Kentucky Form 8863-K

Kentucky Form 8863-K - 1720 kentucky tax forms and templates are collected for any of your needs. This form is for income. Web you must attach the federal form 8863. Kentucky education tuition tax credit. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. Part iii, lifetime learning credit—you must enter student’s. Total tentative credits for all students on line 2. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. Web you must attach the federal form 8863. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses.

The hope credit and the lifetime learning credit. Web must attach the federal form 8863. 2008 kentucky education tuition tax credit enter name(s) as. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. Part i—qualifications ye sno are all expenses claimed on this form for. Web you must attach the federal form 8863. Total tentative credits for all students on line 2. The hope credit and the lifetime. Web you must attach the federal form 8863. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses.

Web you must attach the federal form 8863. This form is for income. 2008 kentucky education tuition tax credit enter name(s) as. Part i—qualifications ye sno are all expenses claimed on this form for. Web must attach the federal form 8863. Total tentative credits for all students on line 2. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. The hope credit and the lifetime learning credit.

K Is For Key Letter K Template printable pdf download

If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. Part iii, lifetime learning credit—you must enter student’s. Total tentative credits for all students on line 2. Web you must attach the federal form 8863. 1720 kentucky tax forms and templates are collected for any of your needs.

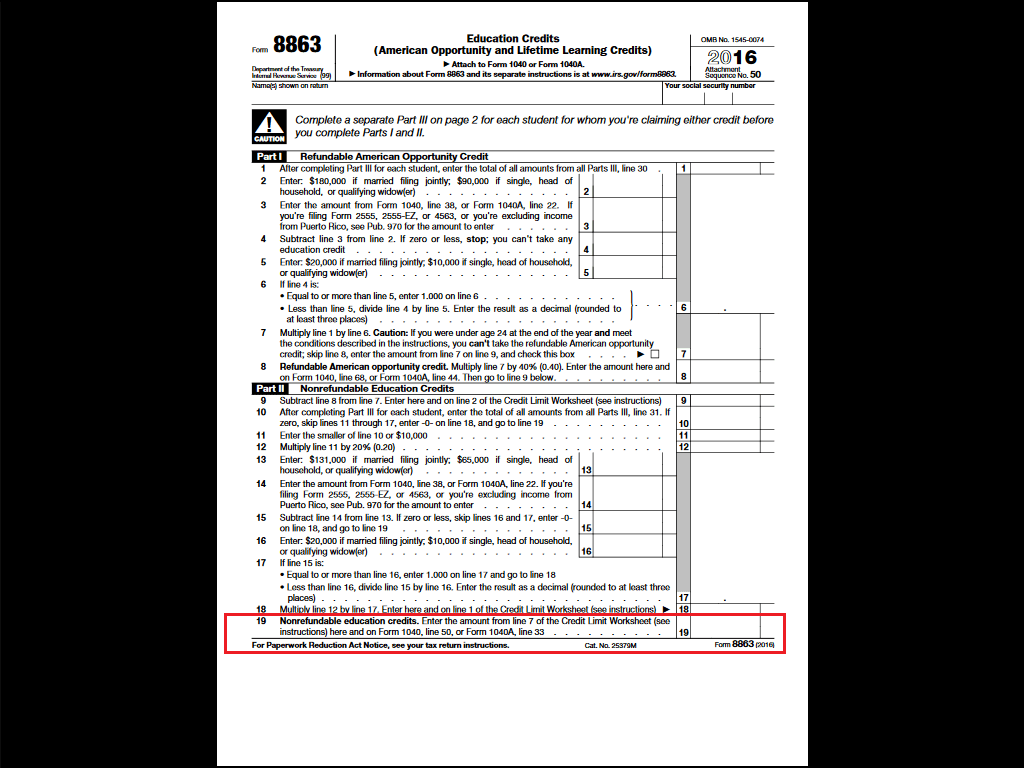

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

The hope credit and the lifetime learning credit. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. Total tentative credits for all students on line 2. The hope credit and the lifetime. 1720 kentucky tax forms and templates are collected for.

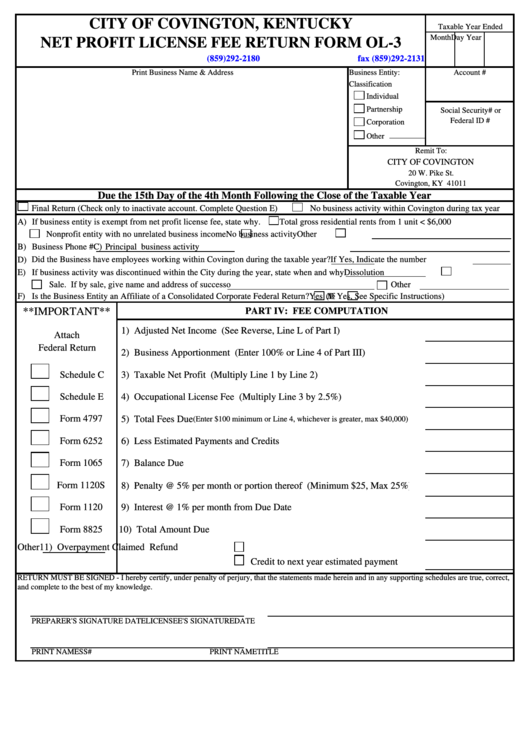

29 Kentucky Department Of Revenue Forms And Templates free to download

Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. Kentucky education tuition tax credit. Web you must attach the federal form 8863. 1720 kentucky tax forms and templates are collected for any of your needs. Web must attach the federal form.

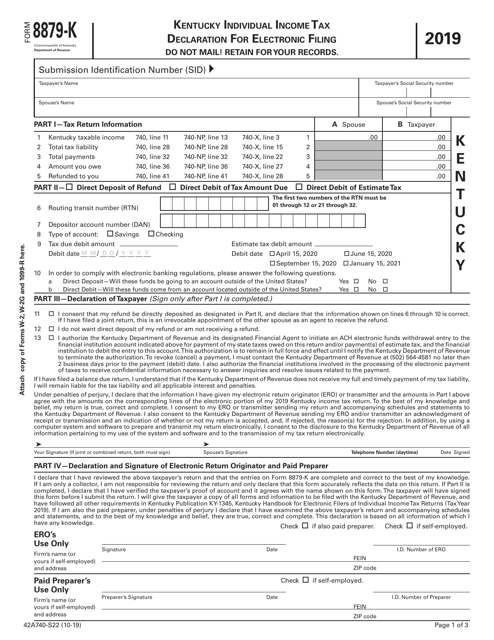

Form 8879K (42A740S22) Download Printable PDF or Fill Online Kentucky

An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. Kentucky education tuition tax credit. Web must attach the federal form 8863. The hope credit and the lifetime learning credit. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount.

Form 886 A Worksheet Worksheet List

Web you must attach the federal form 8863. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. Part iii, lifetime learning credit—you must enter student’s. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless..

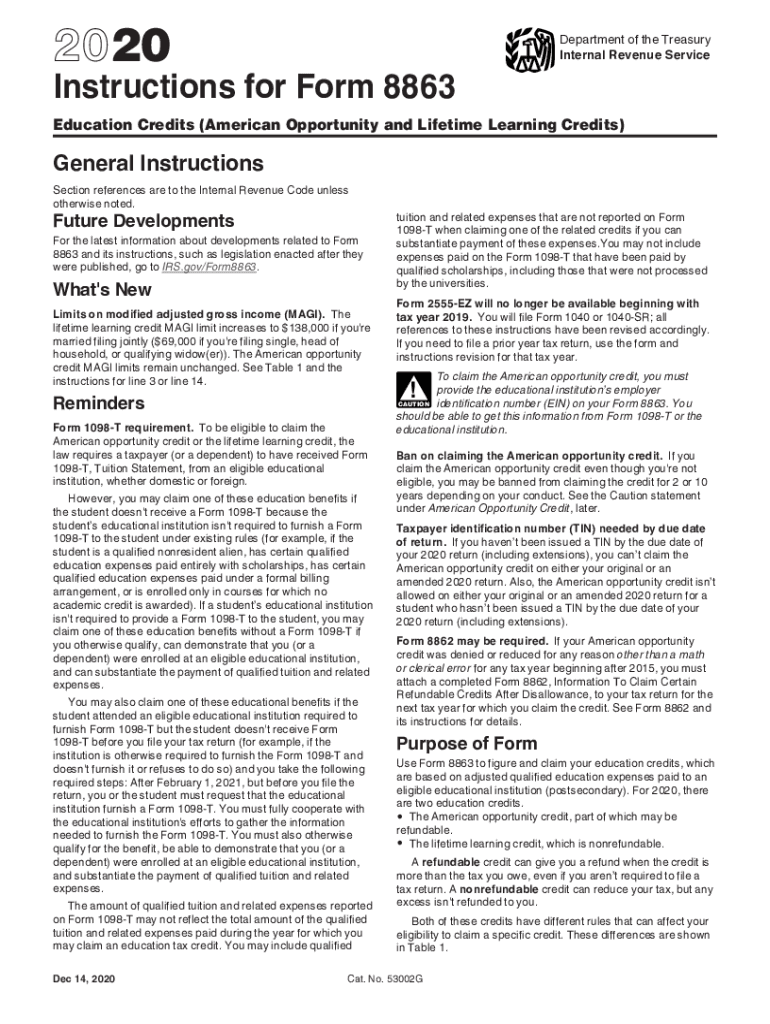

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Web you must attach the federal form 8863. This form is for income. The hope credit and the lifetime. Kentucky education tuition tax credit. The hope credit and the lifetime learning credit.

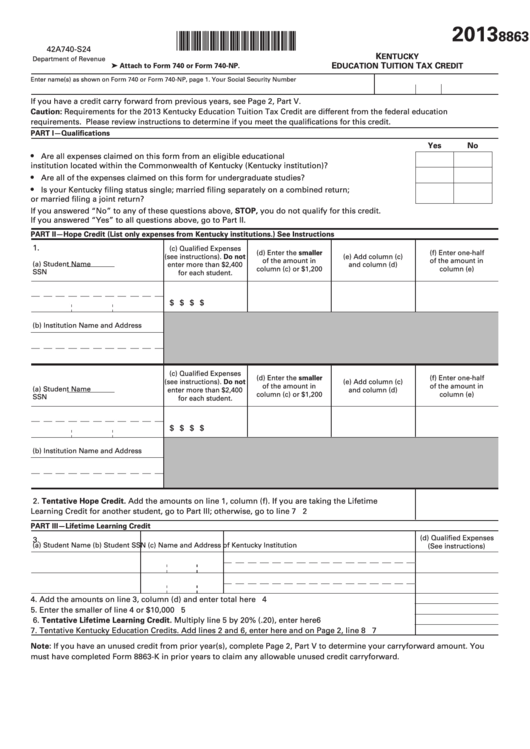

Form 8863K Kentucky Education Tuition Tax Credit 2013 printable

Total tentative credits for all students on line 2. The hope credit and the lifetime learning credit. Web you must attach the federal form 8863. Kentucky education tuition tax credit. The hope credit and the lifetime.

740 Packet—2008 Kentucky Individual Tax Booklet, Forms and Instructio…

Total tentative credits for all students on line 2. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. This form is for income. Web you must attach the federal form 8863. 1720 kentucky tax forms and templates are collected for any of your needs.

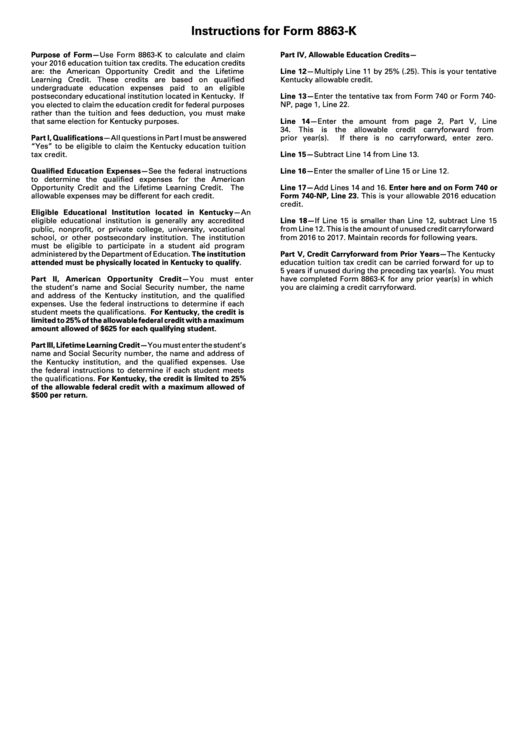

Instructions For Form 8863K Kentucky Education Tuition Tax Credit

Part iii, lifetime learning credit—you must enter student’s. Part i—qualifications ye sno are all expenses claimed on this form for. 1720 kentucky tax forms and templates are collected for any of your needs. The hope credit and the lifetime learning credit. Web you must attach the federal form 8863.

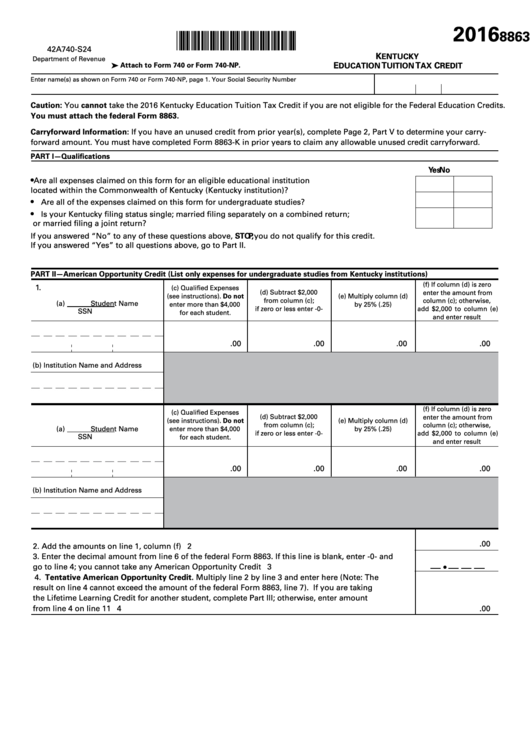

Form 8863K Kentucky Education Tax Credit 2016 printable pdf download

An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. 1720 kentucky tax forms and templates are collected for any of your needs. Total tentative credits for all students on line 2. 2008 kentucky education tuition tax.

Part I—Qualifications Ye Sno Are All Expenses Claimed On This Form For.

The hope credit and the lifetime. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. Kentucky education tuition tax credit. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless.

This Form Is For Income.

1720 kentucky tax forms and templates are collected for any of your needs. Part iii, lifetime learning credit—you must enter student’s. Web you must attach the federal form 8863. Web must attach the federal form 8863.

The Hope Credit And The Lifetime Learning Credit.

Web you must attach the federal form 8863. 2008 kentucky education tuition tax credit enter name(s) as. Total tentative credits for all students on line 2. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount.