New Jersey Inheritance Tax Waiver Form

New Jersey Inheritance Tax Waiver Form - For full details, refer to n.j.a.c. It is designed to insure that the inheritance tax is paid. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures. Executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. Once the state is satisfied, it. Payment on account (estimated payment) voucher: Web the reason is new jersey’s tax waiver system. New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. Complete and notarize testate (with will) intestate (no will)

Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures. Executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. For full details, refer to n.j.a.c. Web the reason is new jersey’s tax waiver system. Payment on account (estimated payment) voucher: Once the state is satisfied, it. Web cases, a full return must be filed with the inheritance tax branch, even if the assets all appear to be passing to class a beneficiaries. New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. It is designed to insure that the inheritance tax is paid.

For full details, refer to n.j.a.c. Payment on account (estimated payment) voucher: Once the state is satisfied, it. Web cases, a full return must be filed with the inheritance tax branch, even if the assets all appear to be passing to class a beneficiaries. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures. New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. Executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. Web the reason is new jersey’s tax waiver system. Complete and notarize testate (with will) intestate (no will) It is designed to insure that the inheritance tax is paid.

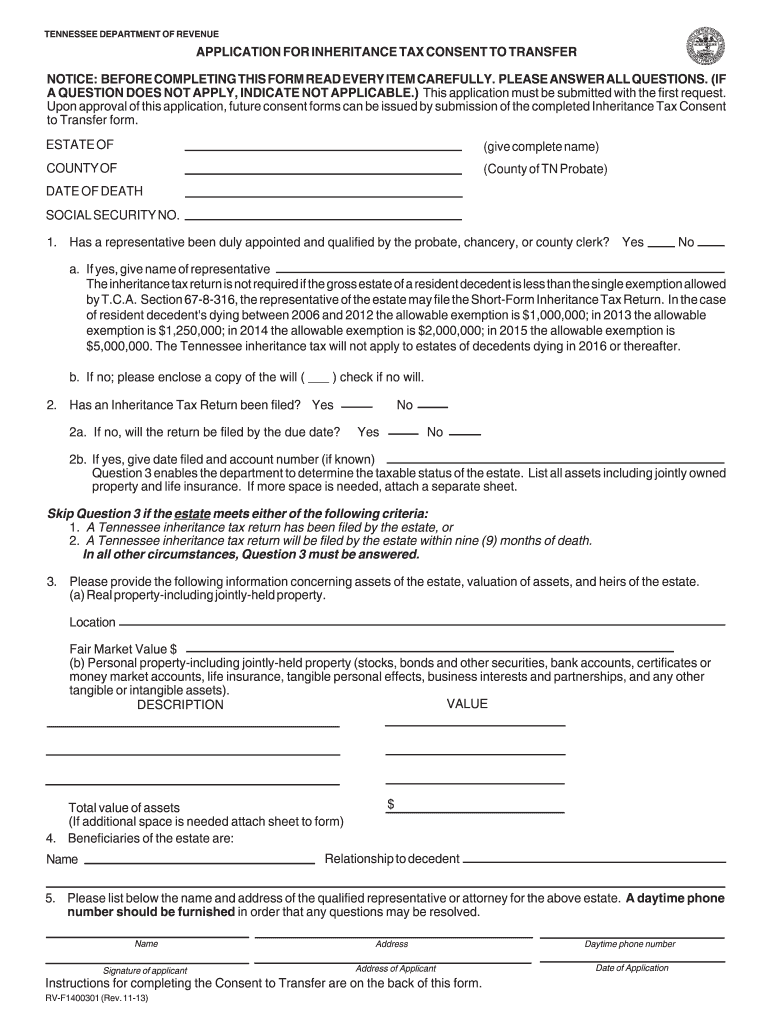

20132021 Form TN RVF1400301 Fill Online, Printable, Fillable, Blank

Once the state is satisfied, it. Executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. Web the reason is new jersey’s tax waiver system. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax.

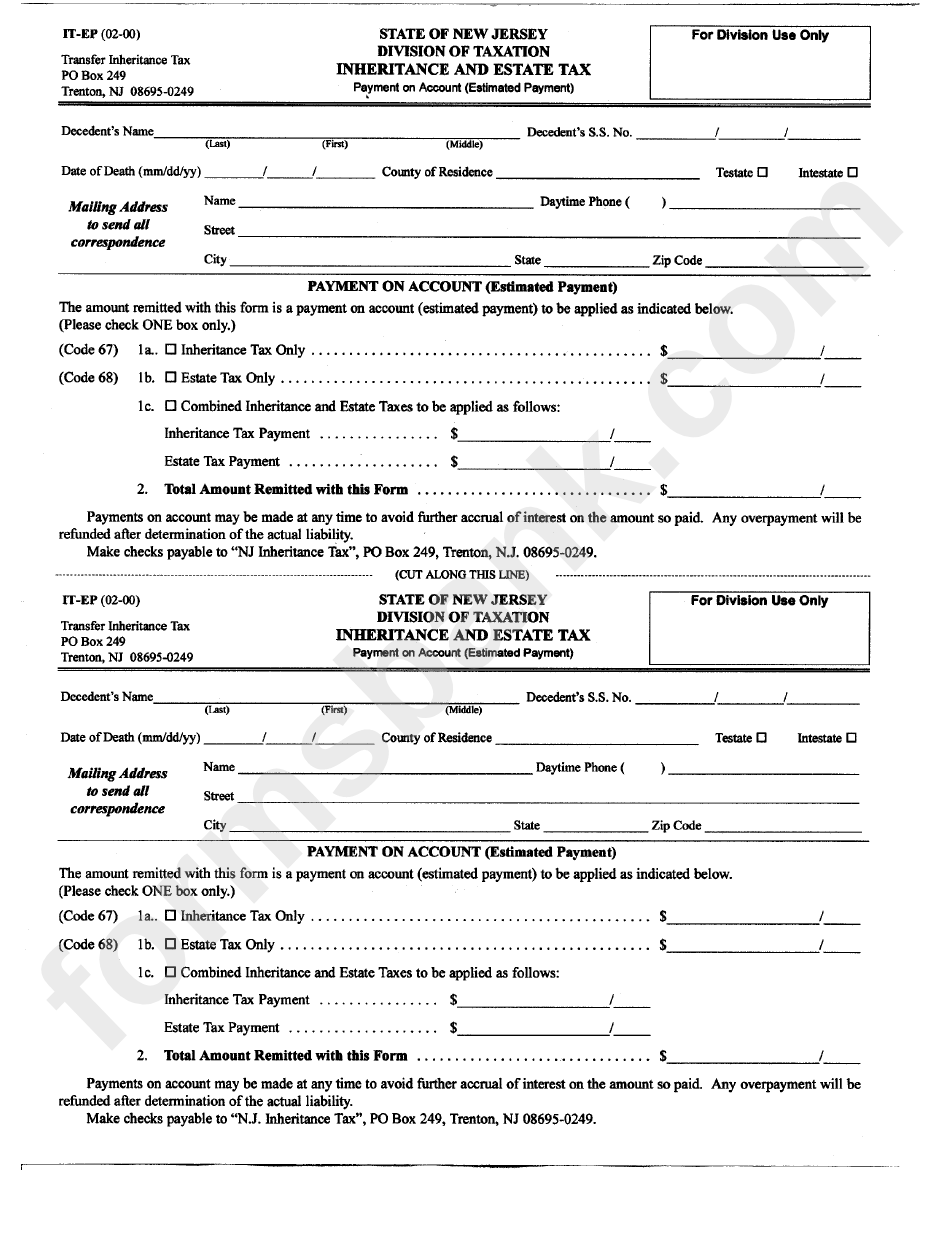

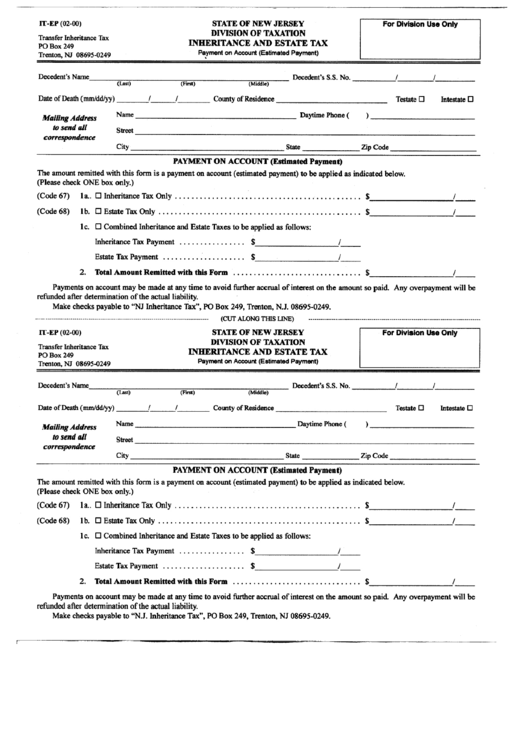

Form ItEp State Of New Jersey Division Of Taxation Inheritance And

New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. Web cases, a full return must be filed with the inheritance tax branch, even if the assets all appear to be passing to class a beneficiaries. Payment on account (estimated payment) voucher: For full details, refer to n.j.a.c. Web the reason is.

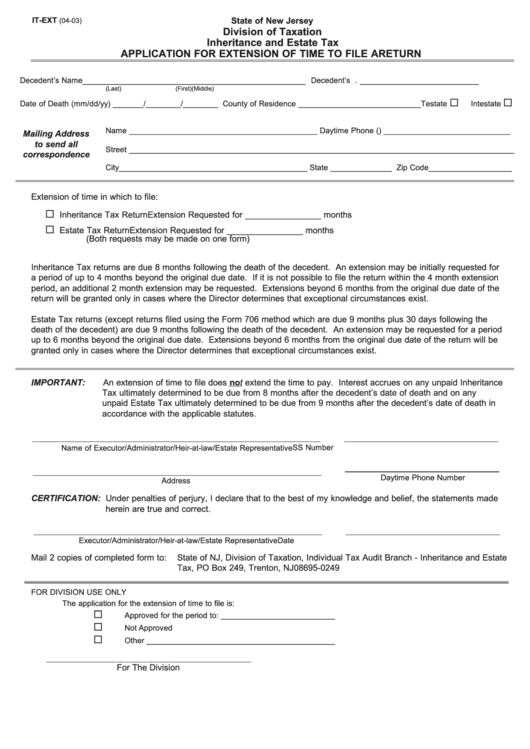

Fillable Form ItExt Inheritance And Estate Tax Application For

Web cases, a full return must be filed with the inheritance tax branch, even if the assets all appear to be passing to class a beneficiaries. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. Executor’s.

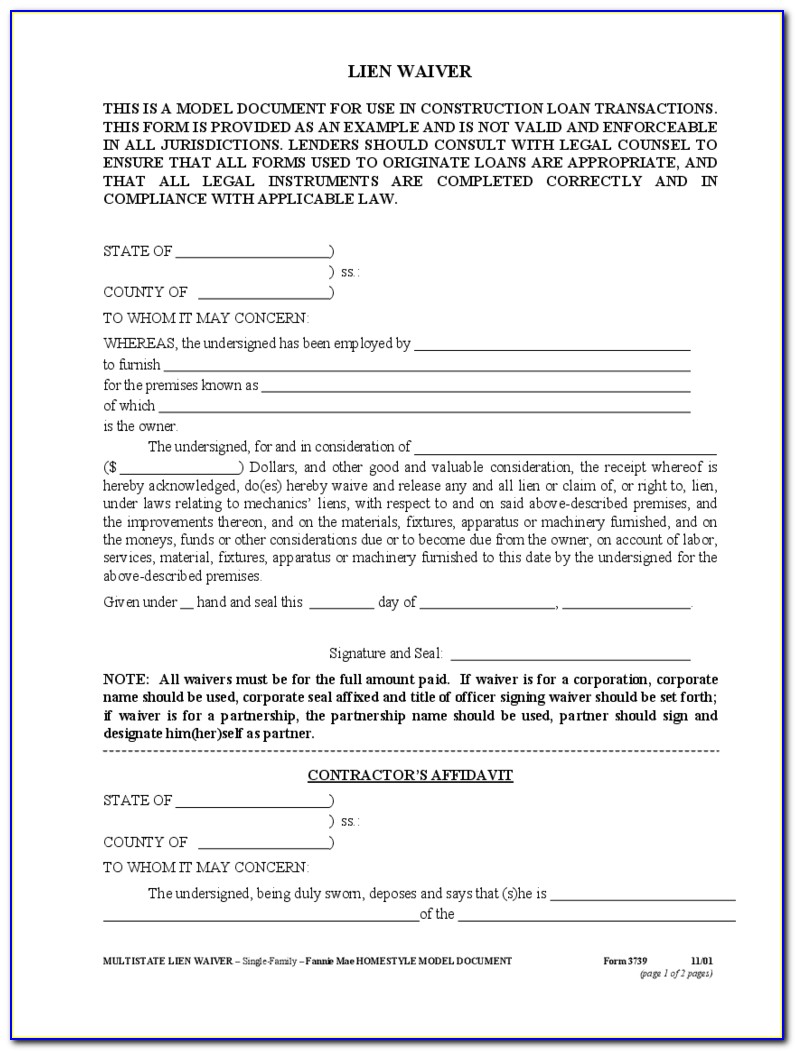

Inheritance Tax Waiver Form Missouri Form Resume Examples EpDLm675xR

For full details, refer to n.j.a.c. Once the state is satisfied, it. It is designed to insure that the inheritance tax is paid. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. Payment on account (estimated.

Form ITR Fill Out, Sign Online and Download Fillable PDF, New Jersey

Web the reason is new jersey’s tax waiver system. Executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. New jersey places a lien.

Form ItEp State Of New Jersey Division Of Taxation Inheritance And

Web cases, a full return must be filed with the inheritance tax branch, even if the assets all appear to be passing to class a beneficiaries. Web the reason is new jersey’s tax waiver system. New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. It is designed to insure that the.

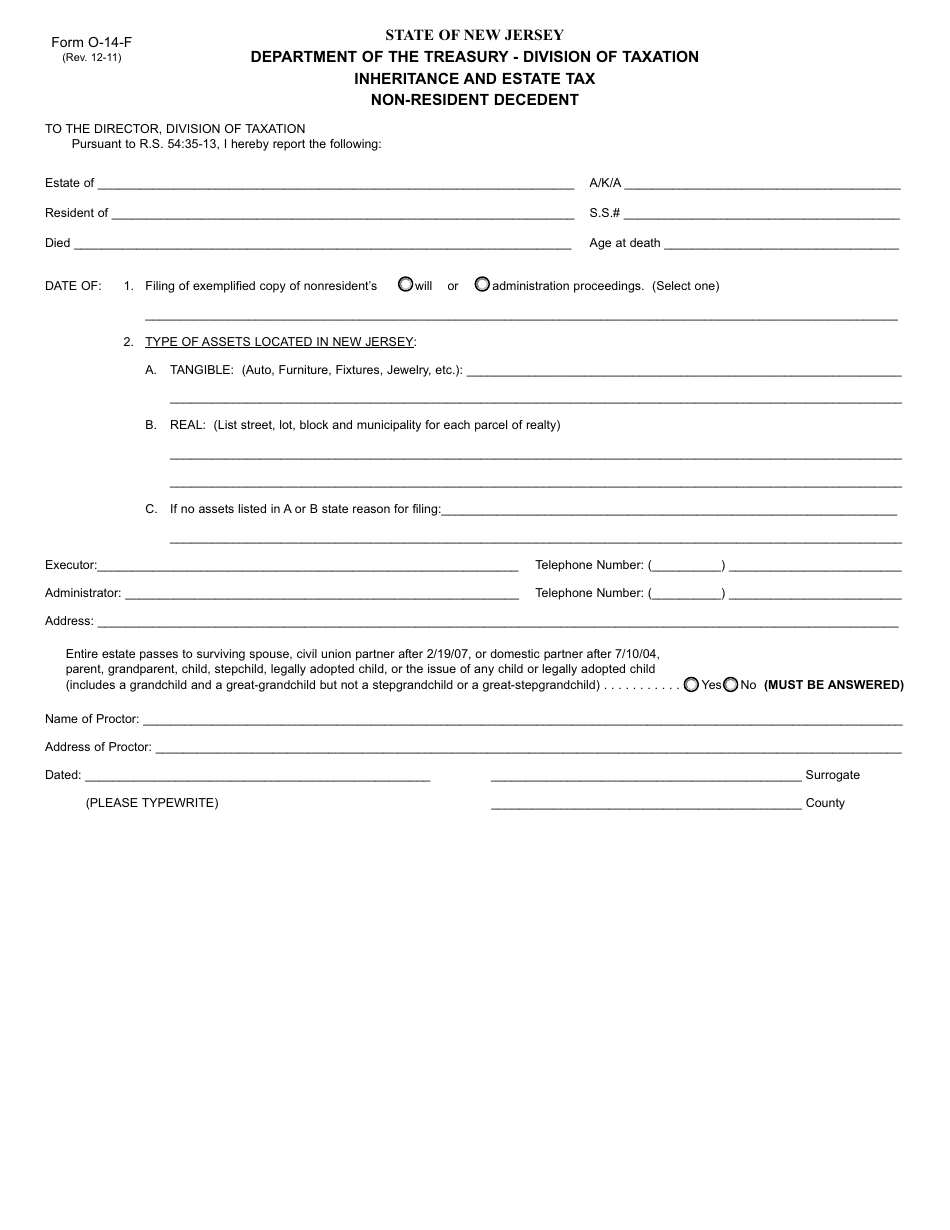

Form O14f Download Fillable PDF or Fill Online Inheritance and Estate

Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures. For full details, refer to n.j.a.c. Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. Complete.

The dreaded New Jersey inheritance tax How it works, who pays and how

Payment on account (estimated payment) voucher: Complete and notarize testate (with will) intestate (no will) For full details, refer to n.j.a.c. New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. It is designed to insure that the inheritance tax is paid.

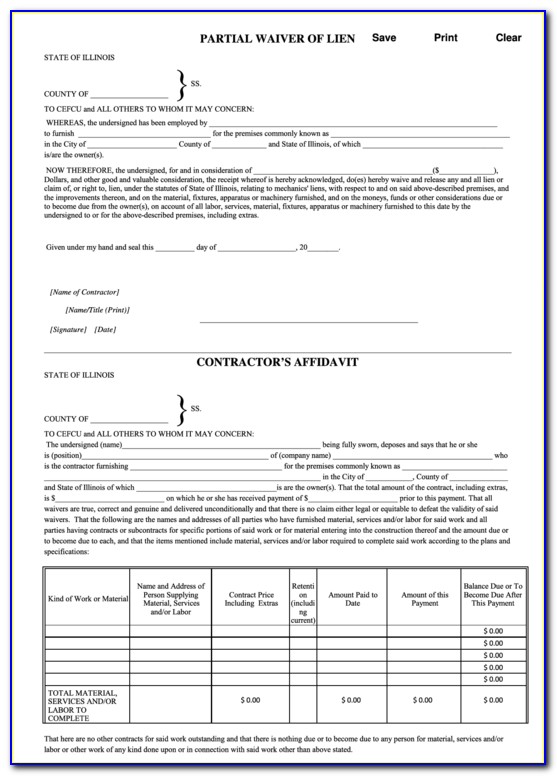

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures. Payment on account (estimated payment) voucher: New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. Once the state is satisfied, it. Web the tax waiver form issued by the division releases.

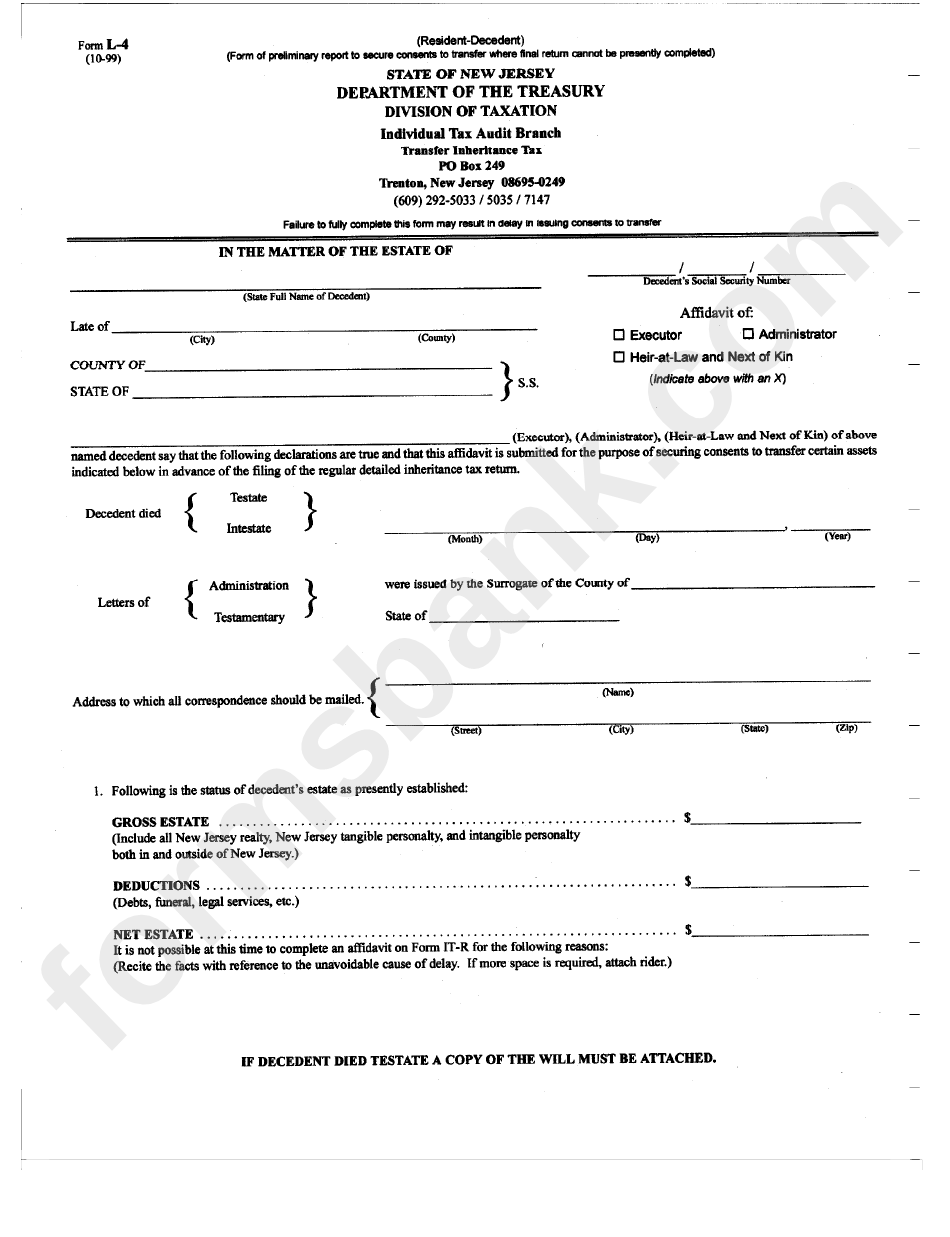

Form L4 Transfer Inheritance Tax New Jersey Department Of Treasury

Payment on account (estimated payment) voucher: Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures. Once.

Web The Reason Is New Jersey’s Tax Waiver System.

Payment on account (estimated payment) voucher: Web the tax waiver form issued by the division releases both the inheritance tax and the estate tax lien, and permits the transfer of property for both inheritance tax and estate tax purposes. Once the state is satisfied, it. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures.

Web Cases, A Full Return Must Be Filed With The Inheritance Tax Branch, Even If The Assets All Appear To Be Passing To Class A Beneficiaries.

New jersey places a lien on new jersey assets until the state issues a waiver releasing that lien. For full details, refer to n.j.a.c. It is designed to insure that the inheritance tax is paid. Complete and notarize testate (with will) intestate (no will)