Irs Form 5310

Irs Form 5310 - Enter 2 for a notice of a plan merger or consolidation. Web as of april 16, 2021, the irs requires that form 5310 be completed and submitted through pay.gov. Go to www.irs.gov/form5310 for more information. Enter “5310” in the search box, select form 5310, and 3. Future developments for the latest information. Consolidate your attachments into a single pdf. Enter 3 for a notice of a plan spinoff. Web form 5310 must be submitted electronically through pay.gov. Pay.gov can accommodate only one uploaded file. December 2013) department of the treasury internal revenue service.

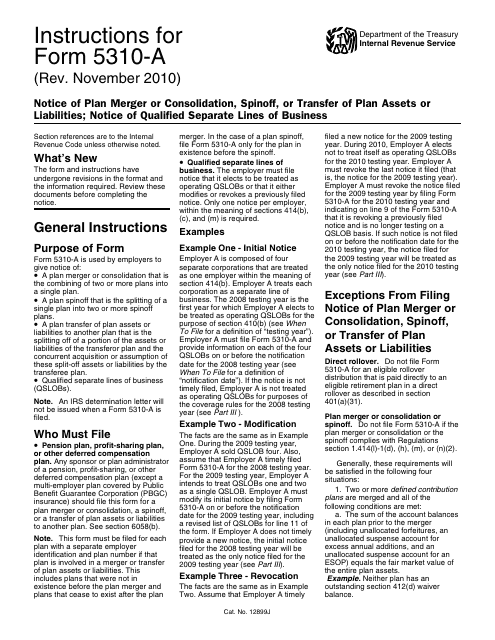

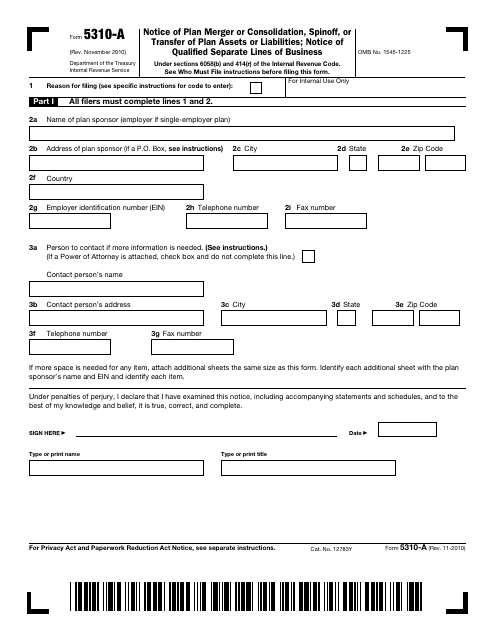

Enter 4 for a notice of a transfer of plan assets or liabilities to another plan. Notice of qualified separate lines of business department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web we last updated the application for determination for terminating plan in february 2023, so this is the latest version of form 5310, fully updated for tax year 2022. Go to www.irs.gov/form5310 for more information. Web form 5310 must be submitted electronically through pay.gov. Employers use this form to give notice of: Web as of april 16, 2021, the irs requires that form 5310 be completed and submitted through pay.gov. Enter 3 for a notice of a plan spinoff. December 2013) department of the treasury internal revenue service. Enter 2 for a notice of a plan merger or consolidation.

Pay.gov can accommodate only one uploaded file. Notice of qualified separate lines of business department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Employers use this form to give notice of: To submit form 5310, you must: Register for an account on pay.gov, 2. Enter “5310” in the search box, select form 5310, and 3. Web as of april 16, 2021, the irs requires that form 5310 be completed and submitted through pay.gov. See the instructions for form 5310 for help with the form. Future developments for the latest information. December 2013) department of the treasury internal revenue service.

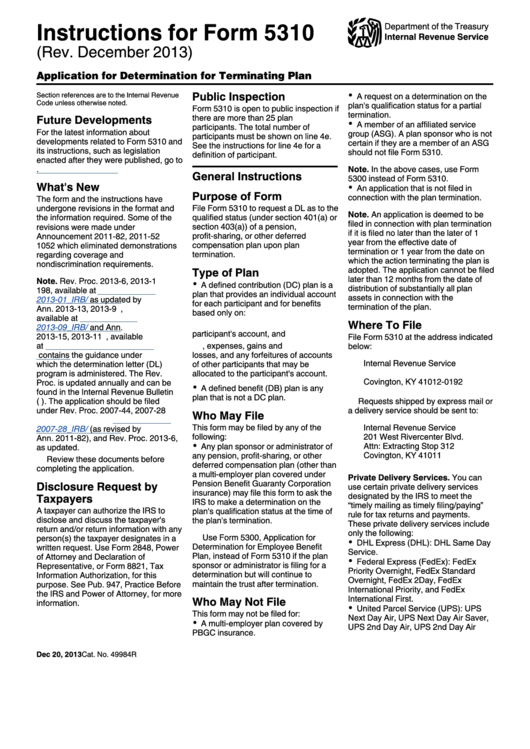

Instructions For Form 5310 (Rev. 2013) printable pdf download

Enter “5310” in the search box, select form 5310, and 3. Web form 5310 must be submitted electronically through pay.gov. Enter 3 for a notice of a plan spinoff. You can access the most recent version of the form at pay.gov. Employers use this form to give notice of:

Form 5310 Application for Determination upon Termination (2013) Free

Enter 1 for a notice of qualified separate lines of business. Notice of qualified separate lines of business. A plan merger or consolidation that is the combining of two or more plans into a single plan. Enter 3 for a notice of a plan spinoff. Go to www.irs.gov/form5310 for more information.

Form 5310 Application for Determination upon Termination (2013) Free

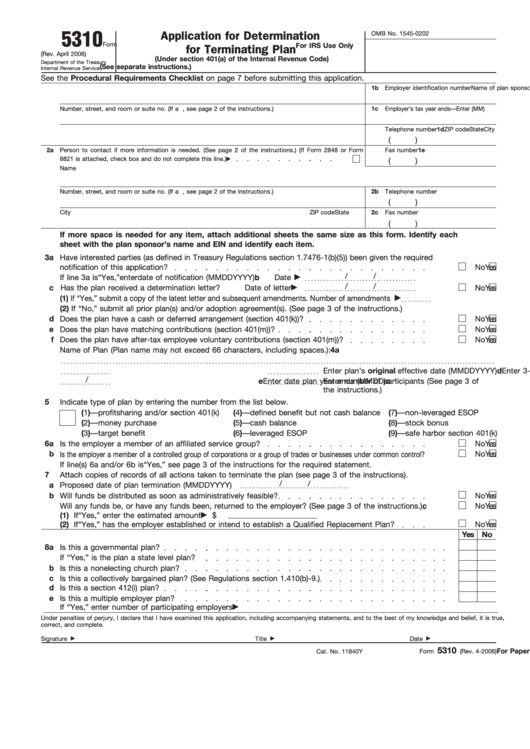

Application for determination for terminating plan (under sections 401(a) and 501(a) of the internal revenue code) information about form 5310 and its instructions is at. Notice of qualified separate lines of business. To submit form 5310, you must: Pay.gov can accommodate only one uploaded file. Consolidate your attachments into a single pdf.

Download Instructions for IRS Form 5310A Notice of Plan Merger or

December 2013) department of the treasury internal revenue service. Notice of qualified separate lines of business department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web we last updated the application for determination for terminating plan in february 2023, so this is the latest version of form 5310, fully updated for.

Form 5310 Application for Determination upon Termination (2013) Free

Notice of qualified separate lines of business department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web we last updated the application for determination for terminating plan in february 2023, so this is the latest version of form 5310, fully updated for tax year 2022. Enter 2 for a notice of.

Form 5310 Application for Determination upon Termination (2013) Free

Web as of april 16, 2021, the irs requires that form 5310 be completed and submitted through pay.gov. Register for an account on pay.gov, 2. Pay.gov can accommodate only one uploaded file. A plan merger or consolidation that is the combining of two or more plans into a single plan. You can access the most recent version of the form.

IRS Form 5310A Download Fillable PDF or Fill Online Notice of Plan

Enter 1 for a notice of qualified separate lines of business. Web form 5310 must be submitted electronically through pay.gov. Enter 4 for a notice of a transfer of plan assets or liabilities to another plan. Enter “5310” in the search box, select form 5310, and 3. You can access the most recent version of the form at pay.gov.

Form 5310 Application for Determination upon Termination (2013) Free

December 2013) department of the treasury internal revenue service. Enter 4 for a notice of a transfer of plan assets or liabilities to another plan. Enter 3 for a notice of a plan spinoff. Register for an account on pay.gov, 2. Enter 1 for a notice of qualified separate lines of business.

Fillable Form 5310 Application For Determination For Terminating Plan

Application for determination for terminating plan (under sections 401(a) and 501(a) of the internal revenue code) information about form 5310 and its instructions is at. Enter 1 for a notice of qualified separate lines of business. Web as of april 16, 2021, the irs requires that form 5310 be completed and submitted through pay.gov. Notice of qualified separate lines of.

Getting a C&R FFL 03 License Ffl, Licensing, Alcohol

Enter “5310” in the search box, select form 5310, and 3. Application for determination for terminating plan (under sections 401(a) and 501(a) of the internal revenue code) information about form 5310 and its instructions is at. To submit form 5310, you must: Enter 3 for a notice of a plan spinoff. See the instructions for form 5310 for help with.

Enter “5310” In The Search Box, Select Form 5310, And 3.

Register for an account on pay.gov, 2. You can access the most recent version of the form at pay.gov. December 2013) department of the treasury internal revenue service. Notice of qualified separate lines of business department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted.

Go To Www.irs.gov/Form5310 For More Information.

Enter 1 for a notice of qualified separate lines of business. Pay.gov can accommodate only one uploaded file. To submit form 5310, you must: Notice of qualified separate lines of business.

See The Instructions For Form 5310 For Help With The Form.

Web as of april 16, 2021, the irs requires that form 5310 be completed and submitted through pay.gov. Application for determination for terminating plan (under sections 401(a) and 501(a) of the internal revenue code) information about form 5310 and its instructions is at. Consolidate your attachments into a single pdf. Enter 4 for a notice of a transfer of plan assets or liabilities to another plan.

Web Form 5310 Must Be Submitted Electronically Through Pay.gov.

Enter 3 for a notice of a plan spinoff. Future developments for the latest information. Web we last updated the application for determination for terminating plan in february 2023, so this is the latest version of form 5310, fully updated for tax year 2022. Employers use this form to give notice of: