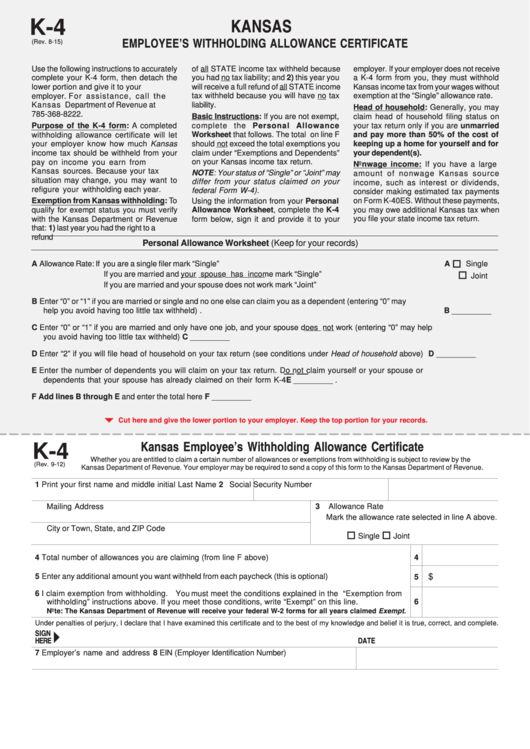

K4 Tax Form

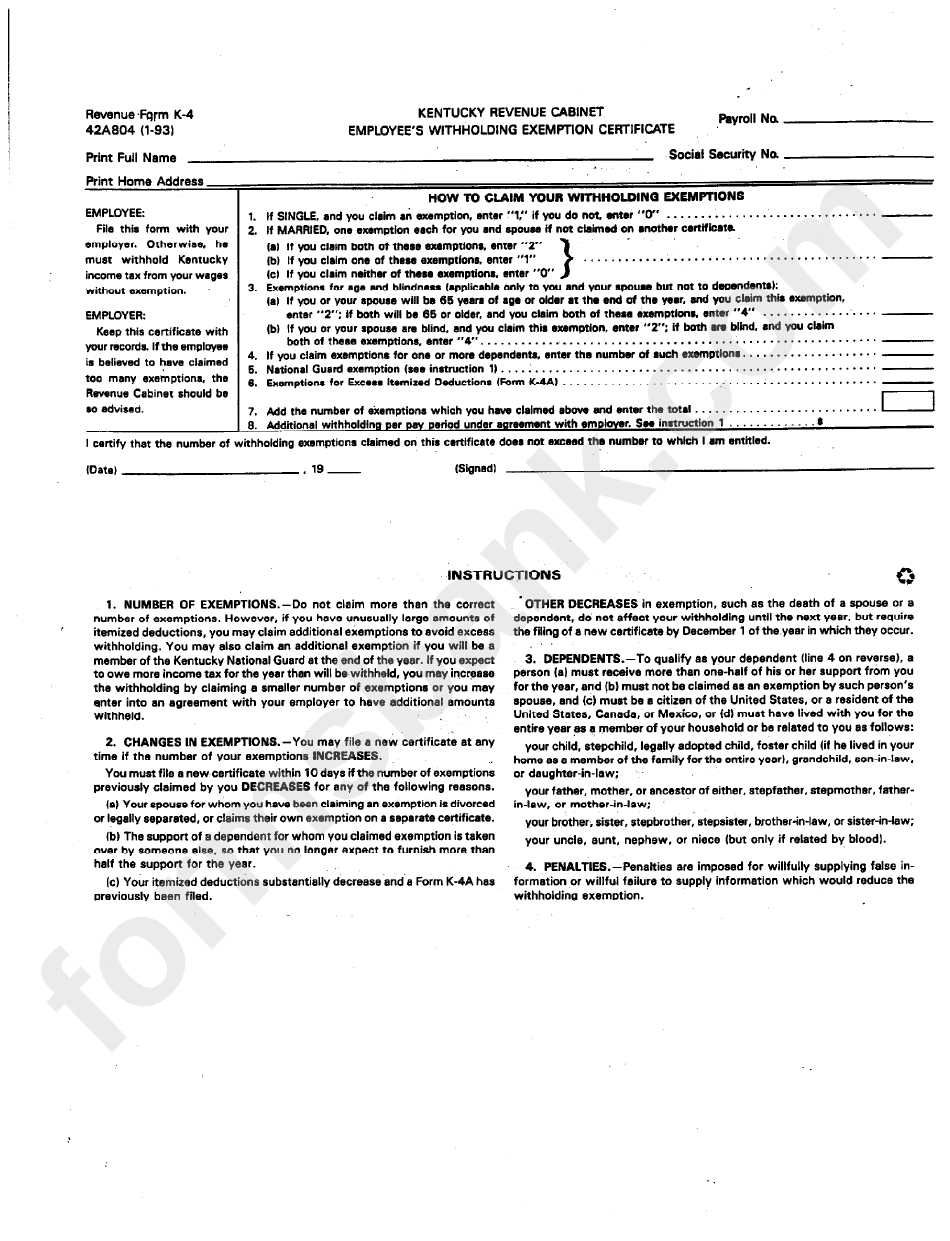

K4 Tax Form - A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Sign it in a few clicks. This form is for income earned in tax year 2022, with tax returns due in april. Edit your kentucky k 4 fillable tax form online. File your state taxes online; Type text, add images, blackout confidential details, add comments, highlights and more. State and federal tax policies and laws differ. Web kentucky’s 2022 withholding formula was released dec. Compared to the 2021 version, the formula’s standard deduction. 15 by the state revenue department.

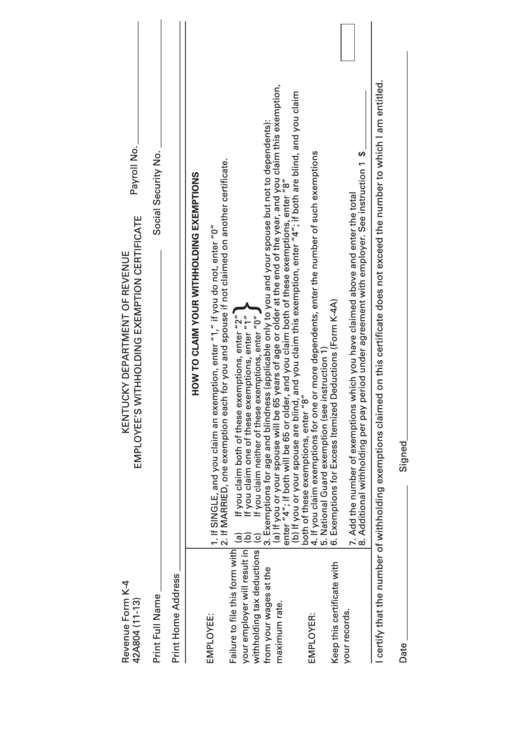

Type text, add images, blackout confidential details, add comments, highlights and more. 15 by the state revenue department. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web kentucky’s 2022 withholding formula was released dec. You may be exempt from withholding if any of. Web instructions to employees all kentucky wage earners are taxed at a flat 4.5% tax rate with an allowance for the standard deduction. You may be exempt from withholding if any of the. To allow for these differences. File your state taxes online; This form is for income earned in tax year 2022, with tax returns due in april.

Sign it in a few clicks. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. State and federal tax policies and laws differ. This form is for income earned in tax year 2022, with tax returns due in april. To allow for these differences. Edit your kentucky k 4 fillable tax form online. 15 by the state revenue department. Compared to the 2021 version, the formula’s standard deduction. Web if you expect to owe more income tax for the year than will be withheld, you may increase the withholding by claiming a smaller number of exemptions or you may enter into an. You may be exempt from withholding if any of the.

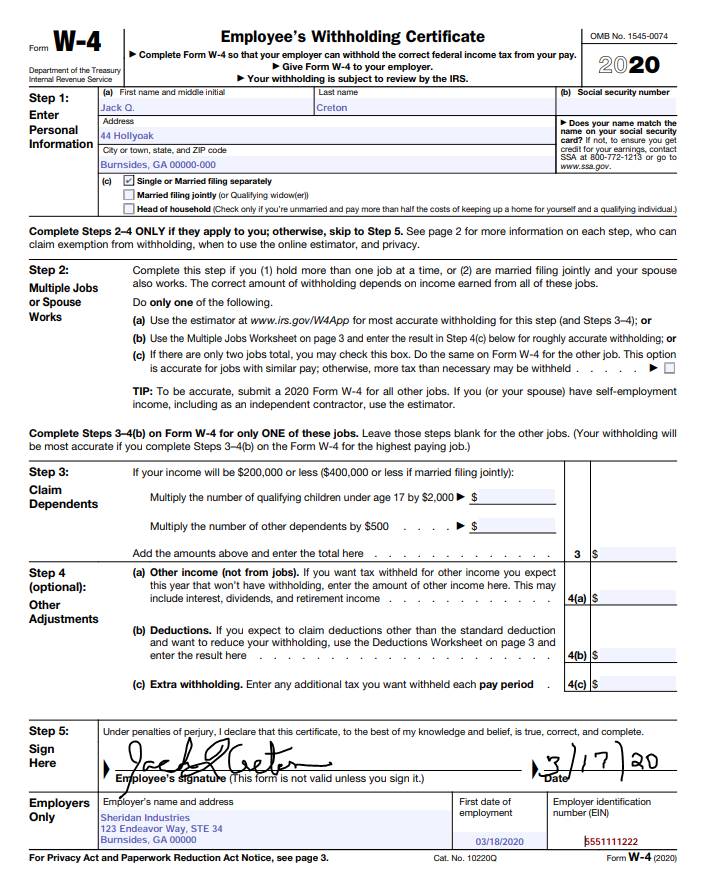

Il W 4 2020 2022 W4 Form

Type text, add images, blackout confidential details, add comments, highlights and more. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Sign it in a few clicks. You may be exempt from withholding if any of the. A completed withholding allowance certificate will let your employer.

What Is a W4 Form and How Does it Work? Form W4 for Employers

15 by the state revenue department. To allow for these differences. Type text, add images, blackout confidential details, add comments, highlights and more. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web if you expect to owe more income tax for the year than will be.

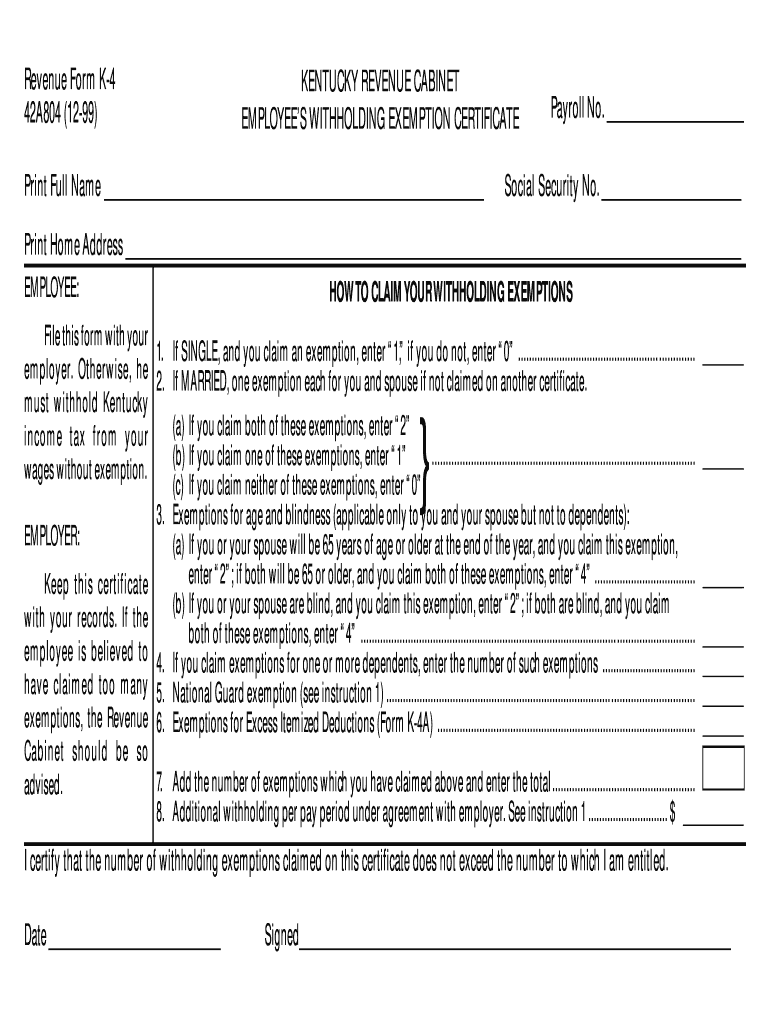

1999 KY DoR 42A804 Form K4 Fill Online, Printable, Fillable, Blank

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. State and federal tax policies and laws differ. To allow for these differences. You may be exempt from withholding if any of. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld.

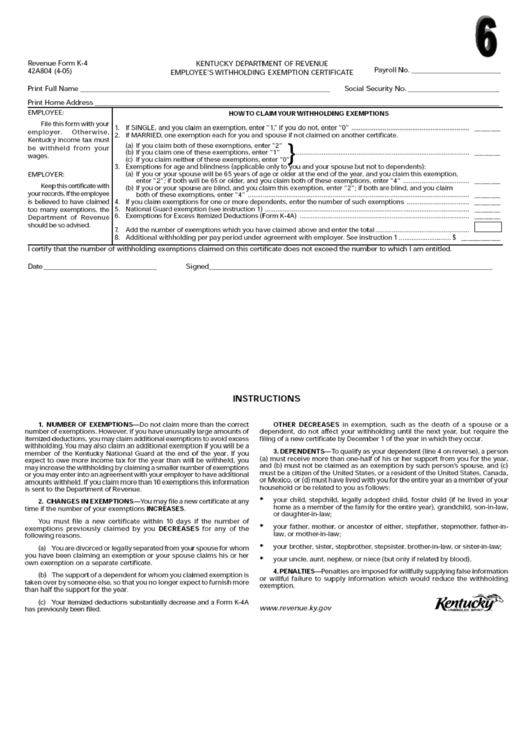

Top Kentucky Form K4 Templates free to download in PDF format

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. You may be exempt from withholding if any of. Compared to the 2021 version, the.

Kansas K4 App

To allow for these differences. Sign it in a few clicks. File your state taxes online; State and federal tax policies and laws differ. You may be exempt from withholding if any of.

Kentucky K4 App

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. 15 by the state revenue department. Compared to the 2021 version, the formula’s standard deduction. Web kentucky’s 2022 withholding formula was released dec. To allow for these differences.

Kansas K4 App

This form is for income earned in tax year 2022, with tax returns due in april. Compared to the 2021 version, the formula’s standard deduction. You may be exempt from withholding if any of. 15 by the state revenue department. Web if you expect to owe more income tax for the year than will be withheld, you may increase the.

Fillable Form K4 Employee'S Withholding Exemption Certificate

State and federal tax policies and laws differ. Web if you expect to owe more income tax for the year than will be withheld, you may increase the withholding by claiming a smaller number of exemptions or you may enter into an. Web instructions to employees all kentucky wage earners are taxed at a flat 4.5% tax rate with an.

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web instructions to employees all kentucky wage earners are taxed at a flat 4.5% tax rate with an allowance for the standard deduction. Web kentucky’s 2022 withholding formula was released dec. You may be exempt from withholding if any of.

Top Kentucky Form K4 Templates free to download in PDF format

Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. This form is for income earned in tax year 2022, with tax returns due in april. You may be exempt from withholding if any of. 15 by the state revenue department. File your state taxes online;

Web Instructions To Employees All Kentucky Wage Earners Are Taxed At A Flat 4.5% Tax Rate With An Allowance For The Standard Deduction.

15 by the state revenue department. Edit your kentucky k 4 fillable tax form online. Web if you expect to owe more income tax for the year than will be withheld, you may increase the withholding by claiming a smaller number of exemptions or you may enter into an. You may be exempt from withholding if any of.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Sign it in a few clicks. Web kentucky’s 2022 withholding formula was released dec. Compared to the 2021 version, the formula’s standard deduction. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On.

You may be exempt from withholding if any of the. State and federal tax policies and laws differ. To allow for these differences. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

File your state taxes online;