Irs Form 668 A

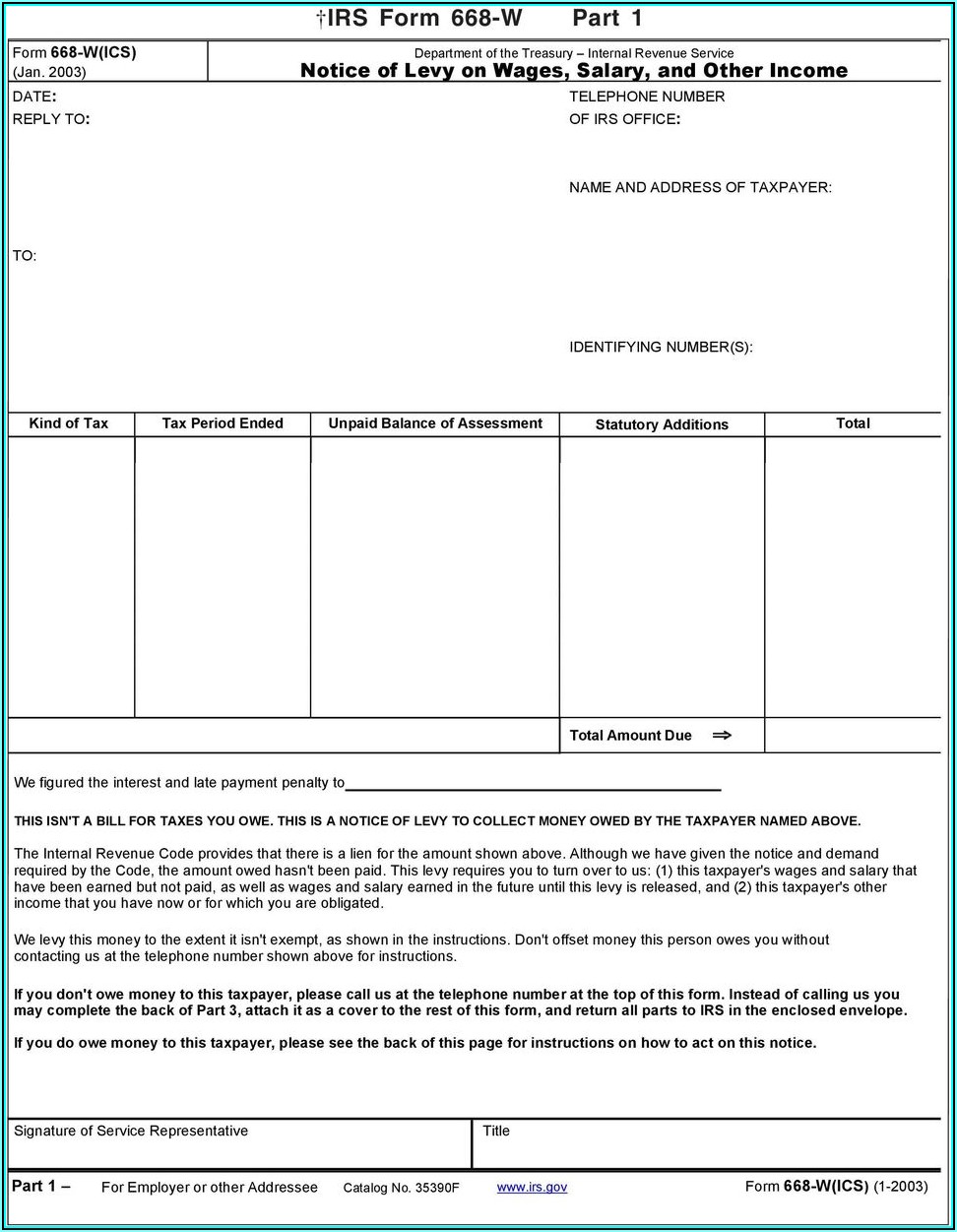

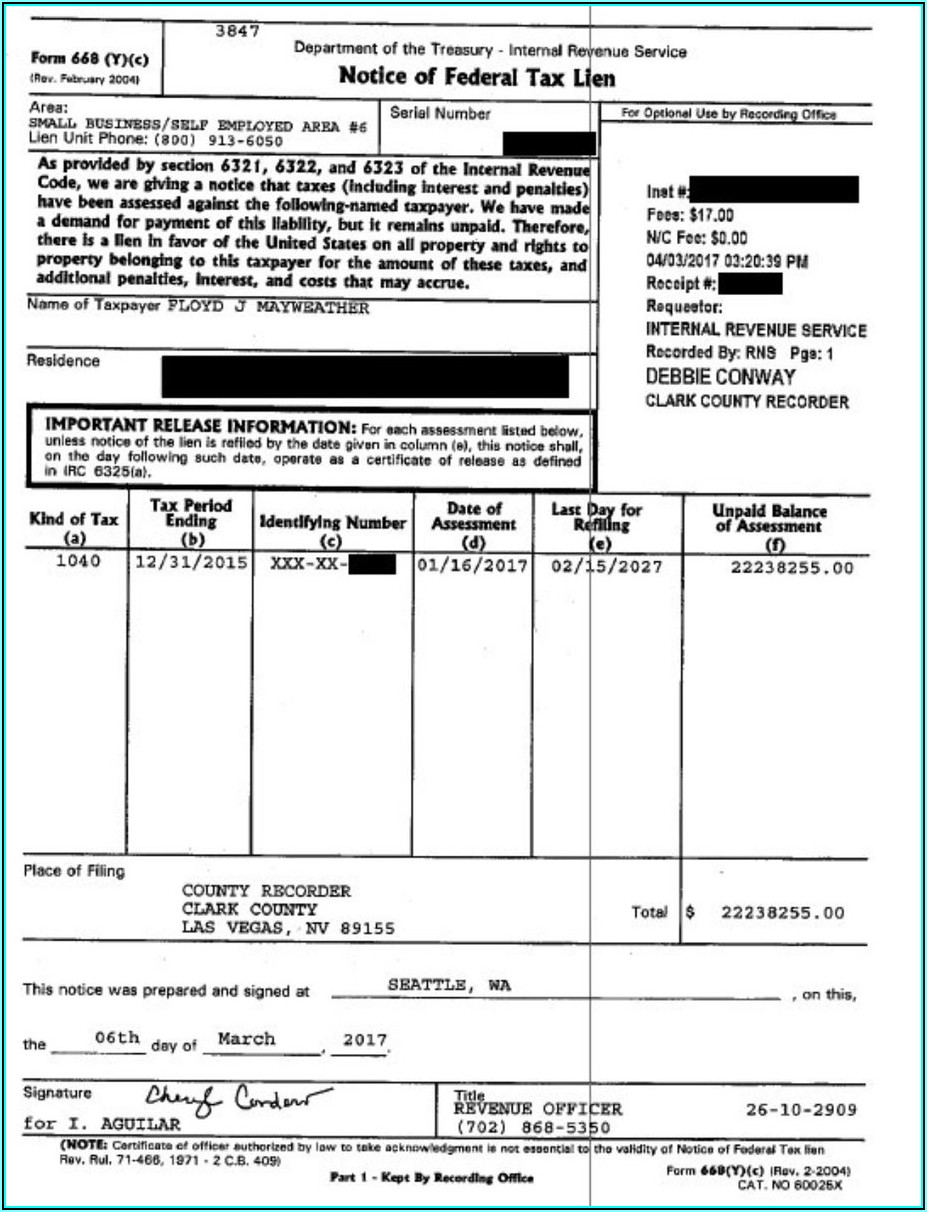

Irs Form 668 A - Complete, edit or print tax forms instantly. That way, your bank can levy your income. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Web this form is filed with local and/or state authorities to alert creditors that the government has an interest in your current and future property and assets. It usually addresses employment tax issues, which in. Get ready for tax season deadlines by completing any required tax forms today. This internal revenue manual (irm) section describes the process and procedures for serving. Make a reasonable effort to identify all property and rights to property belonging to this person. Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere.

When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. It usually addresses employment tax issues, which in. Complete, edit or print tax forms instantly. Get your online template and fill it in using. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Ad access irs tax forms. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf. Web this form is filed with local and/or state authorities to alert creditors that the government has an interest in your current and future property and assets. Make a reasonable effort to identify all property and rights to property belonging to this person. Web form 668 a rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 59 votes how to fill out and sign irs form 668 a online?

It usually addresses employment tax issues, which in. Get your online template and fill it in using. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. That way, your bank can levy your income. This internal revenue manual (irm) section describes the process and procedures for serving. Web october 4, 2019 (hint: Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Levy a lien is not. Complete, edit or print tax forms instantly. Web this form is filed with local and/or state authorities to alert creditors that the government has an interest in your current and future property and assets.

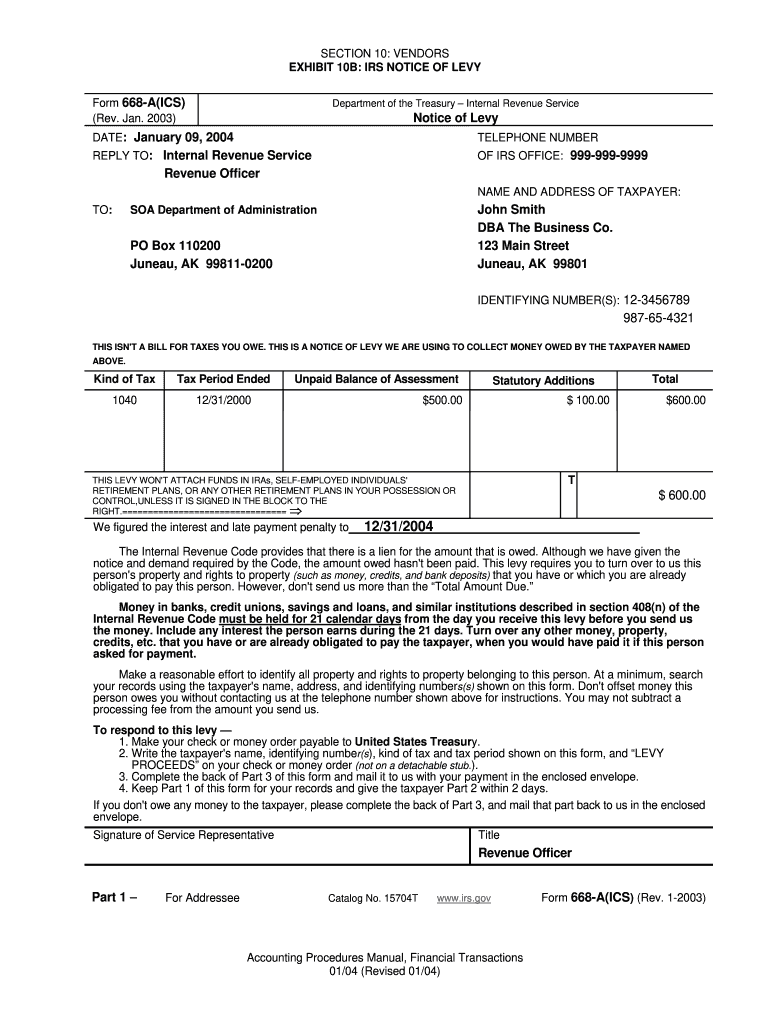

Irs Form 668 a Fill Out and Sign Printable PDF Template signNow

Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 668 a pdf use a irs form 668 a pdf template to make your document workflow more streamlined. This internal revenue manual (irm) section describes the process and procedures.

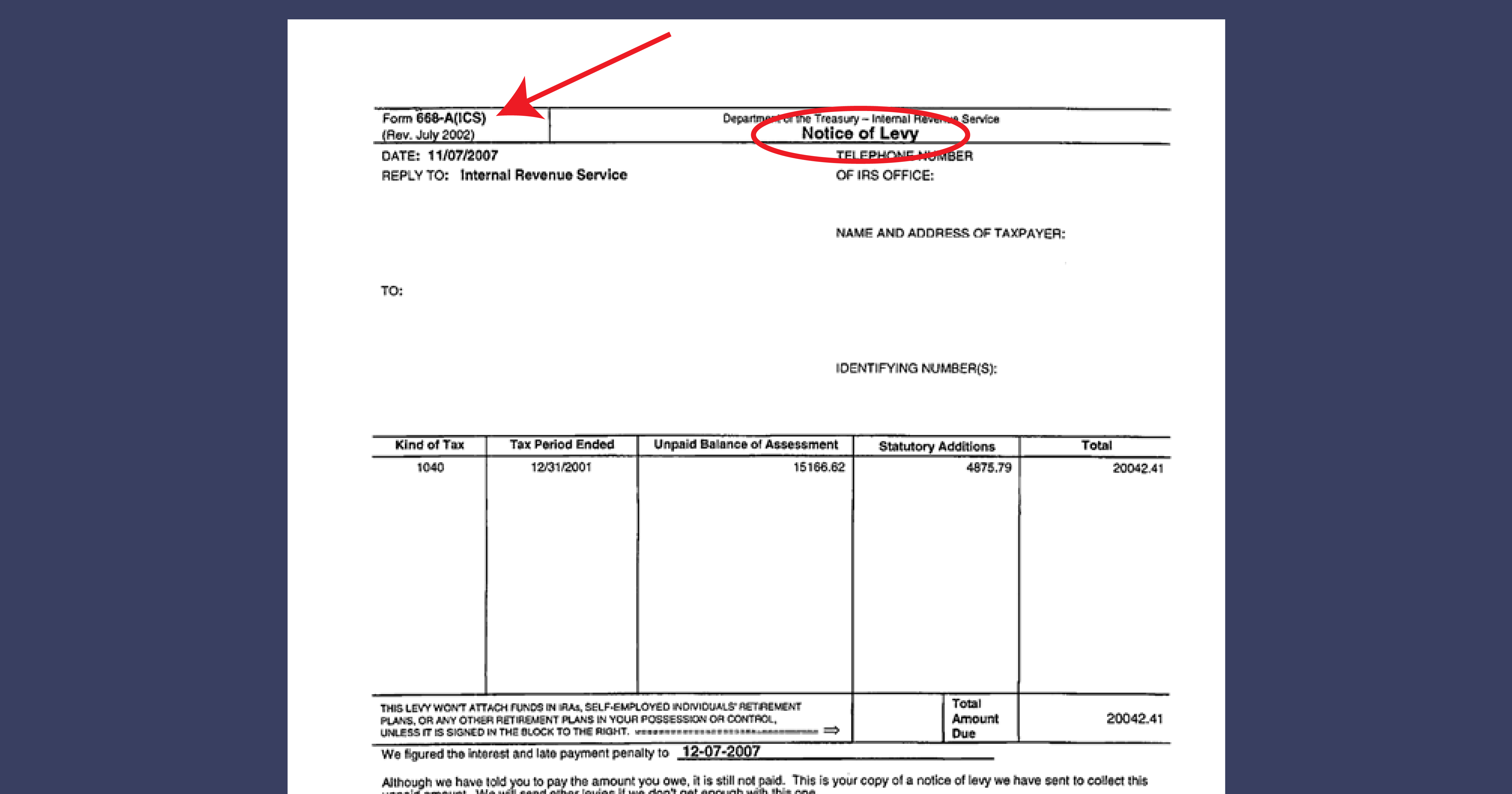

What Are the Series 668 Forms All About? ASTPS

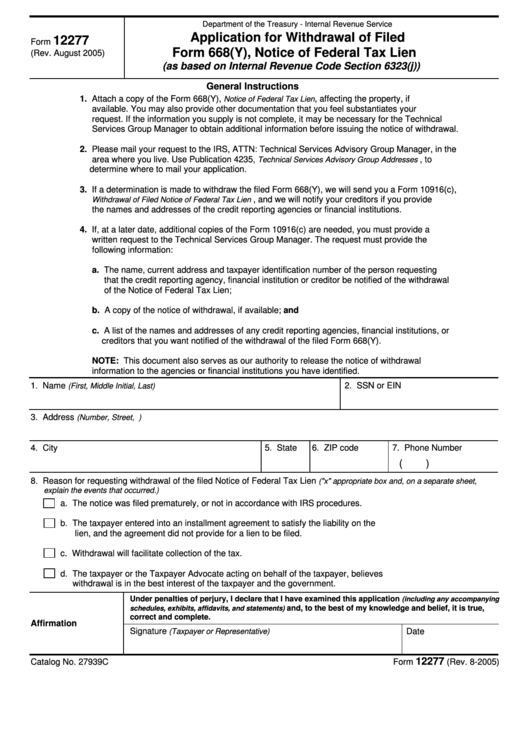

Get your online template and fill it in using. Make a reasonable effort to identify all property and rights to property belonging to this person. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf. Web october 4, 2019 (hint: Complete and.

Irs Form 668 A Pdf Fill and Sign Printable Template Online US Legal

Levy a lien is not. Often, this type of levy goes to your bank. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf. Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much.

What are the Options For Dealing With an IRS Tax Lien? I Owe the IRS

Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Get your online template and fill it in using. Ad access irs tax forms. Levy a lien is not. Make a reasonable effort to identify all property and rights to property belonging to this person.

Fillable Form 12277 Application For Withdrawal Of Filed Form 668(Y

Web irs form 668 z. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. That way, your bank can levy your income. Web for eligibility, refer to form 12277, application for the withdrawal of.

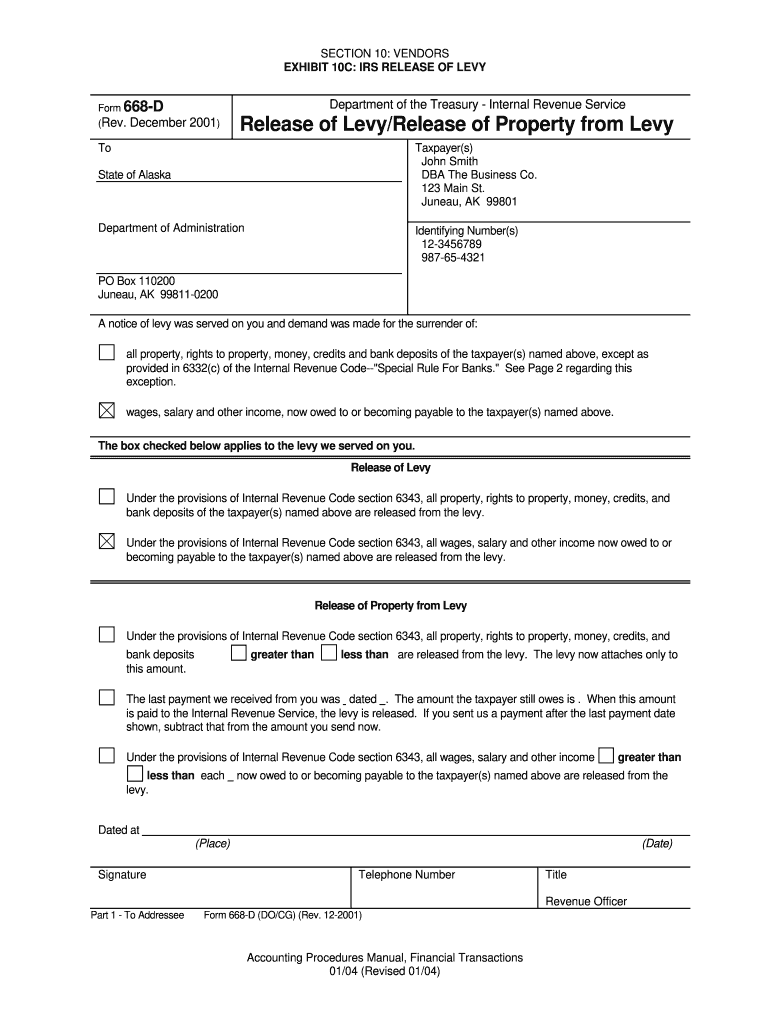

Irs Form 668 D Release of Levy Fill Out and Sign Printable PDF

Web this form is filed with local and/or state authorities to alert creditors that the government has an interest in your current and future property and assets. Often, this type of levy goes to your bank. Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. It usually addresses.

Medicare Form 1490s Instructions Form Resume Examples Wk9yGWvV3D

Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Get a fillable 668z template online. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web this form is filed with local and/or state authorities to alert creditors that the government has an.

Irs Form 668 D Release Of Levy Forms OTQ5Mw Resume Examples

Make a reasonable effort to identify all property and rights to property belonging to this person. Complete, edit or print tax forms instantly. Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Get a fillable 668z template online. Web this form is filed with local and/or state authorities.

What Is Irs Form 668 Y C Form Resume Examples 76YGjag9oL

It usually addresses employment tax issues, which in. Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Web october 4, 2019 (hint: Web irs form 668 z. Web form 668 a rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8.

What forms do you need to remove an IRS federal Tax lien? IRS form

Get a fillable 668z template online. Get ready for tax season deadlines by completing any required tax forms today. Often, this type of levy goes to your bank. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web this form is filed with local and/or state authorities to alert creditors that the government has.

Web This Form Is Filed With Local And/Or State Authorities To Alert Creditors That The Government Has An Interest In Your Current And Future Property And Assets.

Often, this type of levy goes to your bank. It usually addresses employment tax issues, which in. This internal revenue manual (irm) section describes the process and procedures for serving. Web form 668 a rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 59 votes how to fill out and sign irs form 668 a online?

That Way, Your Bank Can Levy Your Income.

Web october 4, 2019 (hint: Complete, edit or print tax forms instantly. Get a fillable 668z template online. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere.

Ad Access Irs Tax Forms.

Get ready for tax season deadlines by completing any required tax forms today. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Web form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Get your online template and fill it in using.

Web For Eligibility, Refer To Form 12277, Application For The Withdrawal Of Filed Form 668 (Y), Notice Of Federal Tax Lien (Internal Revenue Code Section 6323 (J)) Pdf.

Web irs form 668 a pdf use a irs form 668 a pdf template to make your document workflow more streamlined. Levy a lien is not. Web irs form 668 z. Make a reasonable effort to identify all property and rights to property belonging to this person.