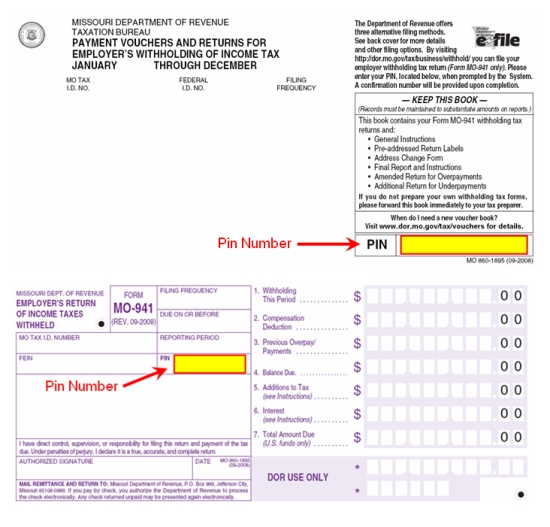

Mo 941 Form

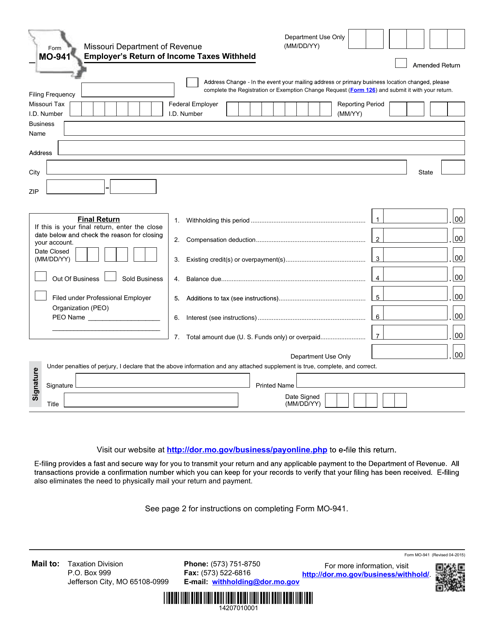

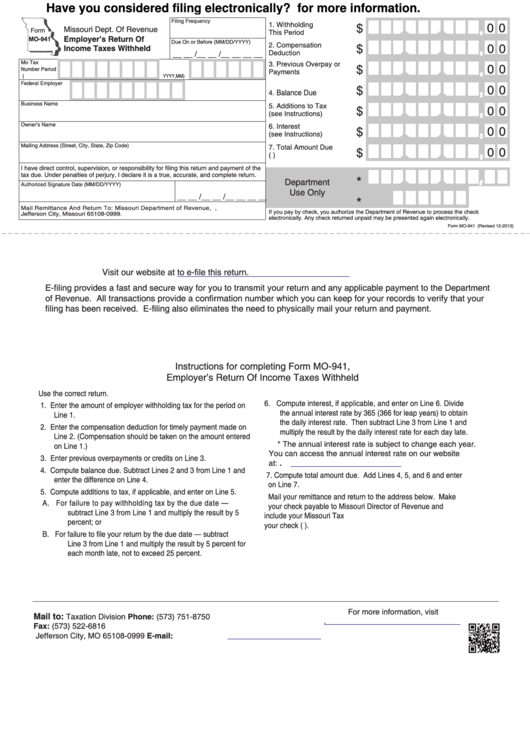

Mo 941 Form - Information can be submitted by one of the following methods: Employer's withholding tax final report: Missouri division of employment security, p.o. You will need the following information to complete this transaction: Web form 941 for 2023: A separate filing is not required. Submit a letter containing the missouri tax identification number and effective date of the last payroll. Fill out and mail to: Date signed (mm/dd/yy) visit our website at. Employer's return of income taxes withheld (note:

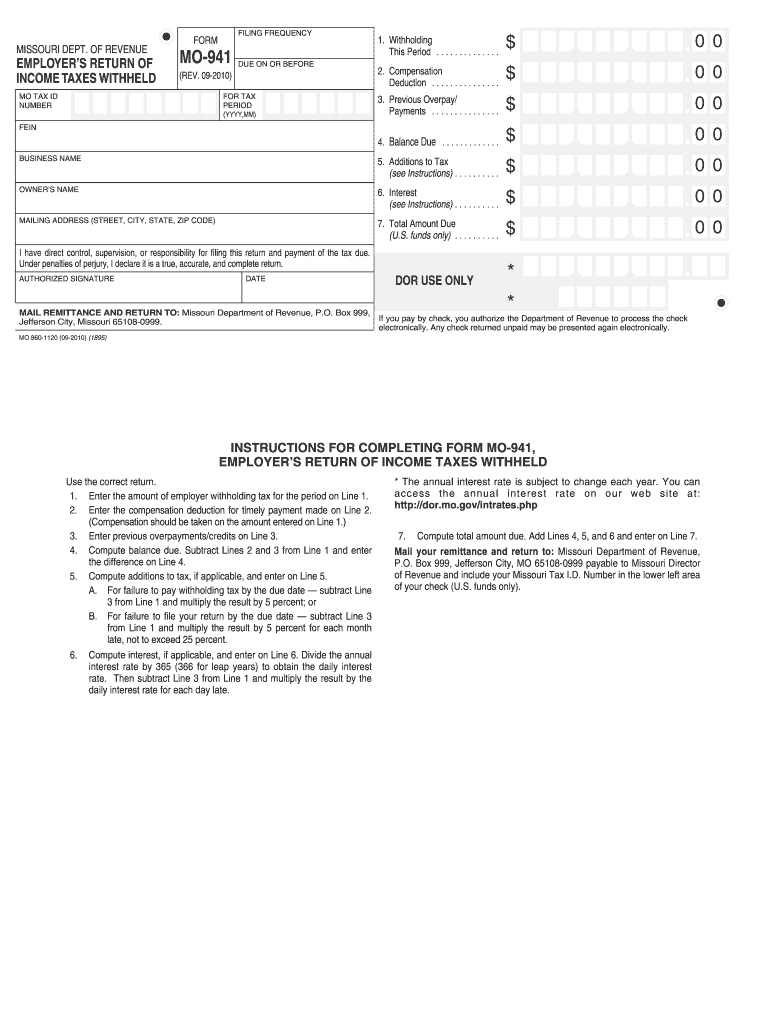

Employer's return of income taxes withheld (note: Submit a letter containing the missouri tax identification number and effective date of the last payroll. Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. You will need the following information to complete this transaction: Fill out and mail to: Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. You can print other missouri tax forms here. A separate filing is not required. Employer identification number (ein) — name (not. Date signed (mm/dd/yy) visit our website at.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. A separate filing is not required. Employer's withholding tax final report: Web form 941 for 2023: Employer identification number (ein) — name (not. Submit a letter containing the missouri tax identification number and effective date of the last payroll. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Information can be submitted by one of the following methods: You can print other missouri tax forms here. Employer's return of income taxes withheld (note:

11 Form Missouri The Ultimate Revelation Of 11 Form Missouri AH

Date signed (mm/dd/yy) visit our website at. Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service.

Skatt utleie april 2016

Date signed (mm/dd/yy) visit our website at. Web form 941 for 2023: Missouri division of employment security, p.o. Fill out and mail to: You can print other missouri tax forms here.

Withholding Tax Credit Inquiry Instructions

Fill out and mail to: For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. You can print other missouri tax forms here. Employer's withholding tax return correction:

Mo 941 Fill Online, Printable, Fillable, Blank pdfFiller

Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Employer's return of income taxes withheld (note: A separate filing is not required. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. For optimal functionality, save the form to your computer before completing and utilize adobe reader.).

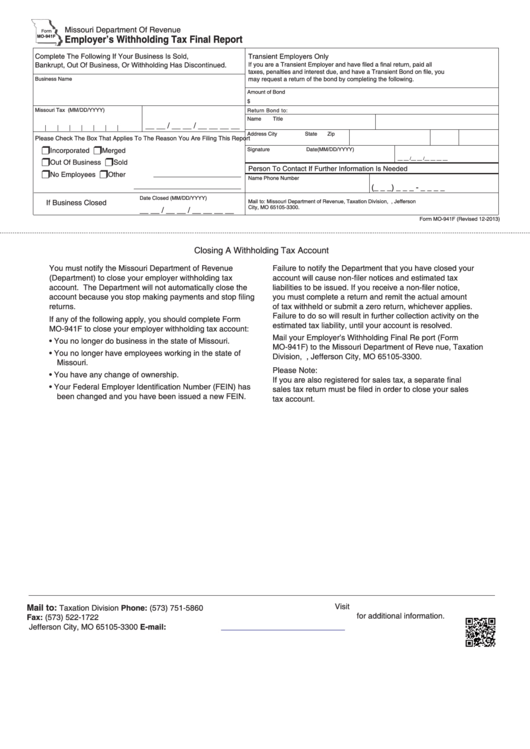

Fillable Form Mo941f Employer'S Withholding Tax Final Report 2013

Employer identification number (ein) — name (not. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Web form 941 for 2023: You will need the following information to complete this transaction: You can print other missouri tax forms here.

Form MO941 Download Fillable PDF or Fill Online Employer's Return of

You can print other missouri tax forms here. Missouri division of employment security, p.o. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. A separate filing is not required. Employer's return of income taxes withheld (note:

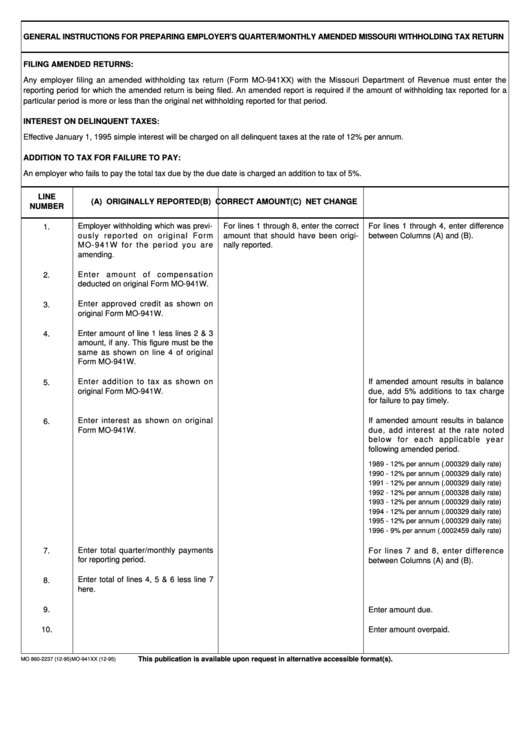

Top Mo941 X Form Templates free to download in PDF format

Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Employer's return of income taxes withheld (note: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Fill out and mail to: Under penalties of perjury, i declare that the above information and any attached.

Fillable Form Mo941 Employer'S Return Of Taxes Withheld

You will need the following information to complete this transaction: Employer's withholding tax final report: Employer identification number (ein) — name (not. Web form 941 for 2023: A separate filing is not required.

2018 Form MO DOR 5049 Fill Online, Printable, Fillable, Blank pdfFiller

Date signed (mm/dd/yy) visit our website at. Employer's withholding tax return correction: Employer identification number (ein) — name (not. Employer's withholding tax final report: You will need the following information to complete this transaction:

What Is Form 941 and How Do I File It? Ask Gusto

For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: Date signed (mm/dd/yy) visit our website at. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employer identification number (ein) — name (not. Employer's return of income taxes withheld (note:

Submit A Letter Containing The Missouri Tax Identification Number And Effective Date Of The Last Payroll.

For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: Missouri division of employment security, p.o. Employer identification number (ein) — name (not. Employer's return of income taxes withheld (note:

Employer's Withholding Tax Return Correction:

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. A separate filing is not required. You will need the following information to complete this transaction:

Employer's Withholding Tax Final Report:

Information can be submitted by one of the following methods: Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Date signed (mm/dd/yy) visit our website at. Fill out and mail to:

You Can Print Other Missouri Tax Forms Here.

Web form 941 for 2023: Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct.