Kentucky Form Pte Instructions 2022

Kentucky Form Pte Instructions 2022 - Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. Web kentucky tax law changes. We last updated the owner's share of income, credits, deductions, etc. Web form pte (2022) section a—income (loss) and deductions total amount. For specific instructions for this form, refer to the nrwh packet. 1 kentucky ordinary income (loss) from trade or business activites (page 2, part i, line 21) 2 net income (loss) from rental real estate activities (attach federal form 8825) 3 (a) gross income from other rental activities (b) less expenses from other rental activities (attach

Web kentucky tax law changes. For specific instructions for this form, refer to the nrwh packet. We last updated the owner's share of income, credits, deductions, etc. Web form pte (2022) section a—income (loss) and deductions total amount. Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. 1 kentucky ordinary income (loss) from trade or business activites (page 2, part i, line 21) 2 net income (loss) from rental real estate activities (attach federal form 8825) 3 (a) gross income from other rental activities (b) less expenses from other rental activities (attach

Web kentucky tax law changes. For specific instructions for this form, refer to the nrwh packet. Web form pte (2022) section a—income (loss) and deductions total amount. Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. 1 kentucky ordinary income (loss) from trade or business activites (page 2, part i, line 21) 2 net income (loss) from rental real estate activities (attach federal form 8825) 3 (a) gross income from other rental activities (b) less expenses from other rental activities (attach We last updated the owner's share of income, credits, deductions, etc.

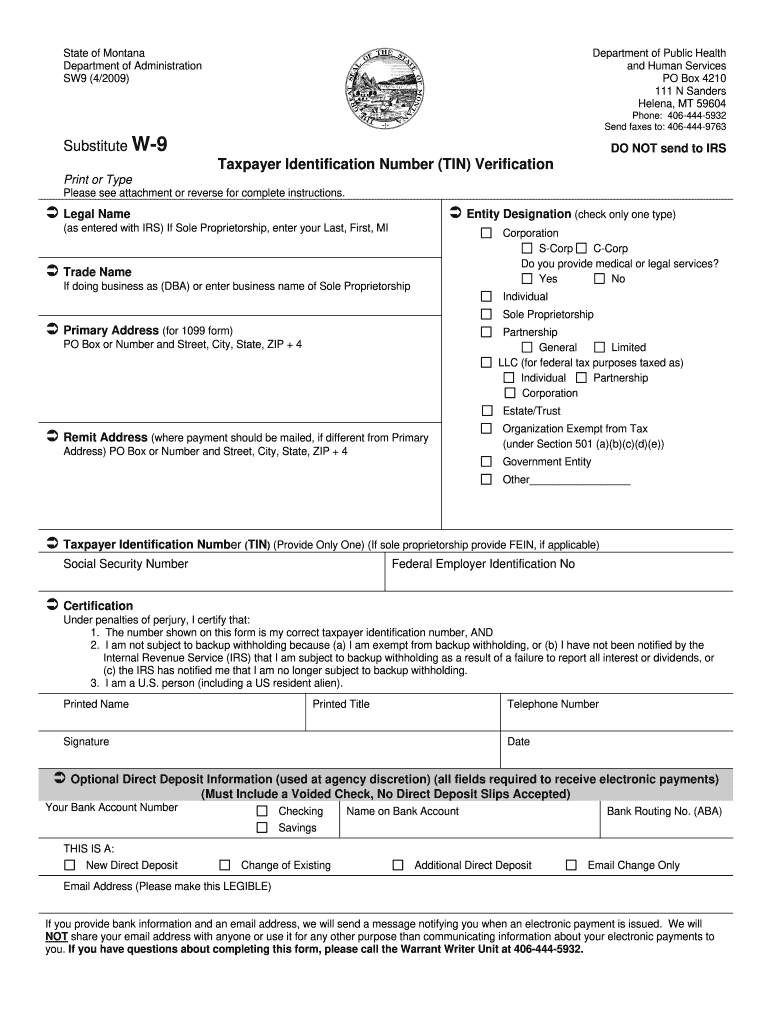

Montana W9 Form Fill Out and Sign Printable PDF Template signNow

1 kentucky ordinary income (loss) from trade or business activites (page 2, part i, line 21) 2 net income (loss) from rental real estate activities (attach federal form 8825) 3 (a) gross income from other rental activities (b) less expenses from other rental activities (attach Web kentucky tax law changes. Web form pte (2022) section a—income (loss) and deductions total.

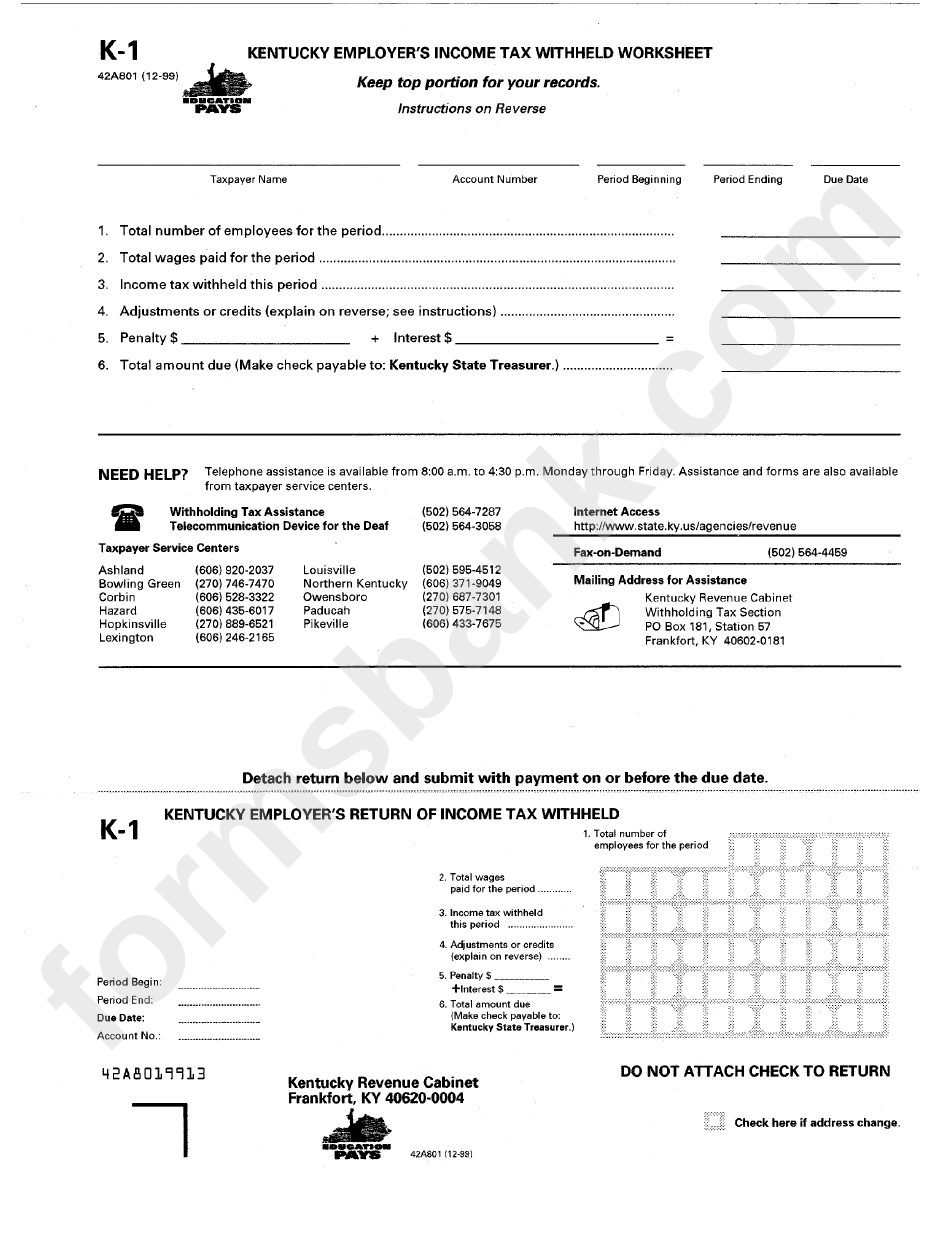

Ky State Tax Withholding Form

Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. Web kentucky tax law changes. For specific instructions for this form, refer to the nrwh packet. We.

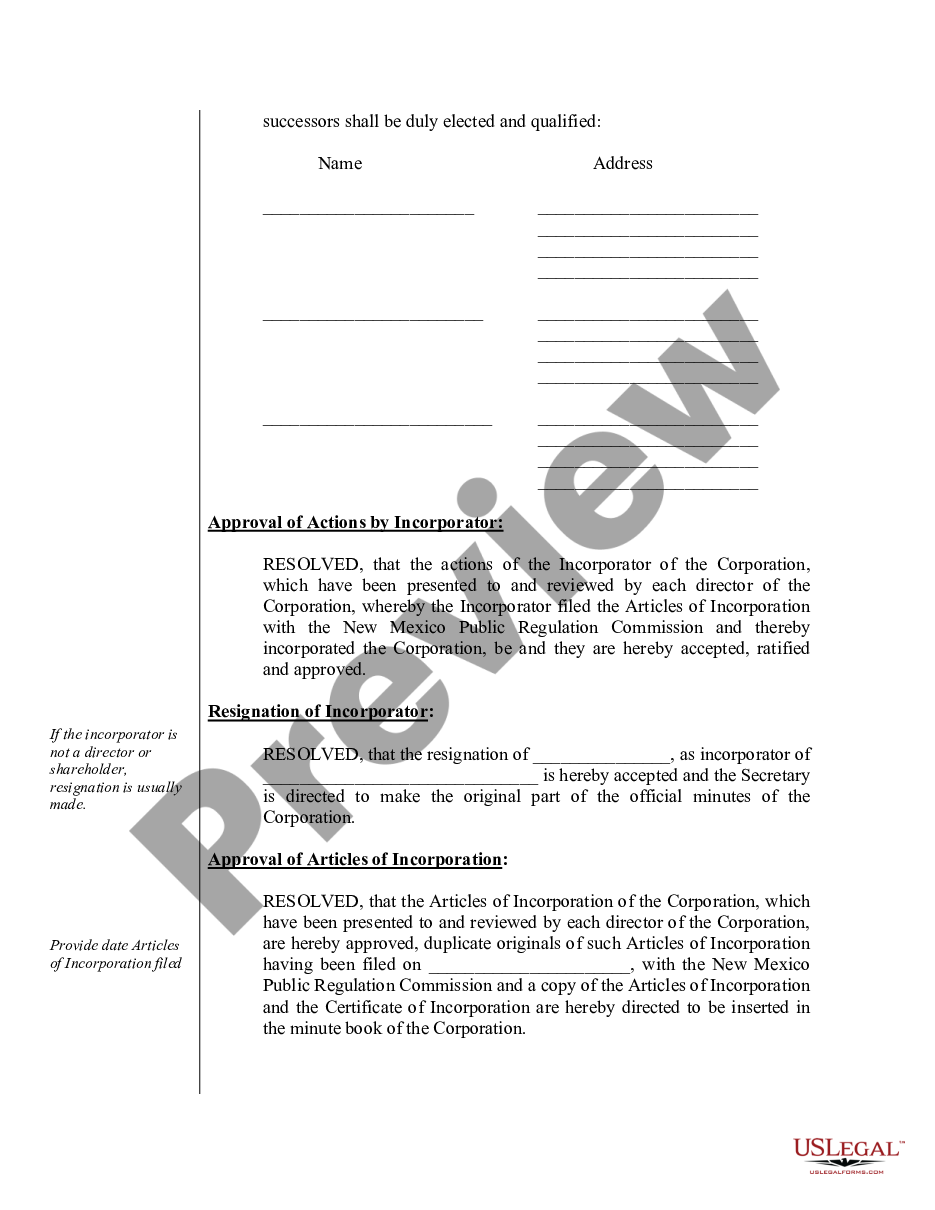

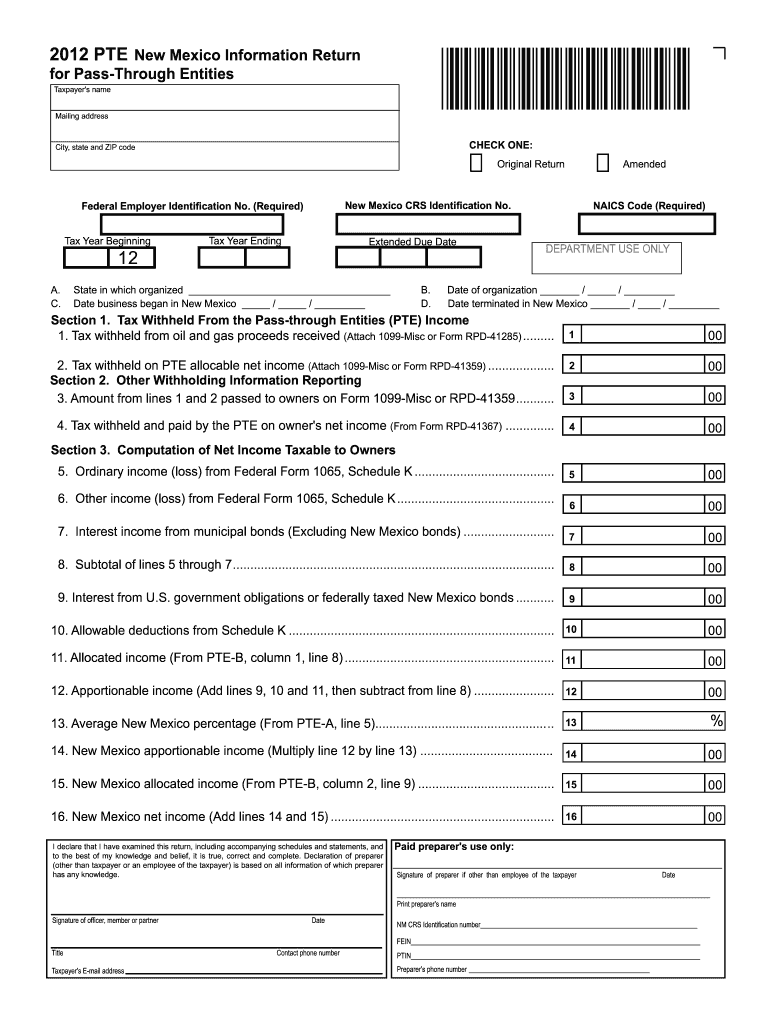

New Mexico Corporation Form Pte Instructions 2020 US Legal Forms

Web kentucky tax law changes. Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. Web form pte (2022) section a—income (loss) and deductions total amount. For.

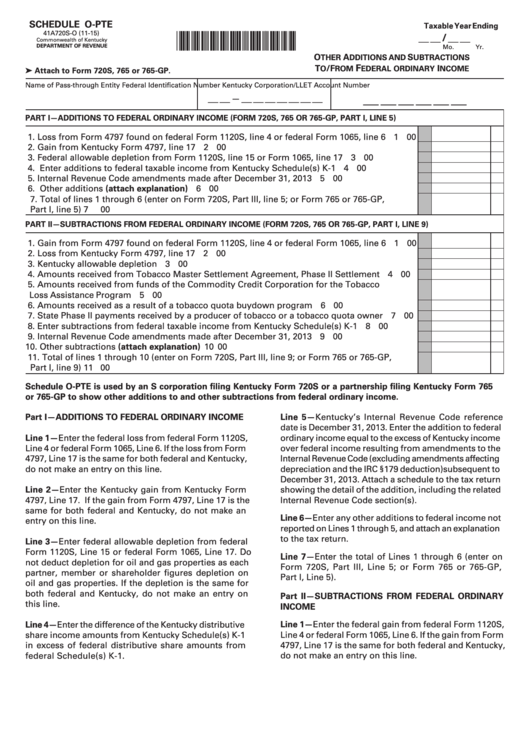

Fillable Schedule OPte (Form 41a720sO) Other Additions And

Web form pte (2022) section a—income (loss) and deductions total amount. For specific instructions for this form, refer to the nrwh packet. Web kentucky tax law changes. We last updated the owner's share of income, credits, deductions, etc. 1 kentucky ordinary income (loss) from trade or business activites (page 2, part i, line 21) 2 net income (loss) from rental.

New Mexico Pte Instructions Fill Out and Sign Printable PDF Template

Web kentucky tax law changes. Web form pte (2022) section a—income (loss) and deductions total amount. Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. 1.

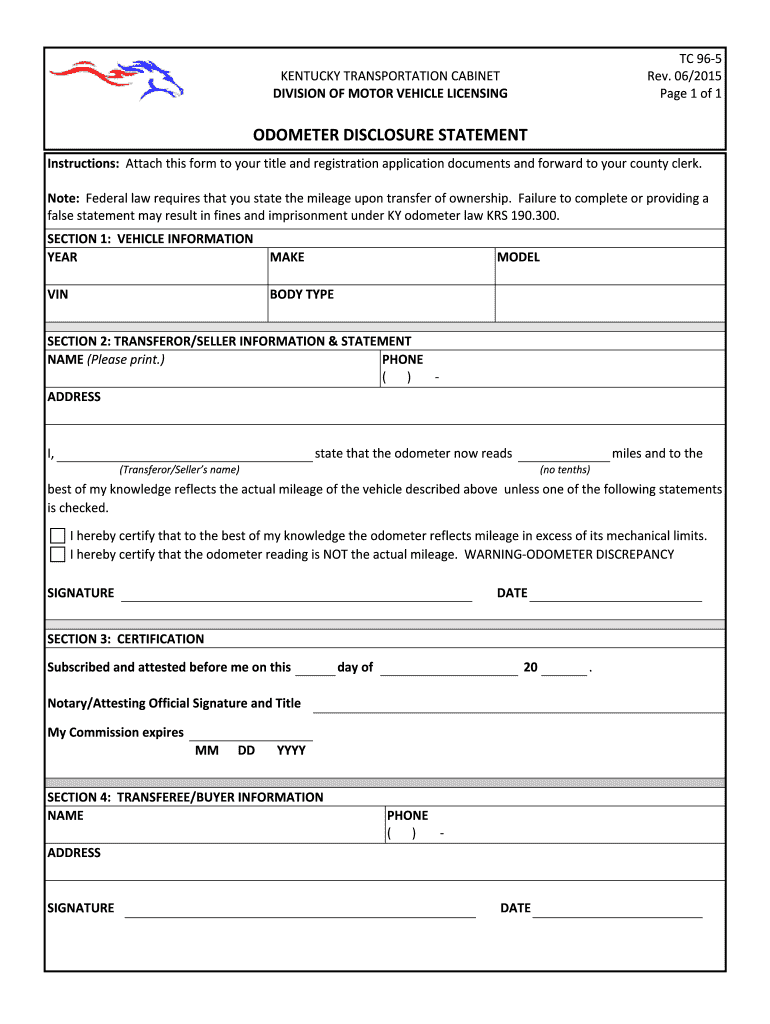

20152023 Form KY TC 965 Fill Online, Printable, Fillable, Blank

Web kentucky tax law changes. For specific instructions for this form, refer to the nrwh packet. We last updated the owner's share of income, credits, deductions, etc. Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021,.

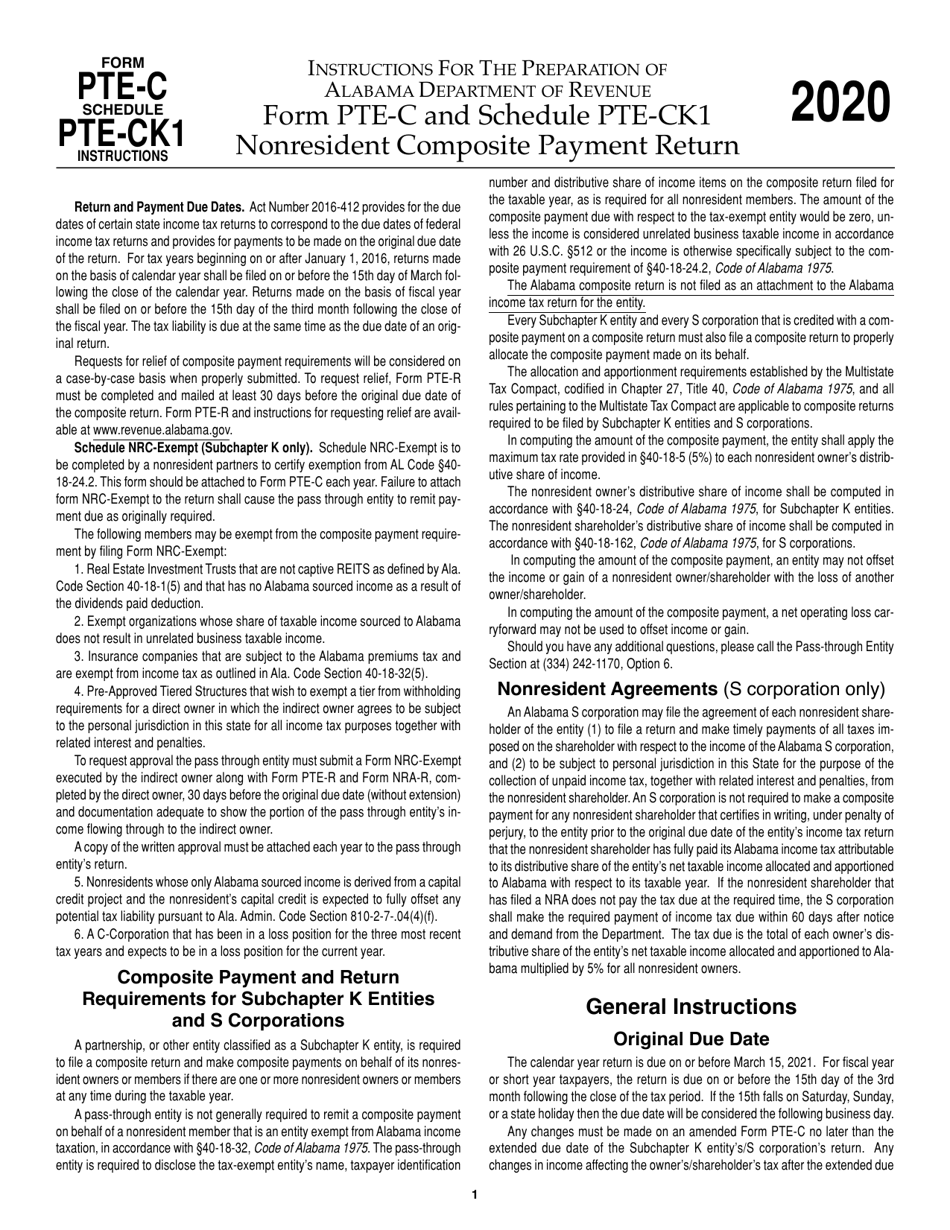

Download Instructions for Form PTEC Schedule PTECK1 Nonresident

Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. Web form pte (2022) section a—income (loss) and deductions total amount. For specific instructions for this form,.

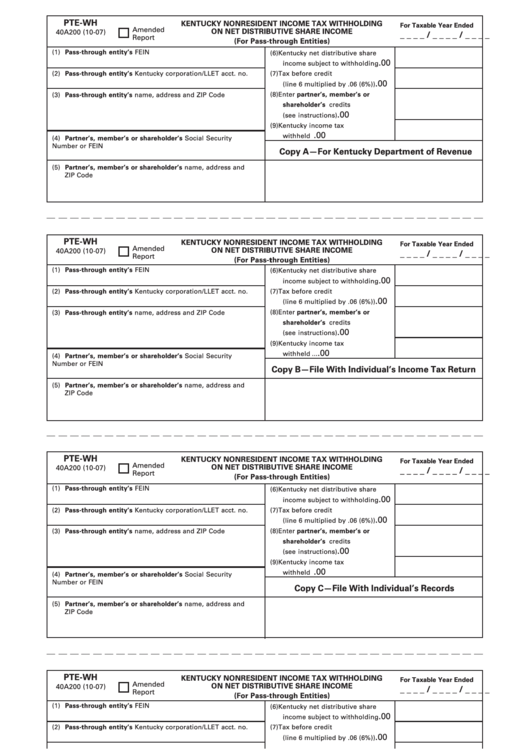

Form PteWh Kentucky Nonresident Tax Withholding On Net

Web kentucky tax law changes. Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. 1 kentucky ordinary income (loss) from trade or business activites (page 2,.

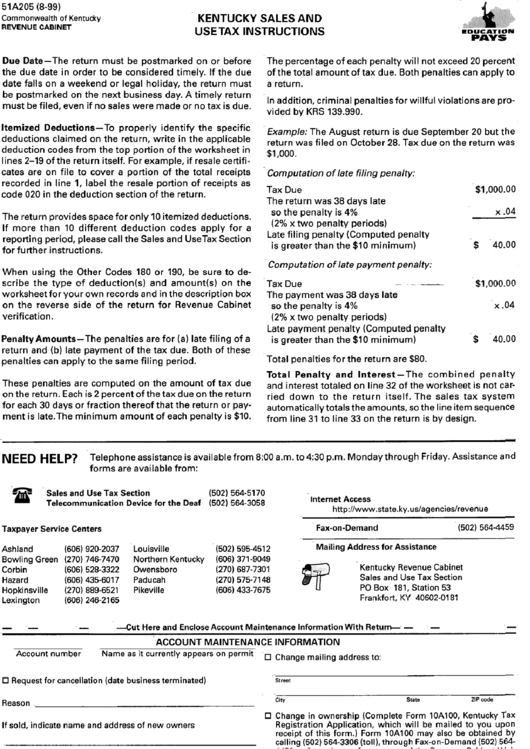

Form 51a205 Kentucky Sales And Use Tax Instructions printable pdf

Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. We last updated the owner's share of income, credits, deductions, etc. Web kentucky tax law changes. For.

Montana Form Pte Instructions Fill Online, Printable, Fillable, Blank

We last updated the owner's share of income, credits, deductions, etc. Web form pte (2022) section a—income (loss) and deductions total amount. 1 kentucky ordinary income (loss) from trade or business activites (page 2, part i, line 21) 2 net income (loss) from rental real estate activities (attach federal form 8825) 3 (a) gross income from other rental activities (b).

1 Kentucky Ordinary Income (Loss) From Trade Or Business Activites (Page 2, Part I, Line 21) 2 Net Income (Loss) From Rental Real Estate Activities (Attach Federal Form 8825) 3 (A) Gross Income From Other Rental Activities (B) Less Expenses From Other Rental Activities (Attach

Enacted by the 2022 regular session of the kentucky general assembly internal revenue code (irc) update—house bill (hb) 8 and hb 659 updated the internal revenue code reference date to december 31, 2021, for taxable years beginning on or after january 1, 2022. Web kentucky tax law changes. For specific instructions for this form, refer to the nrwh packet. Web form pte (2022) section a—income (loss) and deductions total amount.