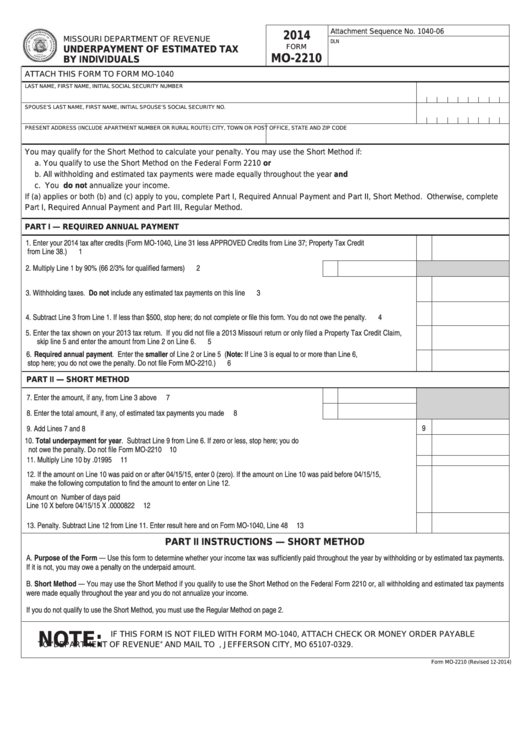

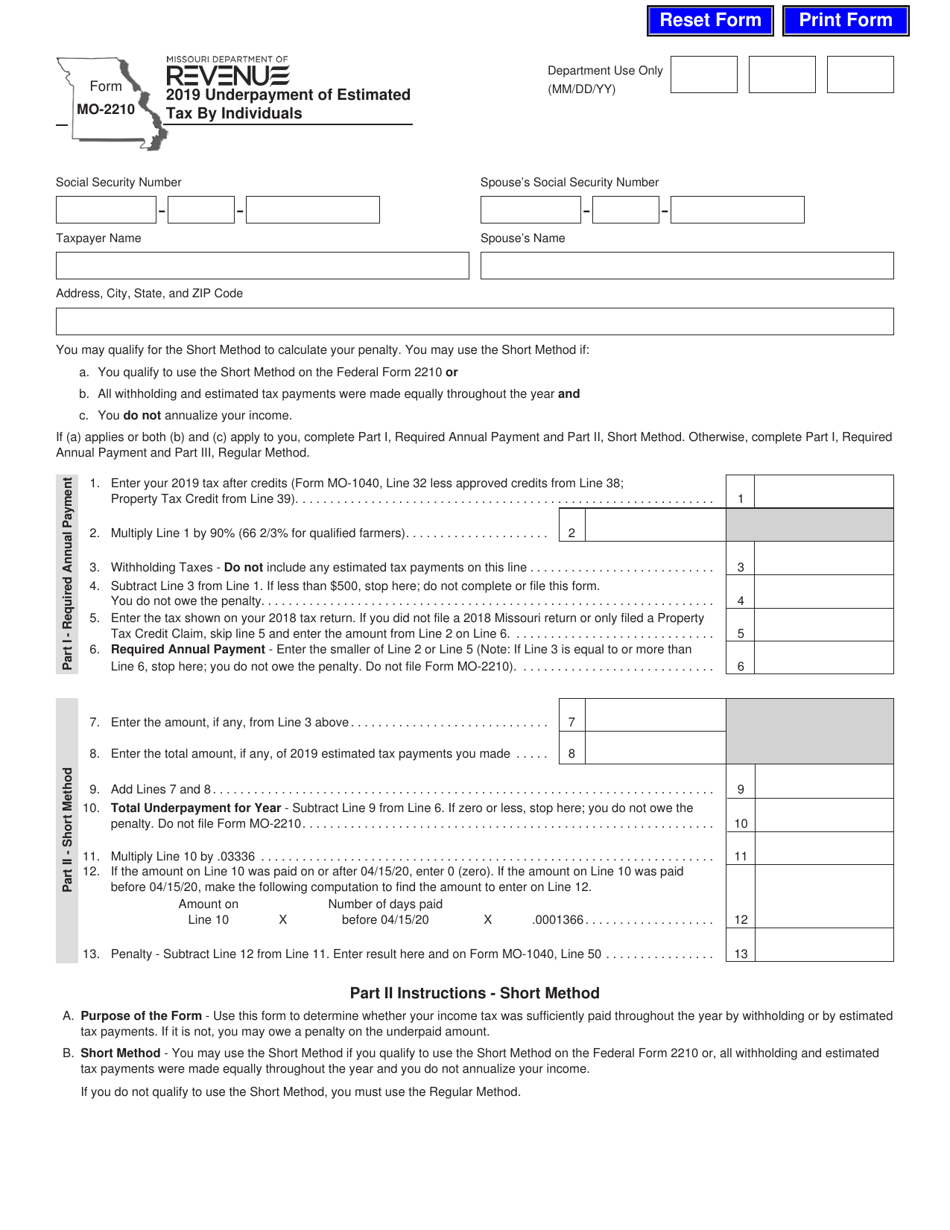

Missouri Form 2210

Missouri Form 2210 - If it is not, you may owe a penalty on the underpaid amount. This form is for income earned in tax year 2022, with tax returns due in april 2023. If it is not, you may owe a penalty on the underpaid amount. Web how to fill out and sign missouri underpayment tax online? Enjoy smart fillable fields and interactivity. Date return filed (if other than due date of return) Web what is mo tax form 2210? Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. Follow the simple instructions below: Get your online template and fill it in using progressive features.

If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe additions to tax on the underpaid amount. Filing an estimated declaration and paying the tax, calendar Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. Date return filed (if other than due date of return) If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount. Enjoy smart fillable fields and interactivity. This form is for income earned in tax year 2022, with tax returns due in april 2023. Follow the simple instructions below:

Web how to fill out and sign missouri underpayment tax online? Date return filed (if other than due date of return) Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. If it is not, you may owe a penalty on the underpaid amount. Get your online template and fill it in using progressive features. If it is not, you may owe a penalty on the underpaid amount. This form is for income earned in tax year 2022, with tax returns due in april 2023. If it is not, you may owe additions to tax on the underpaid amount. Web what is mo tax form 2210? Filing an estimated declaration and paying the tax, calendar

تعليمات نموذج الضريبة الفيدرالية 2210 أساسيات 2021

If it is not, you may owe a penalty on the underpaid amount. Web how to fill out and sign missouri underpayment tax online? Web what is mo tax form 2210? Follow the simple instructions below: Filing an estimated declaration and paying the tax, calendar

Fillable Form Mo2210 Underpayment Of Estimated Tax By Individuals

Web how to fill out and sign missouri underpayment tax online? If it is not, you may owe a penalty on the underpaid amount. Get your online template and fill it in using progressive features. Filing an estimated declaration and paying the tax, calendar If it is not, you may owe a penalty on the underpaid amount.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Follow the simple instructions below: Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Web what is mo tax form 2210?

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Web what is mo tax form 2210? Filing an estimated declaration and paying the tax, calendar This form is for income earned in tax year 2022, with tax returns due in april 2023. Purpose of.

Underpayment Of Estimated Tax By Individuals Form Mo2210 Edit, Fill

If it is not, you may owe additions to tax on the underpaid amount. Get your online template and fill it in using progressive features. This form is for income earned in tax year 2022, with tax returns due in april 2023. Follow the simple instructions below: If it is not, you may owe a penalty on the underpaid amount.

Form MO2210 Download Fillable PDF or Fill Online Underpayment of

Follow the simple instructions below: Enjoy smart fillable fields and interactivity. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Filing an estimated declaration and paying the tax, calendar If it is not, you may owe additions to tax on the underpaid amount.

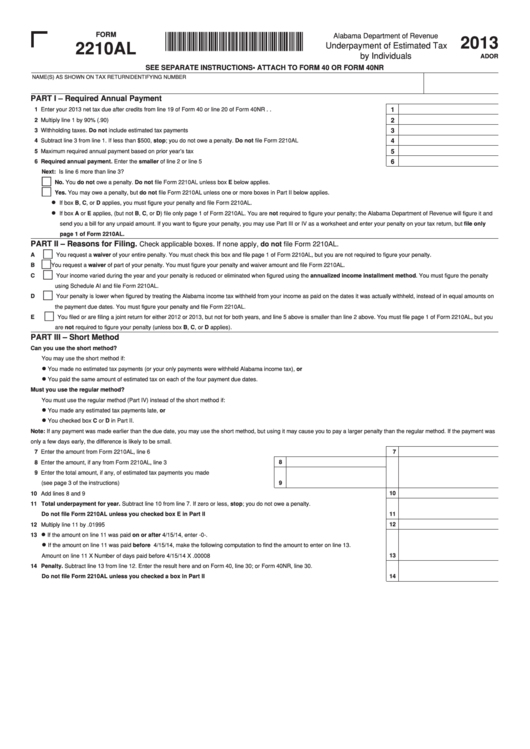

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals

If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe additions to tax on the underpaid amount. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Enjoy smart fillable fields and interactivity. This form.

JOHN DEERE 2210 For Sale In Gallatin, Missouri

If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount. Follow the simple instructions below: Date return filed (if other than due date of return) Filing an estimated declaration and paying the tax, calendar

Ssurvivor Irs Form 2210 Ai Instructions

We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Web what is mo tax form 2210? This form is for income earned in tax year 2022, with tax returns due in april 2023. Get your online template and fill it in using progressive features..

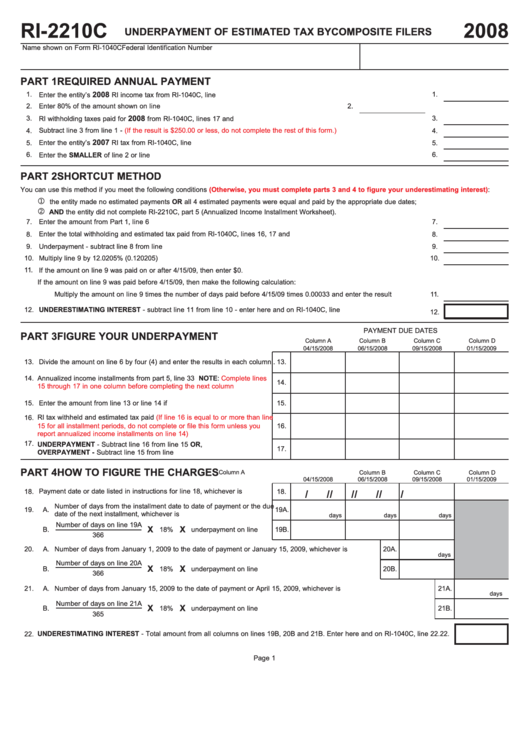

Form Ri2210c Underpayment Of Estimated Tax By Composite Filers

Follow the simple instructions below: Date return filed (if other than due date of return) If it is not, you may owe a penalty on the underpaid amount. Web how to fill out and sign missouri underpayment tax online? Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Missouri Government.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web what is mo tax form 2210? Date return filed (if other than due date of return) Filing an estimated declaration and paying the tax, calendar

Enjoy Smart Fillable Fields And Interactivity.

Get your online template and fill it in using progressive features. If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount. Follow the simple instructions below:

If It Is Not, You May Owe A Penalty On The Underpaid Amount.

Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. If it is not, you may owe additions to tax on the underpaid amount. Web how to fill out and sign missouri underpayment tax online?