Md State Withholding Form

Md State Withholding Form - Web click here for a complete list of current city and local counties' tax rate. For maryland state government employees only. Retirement use only form 766 (rev. Government of the district of. The request for mail order forms may be used to order one copy or. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Form used to determine the amount of income tax withholding due on the sale of property. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. Web this is the fastest and most secure method to update your maryland state tax withholding.

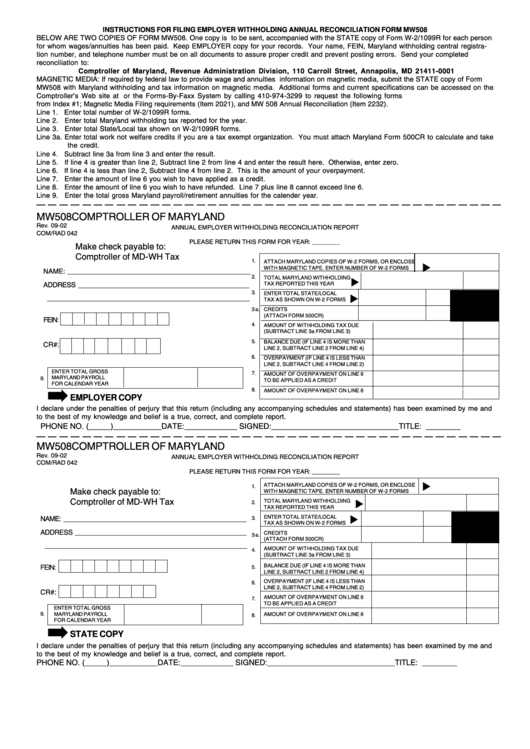

Web maryland return of income tax withholding for nonresident sale of real property: Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Retirement use only form 766 (rev. Md mw507 (2023) md mw507 (2023) instructions. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. Web this is the fastest and most secure method to update your maryland state tax withholding. Payees may request that federal and maryland state taxes be withheld from their retirement allowance. Web form used by employers to amend their employer withholding reports. The request for mail order forms may be used to order one copy or.

Md mw507 (2023) md mw507 (2023) instructions. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. Web of maryland, can withhold federal and state income tax from your pay. Web maryland return of income tax withholding for nonresident sale of real property: Retirement use only form 766 (rev. Web click here for a complete list of current city and local counties' tax rate. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. 1/15) you must file one combined form covering both your. Web this is the fastest and most secure method to update your maryland state tax withholding. Web 11 rows federal withholding/employee address update.

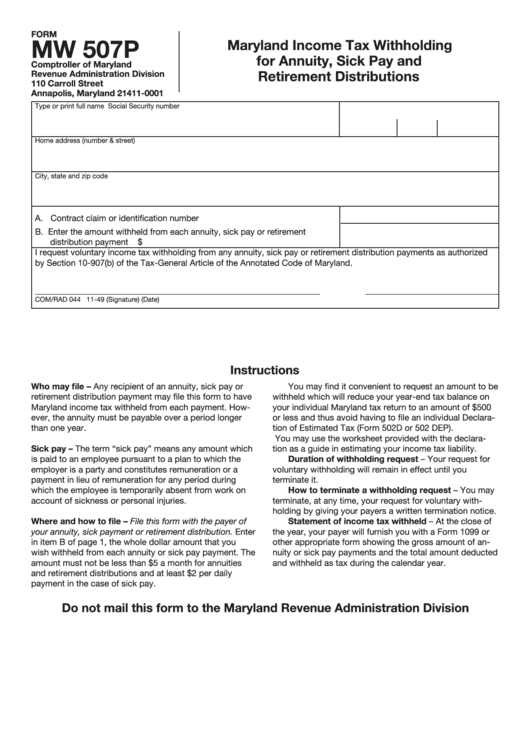

Fillable Form Mw 507p Maryland Tax Withholding For Annuity

The retirement agency does not withhold. Withholding exemption certificate/employee address update. If you have previously filed as “exempt”. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. Web this is the fastest and most secure method to update your maryland state tax withholding.

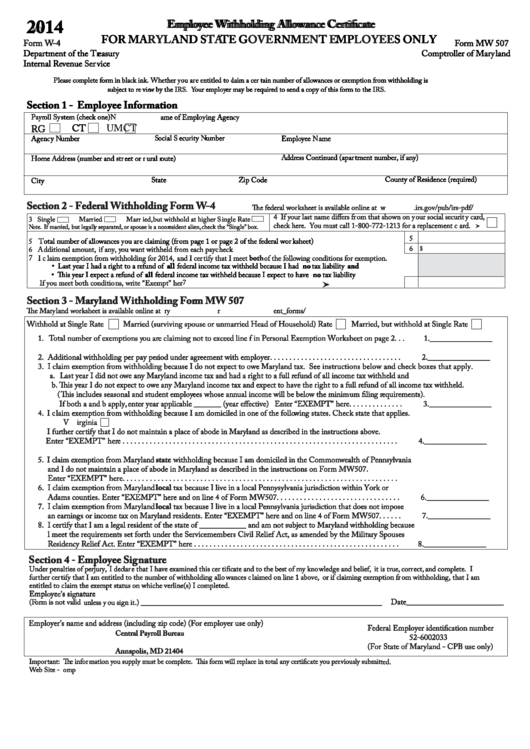

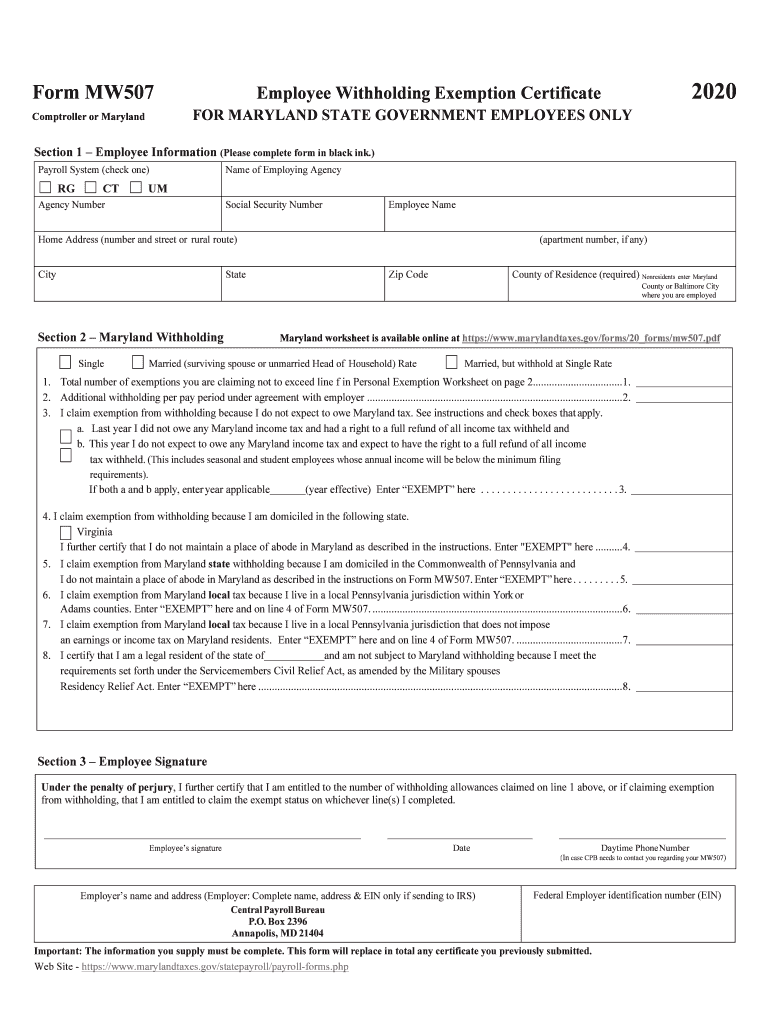

Employee's Maryland Withholding Exemption Certificate

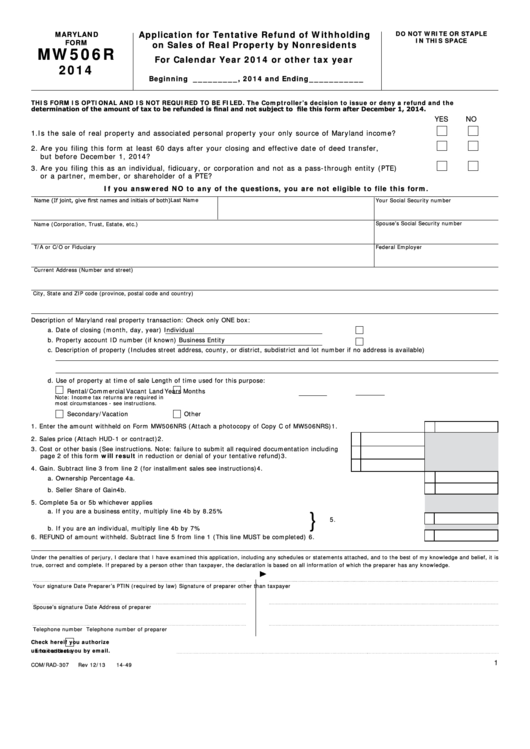

Form used to determine the amount of income tax withholding due on the sale of property. Web 7 rows employee's maryland withholding exemption certificate. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. For maryland state government employees only. The.

Fillable Maryland Form Mw506r Application For Tentative Refund Of

Web 7 rows employee's maryland withholding exemption certificate. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. Payees may request that federal and maryland state taxes be withheld from their retirement allowance. Web this is the fastest and most secure method to.

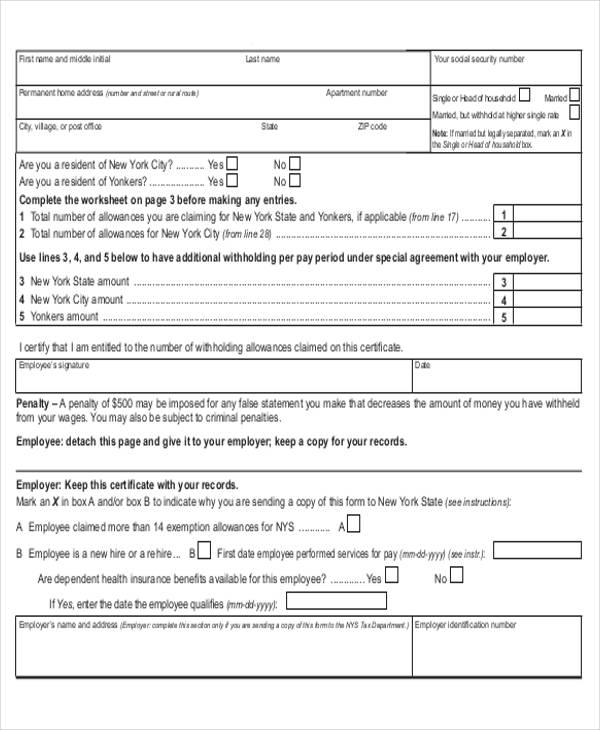

Fillable Form W4 (Form Mw 507) Employee Withholding Allowance

1/15) you must file one combined form covering both your. Web federal and maryland state tax withholding request. Md mw507 (2023) md mw507 (2023) instructions. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. For maryland state government employees only.

20202022 Form MD BCPS Employee Combined Withholding Allowance

For maryland state government employees only. Government of the district of. ) bill pay ( make. Web an employee who is required to file a withholding exemption certificate shall file with the employer a form mw 507 or other approved form. Web maryland return of income tax withholding for nonresident sale of real property:

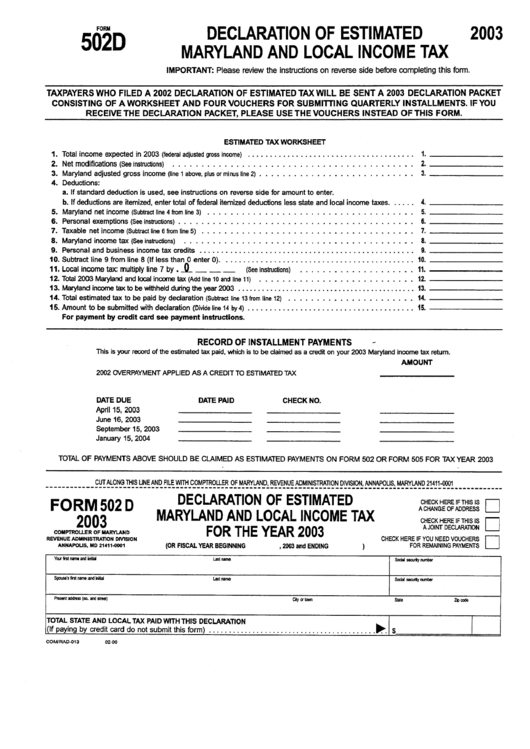

Form 502d Declaration Of Estimated Maryland And Lockal Tax

Web federal and maryland state tax withholding request. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. ) bill pay ( make. The retirement agency does not withhold. Web of maryland, can withhold federal and state income tax from your pay.

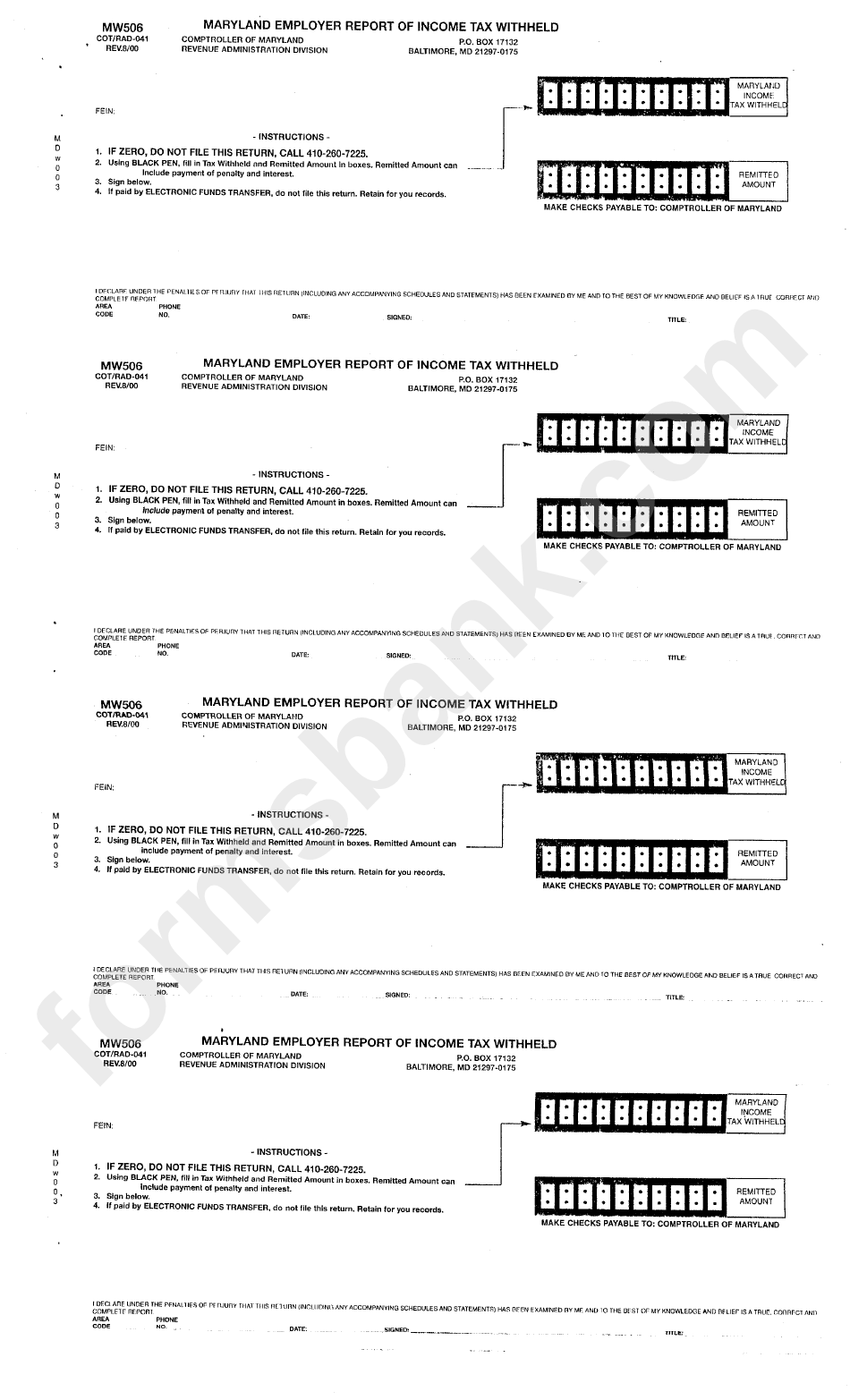

Form Mw506 Maryland Employer Report Of Tax Withheld printable

Md mw507 (2023) md mw507 (2023) instructions. ) bill pay ( make. Web 7 rows employee's maryland withholding exemption certificate. Retirement use only form 766 (rev. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil.

Maryland Employer Tax Withholding 2021 Federal Withholding Tables 2021

For maryland state government employees only. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web click here for a complete list of current city and local counties' tax rate. Web the law requires that you complete an employee’s withholding.

Md State Tax Withholding Form

The retirement agency does not withhold. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. Web form used by employers to amend their employer withholding reports. Md mw507 (2023) md mw507 (2023) instructions. For maryland state government employees only.

Maryland Withholding

I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. You can log into your account here: If you have previously filed as “exempt”. Web 7 rows employee's maryland withholding exemption certificate. I certify that i am a legal resident of.

Web Of Maryland, Can Withhold Federal And State Income Tax From Your Pay.

The retirement agency does not withhold. For maryland state government employees only. Government of the district of. Web form used by employers to amend their employer withholding reports.

For Maryland State Government Employees Only.

) bill pay ( make. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. Your current certificate remains in effect until you change it. Retirement use only form 766 (rev.

The Request For Mail Order Forms May Be Used To Order One Copy Or.

Web this is the fastest and most secure method to update your maryland state tax withholding. Web 7 rows employee's maryland withholding exemption certificate. Web 11 rows federal withholding/employee address update. Withholding exemption certificate/employee address update.

Form Used To Determine The Amount Of Income Tax Withholding Due On The Sale Of Property.

Web click here for a complete list of current city and local counties' tax rate. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. You can log into your account here: