online payment agreement on the. Monthly necessary living expenses (list monthly amounts. Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. These standards are effective on april 25, 2022 for purposes of federal tax administration only.

2010 Form IRS 433F Fill Online, Printable, Fillable, Blank PDFfiller

These standards are effective on april 25, 2022 for purposes of federal tax administration only. Web this is the amount earned after ordinary and necessary monthly rental expenses are paid. You may be able to establish an online payment agreement on the. Do not include deductions for depreciation or depletion. Requests for copy of tax return (form 4506)

Irs Form 433 A Oic Instructions Form Resume Examples N8VZ8K09we

If the net rental income is a loss, enter “0.” do not enter a negative number. Refer to form 8821, tax information authorization. You may be able to establish an online payment agreement on the. Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. Monthly necessary living expenses (list monthly amounts.

2019 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

Do not include deductions for depreciation or depletion. Refer to form 8821, tax information authorization. Monthly necessary living expenses (list monthly amounts. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del If the net rental income is a loss, enter “0.” do not enter a negative number.

How to Complete an IRS Form 433D Installment Agreement

If the net rental income is a loss, enter “0.” do not enter a negative number. Use this form if you are an individual who owes income tax on a form 1040, u.s. Refer to form 8821, tax information authorization. Monthly necessary living expenses (list monthly amounts. Usted tal vez pueda establecer un plan de pagos a plazos por internet.

It Is Often Used To Determine Eligibility For Certain Types Of Installment Agreements Or Currently Not Collectible Status.

Web this is the amount earned after ordinary and necessary monthly rental expenses are paid. You may be able to establish an online payment agreement on the. Refer to form 8821, tax information authorization. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del

Irs Collection Financial Standards Are Intended For Use In Calculating Repayment Of Delinquent Taxes.

Monthly necessary living expenses (list monthly amounts. Requests for copy of tax return (form 4506) Do not include deductions for depreciation or depletion. Use this form if you are an individual who owes income tax on a form 1040, u.s.

If The Net Rental Income Is A Loss, Enter “0.” Do Not Enter A Negative Number.

These standards are effective on april 25, 2022 for purposes of federal tax administration only. For expenses paid other than monthly, see instructions.)