Irs Form 982 Credit Card Settlement

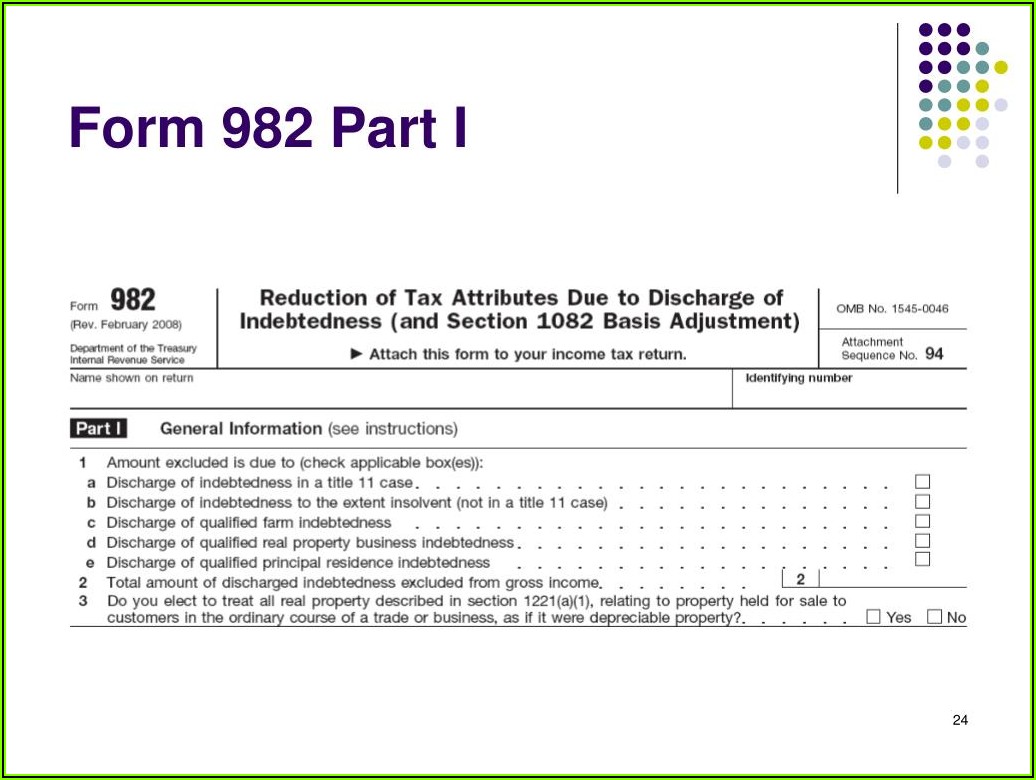

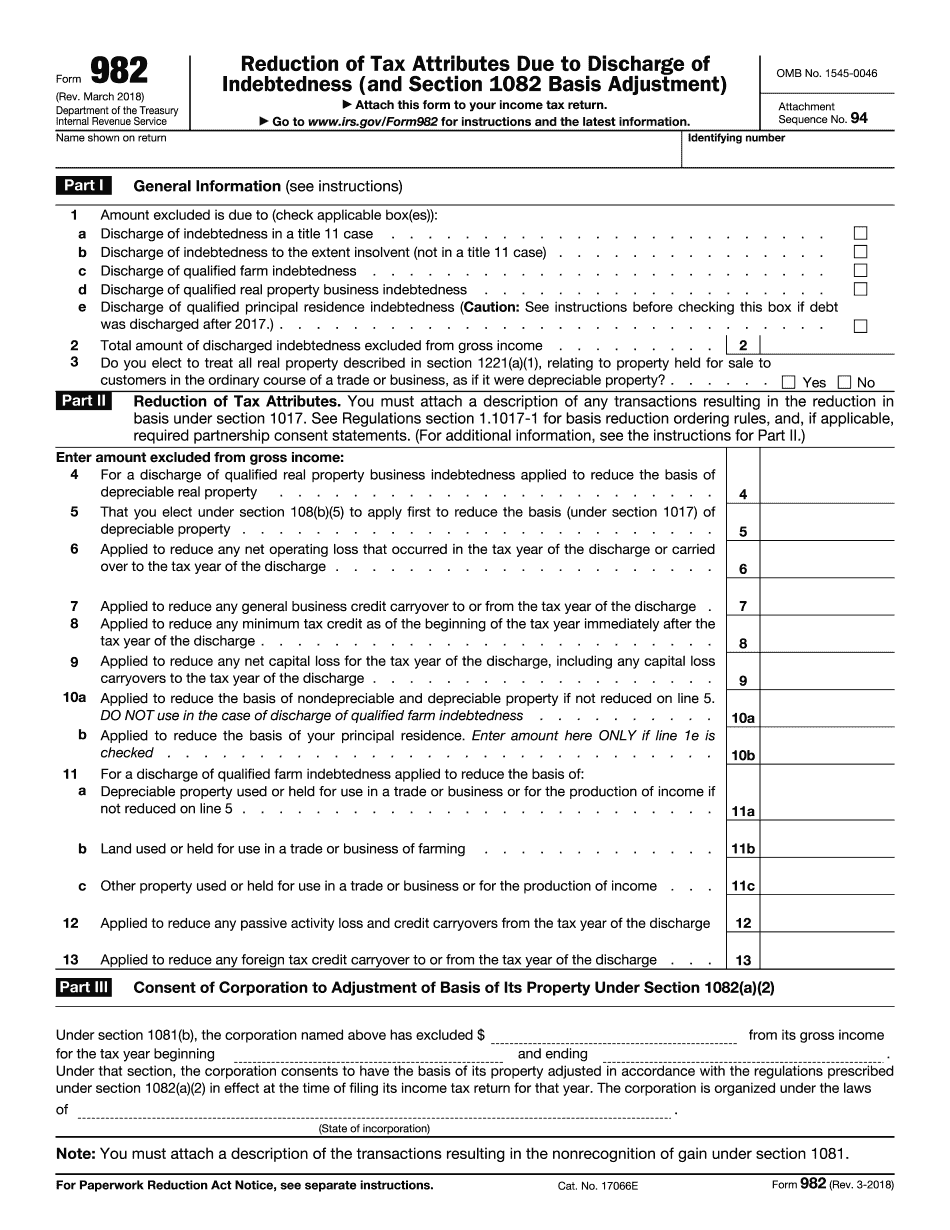

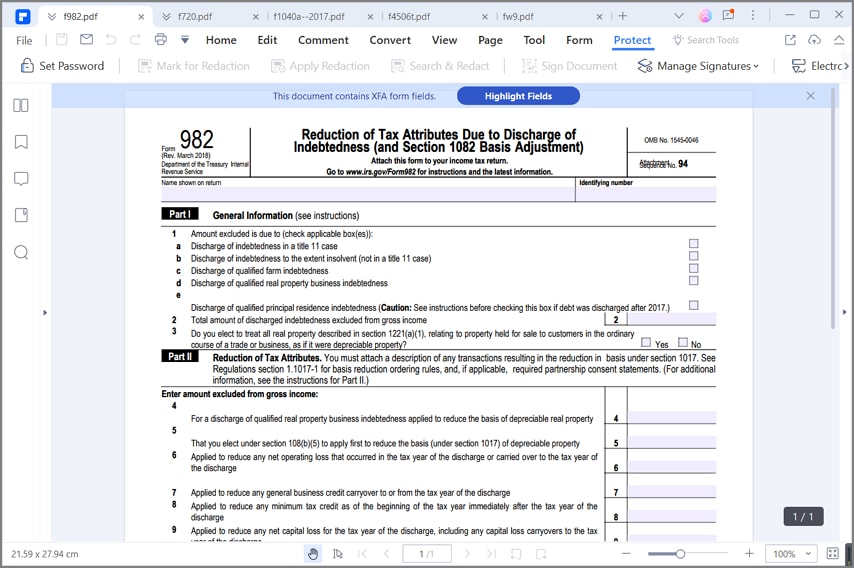

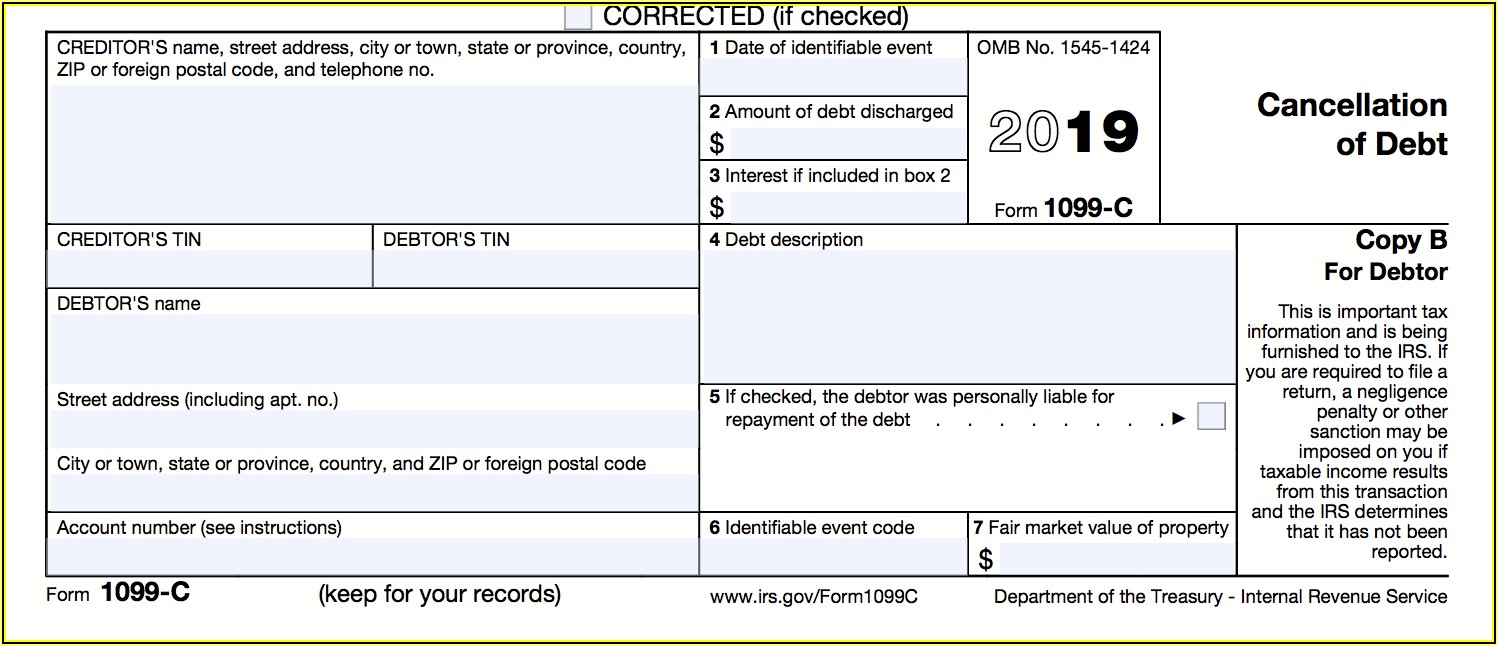

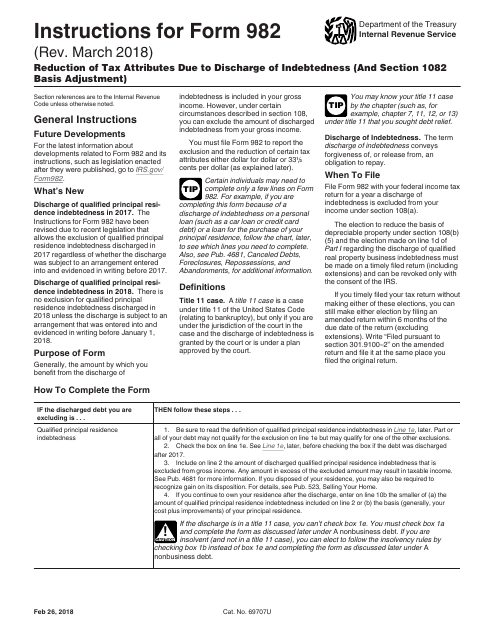

Irs Form 982 Credit Card Settlement - Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Web if your liabilities might exceed your assets, he recommends that you review irs form 982 with your tax preparer to determine whether you qualify as insolvent. Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments. Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. Cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form. Form 982 notifies the irs of the amount of canceled debt that should be excluded from the gross income and under which exclusion.

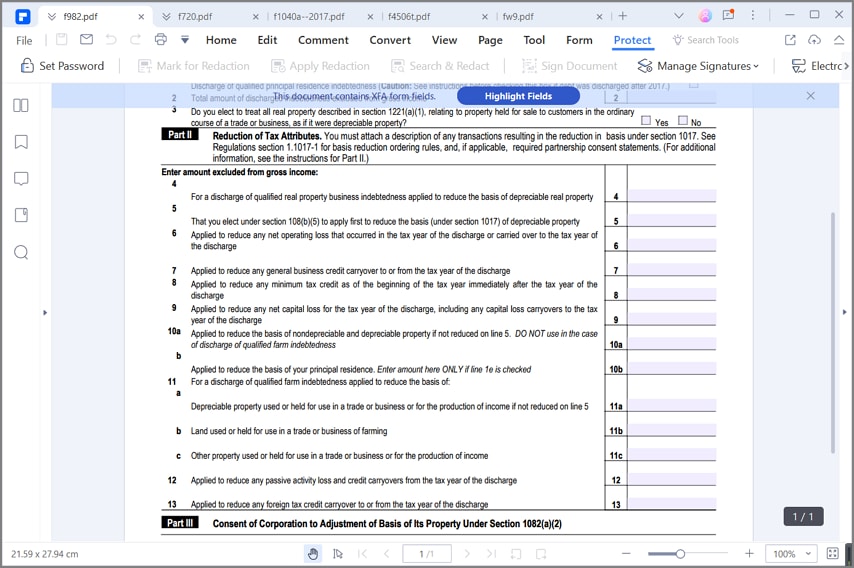

Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Web the actual balance at the time of settlement was $ 3,440 and the total settlement was for $1,500. Web to claim a canceled debt amount should be excluded from gross income, the taxpayer needs to complete irs form 982 and attach the completed form to their return. Web any foreign tax credit carryover to or from the tax year of the discharge (33 1 / 3 cents per dollar). The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Unless your debt forgiveness falls into a defined category, line 1b may help relieve you of your tax burden. Cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in reporting the settlement to the irs. (for additional information, see the instructions for part ii.) Look carefully at the bottom of the form and you will see,

Web the actual balance at the time of settlement was $ 3,440 and the total settlement was for $1,500. Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. Web how to fill out irs form 982 with credit card debt. Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. Web any foreign tax credit carryover to or from the tax year of the discharge (33 1 / 3 cents per dollar). For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. (for additional information, see the instructions for part ii.) Look carefully at the bottom of the form and you will see, Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments.

Debt Irs Form 982 Form Resume Examples 0g27K7n2Pr

Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in reporting the settlement to the irs. Web any foreign tax credit carryover to or from the tax year of the discharge.

form 982 line 10a Fill Online, Printable, Fillable Blank

Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. Web how to fill out irs form 982 with credit card debt. Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Web.

Modulo IRS 982 Come compilarlo correttamente

Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. Web how to fill out irs form 982.

IRS Form 982 How to Fill it Right

Web generally, you abandon property when you voluntarily and permanently give up possession and use of property you own with the intention of ending your ownership but without passing it on to anyone else. Cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Look carefully at the bottom of the form and you will see,.

Irs Debt Form 982 Form Resume Examples MeVRkgq2Do

Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form. The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Use part iii to exclude.

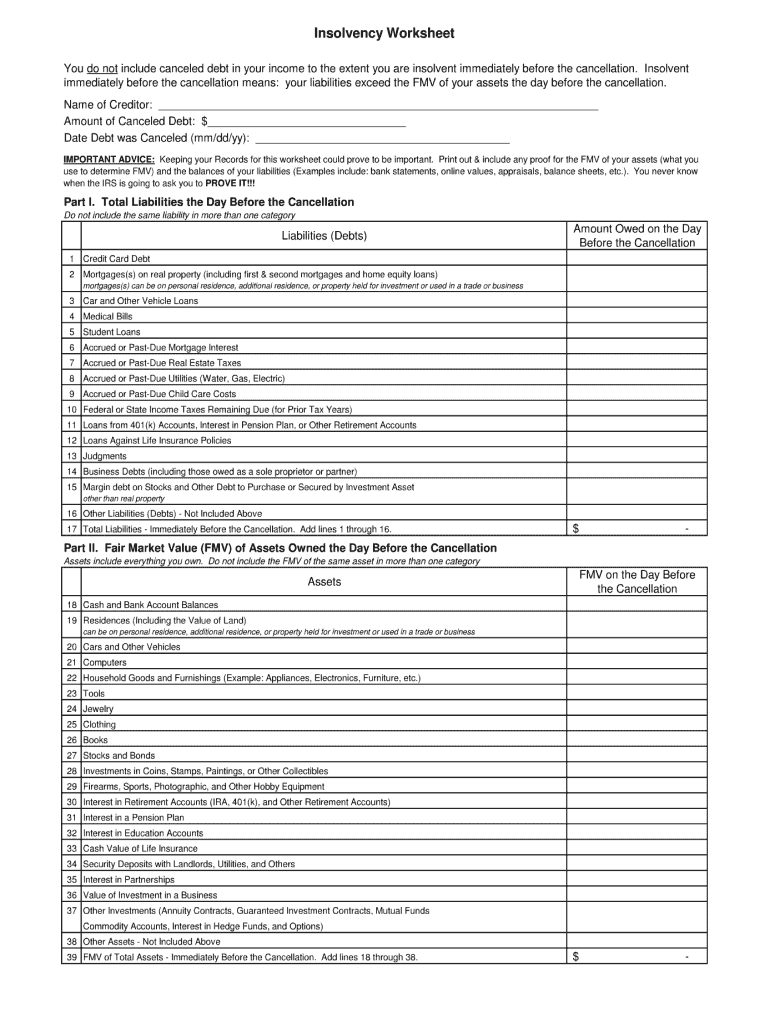

Tax form 982 Insolvency Worksheet

Web if your liabilities might exceed your assets, he recommends that you review irs form 982 with your tax preparer to determine whether you qualify as insolvent. The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Web to claim the insolvency exemption, you must file irs form 982,.

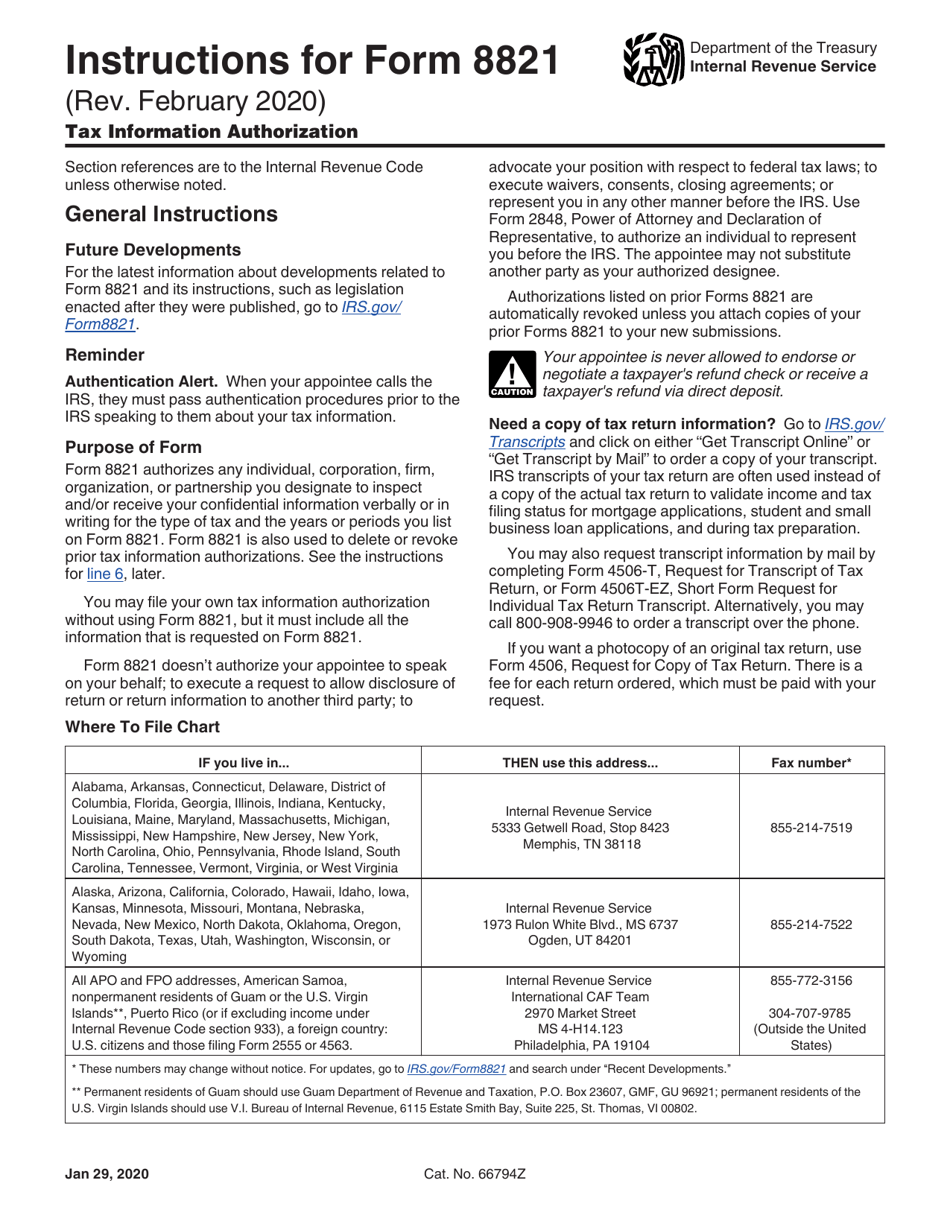

Download Instructions for IRS Form 8821 Tax Information Authorization

Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments. Form 982 notifies the irs of the amount of canceled debt that should be excluded from the gross income and.

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

Unless your debt forgiveness falls into a defined category, line 1b may help relieve you of your tax burden. About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find.

understanding irs form 982 Fill Online, Printable, Fillable Blank

Web if your liabilities might exceed your assets, he recommends that you review irs form 982 with your tax preparer to determine whether you qualify as insolvent. Look carefully at the bottom of the form and you will see, Web generally, you abandon property when you voluntarily and permanently give up possession and use of property you own with the.

Form 982 Insolvency Worksheet —

For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Web.

The Internal Revenue Service Considers That The Cancellation Or Forgiveness Of A Taxpayer's Indebtedness Results In Taxable Income To The Taxpayer.

Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Look carefully at the bottom of the form and you will see, Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments.

Web The Actual Balance At The Time Of Settlement Was $ 3,440 And The Total Settlement Was For $1,500.

Unless your debt forgiveness falls into a defined category, line 1b may help relieve you of your tax burden. Form 982 notifies the irs of the amount of canceled debt that should be excluded from the gross income and under which exclusion. Cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. (for additional information, see the instructions for part ii.)

Web Form 982, Reduction Of Tax Attributes Due To Discharge Of Indebtedness At The Top Of Form 982, You’ll Find A Series Of Check Boxes That Indicated Why You Are Filling Out This Form.

Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Web if your liabilities might exceed your assets, he recommends that you review irs form 982 with your tax preparer to determine whether you qualify as insolvent. Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in reporting the settlement to the irs.

Web To Claim A Canceled Debt Amount Should Be Excluded From Gross Income, The Taxpayer Needs To Complete Irs Form 982 And Attach The Completed Form To Their Return.

Web any foreign tax credit carryover to or from the tax year of the discharge (33 1 / 3 cents per dollar). Web generally, you abandon property when you voluntarily and permanently give up possession and use of property you own with the intention of ending your ownership but without passing it on to anyone else. For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section.