K-5 Tax Form

K-5 Tax Form - Under the authority of the finance. If claiming a foreign tax. However, due to differences between state and. Beginning january 2019, employers and payers issuing 25 or fewer withholding statements. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. 12th st.) or at the water services department (4800 e. It is important to make this final payment on time (along with the rest of the payments, of. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Other web filing methods are still available for wage and tax. Employers and payers who issue kentucky.

It is important to make this final payment on time (along with the rest of the payments, of. This form is for income earned in tax year. 12th st.) or at the water services department (4800 e. However, due to differences between state and. Please update your bookmarks to this new location. Other web filing methods are still available for wage and tax. Divide the gross annual kentucky tax by the number of annual pay. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Web here is a link to its new location. Kentucky has also published instructions for this form.

Divide the gross annual kentucky tax by the number of annual pay. Kentucky has also published instructions for this form. 12th st.) or at the water services department (4800 e. Beginning january 2019, employers and payers issuing 25 or fewer withholding statements. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name federal. However, due to differences between state and. The kentucky department of revenue conducts work. Other web filing methods are still available for wage and tax. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024.

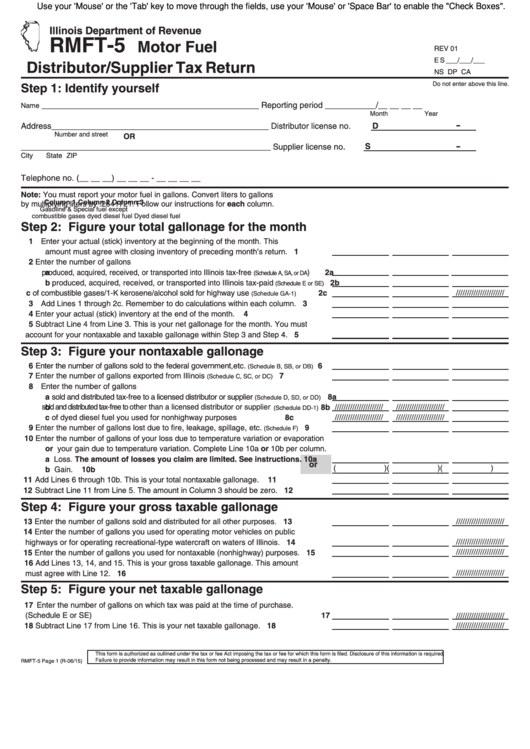

Fillable Form Rmft5 Motor Fuel Distributor/supplier Tax Return

63rd st.) using cash, check or credit card. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. This form is for income earned in tax year. Other web filing methods are still available for wage and tax. Web water bills can be paid online or in person at city hall (414.

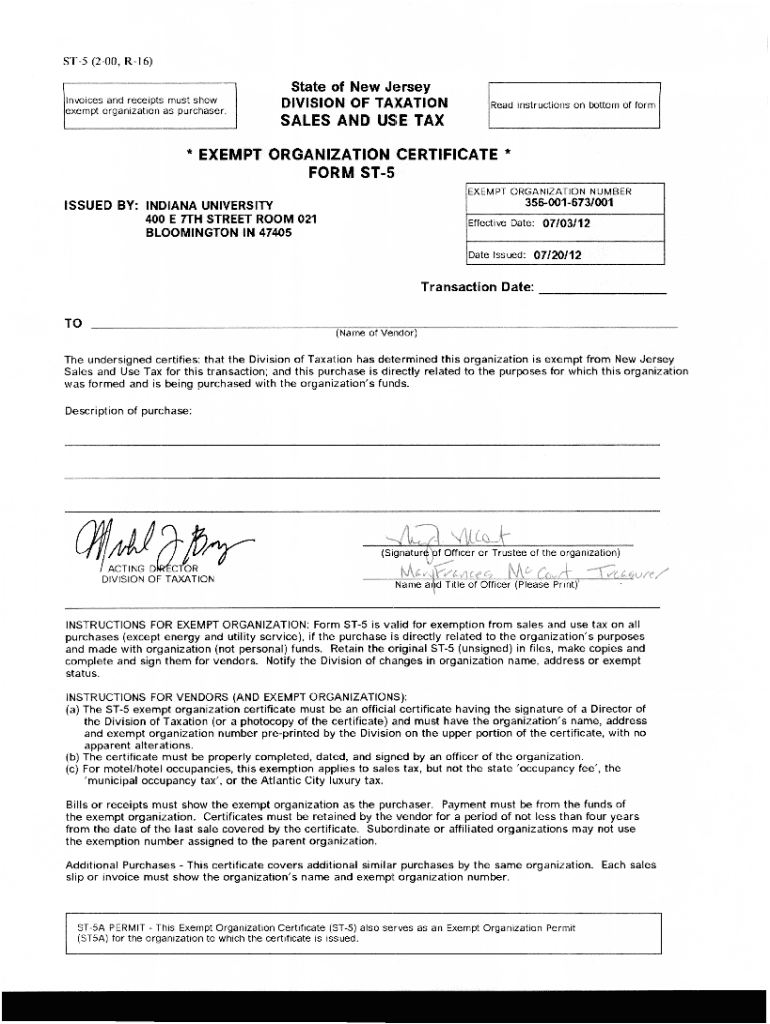

St5 Form Fill Out and Sign Printable PDF Template signNow

Divide the gross annual kentucky tax by the number of annual pay. However, due to differences between state and. If claiming a foreign tax. Under the authority of the finance. Beginning january 2019, employers and payers issuing 25 or fewer withholding statements.

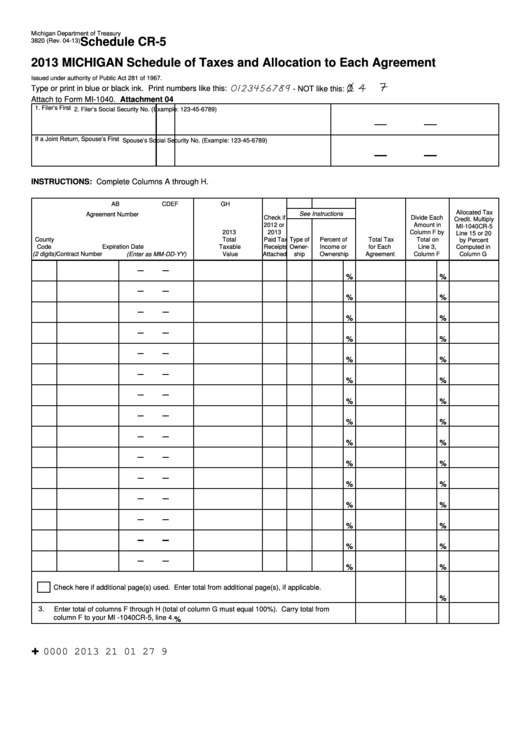

Fillable Schedule Cr5 (Form 3820) Michigan Schedule Of Taxes And

Beginning january 2019, employers and payers issuing 25 or fewer withholding statements. Please update your bookmarks to this new location. 63rd st.) using cash, check or credit card. Divide the gross annual kentucky tax by the number of annual pay. Web water bills can be paid online or in person at city hall (414 e.

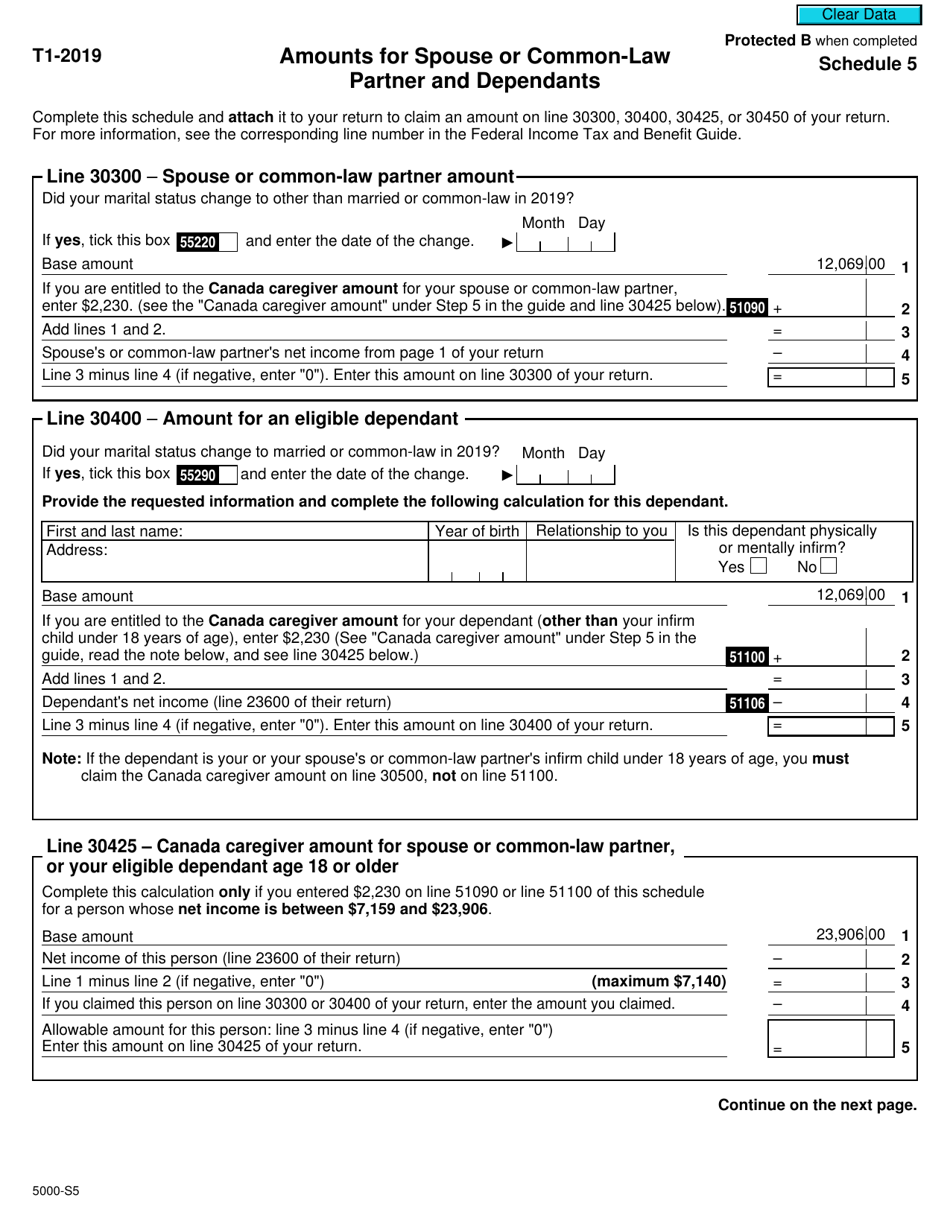

Form 5000S5 Schedule 5 Download Fillable PDF or Fill Online Amounts

Employers and payers who issue kentucky. 12th st.) or at the water services department (4800 e. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Web water bills can be paid online or in person at city hall (414 e. This form is for income earned in tax year.

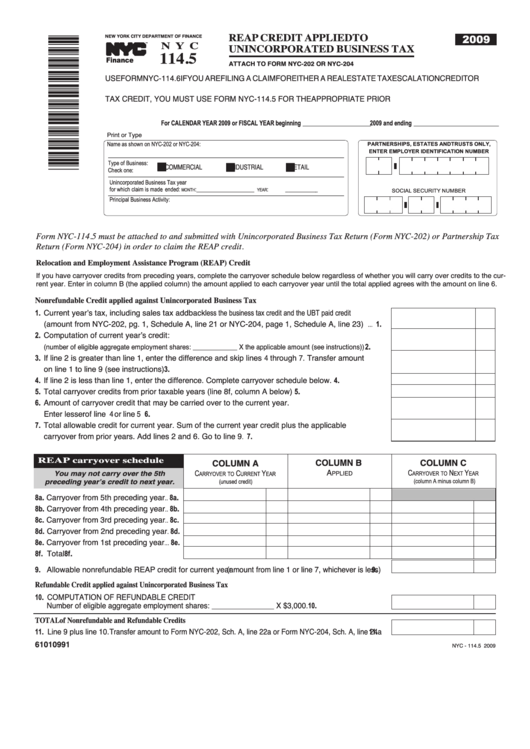

Form Nyc 114.5 Reap Credit Applied To Unincorporated Business Tax

It is important to make this final payment on time (along with the rest of the payments, of. Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name federal. 63rd st.) using cash, check or credit card. Under the authority of the finance. If claiming a foreign tax.

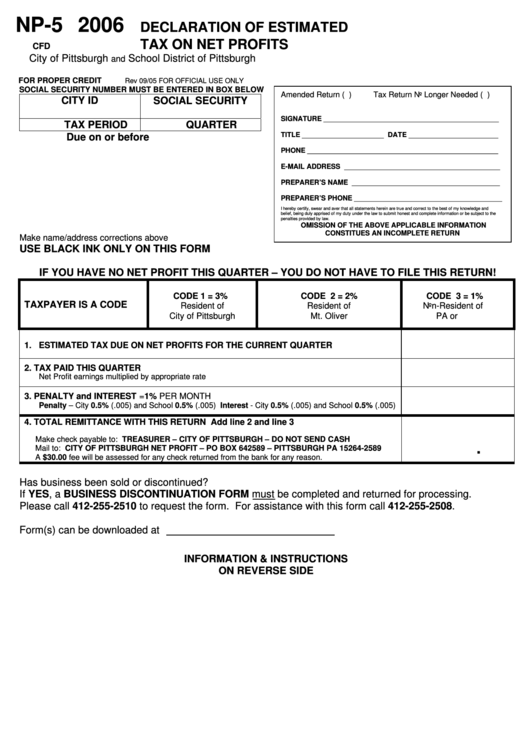

Form Np5 Declaration Of Estimated Tax On Net Profits 2006

The kentucky department of revenue conducts work. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Other web filing methods are still available for wage and tax. Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name federal. Kentucky has also published instructions for this.

20092022 Form MA DoR ST5 Fill Online, Printable, Fillable, Blank

Web water bills can be paid online or in person at city hall (414 e. Divide the gross annual kentucky tax by the number of annual pay. Please update your bookmarks to this new location. However, due to differences between state and. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax.

Nc Nc5 Form Fill Online, Printable, Fillable, Blank pdfFiller

If claiming a foreign tax. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Other web filing methods are still available for.

NJ DoT LF5 2020 Fill out Tax Template Online US Legal Forms

Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Beginning january 2019, employers and payers issuing 25 or fewer withholding statements. If claiming a foreign tax. Divide the gross annual kentucky tax by the number of annual pay. This form is for income earned in tax year.

2008 Form NJ DoT ST8 Fill Online, Printable, Fillable, Blank pdfFiller

Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name federal. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more.

It Is Important To Make This Final Payment On Time (Along With The Rest Of The Payments, Of.

Web water bills can be paid online or in person at city hall (414 e. 12th st.) or at the water services department (4800 e. Under the authority of the finance. Beginning january 2019, employers and payers issuing 25 or fewer withholding statements.

The Kentucky Department Of Revenue Conducts Work.

Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Please update your bookmarks to this new location. Employers and payers who issue kentucky. If claiming a foreign tax.

Web Here Is A Link To Its New Location.

This form is for income earned in tax year. Kentucky has also published instructions for this form. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. 63rd st.) using cash, check or credit card.

However, Due To Differences Between State And.

Divide the gross annual kentucky tax by the number of annual pay. Web compute tax on wages using the 5% kentucky flat tax rate to determine gross annual kentucky tax. Web department of revenue corrected report of kentucky withholding statements kentucky withholding account number business name federal. Other web filing methods are still available for wage and tax.