Multi Member Llc To Single-Member Llc Form 8832

Multi Member Llc To Single-Member Llc Form 8832 - Thus, an llc with multiple owners can. Web irs form 8832 single member llc is used in order for a limited liability company to be taxed as a c corporation. You also need to use this form if your llc is being taxed as a. Complete, edit or print tax forms instantly. Buy direct and save up to 20% online. An entity disregarded as separate from its. Web 1 best answer. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. Web single member llc, owner reports profits and losses on form with the internal revenue service.it is also called a disregarded entity. Web how to complete form 8832 frequently asked questions llcs are formed at the state level.

Web an llc with either a single member or more than one member can elect to be classified as a corporation rather than be classified as a partnership or disregarded. And that’s where form 8832 comes in. Thus, an llc with multiple owners can. Web how to complete form 8832 frequently asked questions llcs are formed at the state level. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: You do not have to file a 1065 for the llc if the llc received no income nor incurred any expenses. Ad get coverage instantly from biberk. Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Trusted by thousands of businesses nationwide. Web single member llc, owner reports profits and losses on form with the internal revenue service.it is also called a disregarded entity.

An entity disregarded as separate from its. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Web single member llc, owner reports profits and losses on form with the internal revenue service.it is also called a disregarded entity. Get a quote and buy a policy in 5 minutes. Web form 8832 an llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default. Trusted by thousands of businesses nationwide. You do not have to file a 1065 for the llc if the llc received no income nor incurred any expenses. Web www.nsacct.org learning objectives at the end of this course, you will be able to: And that’s where form 8832 comes in. Ad get coverage instantly from biberk.

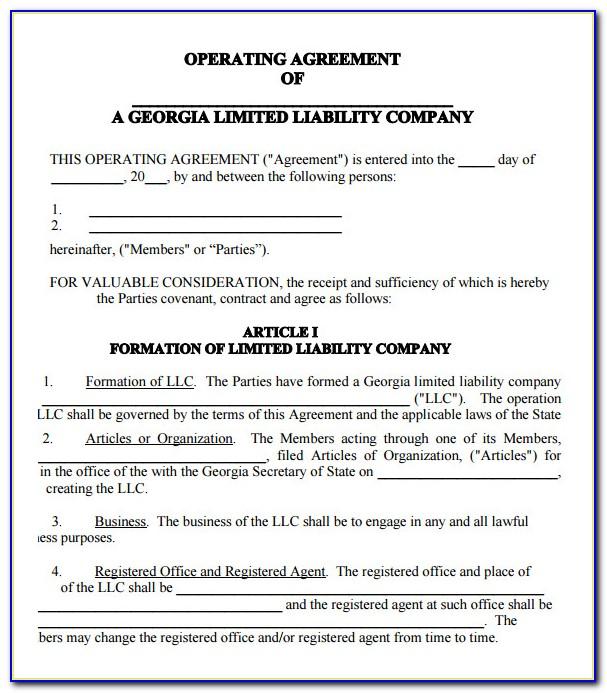

Multi Member Llc Operating Agreement Template Pennsylvania

Complete, edit or print tax forms instantly. Web how to complete form 8832 frequently asked questions llcs are formed at the state level. Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. And that’s where form 8832 comes in. Complete, edit or print tax forms instantly.

Single Member LLC vs. MultiMember LLC Pros & Cons

You also need to use this form if your llc is being taxed as a. Get a quote and buy a policy in 5 minutes. Buy direct and save up to 20% online. An entity disregarded as separate from its. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as:

Llc operating agreement illinois template starsapje

You can change the tax status of your. Web single member llc, owner reports profits and losses on form with the internal revenue service.it is also called a disregarded entity. Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. That is, of course, unless you request otherwise. Web.

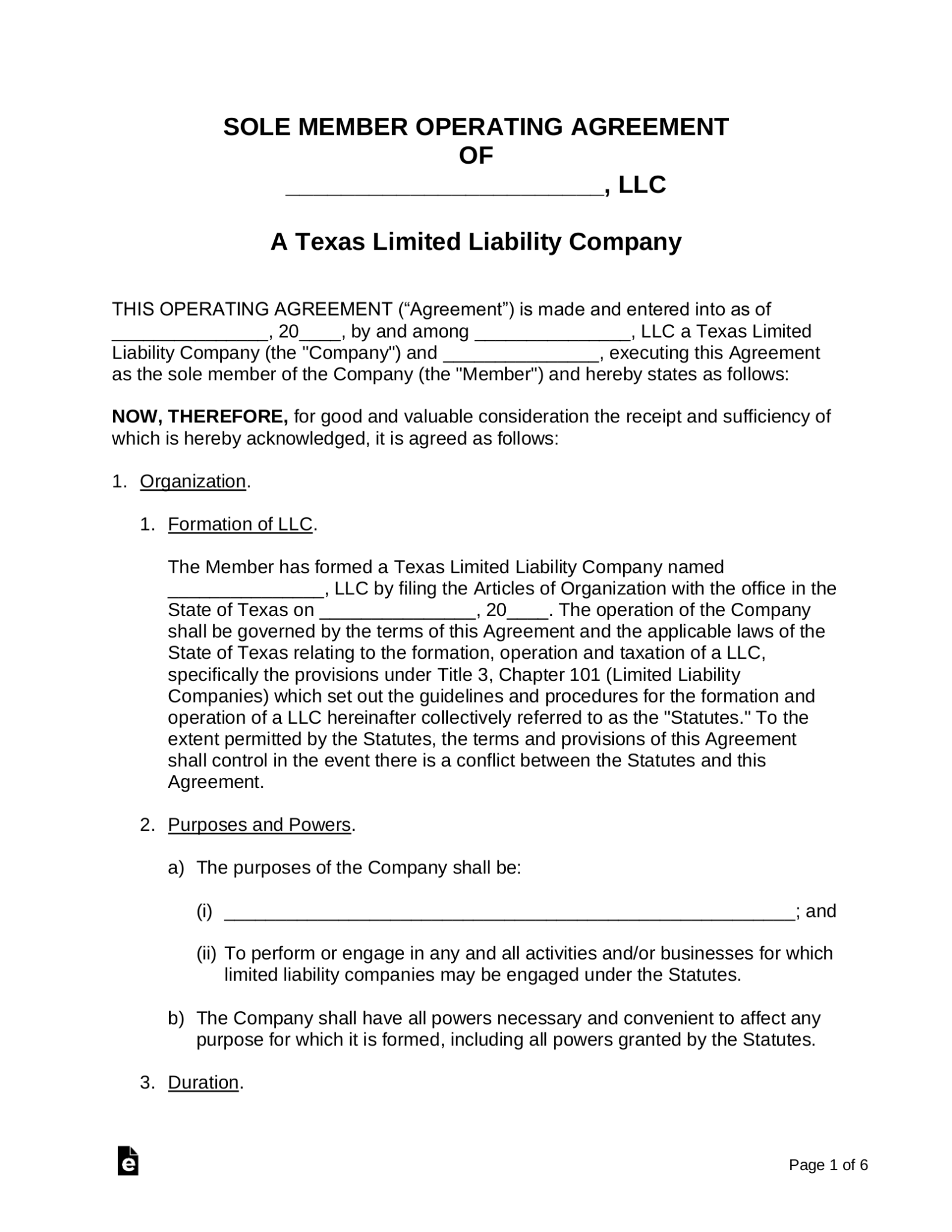

Free Texas Single Member LLC Operating Agreement Form PDF Word eForms

Complete, edit or print tax forms instantly. You do not have to file a 1065 for the llc if the llc received no income nor incurred any expenses. Thus, an llc with multiple owners can. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files.

The Difference Between A MultiMember LLC And SingleMember LLC YouTube

Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. Trusted by thousands of businesses nationwide. That is, of course, unless you request otherwise. Get a quote and buy a policy in 5 minutes. Complete, edit or print.

Multi Member Llc Operating Agreement Template Free

Web single member llc, owner reports profits and losses on form with the internal revenue service.it is also called a disregarded entity. And that’s where form 8832 comes in. Web an llc with either a single member or more than one member can elect to be classified as a corporation rather than be classified as a partnership or disregarded. That.

SingleMember LLC Tax Considerations Seaton CPA, LLC

And that’s where form 8832 comes in. Web 1 best answer. Thus, an llc with multiple owners can. Web how to complete form 8832 frequently asked questions llcs are formed at the state level. Complete, edit or print tax forms instantly.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

Web how to complete form 8832 frequently asked questions llcs are formed at the state level. Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Get a quote and buy a policy in 5 minutes. Web 1 best answer. Web single member llc, owner reports profits and losses.

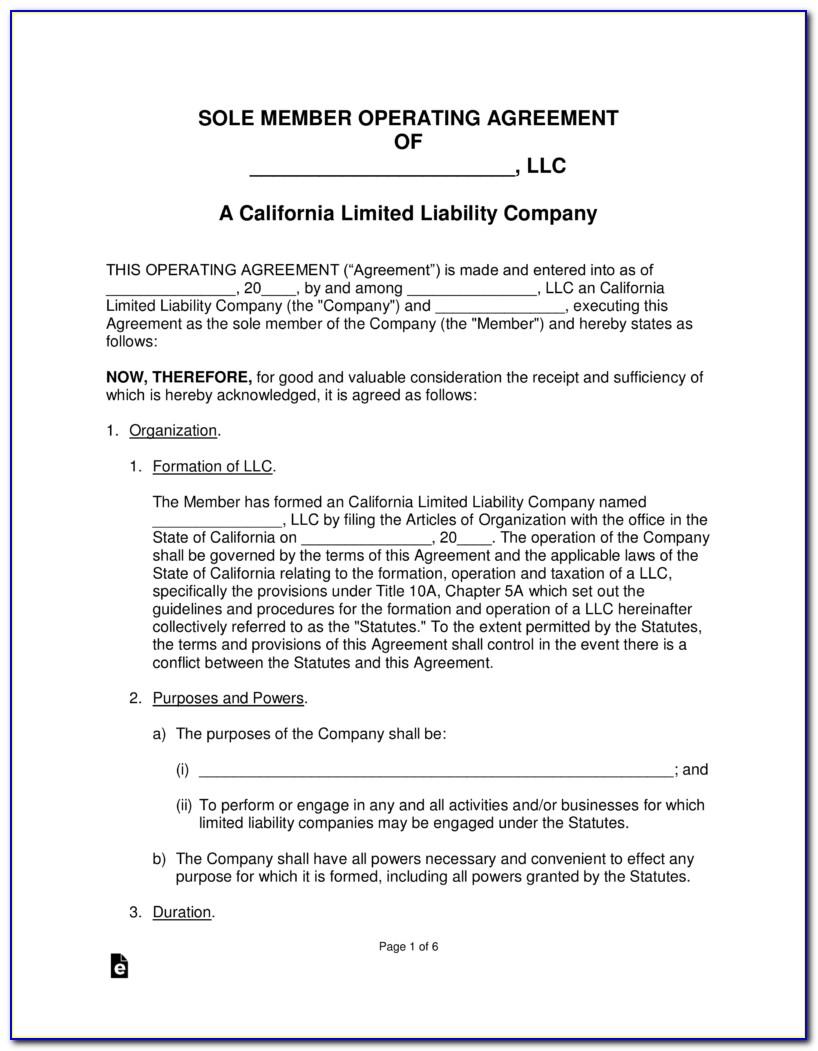

Single Member Llc Operating Agreement Template Oregon

Web irs form 8832 single member llc is used in order for a limited liability company to be taxed as a c corporation. You can change the tax status of your. When filing taxes with the federal government for the first time, you. Web single member llc, owner reports profits and losses on form with the internal revenue service.it is.

Multi Member Llc Operating Agreement Template

Thus, an llc with multiple owners can. And that’s where form 8832 comes in. Get a quote and buy a policy in 5 minutes. Web irs form 8832 single member llc is used in order for a limited liability company to be taxed as a c corporation. Web www.nsacct.org learning objectives at the end of this course, you will be.

Web An Llc With Either A Single Member Or More Than One Member Can Elect To Be Classified As A Corporation Rather Than Be Classified As A Partnership Or Disregarded.

Get a quote and buy a policy in 5 minutes. Ad get coverage instantly from biberk. And that’s where form 8832 comes in. Web form 8832 an llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default.

Web How To Complete Form 8832 Frequently Asked Questions Llcs Are Formed At The State Level.

You can change the tax status of your. That is, of course, unless you request otherwise. You also need to use this form if your llc is being taxed as a. Trusted by thousands of businesses nationwide.

Web Single Member Llc, Owner Reports Profits And Losses On Form With The Internal Revenue Service.it Is Also Called A Disregarded Entity.

Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. An entity disregarded as separate from its. Complete, edit or print tax forms instantly. Web 1 best answer.

Complete, Edit Or Print Tax Forms Instantly.

You do not have to file a 1065 for the llc if the llc received no income nor incurred any expenses. Web irs form 8832 single member llc is used in order for a limited liability company to be taxed as a c corporation. Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Buy direct and save up to 20% online.