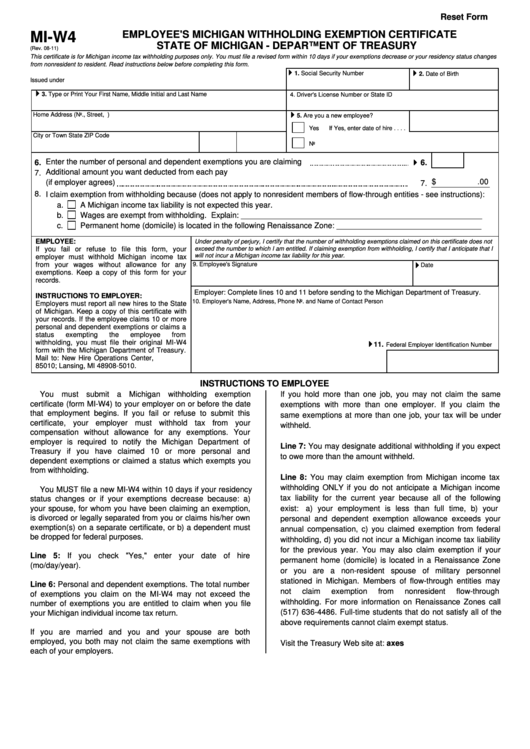

Mi W4 Form

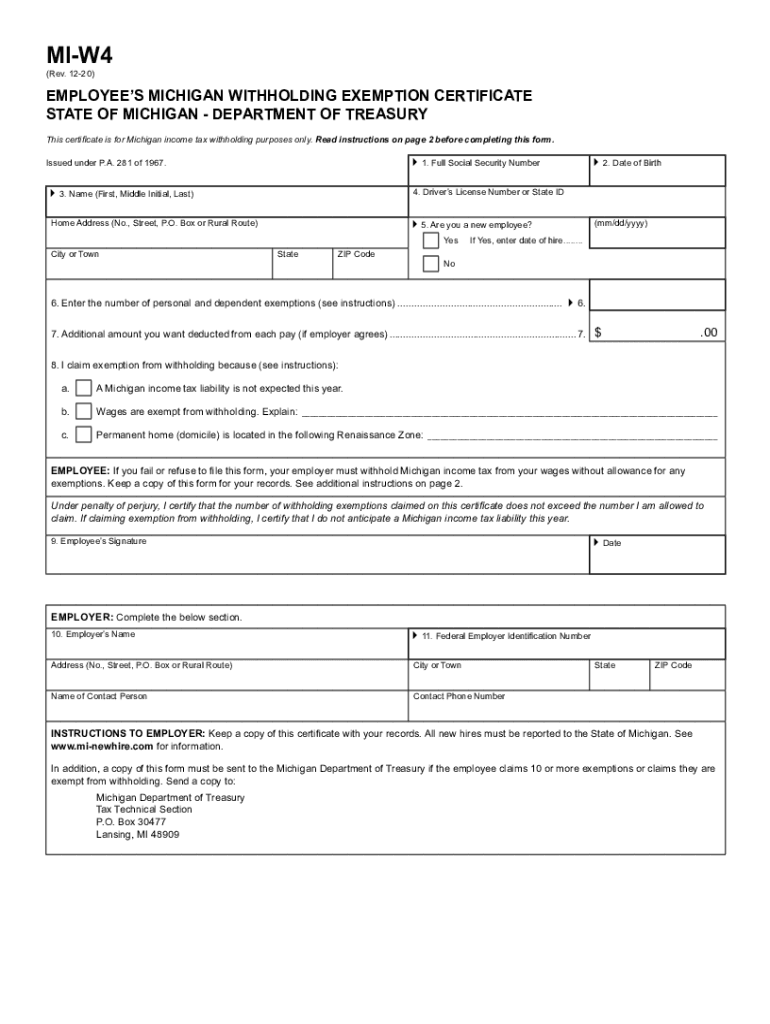

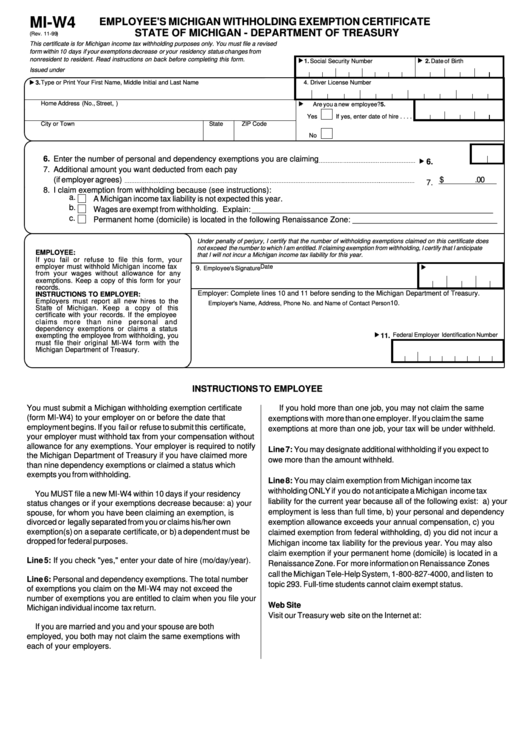

Mi W4 Form - Notice of change or discontinuance: If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and Your employer is required to notify the michigan department of treasury if you have claimed 10 Read instructions on page 2 before completing this form. Employee's withholding exemption certificate and instructions: Your withholding is subject to review by the irs. Withholding certificate for michigan pension or annuity payments: Withholding certificate for michigan pension or annuity payments:

Withholding certificate for michigan pension or annuity payments: Employee's michigan withholding exemption certificate and instructions: Withholding certificate for michigan pension or annuity payments: Your employer is required to notify the michigan department of treasury if you have claimed 10 Read instructions on page 2 before completing this form. Employee's withholding exemption certificate and instructions: Sales and other dispositions of capital assets: Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Your withholding is subject to review by the irs.

Withholding certificate for michigan pension or annuity payments: Read instructions on page 2 before completing this form. Full social security number 42. Withholding certificate for michigan pension or annuity payments: Web instructions included on form: If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Notice of change or discontinuance: If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Sales and other dispositions of capital assets: Your employer is required to notify the michigan department of treasury if you have claimed 10

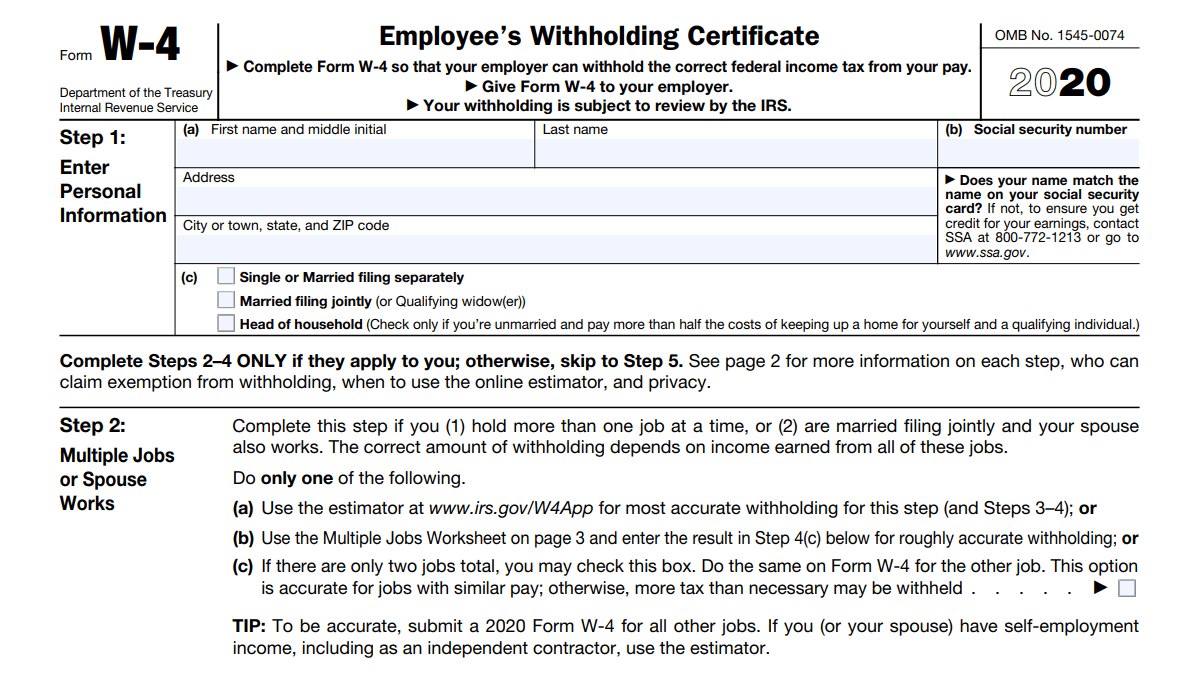

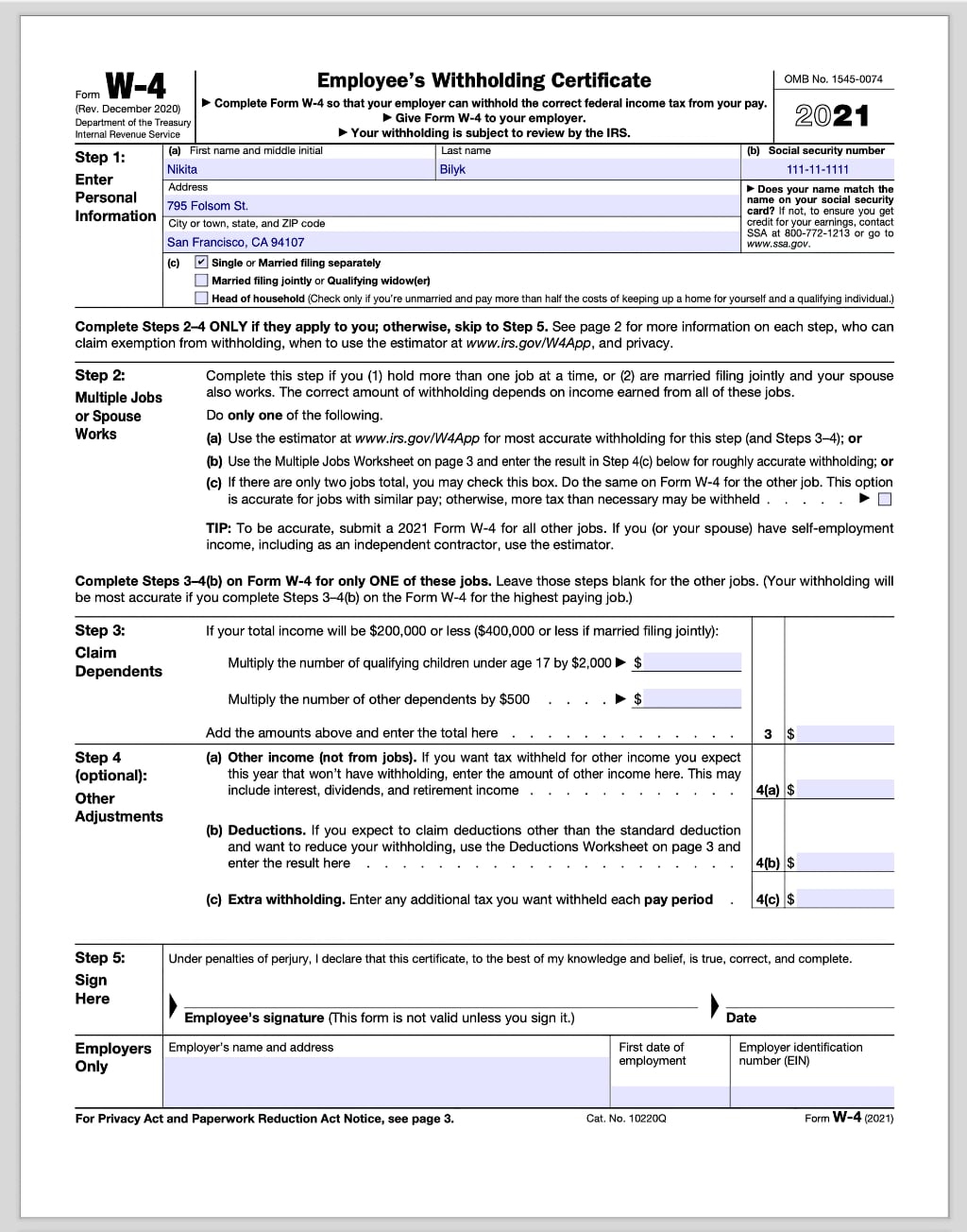

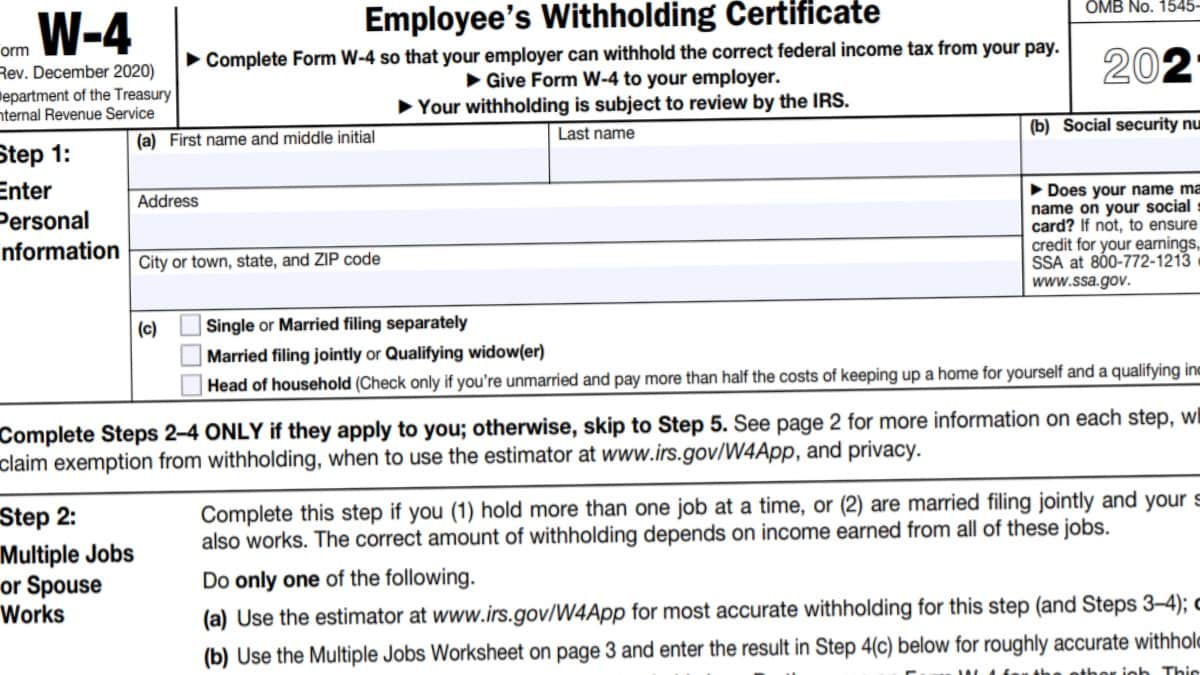

Ms Printable W4 Forms 2021 2022 W4 Form

Your employer is required to notify the michigan department of treasury if you have claimed 10 If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and Employee's michigan.

Fillable W 4 form Michigan W 4 form and Instructions for Nonresident

Your withholding is subject to review by the irs. Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and Sales and other dispositions of capital assets: Read instructions on page 2 before completing this form. Your withholding is subject to review by the irs.

Download Michigan Form MIW4 for Free FormTemplate

Sales and other dispositions of capital assets: Full social security number 42. Employee's michigan withholding exemption certificate and instructions: Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any.

Michigan Form Mi W4 PDFSimpli

Sales and other dispositions of capital assets: Web instructions included on form: Notice of change or discontinuance: Withholding certificate for michigan pension or annuity payments: Withholding certificate for michigan pension or annuity payments:

Mi W4 Form 2021 2022 W4 Form

Web instructions included on form: Withholding certificate for michigan pension or annuity payments: Sales and other dispositions of capital assets: Read instructions on page 2 before completing this form. Employee's michigan withholding exemption certificate and instructions:

W4 Forms 2021 2022 Zrivo

Your employer is required to notify the michigan department of treasury if you have claimed 10 Employee's withholding exemption certificate and instructions: If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Withholding certificate for michigan pension or annuity payments: Sales and other dispositions of capital assets:

Fillable MiW4, Employee'S Michigan Withholding Exemption Certificate

Withholding certificate for michigan pension or annuity payments: Read instructions on page 2 before completing this form. Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and Web instructions included on form: Your employer is required to notify the michigan department of treasury if you have claimed 10

W4 Form 2022 Instructions W4 Forms TaxUni

Your withholding is subject to review by the irs. If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Sales and other dispositions of capital assets: Employee's withholding exemption certificate and instructions: Web instructions included on form:

Michigan W4 Fill Out and Sign Printable PDF Template signNow

Read instructions on page 2 before completing this form. Employee's withholding exemption certificate and instructions: If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Your withholding is subject to review by the irs. Employee's michigan withholding exemption certificate and instructions:

Form MiW4 Employee'S Michigan Withholding Exemption Certificate

Your employer is required to notify the michigan department of treasury if you have claimed 10 Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and Employee's michigan withholding exemption certificate and instructions: Your withholding is subject to review by the irs. Read instructions on page 2 before completing this.

Your Withholding Is Subject To Review By The Irs.

Withholding certificate for michigan pension or annuity payments: Sales and other dispositions of capital assets: Employee's withholding exemption certificate and instructions: Web instructions included on form:

Employee's Michigan Withholding Exemption Certificate And Instructions:

If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Your employer is required to notify the michigan department of treasury if you have claimed 10 If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Notice of change or discontinuance:

Read Instructions On Page 2 Before Completing This Form.

Withholding certificate for michigan pension or annuity payments: Your withholding is subject to review by the irs. Your employer is required to notify the michigan department of treasury if you have claimed 10 or more personal and Full social security number 42.