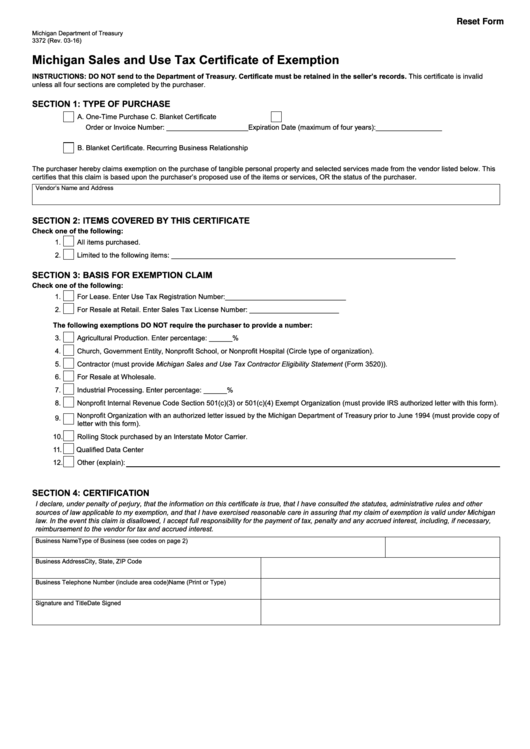

Michigan Form 3372

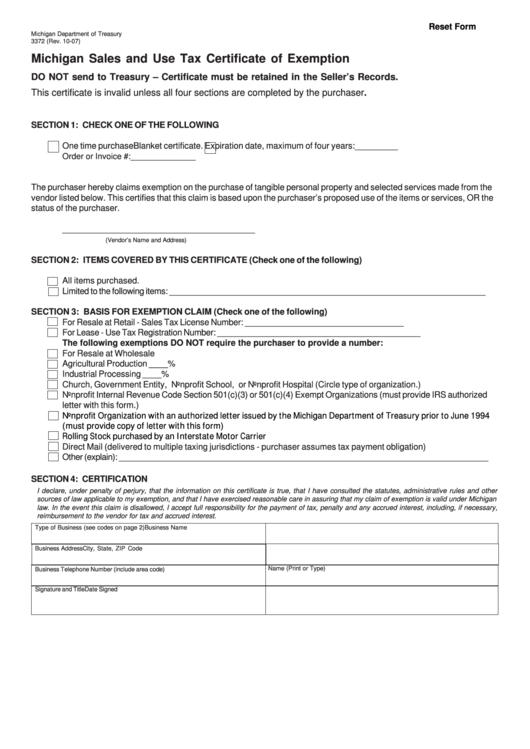

Michigan Form 3372 - Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury. Fill out the michigan 3372 tax exemption certificate form Web michigan department of treasuryform 3372 (rev. This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Obtain a michigan sales tax license. Sales and use tax forms index by year This certificate is invalid unless all four sections are completed by the purchaser. This certificate is invalid unless all four sections are completed by the purchaser. Michigan sales and use tax certificate of exemption:

Web michigan department of treasuryform 3372 (rev. Do not send a copy to treasury unless one is requested. Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Web once you have that, you are eligible to issue a resale certificate. Web michigan department of treasury 3372 (rev. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Web instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. Certificate must be retained in the seller’s records.

Michigan sales and use tax certificate of exemption: Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Corporate income tax (cit) city income tax forms; A seller must meet a. Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Do not send a copy to treasury unless one is requested. This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections.

MI 5081 Instruction 2020 Fill out Tax Template Online US Legal Forms

Corporate income tax (cit) city income tax forms; Web michigan department of treasury 3372 (rev. Web once you have that, you are eligible to issue a resale certificate. Do not send a copy to treasury unless one is requested. Certificate must be retained in the seller’s records.

Form A226 Download Fillable PDF or Fill Online Michigan Department of

Web michigan department of treasuryform 3372 (rev. Corporate income tax (cit) city income tax forms; Obtain a michigan sales tax license. Health insurance claims assessment (hica) ifta / motor carrier; A seller must meet a.

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Do not send a copy to treasury unless one is requested. A seller must meet a. Corporate income tax (cit) city income tax forms; Sales and use tax forms index by year

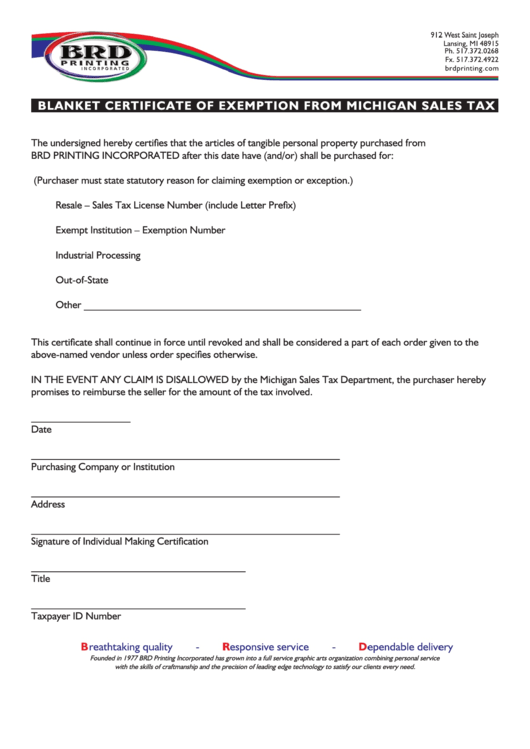

Blank Michigan Sales Tax Exempt Form

Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Do not send a copy to treasury unless one is requested. This certificate is invalid unless all four sections are completed by the purchaser. This.

Sales Order Form Template Business

Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Sales, use and withholding tax due dates for holidays and weekends: Web michigan department of treasury 3372 (rev. This certificate is invalid unless all four sections are completed by.

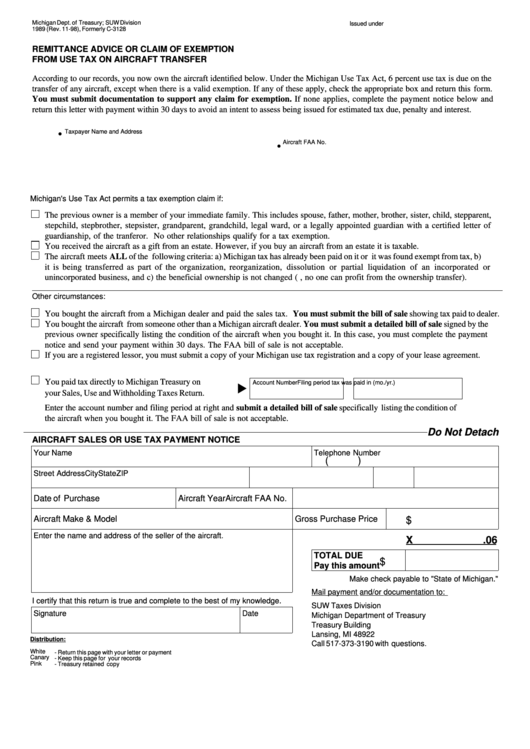

Aircraft Sales Or Use Tax Payment Notice Michigan Deptartment Of

Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. Corporate income tax (cit) city income tax forms; Certificate must be retained in the seller’s records. This certificate is invalid unless all four sections are completed by the purchaser. Web michigan department of treasury 3372 (rev.

How to get a Certificate of Exemption in Michigan

Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury. This certificate is invalid unless all four sections are completed by the purchaser. Certificate must be retained in the seller’s records. Web michigan department.

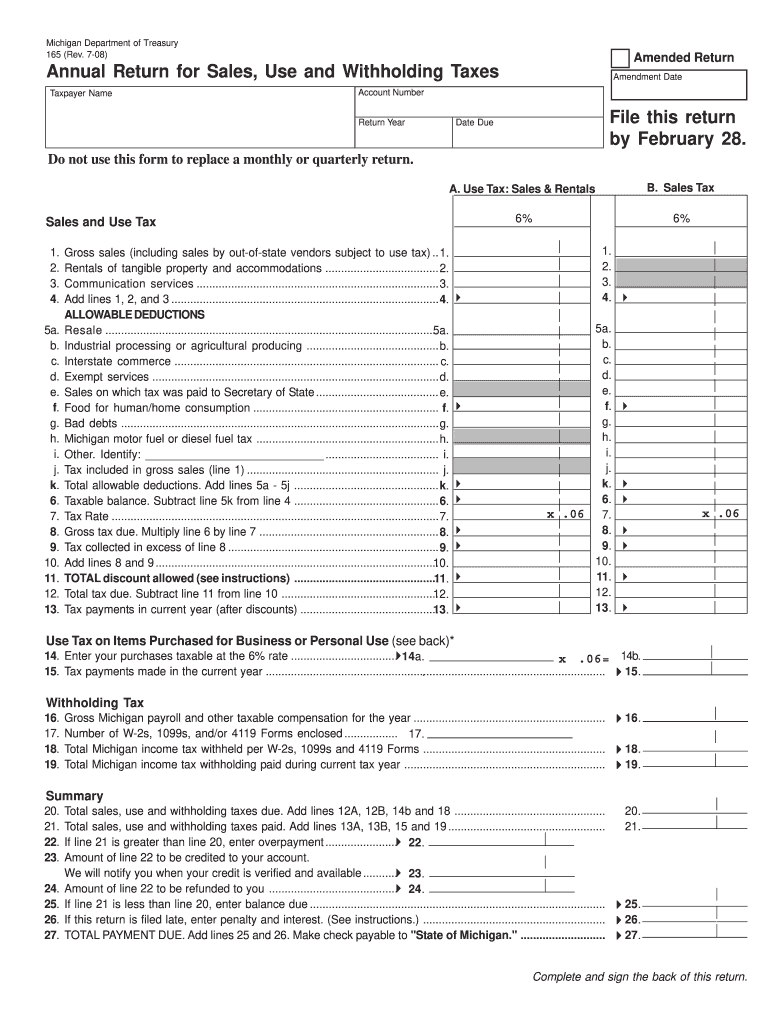

Michigan Form 165 Fill Online, Printable, Fillable, Blank pdfFiller

Corporate income tax (cit) city income tax forms; Certificate must be retained in the seller’s records. A seller must meet a. Certificate must be retained in the seller’s records. Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number.

Michigan form 3372 Fill out & sign online DocHub

Do not send to the department of treasury. A seller must meet a. Web michigan department of treasury 3372 (rev. Web michigan department of treasuryform 3372 (rev. Fill out the michigan 3372 tax exemption certificate form

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury. Sales, use and withholding tax due dates for holidays and weekends: Web in order to claim an exemption from sales or use tax, a.

Corporate Income Tax (Cit) City Income Tax Forms;

Web michigan department of treasuryform 3372 (rev. Certificate must be retained in the seller’s records. Web once you have that, you are eligible to issue a resale certificate. Sales, use and withholding tax due dates for holidays and weekends:

Do Not Send To The Department Of Treasury.

Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Web michigan department of treasury 3372 (rev. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and.

Web Michigan Department Of Treasuryform 3372 (Rev.

Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections. Health insurance claims assessment (hica) ifta / motor carrier; Obtain a michigan sales tax license.

A Seller Must Meet A.

This certificate is invalid unless all four sections are completed by the purchaser. Michigan sales and use tax certificate of exemption: This certificate is invalid unless all four sections are completed by the purchaser. Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury.