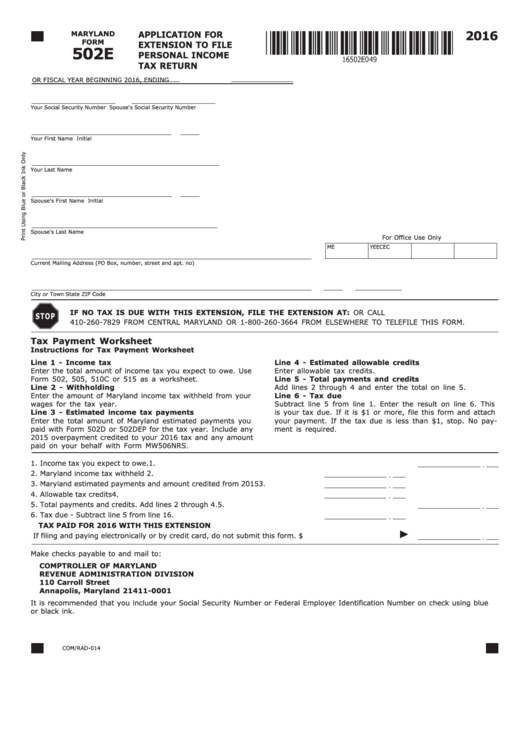

Maryland Form 502E

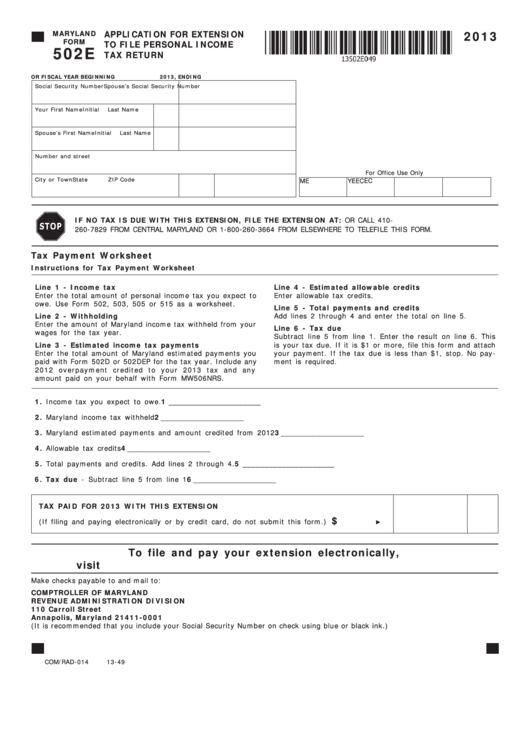

Maryland Form 502E - You should file form 502e only if you are making a payment with your extension request or otherwise, do not file form 502e if no tax is due with your maryland extension. 2022 underpayment of estimated maryland income tax by individuals. Form 402e is also used to pay the tax balance due for your maryland extension. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Payment of the expected tax due is required with form pv by april 18, 2023. For more information about the maryland income tax, see the maryland income tax page. Web printable maryland income tax form 502e. You can file and pay by credit card or electronic funds withdrawal ( direct debit) on our web site. Web filing this form extends the time to file your return, but does not extend the time to pay your taxes. 502ae maryland subtraction for income derived within an arts and entertainment district

Form 402e is also used to pay the tax balance due for your maryland extension. Web we last updated maryland form 502e in march 2021 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in april 2023. And street name) (no po box) maryland physical address line 2 (apt no., suite no., floor no.) (no po box) city state zip code + 4 maryland county required: Use form 502e to apply for an extension of time to file your taxes. You should file form 502e only if you are making a payment with your extension request or otherwise, do not file form 502e if no tax is due with your maryland extension. Web you can make an extension payment with form 502e (application for extension to file personal income tax return). For office use only me ye ec ec print using blue or black ink only Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. Maryland physical address of taxing area as of december 31, 2019 or last day of the taxable year for fiscal year taxpayers.

Web you can make an extension payment with form 502e (application for extension to file personal income tax return). Web printable maryland income tax form 502e. Form 402e is also used to pay the tax balance due for your maryland extension. Web filing this form extends the time to file your return, but does not extend the time to pay your taxes. Web maryland physical address line 1 (street no. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Use form 502e to apply for an extension of time to file your taxes. Maryland physical address of taxing area as of december 31, 2019 or last day of the taxable year for fiscal year taxpayers. Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. 2022 maryland income tax declaration for.

502e Maryland Tax Forms And Instructions printable pdf download

This form is for income earned in tax year 2022, with tax returns due in april 2023. And street name) (no po box) maryland physical address line 2 (apt no., suite no., floor no.) (no po box) city state zip code + 4 maryland county required: Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying.

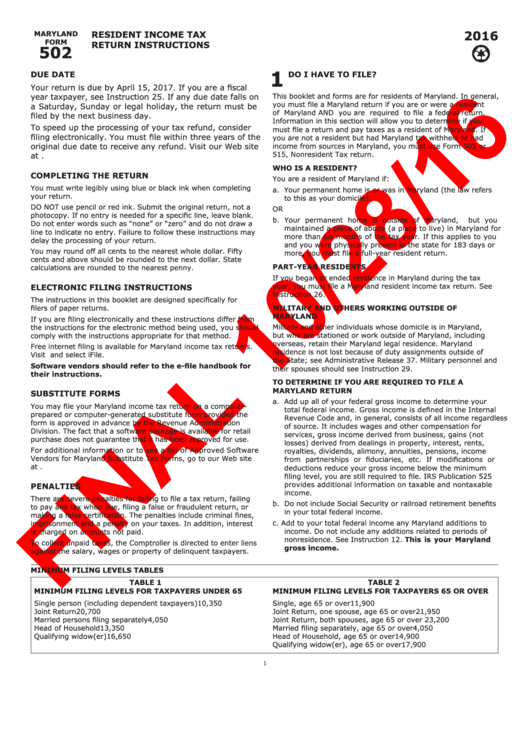

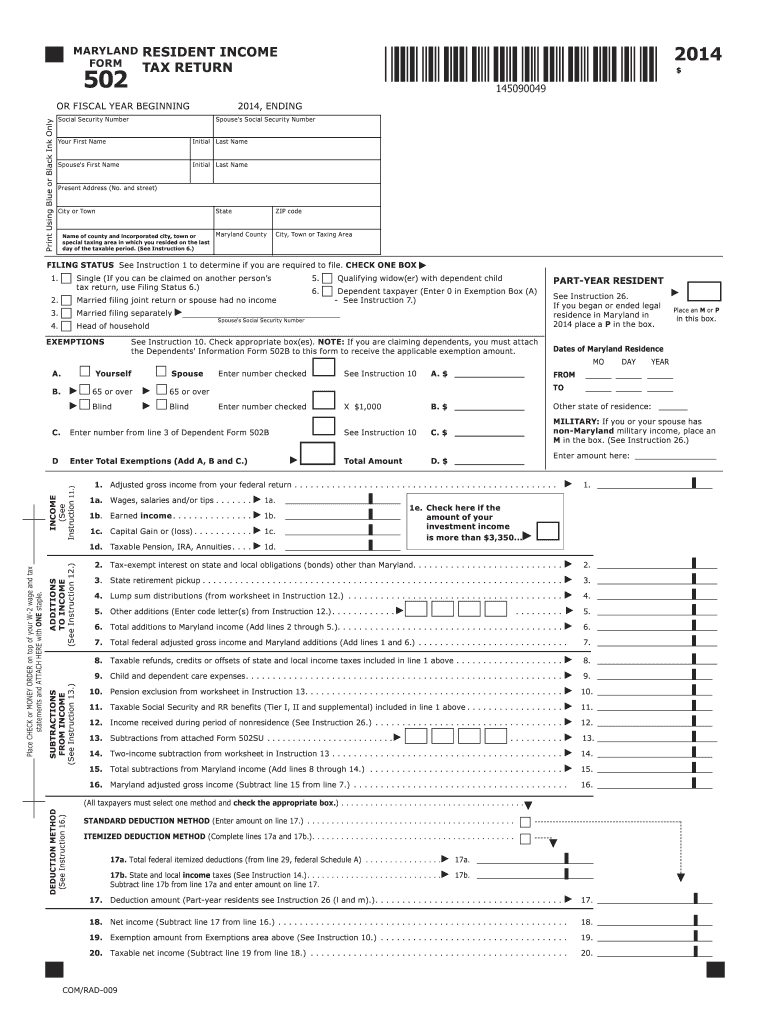

Instructions For Resident Tax Return (Maryland Form 502

Web formmaryland application for 2012502eextension to file personal income tax return instructions who must file form 502e? This form is for income earned in tax year 2022, with tax returns due in april 2023. You can file and pay by credit card or electronic funds withdrawal ( direct debit) on our web site. And street name) (no po box) maryland.

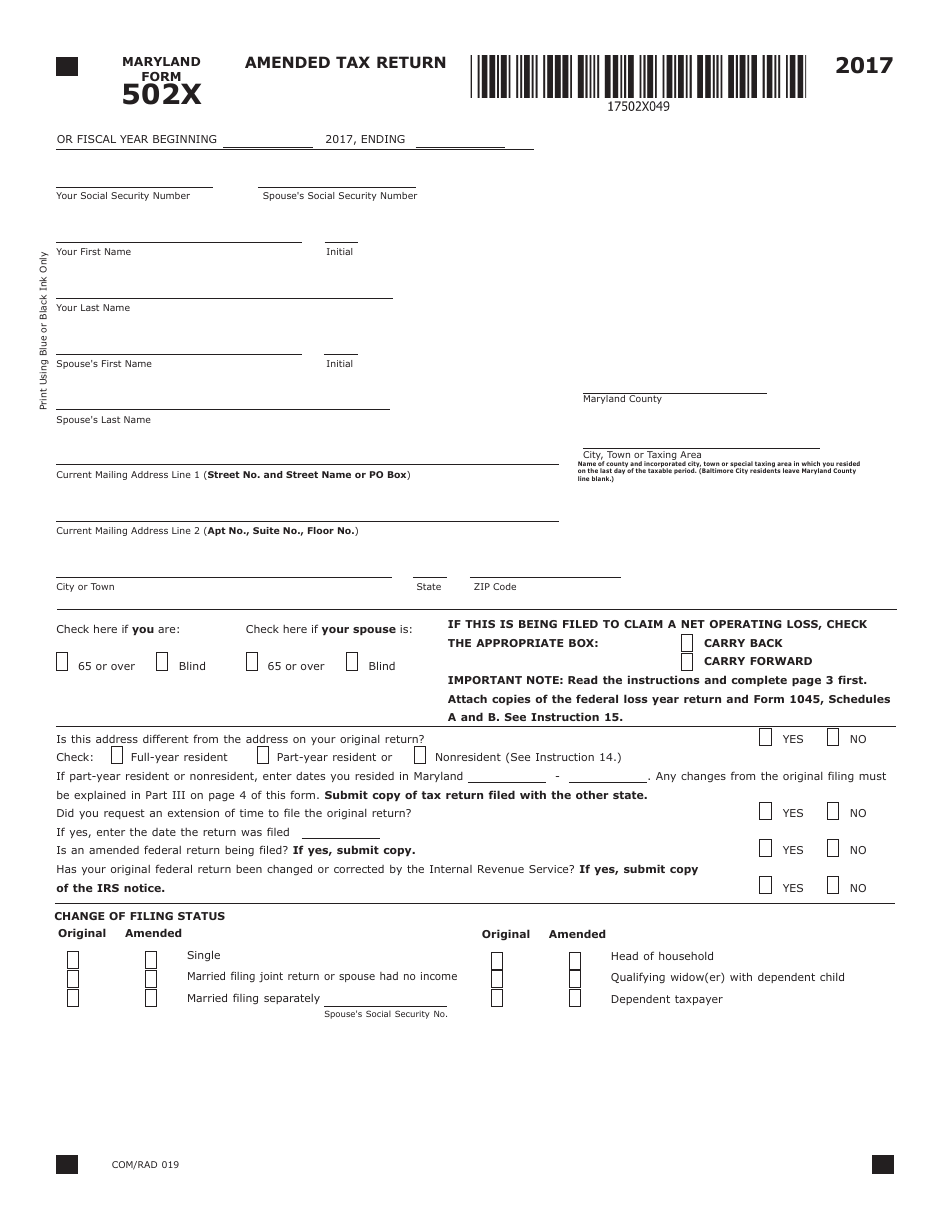

Form 502X Download Fillable PDF or Fill Online Amended Tax Return

Web form 502e is a maryland individual income tax form. Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. Web we last updated the maryland subtraction for income derived within an entertainment district in january 2023, so this is the latest version of form 502ae, fully updated.

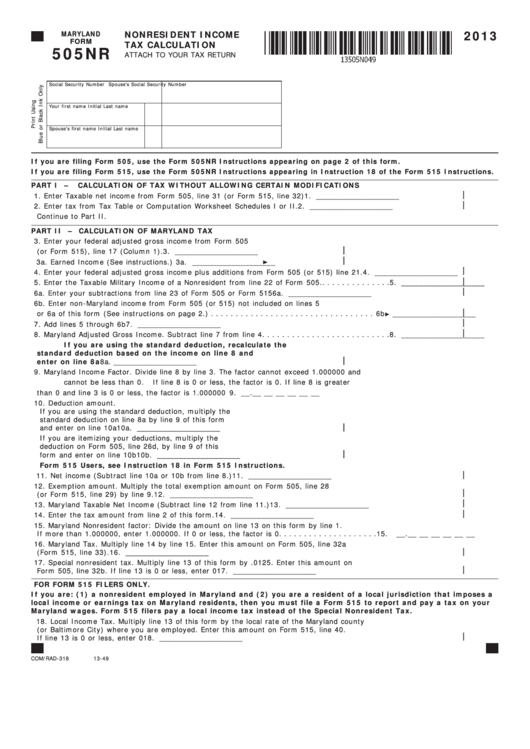

Fillable Maryland Form 505nr Nonresident Tax Calculation

Maryland physical address of taxing area as of december 31, 2019 or last day of the taxable year for fiscal year taxpayers. Web maryland physical address line 1 (street no. If you cannot complete and file your form 502, 503, 505 or 515 by the due date, you should complete the tax payment worksheet to determine if you must file.

Fillable Maryland Form 502e Application For Extension To File

Web you can make an extension payment with form 502e (application for extension to file personal income tax return). You can file and pay by credit card or electronic funds withdrawal ( direct debit) on our web site. Form 402e is also used to pay the tax balance due for your maryland extension. 2022 use of vehicle for charitable purposes..

Maryland Form 502 Fill Out and Sign Printable PDF Template signNow

Web maryland tax forms & instruction booklet for nonresidents. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Do not use form 502e if your maryland tax liability is zero. And street name) (no po box) maryland physical address line 2 (apt no., suite.

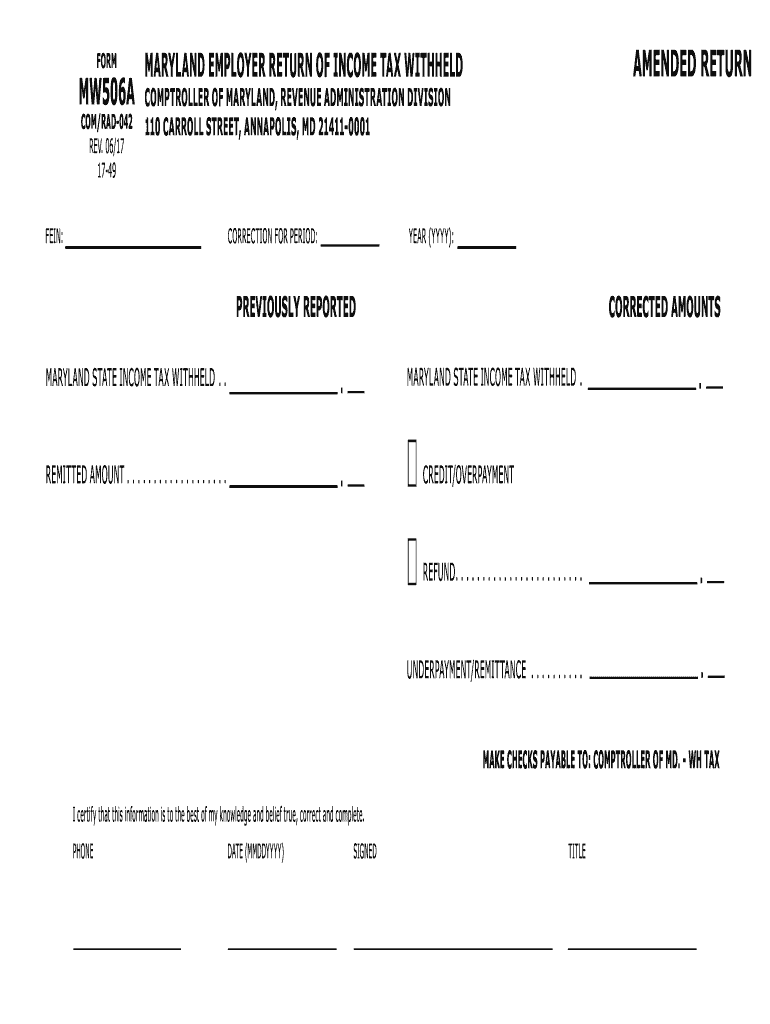

2017 Form MD Comptroller MW506A Fill Online, Printable, Fillable, Blank

And street name) (no po box) maryland physical address line 2 (apt no., suite no., floor no.) (no po box) city state zip code + 4 maryland county required: For more information about the maryland income tax, see the maryland income tax page. 502ae maryland subtraction for income derived within an arts and entertainment district 2022 use of vehicle for.

Fill Free fillable forms Comptroller of Maryland

Web we last updated the maryland subtraction for income derived within an entertainment district in january 2023, so this is the latest version of form 502ae, fully updated for tax year 2022. Web maryland physical address line 1 (street no. You should file form 502e only if you are making a payment with your extension request or otherwise, do not.

[ベスト] mw 507 495852Mw 507 Gambarsaeo4p

Web form and instructions for claiming subtraction for artwork created by qualifying persons and donated to a maryland museum. You should file form 502e only if you are making a payment with your extension request or otherwise, do not file form 502e if no tax is due with your maryland extension. Web we last updated maryland form 502 in january.

Fill Free fillable forms Comptroller of Maryland

Web maryland physical address line 1 (street no. 2022 use of vehicle for charitable purposes. Web printable maryland income tax form 502e. Web formmaryland application for 2012502eextension to file personal income tax return instructions who must file form 502e? If you cannot complete and file your form 502, 503, 505 or 515 by the due date, you should complete the.

Application For Extension To File Fiduciary Return.

Web formmaryland application for 2012502eextension to file personal income tax return instructions who must file form 502e? Use form 502e to apply for an extension of time to file your taxes. And street name) (no po box) maryland physical address line 2 (apt no., suite no., floor no.) (no po box) city state zip code + 4 maryland county required: Do not use form 502e if your maryland tax liability is zero.

Web 10 Rows Form And Instructions For A Fiduciary To File And Pay Estimated Taxes For Tax Year 2021 If The Fiduciary Is Required To File A Maryland Fiduciary Income Tax Return And The Taxable Income Is Expected To Develop A Tax Of More Than $500.

If you cannot complete and file your form 502, 503, 505 or 515 by the due date, you should complete the tax payment worksheet to determine if you must file form 502e. Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. Web printable maryland income tax form 502e. For more information about the maryland income tax, see the maryland income tax page.

For Office Use Only Me Ye Ec Ec Print Using Blue Or Black Ink Only

Web form 502e is a maryland individual income tax form. 2022 maryland income tax declaration for. Web we last updated the maryland subtraction for income derived within an entertainment district in january 2023, so this is the latest version of form 502ae, fully updated for tax year 2022. Web we last updated maryland form 502e in march 2021 from the maryland comptroller of maryland.

Web Form And Instructions For Claiming Subtraction For Artwork Created By Qualifying Persons And Donated To A Maryland Museum.

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web filing this form extends the time to file your return, but does not extend the time to pay your taxes. You can file and pay by credit card or electronic funds withdrawal ( direct debit) on our web site.

![[ベスト] mw 507 495852Mw 507 Gambarsaeo4p](https://www.speedytemplate.com/maryland-form-mw-507_000002.png)