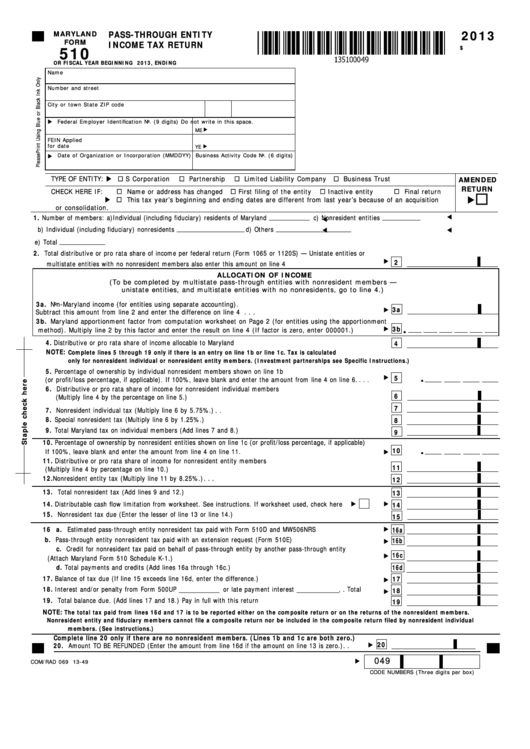

Maryland Form 510

Maryland Form 510 - This form is for income earned in tax year 2022, with tax returns due in april 2023. For 2022, this form will be used to report for form 510 and form 511. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland.

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. For 2022, this form will be used to report for form 510 and form 511.

For 2022, this form will be used to report for form 510 and form 511. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland.

Fill Free fillable forms Comptroller of Maryland

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. For 2022, this form will be used to report for form 510 and form 511. We will update this page with a new version of the form.

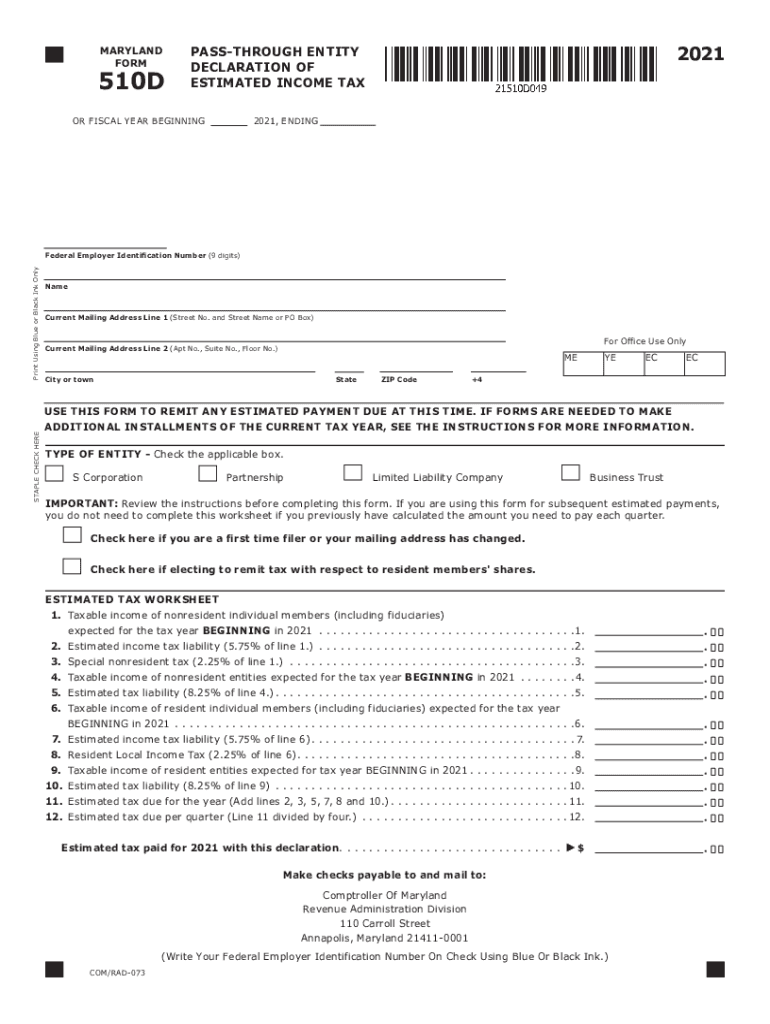

Md 510D Fill Out and Sign Printable PDF Template signNow

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. This form is for income earned in tax year 2022, with tax returns due in april 2023. For 2022,.

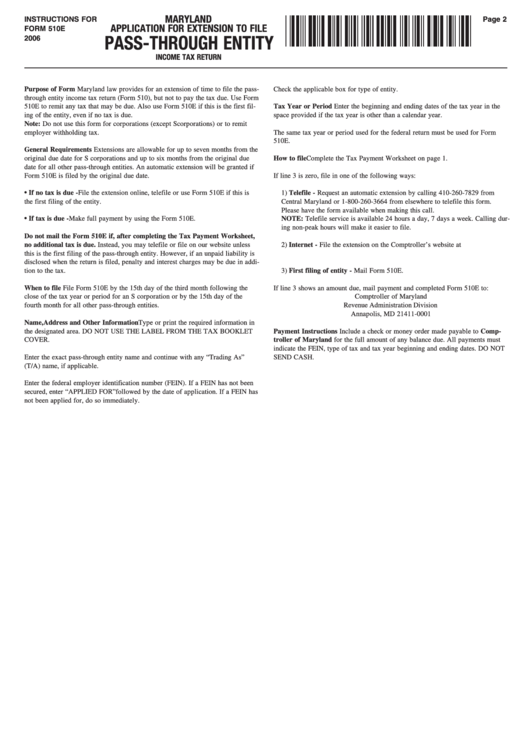

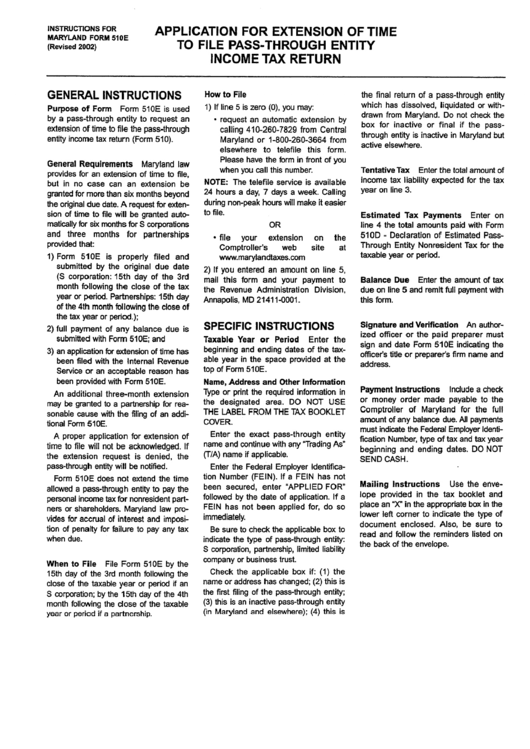

Instructions For Form 510e Maryland Application For Extension To File

For 2022, this form will be used to report for form 510 and form 511. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form.

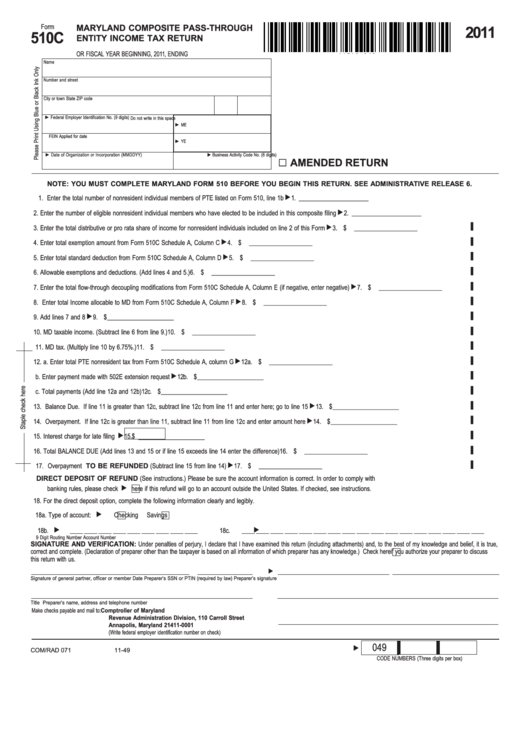

Fillable Form 510c Maryland Composite PassThrough Entity Tax

This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. For 2022,.

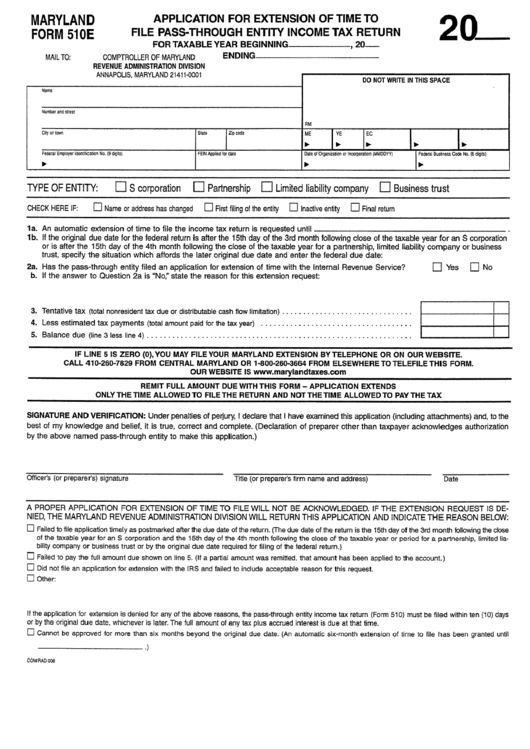

Maryland Form 510e Application For Extension Of Time To File Pass

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. For 2022, this form will be used to report for form 510 and form 511. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last.

Fill Free fillable forms Comptroller of Maryland

For 2022, this form will be used to report for form 510 and form 511. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web we last.

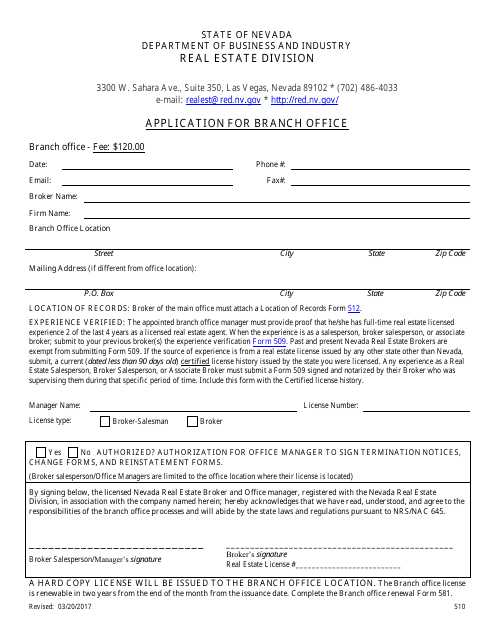

Form 510 Download Fillable PDF or Fill Online Application for Branch

For 2022, this form will be used to report for form 510 and form 511. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. This form is for.

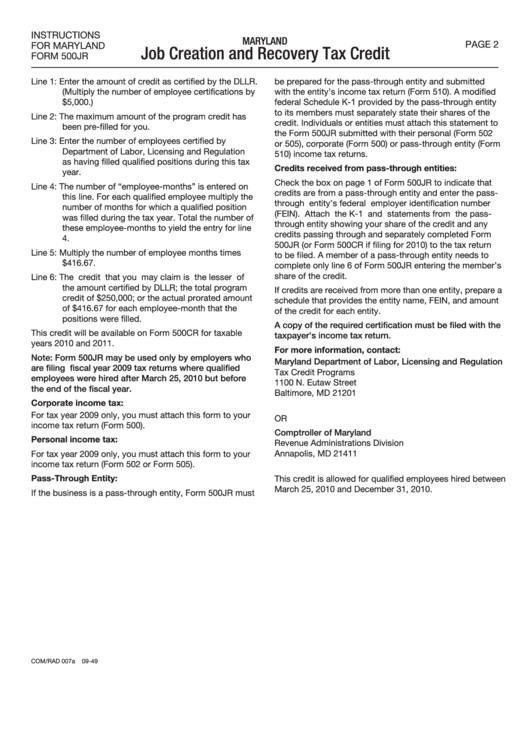

Form Com/rad 007a Instructions For Maryland Form 500jr Job Creation

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. For 2022,.

Fillable Maryland Form 510 PassThrough Entity Tax Return

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in april 2023. For 2022,.

Instructions For Maryland Form 510e Application For Extension Oftime

For 2022, this form will be used to report for form 510 and form 511. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. This form is for.

Web We Last Updated Maryland Form 510 In January 2023 From The Maryland Comptroller Of Maryland.

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. This form is for income earned in tax year 2022, with tax returns due in april 2023. For 2022, this form will be used to report for form 510 and form 511.