Md 502 Form

Md 502 Form - Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md. Do not attach form pv or check/money order to form 502. In order to continue, you will be requested to provide the amount reported on line 1 from your. You can download or print. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Web we last updated maryland form 502 in january 2023 from the maryland comptroller of maryland. Web complete form 502r if you or your spouse were required to filea 2021 form 502 and: Web download or print the 2022 maryland form 502d (maryland personal declaration of estimated income tax (discontinued)) for free from the maryland comptroller of. If you are claiming a credit for taxes paid to multiple. Do not attach form pv or check/money order to form 502.

Web do you have your maryland individual income tax return for tax year 2021? Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Reported income from a pension, annuity or individual retirement account or annuity. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs If you are claiming any dependants, use form 502b. Check here if you authorize your preparer to discuss this return with us. Place form pv with attached check/money order on top of form 502 and mail to: If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and. Web download or print the 2022 maryland form 502d (maryland personal declaration of estimated income tax (discontinued)) for free from the maryland comptroller of. Do not attach form pv or check/money order to form 502.

Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md. Maryland resident income tax return: You can download or print. Web do you have your maryland individual income tax return for tax year 2021? Check here if you authorize your paid. Check here if you authorize your preparer to discuss this return with us. If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. In order to continue, you will be requested to provide the amount reported on line 1 from your. Do not attach form pv or check/money order to form 502.

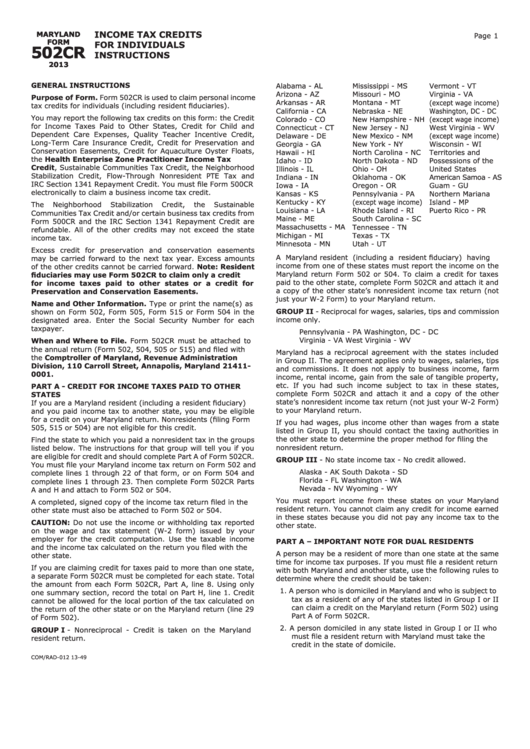

Instructions For Maryland Form 502cr Tax Credits For

Web download or print the 2022 maryland form 502d (maryland personal declaration of estimated income tax (discontinued)) for free from the maryland comptroller of. Check here if you authorize your preparer to discuss this return with us. Web complete form 502r if you or your spouse were required to filea 2021 form 502 and: Place form pv with attached check/money.

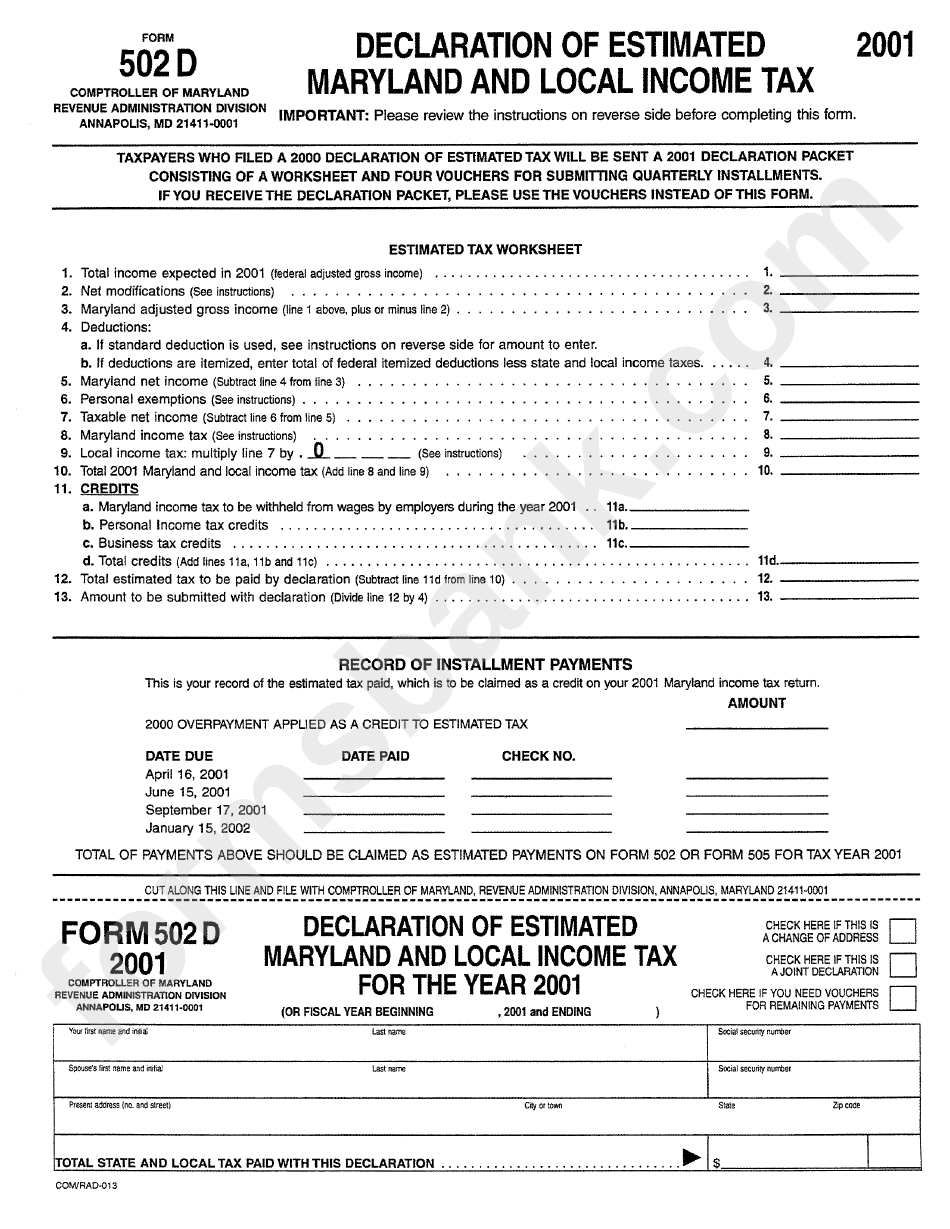

Maryland Form 502d Fill Online, Printable, Fillable, Blank pdfFiller

Do not attach form pv or check/money order to form 502. You can download or print. Web do you have your maryland individual income tax return for tax year 2021? Reported income from a pension, annuity or individual retirement account or annuity. If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here.

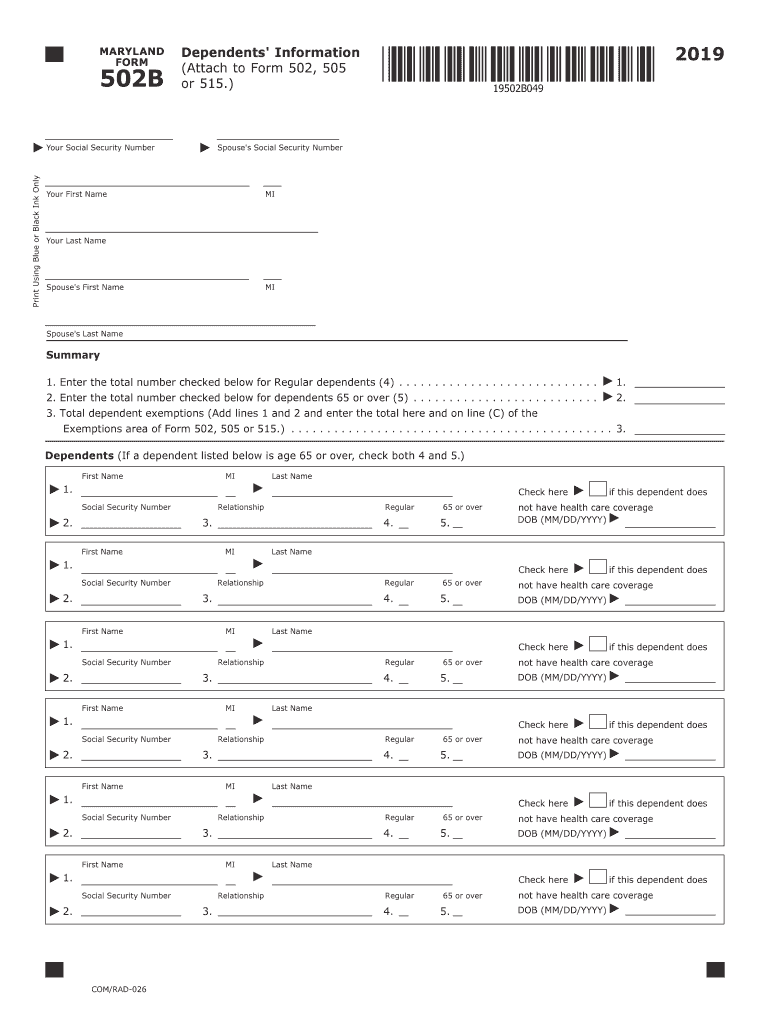

502B Fill Out and Sign Printable PDF Template signNow

Check here if you authorize your paid. Do not attach form pv or check/money order to form 502. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and. Do not attach.

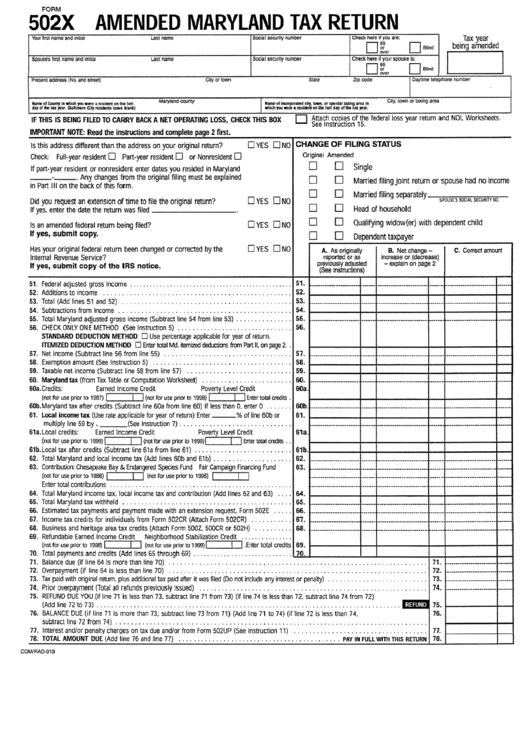

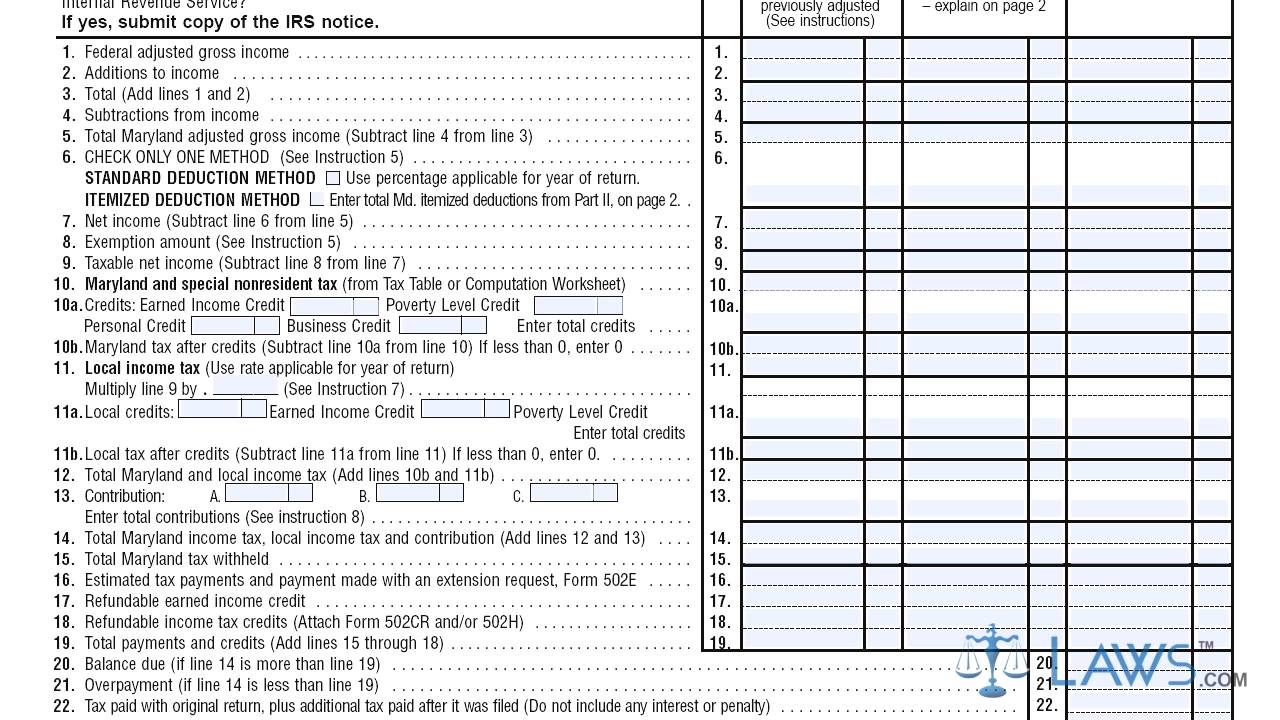

Form 502x Amended Maryland Tax Return printable pdf download

Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Do not attach form pv or check/money order to form 502. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Do not.

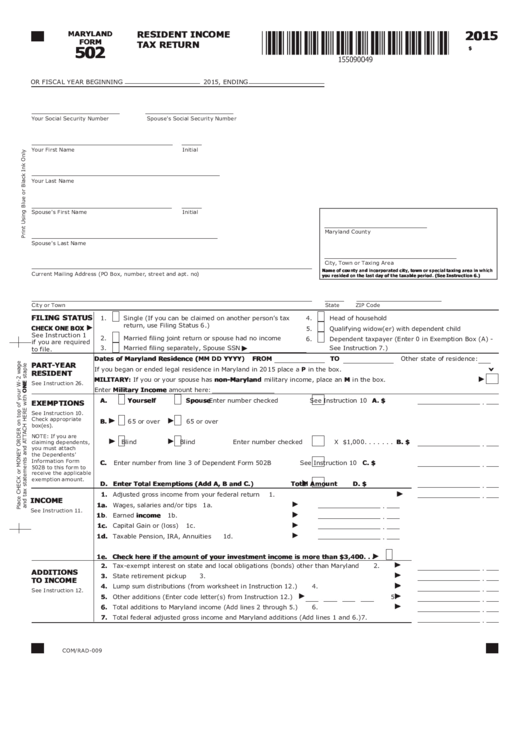

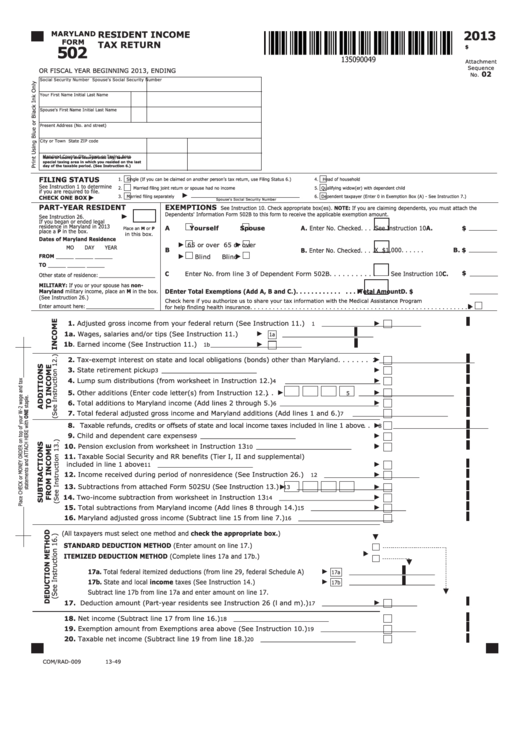

Fillable Maryland Form 502 Resident Tax Return 2015

If you are claiming any dependants, use form 502b. Check here if you authorize your paid. This form is for income earned in tax year 2022, with tax returns due in april. Place form pv with attached check/money order on top of form 502 and mail to: Reported income from a pension, annuity or individual retirement account or annuity.

2014 Md Tax Form 502 Form Resume Examples v19xqxdY7E

Web do you have your maryland individual income tax return for tax year 2021? I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Do not attach form pv or check/money order to form 502. Web we last updated maryland form.

Fill Free fillable forms Comptroller of Maryland

Check here if you authorize your paid. Maryland resident income tax return: Reported income from a pension, annuity or individual retirement account or annuity. If you are claiming a credit for taxes paid to multiple. Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md.

Form 502d Declaration Of Estimated Maryland And Local Tax

Place form pv with attached check/money order on top of form 502 and mail to: Maryland resident income tax return: If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and. Form and instructions for individuals claiming personal income tax credits,. In order to continue, you will be requested to.

Fillable Maryland Form 502 Resident Tax Return 2013

In order to continue, you will be requested to provide the amount reported on line 1 from your. Place form pv with attached check/money order on top of form 502 and mail to: If you are claiming any dependants, use form 502b. Maryland resident income tax return: Form to be used when claiming.

Form 502X Amended Maryland Tax Return YouTube

Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april. Web form 502 is the individual income tax return form for residents that are not claiming.

You Can Download Or Print.

If you are claiming any dependants, use form 502b. Web do you have your maryland individual income tax return for tax year 2021? I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Maryland resident income tax return:

Web Visit The Irs Free File Web Page To See If You Qualify.

Do not attach form pv or check/money order to form 502. Check here if you authorize your paid. Place form pv with attached check/money order on top of form 502 and mail to: Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022.

Web Individual Tax Forms Are Ready Taxpayers Eligible To Subtract Unemployment Benefits Must Use Maryland Form 502Lu Annapolis, Md.

Form to be used when claiming. Place form pv with attached check/money order on top of form 502 and mail to: Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs If you are claiming a credit for taxes paid to multiple.

Web Complete Form 502R If You Or Your Spouse Were Required To Filea 2021 Form 502 And:

In order to continue, you will be requested to provide the amount reported on line 1 from your. Web find maryland form 502 instructions at esmart tax today. If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and. Web form 502 is the individual income tax return form for residents that are not claiming any dependants.