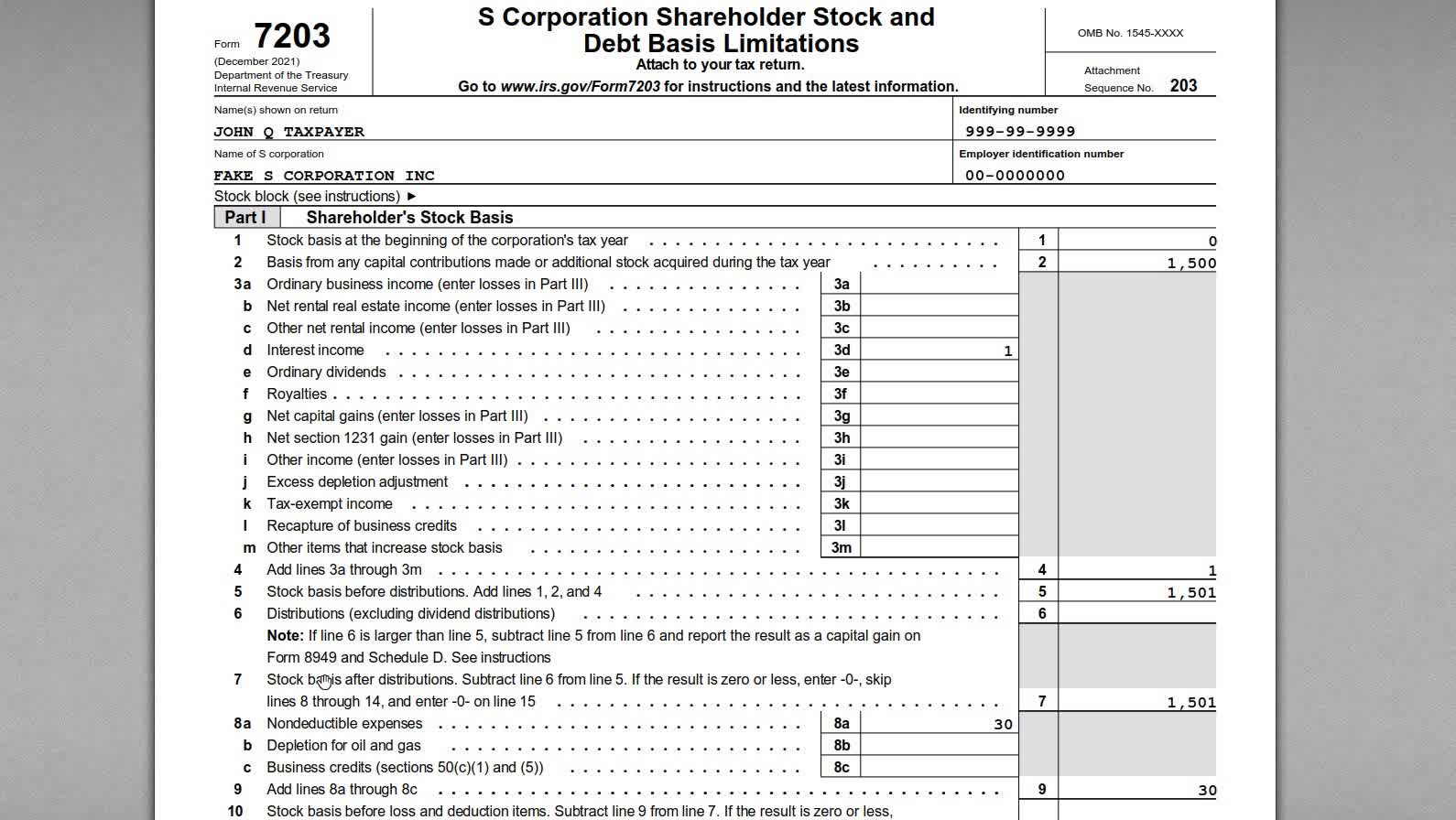

Irs Form 7203 Example

Irs Form 7203 Example - On july 19, 2021, the internal revenue service (irs) issued a notice and request for comments on information collections concerning form 7203, s corporation shareholder stock and debt basis limitations. Additionally, the irs recommends you complete and save this form in years where none of the above apply, to better establish an s corporation stock basis. Web the irs has made a request for basis comments on a new proposed form. By office of advocacy on jul 21, 2021. To generate the form as a pdf: Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. Who must file form 7203 is filed by s corporation shareholders who: Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation. While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes, starting. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns.

Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. Distributions will also be reported on this form after the other basis components are included. The new form is required to be filed by an s corporation shareholder to report shareholder basis. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web the irs has made a request for basis comments on a new proposed form. Entering basis information for a shareholder in an s corporation return: For the 2021 tax year, the irs demands we attach the new form 7203. Web january 19, 2021. Form 8582, passive activity loss limitations; Irs form 5330 is a reporting tool commonly used to report excise taxes for 401 (k) plans.

While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes, starting. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. Web irs form 5330. Web in the past, the irs directed s corp shareholders to attach informal schedules to their tax returns in order to report stock and debt basis. Web form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been generated as part of returns for s corporation shareholders in most tax software programs. Additionally, the irs recommends you complete and save this form in years where none of the above apply, to better establish an s corporation stock basis. Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation. On july 19, 2021, the internal revenue service (irs) issued a notice and request for comments on information collections concerning form 7203, s corporation shareholder stock and debt basis limitations. The new form is required to be filed by an s corporation shareholder to report shareholder basis. If plan sponsors delay a 401 (k) participant’s deposit so it interferes with investments and earnings, they’re required to pay an excise tax based on the missing earnings.

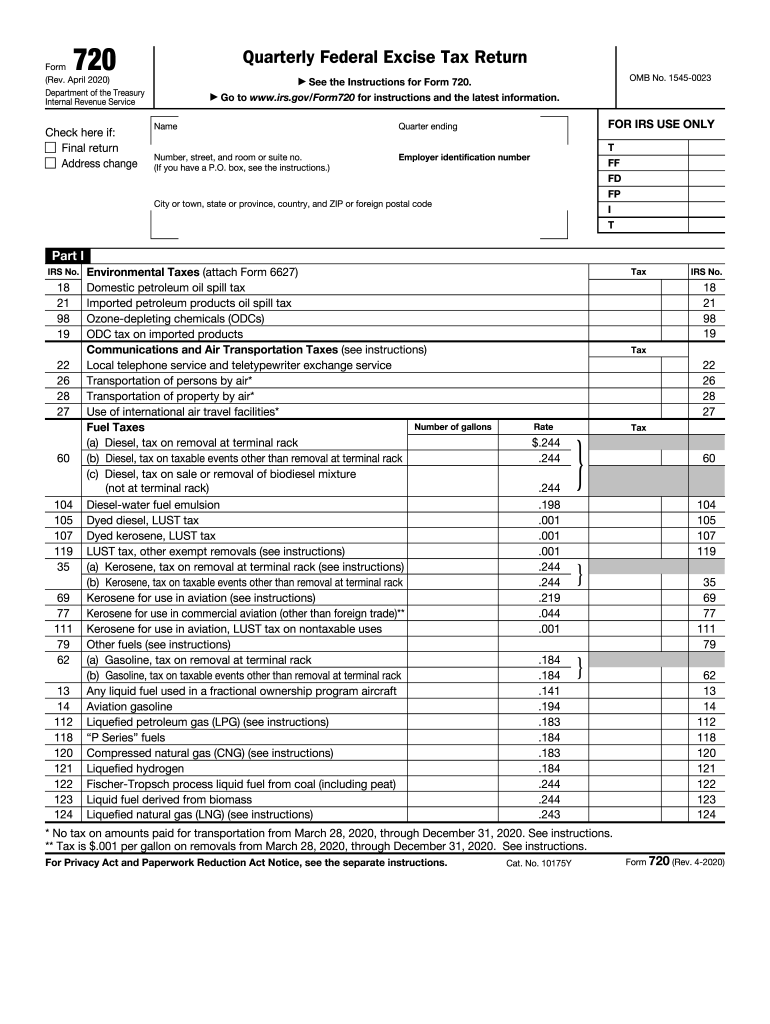

How to complete IRS Form 720 for the PatientCentered Research

On july 19, 2021, the internal revenue service (irs) issued a notice and request for comments on information collections concerning form 7203, s corporation shareholder stock and debt basis limitations. You must report on your By office of advocacy on jul 21, 2021. Web the irs has made a request for basis comments on a new proposed form. December 2022).

How to Complete IRS Form 7203 S Corporation Shareholder Basis

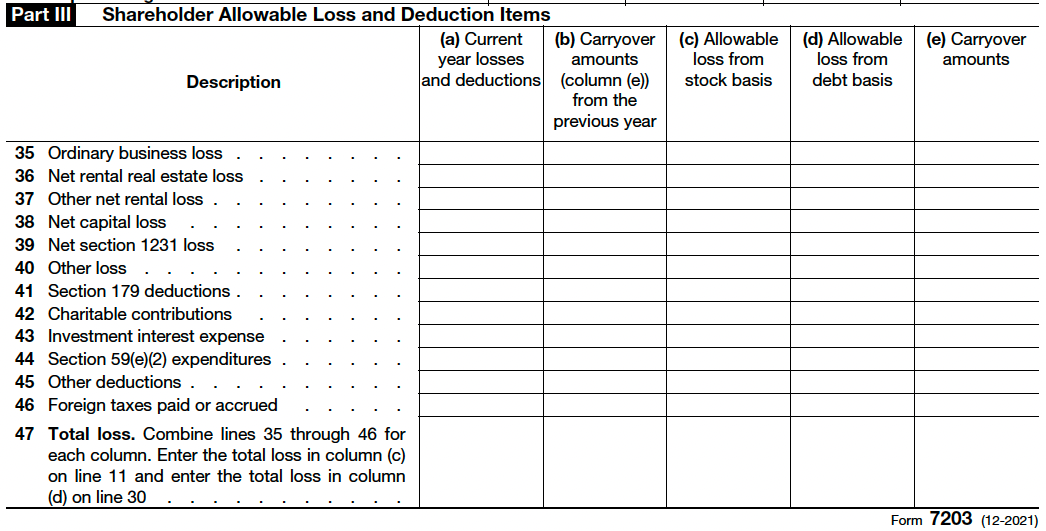

Go to the file return tab. Please note, the form 7203 is not required to be reported by every shareholder of an s corporation, so you may not always have this form available for your cash flow analysis. Form 8582, passive activity loss limitations; Web form 7203 has three parts: Shareholders are only allowed to deduct losses to the extent.

IRS Form 720 Instructions for the PatientCentered Research

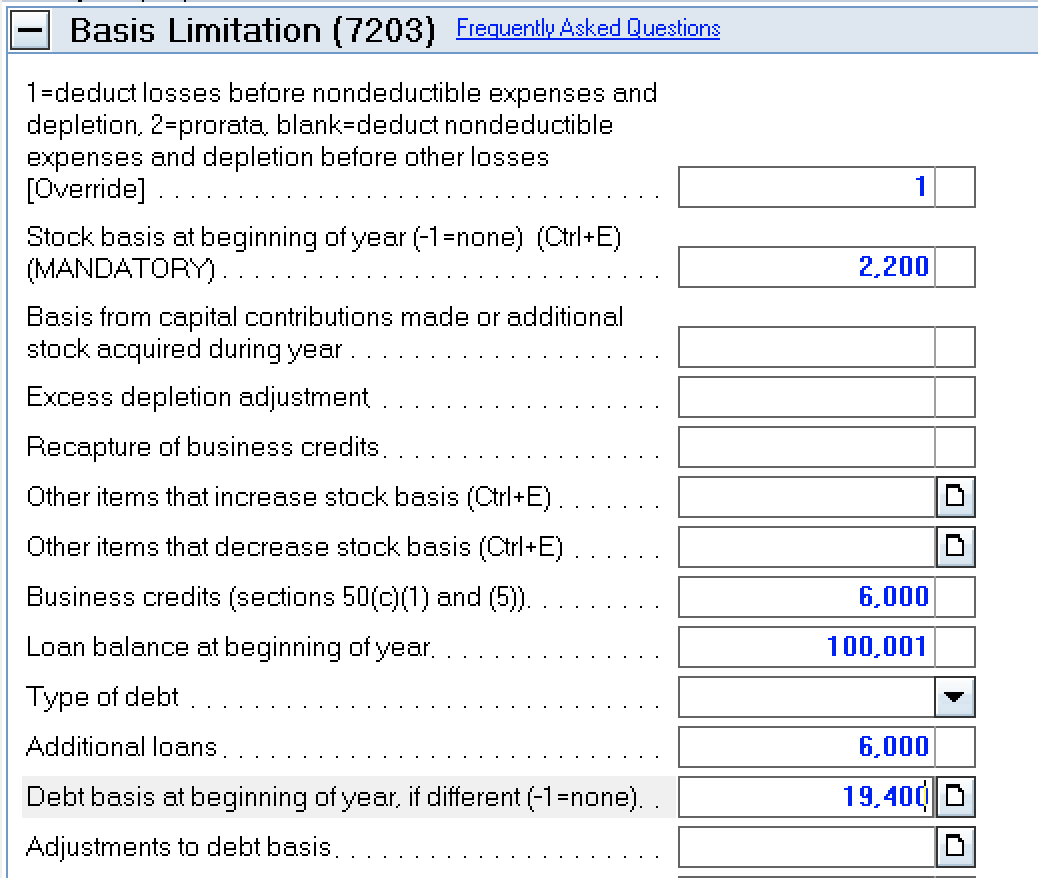

Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. Entering basis information for a shareholder in an s corporation return: Web irs form 5330. Web multiple debt basis example. Form 7203 is a new proposed form that shareholders will use to calculate their stock and debt basis.

More Basis Disclosures This Year for S corporation Shareholders Need

Web irs form 7203 was added in 2021 to adequately track an s corporation shareholders' stock and debt basis. Go to the file return tab. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. Web in the past, the irs directed s corp shareholders to attach informal.

How to complete Form 7203 in Lacerte

Plan sponsors — or their plan administrators — are required. Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. Web irs form 5330. If your client had more than three debts, additional form(s) 7203 will generate to show the loan details. Web general instructions purpose of form use form 7203 to.

Peerless Turbotax Profit And Loss Statement Cvp

Web multiple debt basis example. If your client had more than three debts, additional form(s) 7203 will generate to show the loan details. Attaching form 7203 to the tax return: Additionally, the irs recommends you complete and save this form in years where none of the above apply, to better establish an s corporation stock basis. Web form to figure.

IRS Issues New Form 7203 for Farmers and Fishermen

By office of advocacy on jul 21, 2021. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web january 19, 2021. Distributions will also be reported on this form after the other basis components are included. Who must file form 7203 is.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Please note, the form 7203 is not required to be reported by every shareholder of an s corporation, so you may not always have this form available for your cash flow analysis. Web form 7203 has three parts: 23 debt basis restoration (see instructions). Web general instructions purpose of form use form 7203 to figure potential limitations of your share.

National Association of Tax Professionals Blog

If plan sponsors delay a 401 (k) participant’s deposit so it interferes with investments and earnings, they’re required to pay an excise tax based on the missing earnings. Entering basis information for a shareholder in an s corporation return: Shareholders are only allowed to deduct losses to the extent they have basis, which is why. Form 8582, passive activity loss.

Form 720 Fill out & sign online DocHub

23 debt basis restoration (see instructions). Web irs form 7203 was added in 2021 to adequately track an s corporation shareholders' stock and debt basis. Distributions will also be reported on this form after the other basis components are included. By office of advocacy on jul 21, 2021. Go to the file return tab.

Web Irs Form 5330.

Web general instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web form 7203 has three parts: Web form to figure your aggregate stock and debt basis. Go to screen 9, shareholder's basis.

Web In The Past, The Irs Directed S Corp Shareholders To Attach Informal Schedules To Their Tax Returns In Order To Report Stock And Debt Basis.

The new form is required to be filed by an s corporation shareholder to report shareholder basis. While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes, starting. Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. For the 2021 tax year, the irs demands we attach the new form 7203.

Web Multiple Debt Basis Example.

Plan sponsors — or their plan administrators — are required. Web irs form 7203 was added in 2021 to adequately track an s corporation shareholders' stock and debt basis. Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation. 23 debt basis restoration (see instructions).

Additionally, The Irs Recommends You Complete And Save This Form In Years Where None Of The Above Apply, To Better Establish An S Corporation Stock Basis.

The irs is requesting comments on form 7203, s corporation shareholder stock and debt basis limitations. Web january 19, 2021. Web irs seeking comments on form 7203. Distributions will also be reported on this form after the other basis components are included.