Md 505 Form

Md 505 Form - Web use a maryland form 505 2022 template to make your document workflow more streamlined. Web you will need to file a nonresident income tax return to maryland, using form 505 and form 505nr if you have income derived from: They are required to file a federal return based on the minimum filing requirements, and; Your signature date signature of preparer other than taxpayer spouse’s signature date. Web go to the maryland > composite worksheet. Edit your 505 maryland form online type text, add images, blackout confidential details, add comments, highlights and more. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Show details we are not affiliated with any brand or entity on this form. For returns filed without payments, mail your completed return to: Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or.

Web follow the simple instructions below: Your signature date signature of preparer other than taxpayer spouse’s signature date. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. They are required to file a federal return based on the minimum filing requirements, and; Form for nonresidents to file if: Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Using our service filling out md form 505. Edit your 505 maryland form online type text, add images, blackout confidential details, add comments, highlights and more. Maryland nonresident income tax return: For returns filed without payments, mail your completed return to:

Sign it in a few clicks draw your signature, type. These where to file addresses. Web follow the simple instructions below: Form for nonresidents to file if: Tangible property, real or personal,. Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md. Please use the link below. Web maryland — maryland nonresident income tax return download this form print this form it appears you don't have a pdf plugin for this browser. They are required to file a federal return based on the minimum filing requirements, and; Web maryland 2019 form 505 nonresident income tax return or fiscal year beginning 2019, ending social security number spouse's social security number.

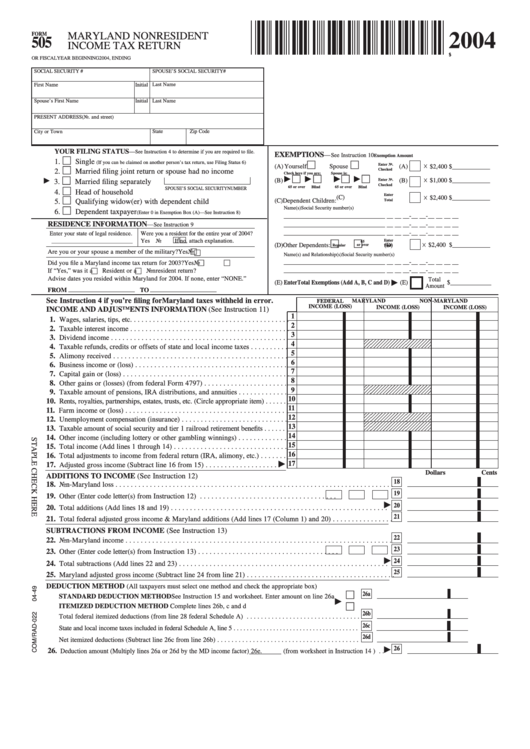

Fillable Form 505 Maryland Nonresident Tax Return 2004

Using our service filling out md form 505. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. Web go to the maryland > composite worksheet. Maryland nonresident income tax return: They are required to file a federal return based on the minimum filing requirements, and;

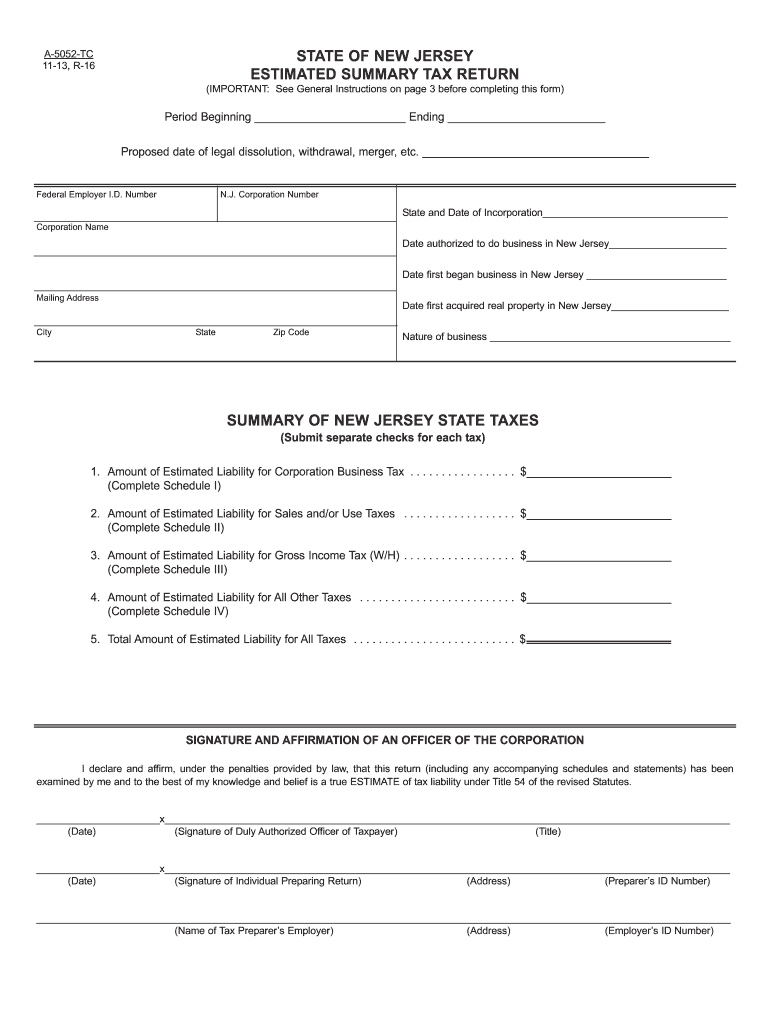

20132022 Form NJ A5052TC Fill Online, Printable, Fillable, Blank

Maryland nonresident income tax return: Tangible property, real or personal,. Web follow the simple instructions below: Please use the link below. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022.

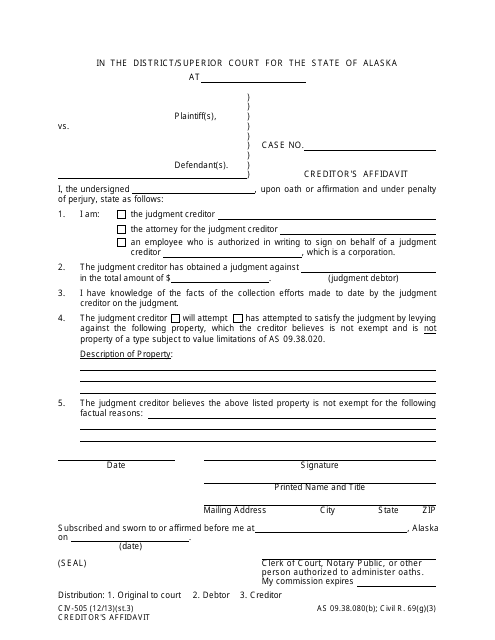

Form CIV505 Download Fillable PDF or Fill Online Creditor's Affidavit

Experience all the key benefits of completing and submitting legal documents on the internet. Your signature date signature of preparer other than taxpayer spouse’s signature date. They are required to file a federal return based on the minimum filing requirements, and; Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md..

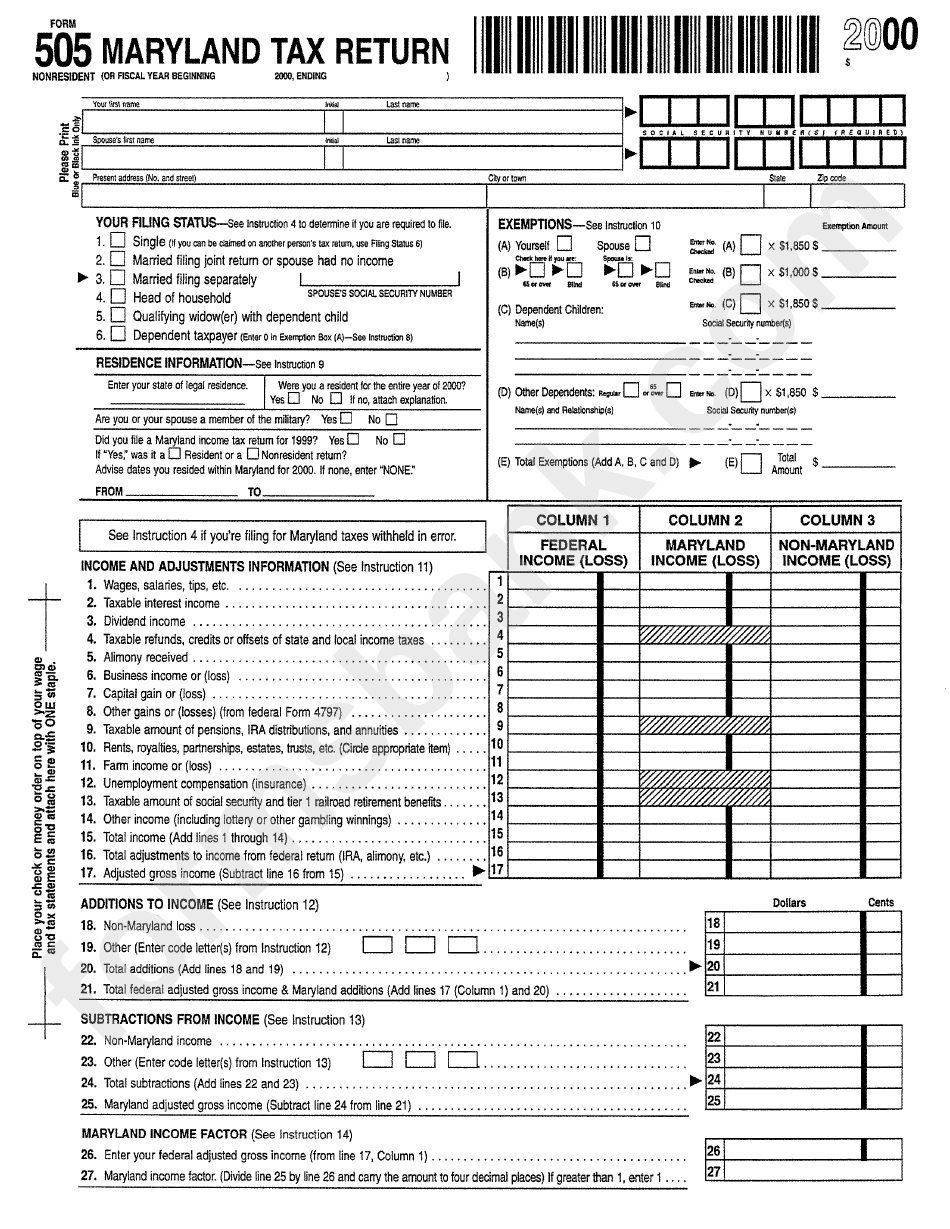

Form 505 Nonresident Maryland Tax Return 2000 printable pdf download

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Sign it in a few clicks draw your signature, type. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. Web.

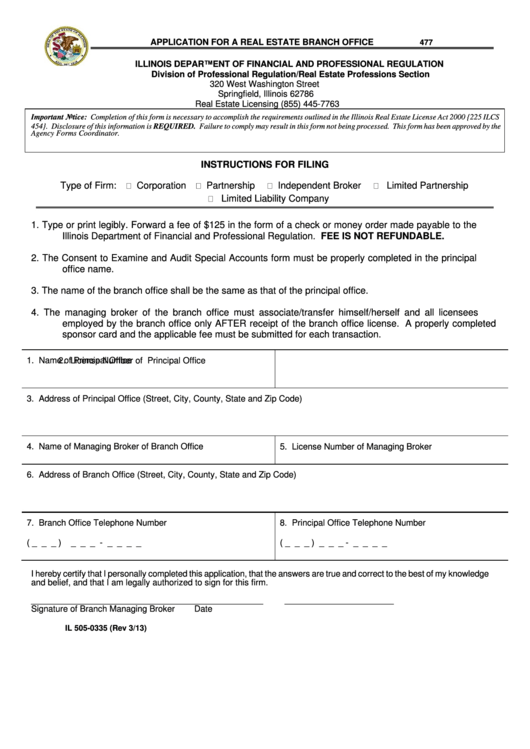

Form Il 5050335 Application For A Real Estate Branch Office/form 505

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. For returns filed without payments, mail your completed return to: Your signature date spouse’s signature date signature of preparer other than taxpayer. Sign it in a few clicks draw your signature,.

Morris MD505. Япония. commerce.acoustic Форумы для гитаристов

Using our service filling out md form 505. For returns filed without payments, mail your completed return to: Web you will need to file a nonresident income tax return to maryland, using form 505 and form 505nr if you have income derived from: Your signature date signature of preparer other than taxpayer spouse’s signature date. Web maryland — maryland nonresident.

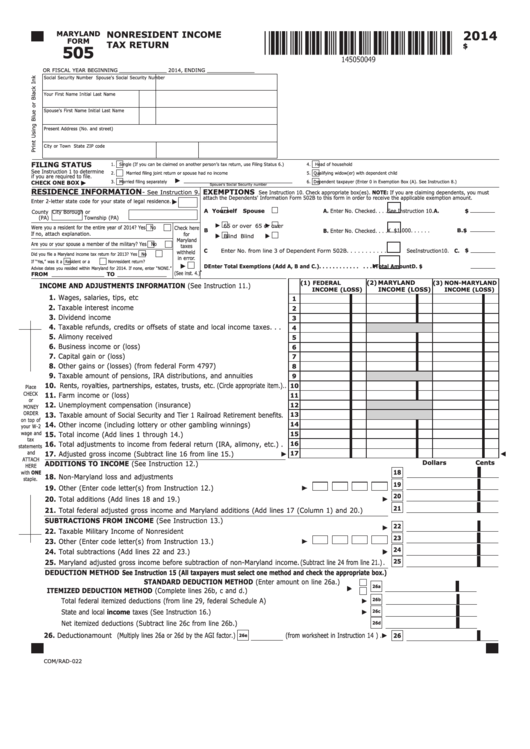

Fillable Maryland Form 505 Nonresident Tax Return 2014

Maryland nonresident income tax return: Your signature date spouse’s signature date signature of preparer other than taxpayer. Form for nonresidents to file if: Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web we last updated the maryland nonresident income.

AD CORE PRODUCTS MD505

Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md. Experience all the key benefits of completing and submitting legal documents on the internet..

Form 505 Download Fillable PDF, Injured Spouse Claim and Allocation

Show details we are not affiliated with any brand or entity on this form. Maryland nonresident income tax return: Web you will need to file a nonresident income tax return to maryland, using form 505 and form 505nr if you have income derived from: Your signature date spouse’s signature date signature of preparer other than taxpayer. These where to file.

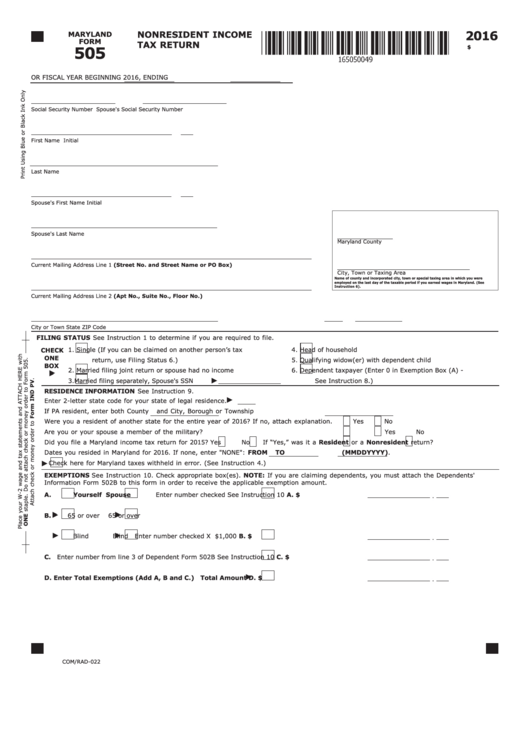

Fillable Maryland Form 505 Nonresident Tax Return 2016

Web go to the maryland > composite worksheet. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Web maryland 2019 form 505 nonresident income tax return or fiscal year beginning 2019, ending social security number spouse's social security number. Please use the.

Please Use The Link Below.

They are required to file a federal return based on the minimum filing requirements, and; Your signature date signature of preparer other than taxpayer spouse’s signature date. Using our service filling out md form 505. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or.

Web Use A Maryland Form 505 2022 Template To Make Your Document Workflow More Streamlined.

For returns filed without payments, mail your completed return to: Experience all the key benefits of completing and submitting legal documents on the internet. Maryland nonresident income tax return: Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md.

Web You Will Need To File A Nonresident Income Tax Return To Maryland, Using Form 505 And Form 505Nr If You Have Income Derived From:

Edit your 505 maryland form online type text, add images, blackout confidential details, add comments, highlights and more. Tangible property, real or personal,. These where to file addresses. Show details we are not affiliated with any brand or entity on this form.

Web We Last Updated The Maryland Nonresident Income Tax Return In January 2023, So This Is The Latest Version Of Form 505, Fully Updated For Tax Year 2022.

Sign it in a few clicks draw your signature, type. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. Web maryland — maryland nonresident income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web go to the maryland > composite worksheet.