Long Calendar Spread

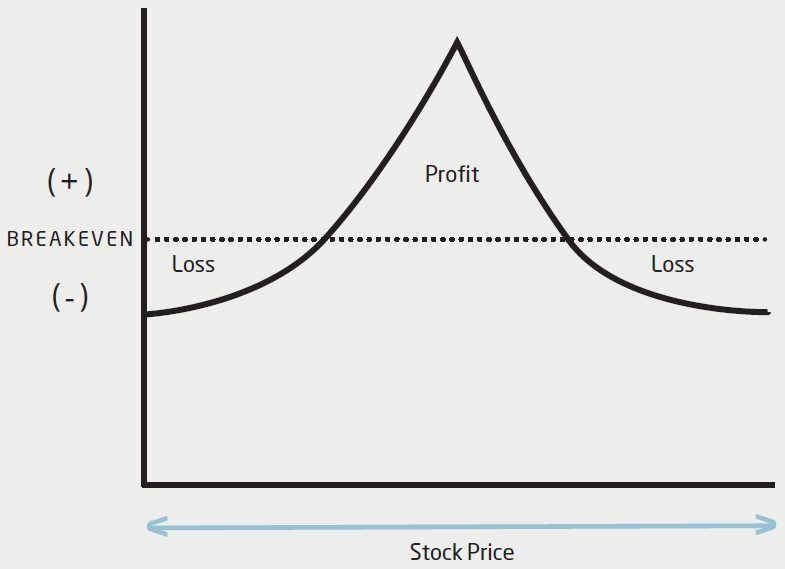

Long Calendar Spread - See examples, logic, and steps to identify and. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Web lesson 7 of 12. What you need to know. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. Find out the profit, loss,. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web ein long call calendar spread (auch: Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. See examples of long and short call and put.

What you need to know. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. See examples of long and short call and put. See examples, logic, and steps to identify and. Web lesson 7 of 12. Web ein long call calendar spread (auch: Find out the profit, loss,.

What you need to know. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. See examples, logic, and steps to identify and. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web lesson 7 of 12. See examples of long and short call and put. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Find out the profit, loss,. Web ein long call calendar spread (auch: Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Web ein long call calendar spread (auch: Web lesson 7 of 12. See examples, logic, and steps to identify and. Find out the profit, loss,.

Long Calendar Spread with Puts Strategy With Example

Find out the profit, loss,. Web lesson 7 of 12. See examples, logic, and steps to identify and. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. See examples of long and short call and put.

Printable Calendar Spreads on Behance

Web lesson 7 of 12. Web ein long call calendar spread (auch: What you need to know. See examples of long and short call and put. Find out the profit, loss,.

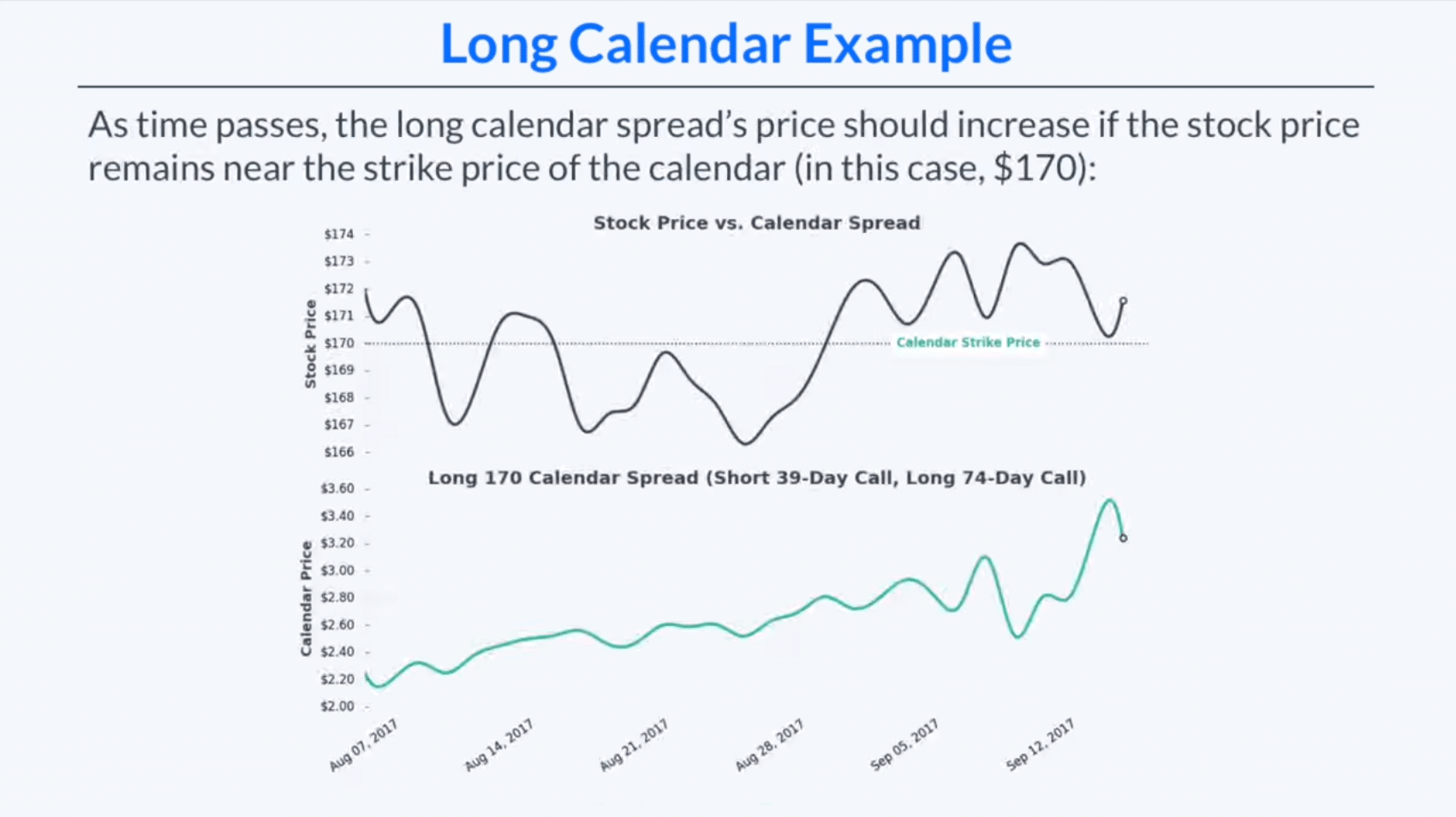

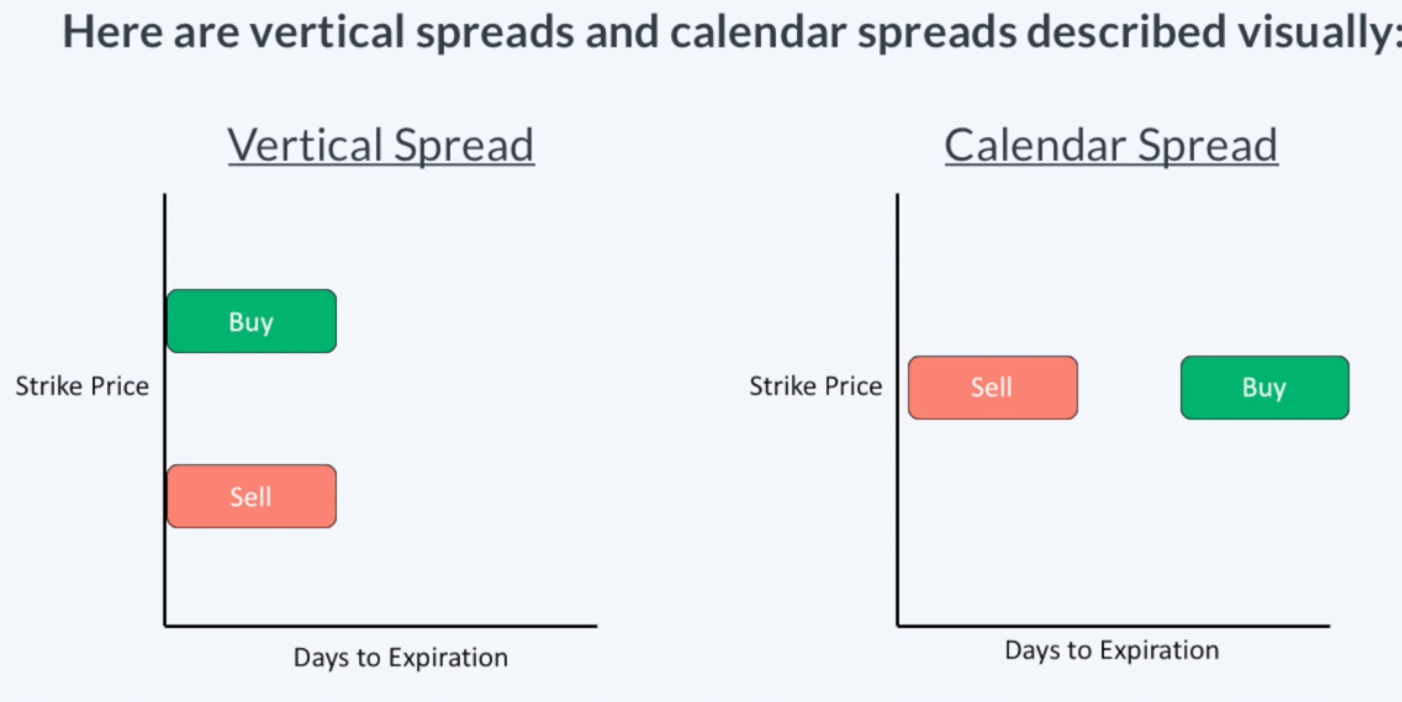

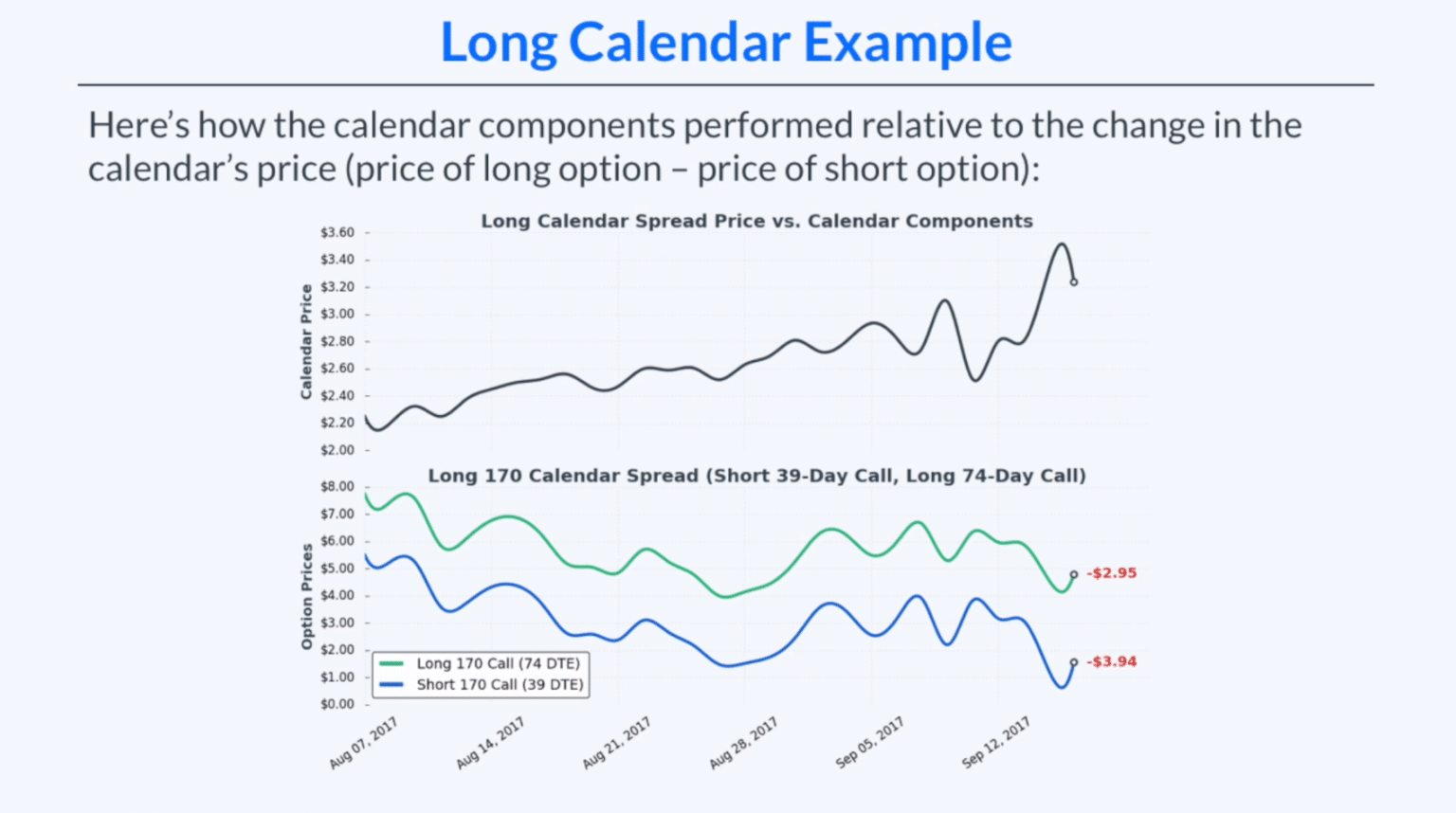

How to Trade Options Calendar Spreads (Visuals and Examples)

Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. What you need to know. Web ein long call calendar spread (auch: Find out the profit, loss,. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration.

Long Calendar Spreads for Beginner Options Traders projectfinance

Find out the profit, loss,. See examples, logic, and steps to identify and. See examples of long and short call and put. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Web learn how to use a long call calendar spread to combine a.

Long Calendar Spreads for Beginner Options Traders projectfinance

See examples of long and short call and put. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. See examples, logic, and steps to identify and. Find out the profit, loss,. Web ein long call calendar spread (auch:

Long Calendar Spreads Unofficed

What you need to know. Web lesson 7 of 12. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Find out the profit, loss,. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a.

The Long Calendar Spread Explained 1 Options Trading Software

Web lesson 7 of 12. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web ein long call calendar spread (auch: Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes..

Long Calendar Spreads for Beginner Options Traders projectfinance

Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. See examples of long and short call and put. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from.

Mastering Long Calendar Spreads A Comprehensive Guide

What you need to know. Web ein long call calendar spread (auch: Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. See examples of long and short call and put. See examples, logic, and steps to identify and.

Web Ein Long Call Calendar Spread (Auch:

Web lesson 7 of 12. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. See examples, logic, and steps to identify and. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay.

See Examples Of Long And Short Call And Put.

Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. What you need to know. Find out the profit, loss,.