Irs Form To Report Foreign Inheritance

Irs Form To Report Foreign Inheritance - Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Foreign inheritance & form 3520: This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Property, there is no inheritance tax but, the u.s. Web reporting rules form 3520. Taxpayers who receive foreign gifts, inheritances, or distributions from foreign trusts. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Web foreign inheritance form 3520 reporting. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web it is essential to properly file a timely irs form 3520 to report a foreign inheritance or foreign gift received by a u.s.

Since brian is the owner of foreign. The ira funds must be distributed to beneficiaries within 10 years of the owner’s death. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Web the irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, refers to gifts or bequests valued at $100k. Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Web irs form 3520 is a reporting requirement imposed on u.s. This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Web foreign inheritance form 3520 reporting. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of the gift on the year he received it, on a form 3520. Web the short answer is that the united states does not impose inheritance taxes on bequests.

Foreign inheritance & form 3520: Web the most important one is irs form 3520. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of. Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Web if you, a us person, receive an inheritance with a fair market value of $100,000 or more, you must file a disclosure to report it. Web the short answer is that the united states does not impose inheritance taxes on bequests. Property, there is no inheritance tax but, the u.s. Web irs form 3520 is a reporting requirement imposed on u.s. Person as large penalties may be imposed. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of.

Demystifying IRS Form 1116 Calculating Foreign Tax Credits SF Tax

This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited. Web irs form 3520 is a reporting requirement imposed on u.s. This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Web foreign inheritance form 3520 reporting. Web the irs form 3520, annual return to report.

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Since brian is the owner of foreign. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web if you are a u.s. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited..

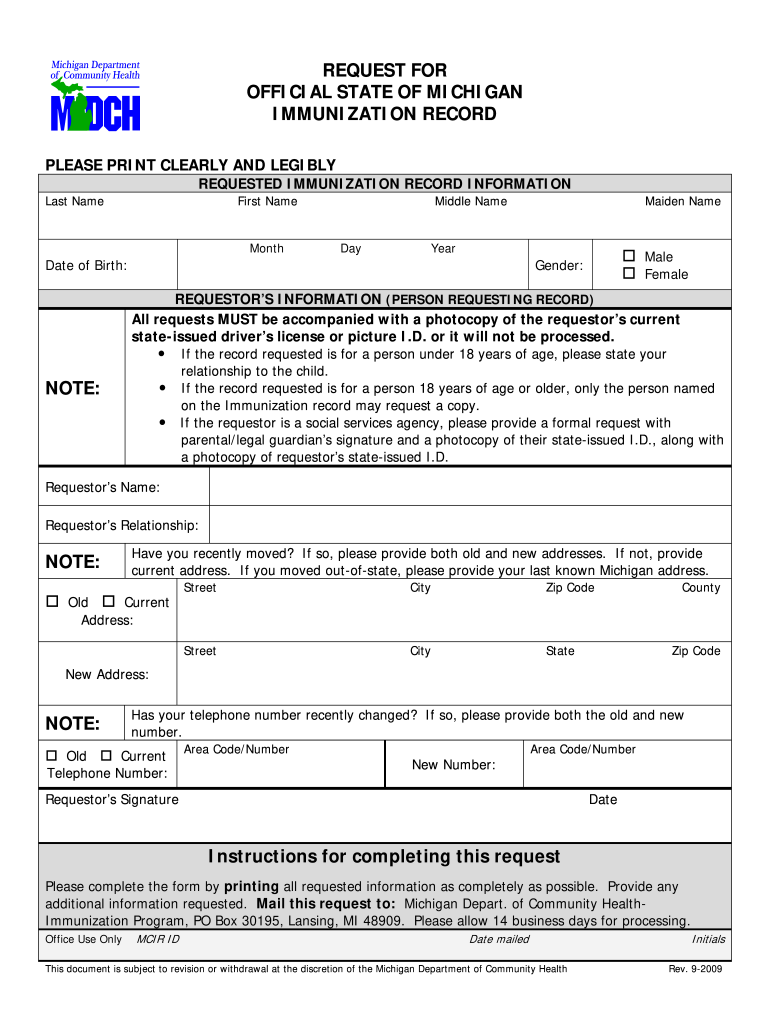

Copy of Immunization Records Michigan Form Fill Out and Sign

Web reporting rules form 3520. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Annual return to report transactions. Web if you, a us person, receive an inheritance with a fair market value of $100,000 or more, you must file a disclosure to report it..

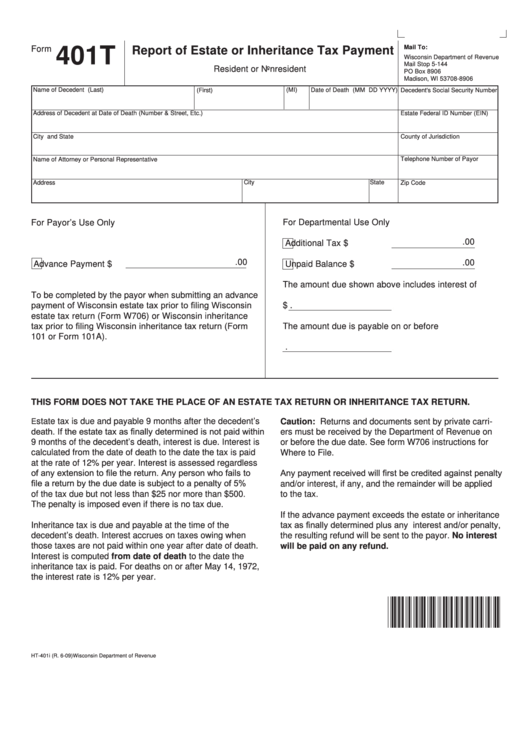

Form 401t Report Of Estate Or Inheritance Tax Payment Resident Or

Web if you are a u.s. Web foreign inheritance & form 3520. Web reporting rules form 3520. Web the most important one is irs form 3520. Web irs form 3520 is a reporting requirement imposed on u.s.

Foreign Inheritance Taxation

The ira funds must be distributed to beneficiaries within 10 years of the owner’s death. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual.

USCs and LPRs Living Outside the U.S. Key Tax and BSA Forms « Tax

The irs form 3520 is used to report certain foreign transactions involving gifts and trust s. Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of the gift on the year he received it, on a.

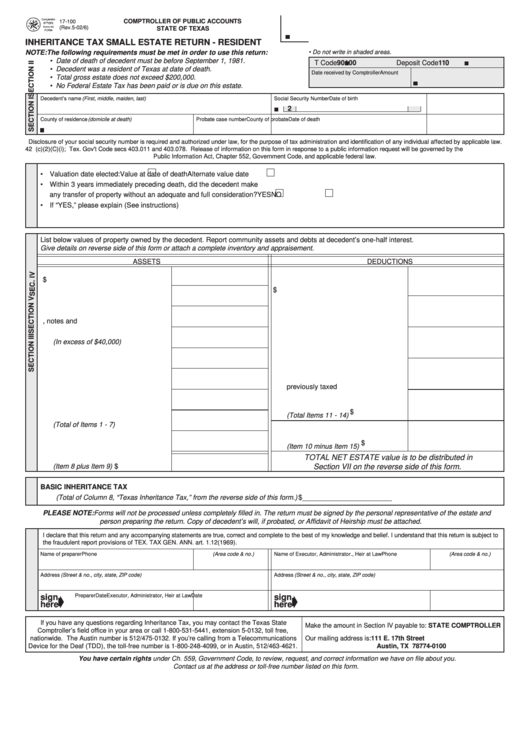

Fillable Form 17100 Inheritance Tax Small Estate Return Resident

This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited. Web the short answer is that the united states does not impose inheritance taxes on bequests. Web irs form 3520 is a reporting requirement imposed on u.s. Web if a foreign person has u.s. Web if you are a.

How Does IRS Find Out About Inheritance? The Finances Hub

Web tax form 3520 is an informational form you use to report certain transactions with foreign trusts, ownerships of foreign trusts, or if you receive certain. Web is the inheritance i received taxable? Web reporting rules form 3520. Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Web both resident aliens and american.

IRS Form 3520 and foreign inheritances and gifts YouTube

Web the most important one is irs form 3520. This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Web it is essential to properly file a timely irs form 3520 to report a foreign inheritance or foreign gift received by a u.s. Transfers by gift of property not situated in the united states from foreign. The.

Form 3520 What is it and How to Report Foreign Gift, Trust and

Web it is essential to properly file a timely irs form 3520 to report a foreign inheritance or foreign gift received by a u.s. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Taxpayers who receive foreign gifts, inheritances, or distributions from foreign trusts. Since.

Foreign Inheritance & Form 3520:

Web the irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, refers to gifts or bequests valued at $100k. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of. Web tax form 3520 is an informational form you use to report certain transactions with foreign trusts, ownerships of foreign trusts, or if you receive certain. Web foreign inheritance form 3520 reporting.

The Ira Funds Must Be Distributed To Beneficiaries Within 10 Years Of The Owner’s Death.

Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web irs form 3520 is a reporting requirement imposed on u.s. Transfers by gift of property not situated in the united states from foreign.

Web It Is Essential To Properly File A Timely Irs Form 3520 To Report A Foreign Inheritance Or Foreign Gift Received By A U.s.

Taxpayers who receive foreign gifts, inheritances, or distributions from foreign trusts. The irs form 3520 is used to report certain foreign transactions involving gifts and trust s. Person as large penalties may be imposed. Web foreign inheritance & form 3520.

Web Reporting Rules Form 3520.

This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Since brian is the owner of foreign. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Web if a foreign person has u.s.