Is Form 3921 Taxable

Is Form 3921 Taxable - It added income limits, price caps and. Each copy goes to a different recipient: Web irs form 3921 is a tax form used to provide employees with information relating to incentive stock options that were exercised during the year. Web no, the startup will not owe any taxes on the employees exercise of isos and form 3921. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. To help figure any amt on the exercise of your iso, see your form 3921. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso).

Web in drake tax, there is no specific data entry screen for form 3921. To help figure any amt on the exercise of your iso, see your form 3921. It does not need to be entered into. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. Web irs form 3921 is a tax form used to provide employees with information relating to incentive stock options that were exercised during the year. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). One form needs to be filed for each transfer of stock that. Web to learn more, see form 6251 instructions at www.irs.gov. What is 3921 tax form?

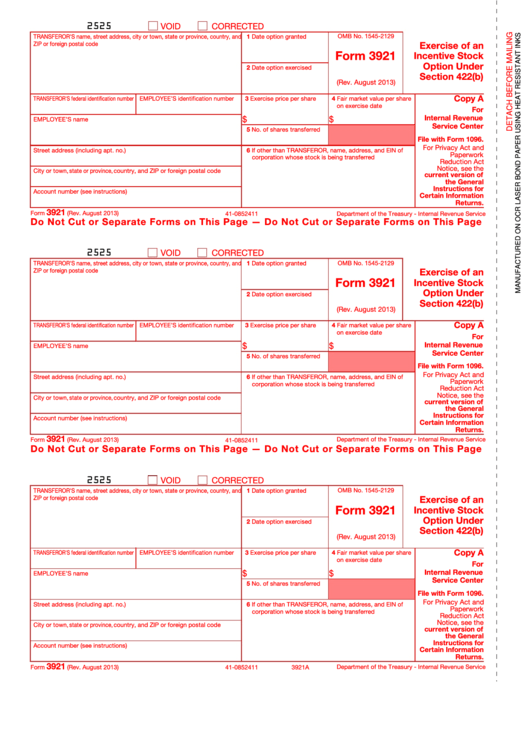

What is 3921 tax form? Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as defined in section 7701(b)) and to whom the corporation is. Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. Form 3921 is an informational report, similar to 1099s, that lets the irs know that certain. Web this is important tax information and is being furnished to the irs. Web there are 4 copies of form 3921, which the employer must file. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. Web no, the startup will not owe any taxes on the employees exercise of isos and form 3921. Web irs form 3921 is a tax form used to provide employees with information relating to incentive stock options that were exercised during the year. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records.

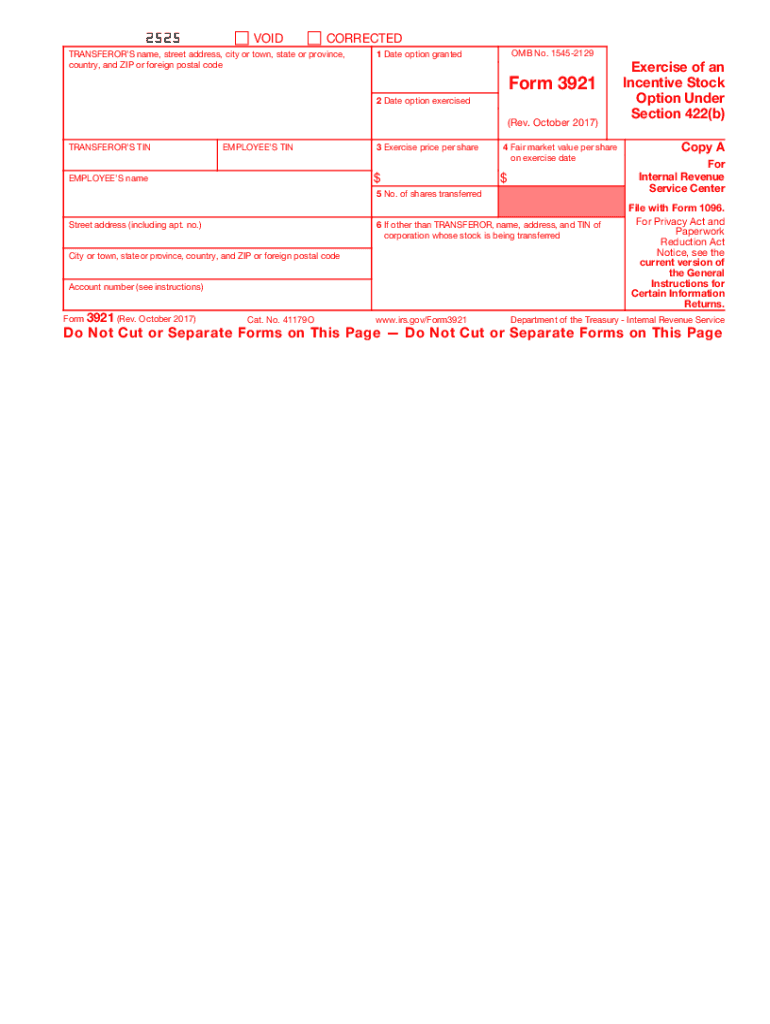

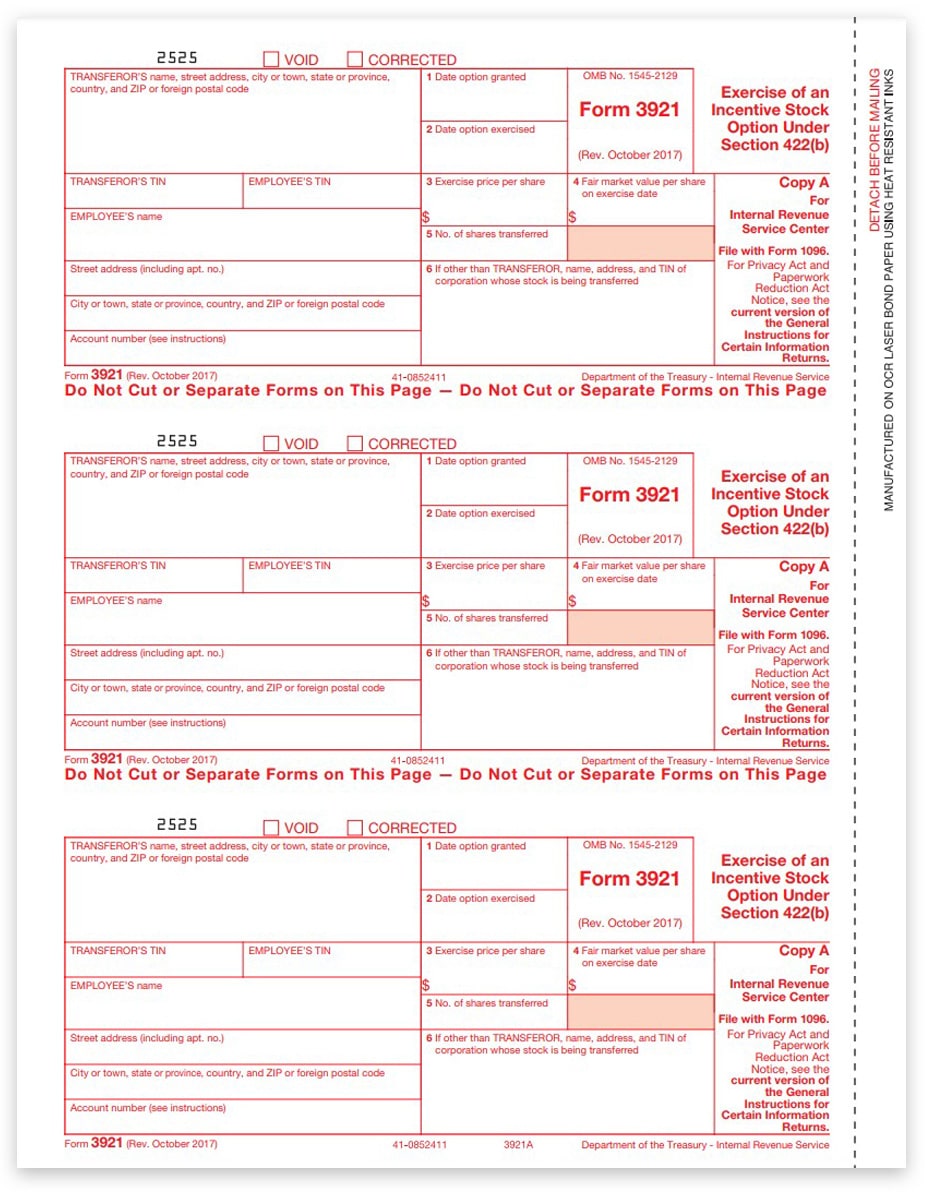

3921 IRS Tax Form Copy A Free Shipping

The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. To help figure any amt on the exercise of your iso, see your form 3921. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is. Your employer must give you. Although this.

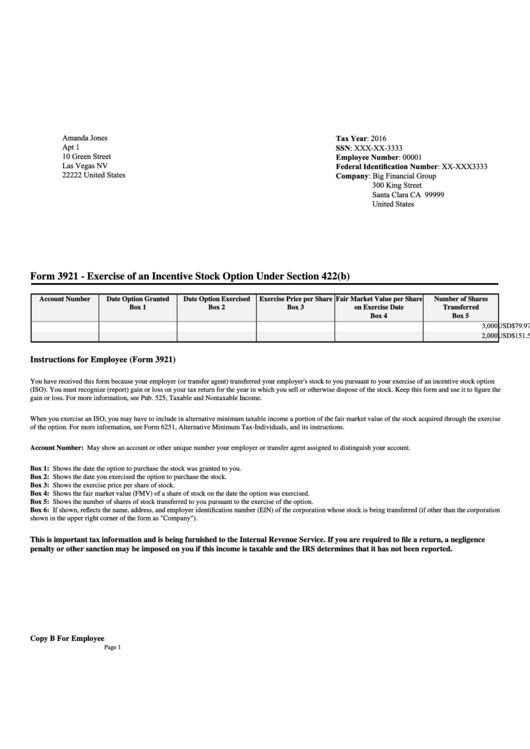

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web irs form 3921 is a tax form used to provide employees with information relating to incentive stock options that were exercised during the year. To help figure any amt on the exercise of your iso, see your form 3921. Web form 3921 is a.

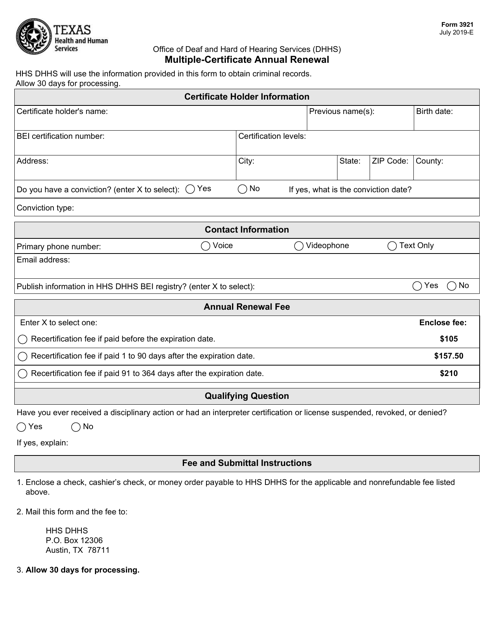

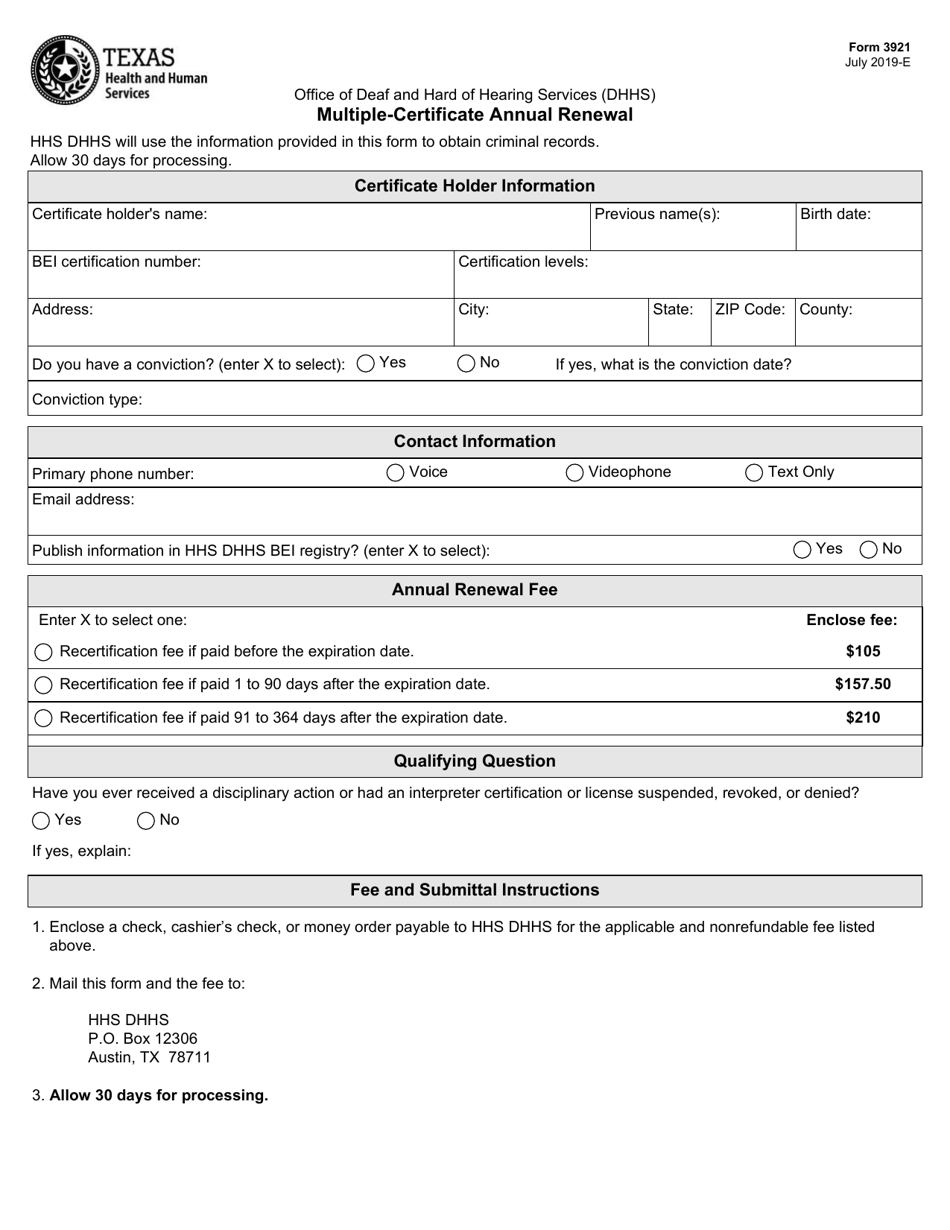

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

1099 pro is a microsoft certified partner, mbe certified and. Web irs form 3921 is a tax form used to provide employees with information relating to incentive stock options that were exercised during the year. What is 3921 tax form? One form needs to be filed for each transfer of stock that. Web the amount to include on this line.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422(B

Web this is important tax information and is being furnished to the irs. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

It added income limits, price caps and. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Web there are 4 copies of form 3921, which the employer must file. Web a form 3921 is not required for the exercise of an incentive stock option.

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. One form needs to be filed for each transfer of stock that. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is..

20172022 Form IRS 3921 Fill Online, Printable, Fillable, Blank pdfFiller

Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web.

3921 Tax Forms for Incentive Stock Option, IRS Copy A DiscountTaxForms

Web the 2023 chevrolet bolt. Web adjunct products include secure hosting and services for information processing, printing, filing and penalty abatement. Web there are 4 copies of form 3921, which the employer must file. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. It.

IRS Form 3921

Each copy goes to a different recipient: Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Although this information is not taxable unless. Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. One form needs to be filed.

3921, Tax Reporting Instructions & Filing Requirements for Form 3921

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web adjunct products include secure hosting and services for information processing, printing, filing and penalty abatement. Web a.

Web Entering Amounts From Form 3921 In The Individual Module Of Lacerte Solved • By Intuit • 283 • Updated July 19, 2022 This Article Will Help You Enter Amounts.

Each copy goes to a different recipient: Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web the amount to include on this line is the total fair market value of the stock when you exercised the option minus any amount you paid to acquire the stock or acquire the. What is 3921 tax form?

Irs Form 3921 Is Used To Report Specific Information About Stock Incentive Options That A Corporation Offers During A Calendar Year.

Web there are 4 copies of form 3921, which the employer must file. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. It does not need to be entered into. Form 3921 is an informational report, similar to 1099s, that lets the irs know that certain.

A Preparer Must Determine If An Entry Is Needed Based On The Facts Of The Transfer.

Web adjunct products include secure hosting and services for information processing, printing, filing and penalty abatement. Although this information is not taxable unless. To help figure any amt on the exercise of your iso, see your form 3921. One form needs to be filed for each transfer of stock that.

Web Form 3921 Exercise Of An Incentive Stock Option Under Section 422 (B), Is For Informational Purposes Only And Should Be Kept With Your Records.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web this is important tax information and is being furnished to the irs. It added income limits, price caps and. Web to learn more, see form 6251 instructions at www.irs.gov.