Iso Tax Form

Iso Tax Form - Web the form helps you collect information for reporting sales of iso shares on your tax return. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. It does not need to. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). The irs receives a copy of the form,. Web isos are reported on your form 1040 tax return in one of three ways, depending on their disposition. Web for early and growth stage companies, isos are the most common form of equity compensation. Web when your compensation includes isos, you will get several tax forms from your employer or brokerage firm. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Every time an employee exercises an iso, the employer.

Web missouri has a state income tax that ranges between 1.5% and 5.4%. Taxing isos the income from isos is subject to regular. Web irs form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. 12 & 24 month bars. Isos give you the option to purchase a set quantity of company. Web when your compensation includes isos, you will get several tax forms from your employer or brokerage firm. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The irs receives a copy of the form,. Every time an employee exercises an iso, the employer. In most cases, incentive stock options provide.

Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). It also helps in the amt calculation at exercise. Web missouri has a state income tax that ranges between 1.5% and 5.4%. Web incentive stock options, or isos, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. The irs receives a copy of the form,. Every time an employee exercises an iso, the employer. Web the form helps you collect information for reporting sales of iso shares on your tax return. Taxing isos the income from isos is subject to regular. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income.

Stock Options and Restricted Stock What You Need to Know About Taxes

Web irs form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Every time an employee exercises an iso, the employer. Web for early and growth stage companies, isos are the most common form of equity compensation. Incentive stock options (isos) and 2. Send all information.

IRS Circular 230 Tax Advice IRS Tax Attorney

In most cases, incentive stock options provide. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. The amt is a separate tax that is imposed in addition to your regular tax. Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have.

Irs.gov Form 1040a 2016 Form Resume Examples dO3wPXGE8E

The irs receives a copy of the form,. Send all information returns filed on paper to the following. Web the form helps you collect information for reporting sales of iso shares on your tax return. Web missouri has a state income tax that ranges between 1.5% and 5.4%. You must file your taxes yearly by april 15.

Top Iso Forms And Templates free to download in PDF format

Web missouri has a state income tax that ranges between 1.5% and 5.4%. It does not need to. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web isos are reported on your form 1040 tax return in one of three ways,.

ISO Tax Form & Reduce AMT Tax on Stock Options by 83(b) ESO FUND

Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web incentive stock options, or isos, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain. 12 & 24 month bars. It also helps in the amt calculation at exercise. The.

Top Iso Forms And Templates free to download in PDF format

Every time an employee exercises an iso, the employer. Web when your compensation includes isos, you will get several tax forms from your employer or brokerage firm. Web irs form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Web trade or business is not subject.

How to Calculate ISO Alternative Minimum Tax (AMT) 2021

Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have to use form 6251 to determine if you owe any. Web missouri has a state income tax that ranges between 1.5% and 5.4%. Web when your compensation includes isos, you will get several tax forms from your employer or brokerage firm..

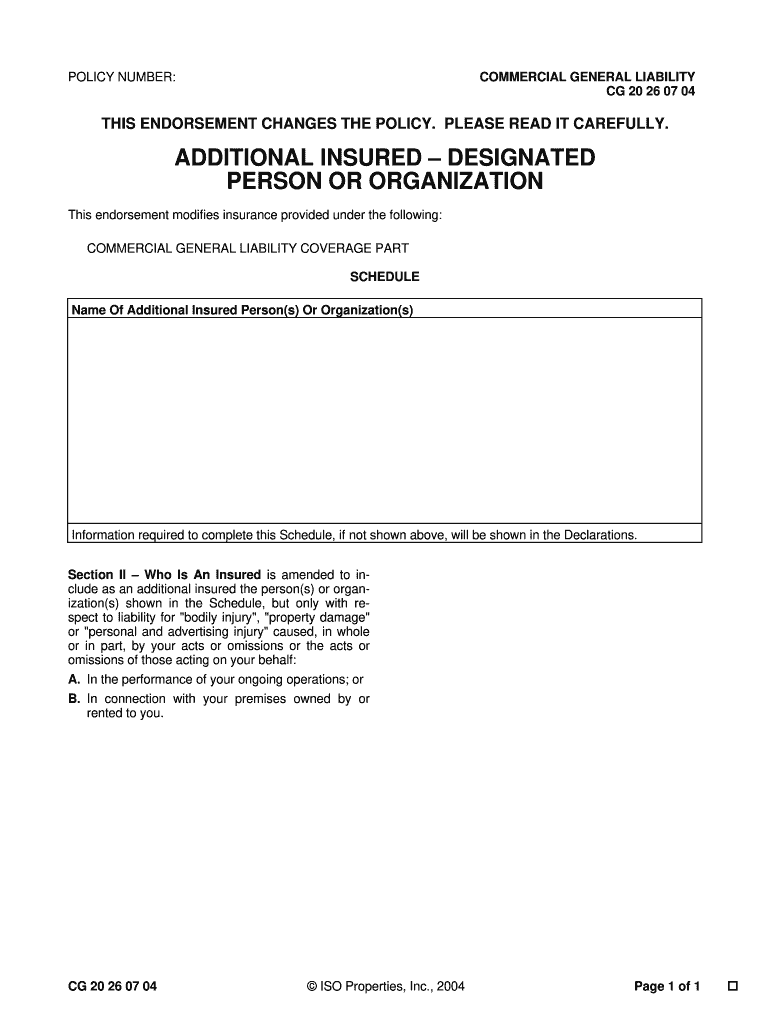

Iso Forms And Endorsements Fill Online, Printable, Fillable, Blank

You must file your taxes yearly by april 15. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. The amt is a separate tax that is imposed in addition to your.

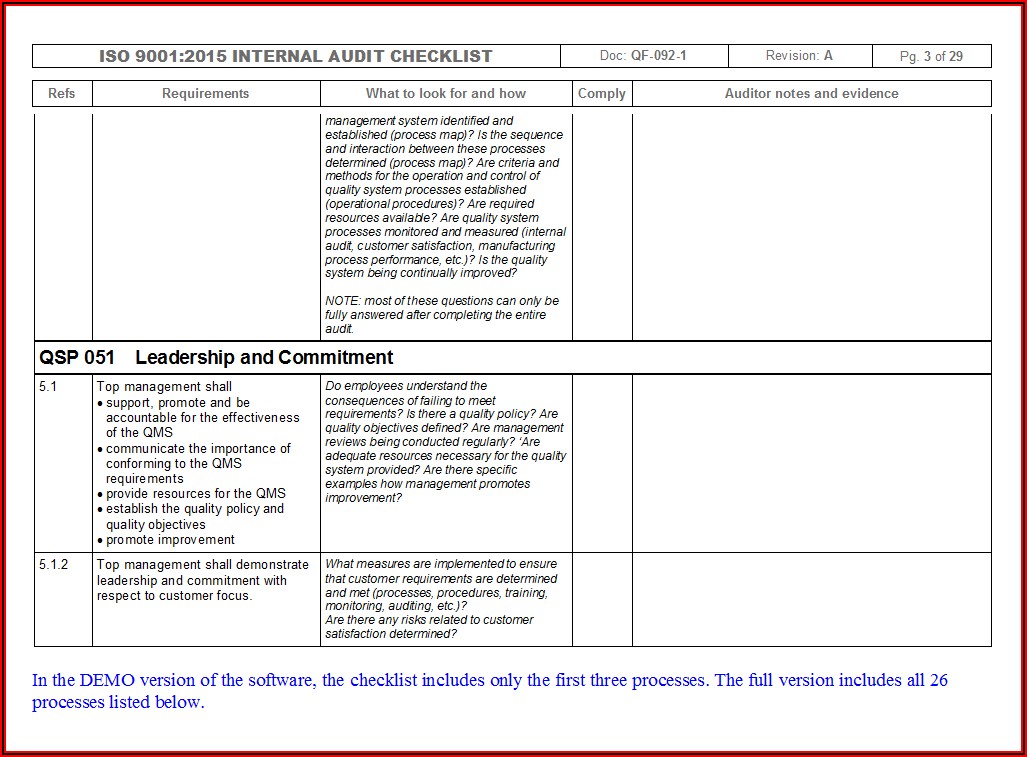

Iso 9001 Internal Audit Checklist Template Template 2 Resume

Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web when your compensation includes isos, you will get several tax forms from your employer or brokerage firm. Web missouri has a state income tax that ranges between 1.5% and 5.4%. Web corporations file this form for each transfer of stock to any person.

Stock Option Compensation Your Cheat Sheet to Planning Monument

The irs receives a copy of the form,. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Isos give you the option to purchase a set quantity of company. In most cases, incentive stock options provide. Web this page provides the addresses for taxpayers and tax professionals to mail paper.

The Irs Receives A Copy Of The Form,.

It also helps in the amt calculation at exercise. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web missouri has a state income tax that ranges between 1.5% and 5.4%.

Taxing Isos The Income From Isos Is Subject To Regular.

Web the form helps you collect information for reporting sales of iso shares on your tax return. Web when your compensation includes isos, you will get several tax forms from your employer or brokerage firm. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt is a separate tax that is imposed in addition to your regular tax.

It Does Not Need To.

Isos give you the option to purchase a set quantity of company. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have to use form 6251 to determine if you owe any. Web isos are reported on your form 1040 tax return in one of three ways, depending on their disposition.

Every Time An Employee Exercises An Iso, The Employer.

Web incentive stock options, or isos, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain. Incentive stock options (isos) and 2. Send all information returns filed on paper to the following. 12 & 24 month bars.

.png)