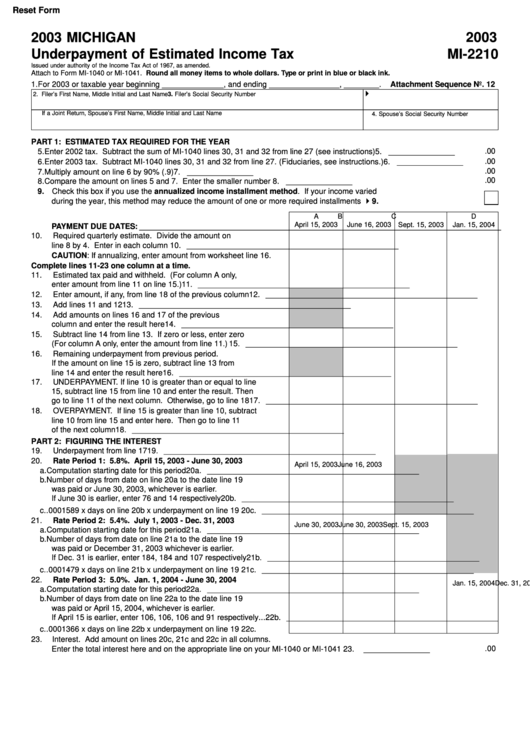

Mi 2210 Form

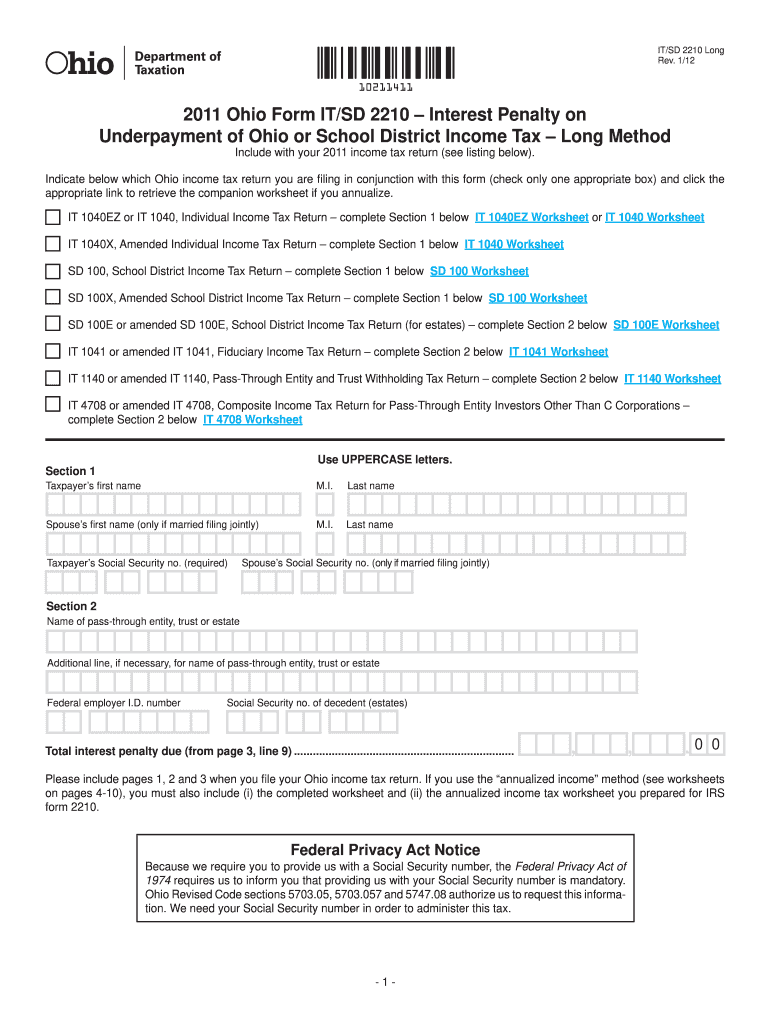

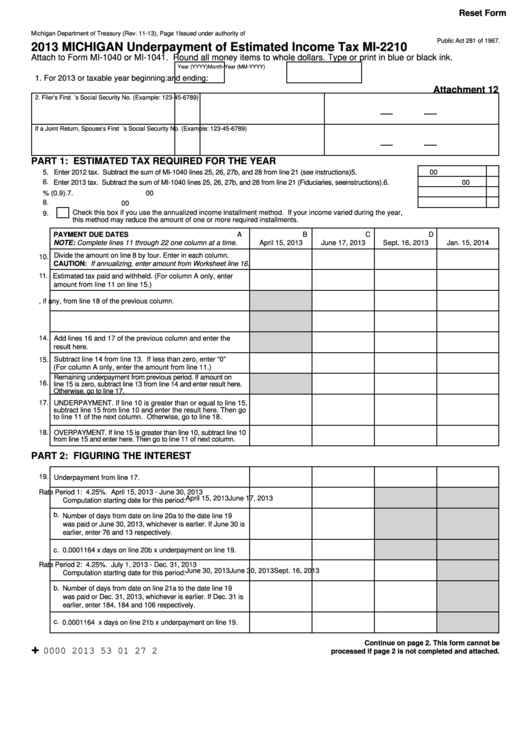

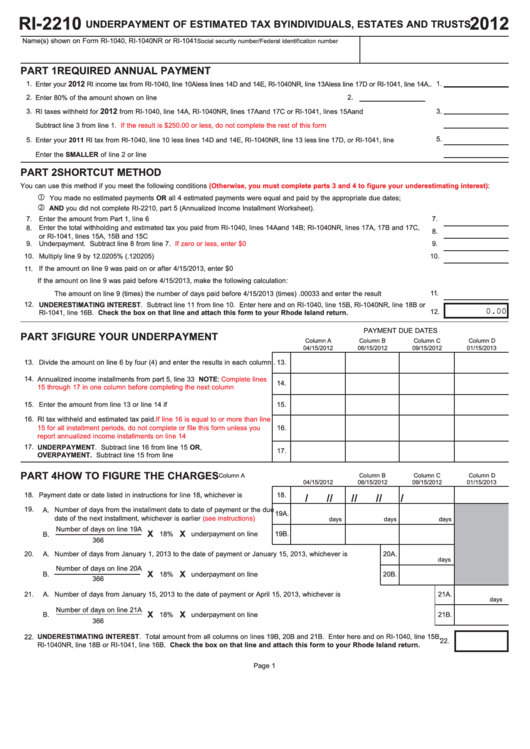

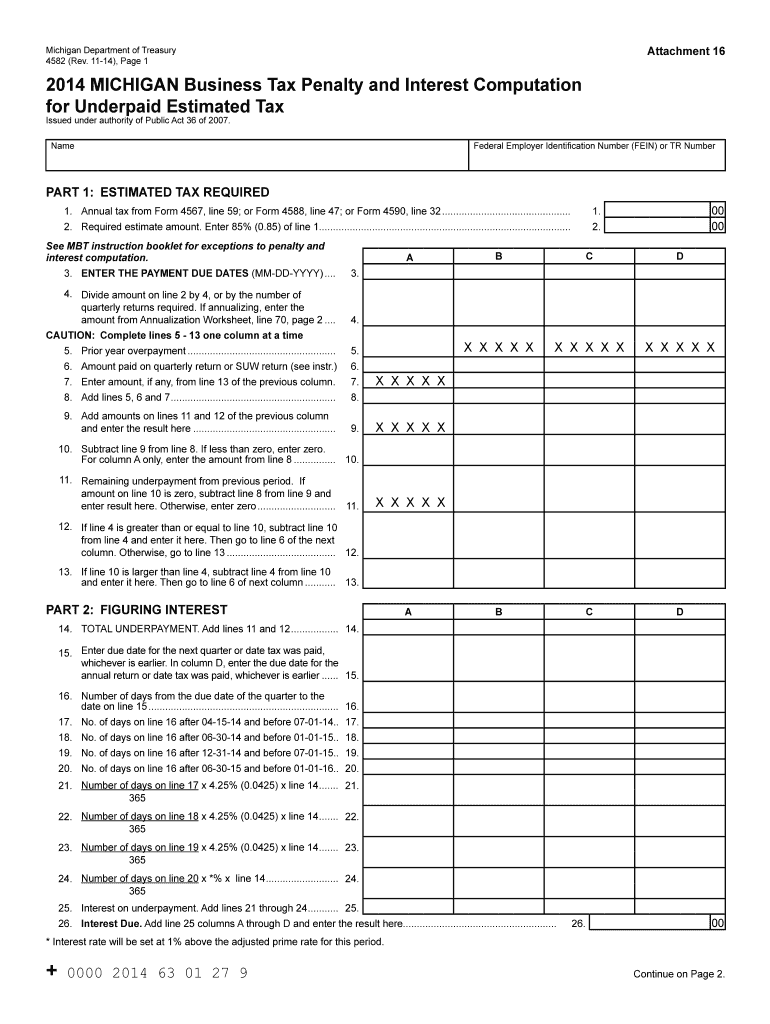

Mi 2210 Form - For 2020, taxpayers received an automatic. Taxpayers required to make estimated payments may owe penalty and interest for underpayment, late payment, or for failing to make estimated tax. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Figure your 2020 tax from your 2020 return. Summary as introduced (6/15/2022) this document analyzes: Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date. Web what is a mi 2210 form? Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. Easily fill out pdf blank, edit, and sign them. Historic preservation tax credit for plans approved after december 31, 2020:

Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date. For 2020, taxpayers received an automatic. Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. This form is for income earned in tax year 2022, with tax returns due in april. Save or instantly send your ready documents. Taxpayers required to make estimated payments may owe penalty and interest for underpayment, late payment, or for failing to make estimated tax. The irs will generally figure your penalty for you and you should not file form 2210. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Historic preservation tax credit for plans approved after december 31, 2020:

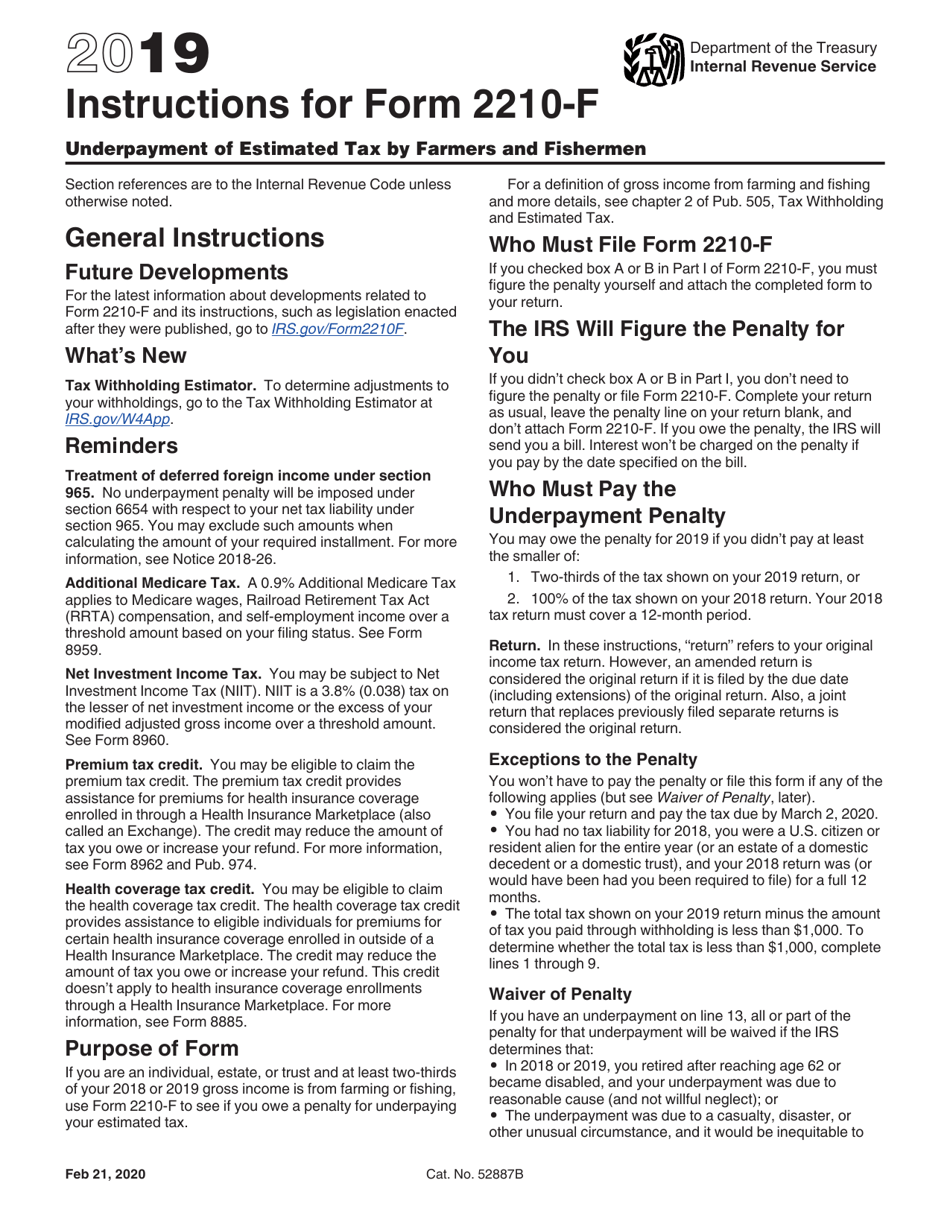

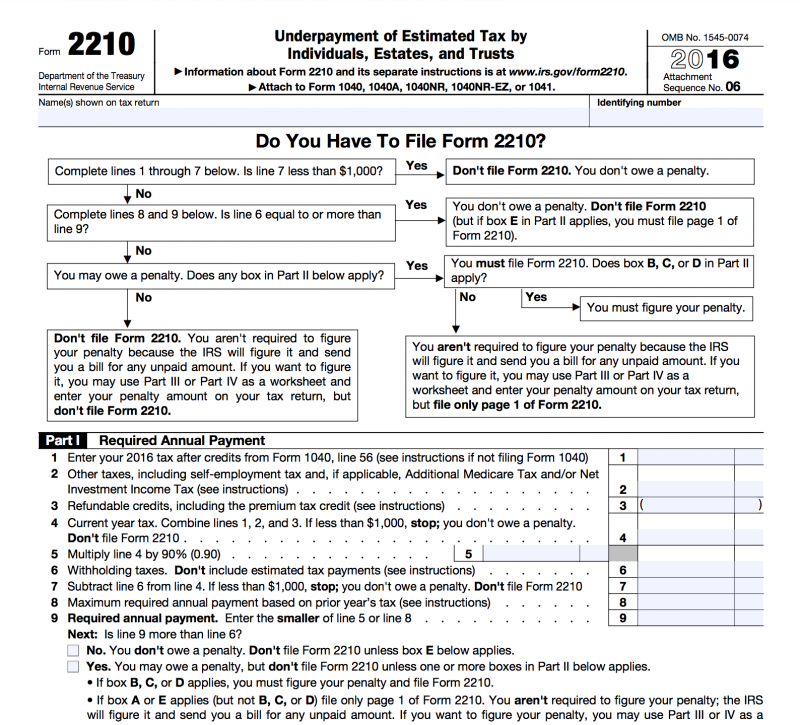

Web instructions included on form. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. This calculator is unofficial and not a substitute for. This form is for income earned in tax year 2022, with tax returns due in april. Web what is a mi 2210 form? Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date. Historic preservation tax credit for plans approved after december 31, 2020: The irs will generally figure your penalty for you and you should not file form 2210. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Figure your 2020 tax from your 2020 return. Round all money items to whole. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. This calculator is unofficial and not a substitute for. This form is for income earned in tax year 2022, with tax returns due in april.

2210 Form Fill Out and Sign Printable PDF Template signNow

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. The irs will generally figure your penalty for you and you should not file form 2210..

Fillable Form Mi2210 Michigan Underpayment Of Estimated Tax

The irs will generally figure your penalty for you and you should not file form 2210. Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. Taxpayers required to make estimated payments may owe penalty and interest for underpayment, late payment, or for failing to make estimated tax. Save or instantly send.

Ssurvivor Irs Form 2210 Instructions

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. Web the michigan mi 2210 form is a crucial tool used to process an.

Ssurvivor Irs Form 2210 Ai Instructions

Figure your 2020 tax from your 2020 return. Summary as introduced (6/15/2022) this document analyzes: It serves as one of michigan's mandatory documents when filing requests with state. Taxpayers required to make estimated payments may owe penalty and interest for underpayment, late payment, or for failing to make estimated tax. Web the michigan mi 2210 form is a crucial tool.

Fillable Form Ri2210 Underpayment Of Estimated Tax By Individuals

Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. Easily fill out pdf blank, edit, and sign them. Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. It serves as one of.

Taxes Why Am I Being Charged MI 2210 Penalty and Interest? Fill Out

Historic preservation tax credit for plans approved after december 31, 2020: Web instructions included on form. Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. Round all money items to whole. It serves as one of michigan's mandatory documents when filing requests with state.

Fillable Form Mi2210 Michigan Underpayment Of Estimated Tax

Easily fill out pdf blank, edit, and sign them. Web instructions included on form. Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. This calculator is unofficial and not a substitute for. Important notice for tax year 2020.

Download Instructions for IRS Form 2210F Underpayment of Estimated Tax

This calculator is unofficial and not a substitute for. Web instructions included on form. This form is for income earned in tax year 2022, with tax returns due in april. Figure your 2020 tax from your 2020 return. The irs will generally figure your penalty for you and you should not file form 2210.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

Web what is a mi 2210 form? Important notice for tax year 2020. This calculator is unofficial and not a substitute for. Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due.

The Irs Will Generally Figure Your Penalty For You And You Should Not File Form 2210.

Figure your 2020 tax from your 2020 return. For 2020, taxpayers received an automatic. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date.

Taxpayers Required To Make Estimated Payments May Owe Penalty And Interest For Underpayment, Late Payment, Or For Failing To Make Estimated Tax.

Easily fill out pdf blank, edit, and sign them. It serves as one of michigan's mandatory documents when filing requests with state. Web what is a mi 2210 form? Round all money items to whole.

Web Form 2210 Is Used To Determine How Much You Owe In Underpayment Penalties On Your Balance Due.

This calculator is unofficial and not a substitute for. Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. Important notice for tax year 2020. Summary as introduced (6/15/2022) this document analyzes:

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Historic preservation tax credit for plans approved after december 31, 2020: Web instructions included on form. Web the michigan mi 2210 form is a crucial tool used to process an entire range of services. Save or instantly send your ready documents.